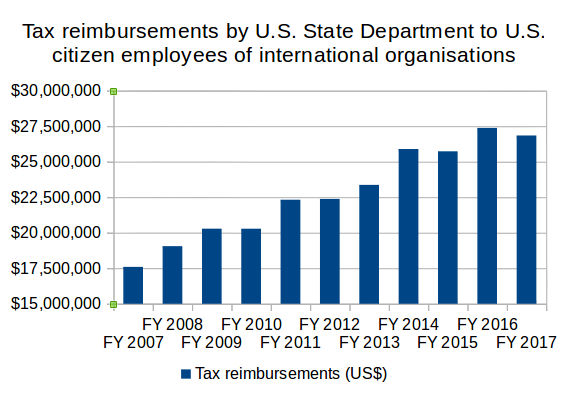

In February, the U.S. State Department published budget requests for the next fiscal year. They estimate that in the current FY 2016 (which ends in September), they will spend US$27.4 million on reimbursing international organisations for those organisations’ reimbursements to their U.S. citizen employees for the U.S. taxes paid by those employees — $9.8 million (56%) more than they did ten years ago.

In February, the U.S. State Department published budget requests for the next fiscal year. They estimate that in the current FY 2016 (which ends in September), they will spend US$27.4 million on reimbursing international organisations for those organisations’ reimbursements to their U.S. citizen employees for the U.S. taxes paid by those employees — $9.8 million (56%) more than they did ten years ago.

This is a fast-growing budget item in an area where Congresscritters have been trying to cut back after period of high spending growth in the late 2000s: State officials estimate that their total spending on “Contributions to International Organizations” (CIO) will be only about 12% higher in 2016 than in 2007, and have only requested 7.5% more than 2007 in the 2017 budget.

Table and explanations

| Fiscal Year |

Tax reimbursements (US$1,000) |

Total CIO budget (US$1,000) |

Tax reimbursements (% of CIO budget) |

Source |

|---|---|---|---|---|

| FY 2007 | 17,595 | 1,201,307 | 1.46% | CBJ 2009: 613, 620 |

| FY 2008 | 19,053 | 1,409,429 | 1.35% | CBJ 2010: 573, 580 |

| FY 2009 | 20,283 | 1,604,400 | 1.26% | CBJ 2011: 537, 544 |

| FY 2010 | 20,280 | 1,682,500 | 1.20% | CBJ 2012: 539, 545 |

| FY 2011 | 22,321 | 1,578,651 | 1.41% | CBJ 2013: 577, 582 |

| FY 2012 | 22,379 | 1,449,700 | 1.54% | CBJ 2014: 482, 493 |

| FY 2013 | 23,367 | 1,376,338 | 1.70% | CBJ 2015: 439, 451 |

| FY 2014 | 25,891 | 1,265,762 | 2.05% | CBJ 2016: 433, 440 |

| FY 2015 | 25,729 | 1,422,159 | 1.81% | CBJ 2017: 473, 478 |

| FY 2016 | 27,378 | 1,344,458 | 2.04% | CBJ 2017: 473, 478 |

| FY 2017 | 26,845 | 1,290,891 | 2.08% | CBJ 2017: 473, 478 |

Each value comes from the “Contributions to International Organizations” chapter of the Department of State Operations Congressional Budget Justification (CBJ). The table does not include amounts contributed to groups like the Food and Agriculture Organization which, instead of having a reimbursement agreement, maintain an internal fund for tax equalisation (to which State also contribute under other budget headings). For years up to 2015, the table shows the actual amount State claims to have spent for that year (contained in the CBJ two years later); for 2016 and 2017, the table uses the estimated or requested amount respectively. Links in the table go to archive.org, in case State randomly decide to reorganise their website and break all old links, as they’ve recently done with the Foreign Affairs Manual and as the IRS did as well four years ago.

The US$27 million to be spent on tax reimbursements is more than twice the American Citizens Services budget of $13.5 million aimed at the rest of diaspora who enjoy no such reimbursements for their U.S. taxes — and that $13.5 million includes items like repatriation assistance, which is far more likely to be extended to Homelanders abroad who have got themselves into trouble in a country they are visiting, not to emigrants who can rely on family, friends, and other support structures in the country where they ordinarily reside and who have no need to be “repatriated” to a country where they don’t.

Background

A 2001 aide-mémoire from the Organization of American States gives a brief history of U.S. tax reimbursement agreements with international organisations:

Most Member States of both the United Nations (“UN”) and the OAS exempt their nationals who are employees in those organizations from taxes on their income from those organizations (“institutional income”). The objectives underlying the policy of exempting staff members of international organizations from taxes on their institutional income, which is endorsed in Article 18(b) of the Vienna Convention on Privileges and Immunities of the UN of 1946 (“the UN Convention”) and the Article 10(b) of the OAS Multilateral Agreement on Privileges and Immunities of 1951 (“the OAS Convention”), are twofold. The first is to assure equal pay for equal work within the organization by providing that employees at the same grade and step will receive the same “net of tax” or “after tax” salary, regardless of their nationality. The second is to prevent Member States from receiving an indirect rebate of their quotas in the form of the tax revenues they would receive from the taxing the institutional income of international organizations’ staff members. …

Article 18(b) of the UN Convention on Privileges and Immunities exempts staff members from taxes on their UN income. In ratifying that convention, however, both the United States of America and Mexico submitted reservations to that provision. The United States specified that the Article 18(b) tax exemption shall not apply to its nationals. Mexico’s reservation was narrower. It specified that Mexican nationals “who exercise their functions in Mexican Territory” are excluded from the exemption and thus must pay taxes on their institutional income. Like Article 18(b) of the UN Convention, Article 10(b) of the OAS Convention on Privileges and Immunities exempts OAS staff members from taxes on their OAS income. Neither Mexico nor the United States of America are parties to that Convention. …

In 1981, the United States Government adopted a uniform tax reimbursement policy for its nationals in all international organizations and asked international organizations to adopt that policy as a condition for receiving future tax reimbursement payments. One of the central elements of that policy was the requirement of a signed agreement between the receiving organization and the United States Government governing reimbursements to United States taxpayers. The United States Government threatened to discontinue tax reimbursement payments to any organization that refused to sign such an Agreement.

Accordingly, the OAS General Secretariat entered into protracted negotiations with the United States Government over the contents of such an agreement. The primary purpose of those negotiations was to assure that the methodology of tax reimbursement adopted under the Agreement would respect the acquired labor rights of the affected staff members.

In short, in this Rube Goldberg budgetary exercise, the State Department requests an appropriation to cover these reimbursements, pays the reimbursement to each international organisation, which then pays it to its employees (after they prove how much U.S. tax they owe), which then pays it to the IRS, so that there will be money available for Congress to appropriate so they can pay for next year’s reimbursements. It’s certainly a nice little jobs program for tax preparation firms — but the actual employees, and the U.S. government, are no better off than they would be if the U.S. were not so “exceptional” and just didn’t tax this income in the first place.

How does the U.S. government as a whole (as opposed to U.S. accountants making campaign contributions to individual Congresscritters) benefit from this arrangement, rather than requiring U.S. citizen employees of international organisations to pay U.S. taxes? Well, as State said in the 2014 CBJ:

The request also includes $26 million for reimbursing U.S. citizens who have paid U.S. Federal, state, or local taxes on income earned at an international organization with which the United States has a tax reimbursement agreement. International organizations typically set salary levels on the assumption that their employees will not be subject to these taxes. The United States is one of very few nations that tax this income, creating a financial disadvantage for U.S. citizens. Reimbursing U.S. citizens in accordance with these agreements helps to address this disadvantage.

The website of the United States Mission to the OECD also notes: “Ensuring that Americans are well represented at international organizations is a U.S. Government priority”. (Ensuring that Americans are well-represented and do not face financial disadvantage in private organisations is clearly less of a priority.)

Do as we say, not as we do

Most international organisations — whether famous ones like the World Health Organization, or far more obscure ones such as the International Pacific Halibut Commission — aren’t doing anything in particular to harm U.S. persons abroad, so you might feel some sympathy for their employees who are caught up in this mess, especially if they have another citizenship, live abroad, and got stuck with U.S. citizenship through no fault of their own. However, I would understand if Brock readers instead feel some schadenfreude upon reading the complaints of certain other international organisations. For example, an OECD request for tenders (i.e. something which they thought only suppliers, not the media or the general public, would ever read) disingenuously whines:

OECD officials of US nationality are themselves responsible for complying with the income tax laws applicable to them. These officials are responsible for preparing tax reporting documentation for the OECD tax reimbursement scheme and for US tax authorities. Penalties and interest resulting from non-compliance with such laws are the responsibility of these officials and are not reimbursed by the OECD. The OECD does not provide its staff with tax report preparation services. The OECD only provides limited information to concerned staff including a list of tax preparation firms. US tax reporting on foreign earned income is highly complex and most US staff are required to use the services of external tax firms to comply with their obligations. These firms charge fees depending on the complexity of the individual reporting. US staff pay these fees which are not reimbursed by the OECD.

See? Even the OECD admits the absurd complexity of US tax compliance — at least when it’s biting them in the hindquarters and they think no one’s listening. Meanwhile they cheer it on when it’s biting us taxpaying peons in the hindquarters, and do their best to exclude us from any discussion of it. Of course, there’s a reason the OECD won’t dare complain too loudly about U.S. exceptionalism, as Bloomberg reported just yesterday (hat tip: iota):

“The U.S. doesn’t follow a lot of the international standards, and because of its political power, it’s able to continue,” said Bruce Zagaris an attorney at Berliner Corcoran & Rowe LLP who specializes in international tax and money laundering regulations. “It’s basically the only country that can continue to do that. Others like Panama have tried, but Panama can’t punch as high as the U.S.”

Indeed, in a statement issued Monday by OECD secretary general Angel Gurria, the OECD said “Panama is the last major holdout that continues to allow funds to be hidden offshore from tax and law-enforcement authorities.”

The statement didn’t mention the U.S., which is the OECD’s largest funder.

Similarly, a few weeks ago we discussed the spectacle of James H. Freis, Jr., former Bank for International Settlements employee and later Financial “Crimes” Enforcement Network director, arguing that living in another country and banking there is inherently suspicious and gives FinCEN sufficient grounds to demand a general warrant to search through your papers at any time he wants. The fear of FinCEN’s FBAR requirement sent thousands of scared minnows running to the various IRS offshore disclosure initiatives. In the 2009 OVD alone, the IRS extracted from the poorest 10% minnows median penalties of nearly $13,000 — 129 times the tax they owed.

Assuming the median penalty for that group was close to the average penalty, the amount of penalty revenue from those bottom thousand of the minnows in the 2009 OVDP would be just enough to pay half of the tax reimbursements for U.S. citizen employees of international organisations in any given year.

I’d LOVE to see CBT illustrated in a Rube Goldberg type cartoon. First we’d have to come up with the policy objective CBT is supposed to achieve in order to build the machine to deliver it. What would that be?

Interesting that the cost of American citizen services is just $13.5 million. There could quite reasonably be 6.75 million Americans abroad, which would come to $2 a head.

@Bubblebustin

I think it is fear: if they don’t have CBT and enforce the heck out of it, they think all the rich Americans will leave.

“The United States specified that the Article 18(b) tax exemption shall not apply to its nationals.”

Instead of not applying to its citizens and green card holders and substantially present persons?

So if an American Samoan goes to New Zealand to work for a New Zealand company they don’t have to file US federal returns, but if they go to New Zealand to work for the UN then they become subject to US federal taxation?

“Interesting that the cost of American citizen services is just $13.5 million. There could quite reasonably be 6.75 million Americans abroad, which would come to $2 a head.”

Yeah, why isn’t it $00.0 million and $0 a head? In view of the amount of services they provide to American citizens, and the amount of theoretical services that wouldn’t be billed for if they’d been provided.

A lot of the problem is, most of the public (of any nationality) have a very twisted idea of what consulates & embassies actually do and who pays.

http://www.iexpats.com/barmy-brits-abroad-drive-our-diplomats-mad/

And State doesn’t like to be too clear about it either:

https://www.washingtonpost.com/lifestyle/travel/us-embassies-at-your-service-around-the-globe/2014/02/27/26104ff2-82de-11e3-bbe5-6a2a3141e3a9_story.html

The top priority of the State Department is to represent the political and commercial interests of the Homeland. Sometimes that will involve hours or even days of work on behalf of certain travellers (e.g. businessfolks complaining of an investment treaty violation), which I presume falls under the ACS budget. On occasion that trickles down to the 99%. The classic example is a large group of folks who lost their passports due to force majeure, and the consulate burns the midnight oil getting them new ones in time for their flight out (though that probably gets recorded as a cost overrun in the passports budget rather than falling under ACS). But most of the rest of both travelers and emigrants ask for nothing and receive nothing and State doesn’t even know they’re there. The others only ask for user-fee services and maybe sign up for the e-mail list (whose maintenance costs are amortised over a large number of users at an average of pennies per user).

Must be rich expats lollying around in tax havens

this is another item for Robert Reich to look at

“it doesn’t matter because we owe it to ourselves”

A six-room flat in the building where Edward Snowden lived in Geneva from 2007 to 2009 goes for CHF 5’400 per month, or CHF 64’800 ($67,500) per year. It is directly on Lake Geneva. Because the IRS allows a foreign housing exclusion of $95,200 for Geneva, Snowden would have been able to exclude the entire amount. On the other hand, if he had lived in Zurich, he would have been able to exclude only $39,219. (Foreign housing exclusion figures are for 2015).

It is interesting to note that there are 1,512 US government diplomats and functionaries in Geneva and -0- in Zurich.

The rent figure for Snowden’s building is mentioned in this article. His cover name in Geneva was Dave M. Churchyard:

http://www.blick.ch/news/schweiz/an-seiner-genfer-adresse-guerilla-gedenktafel-erinnert-an-edward-snowden-id4898674.html

There are many people out there who dislike the United Nations and other international organizations, and they probably will never change their minds. This post is intended for the middle-of-the-roaders, who have no set ideas on the subject. It attempts to encourage them to not reach hasty conclusions.

Criticizing the US-tainted paid staff of international organisations for not paying taxes is something like saying that FATCA is for tax cheats. We should be careful of friendly fire.

I have the greatest respect for Eric’s posts, both in the range of topics treated and in the thoroughness of his research.

On this topic he is once again right on target – the tax treatment of US-tainted staff who work for and are paid by international organisations is absurd. But there is more to it.

Oversimplifying, two basic organizational structures exist within the United Nations and other international organizations.

Delegates and member countries. When Madeleine Albright, John Bolton or Susan Rice spoke before the United Nations, they did so as delegates representing the United States. They were diplomats, paid by the US to represent it and to promote US policies. They were by nature not neutral. Along with delegates from other nations, they discussed, negotiated, made deals, voted on issues and made (or didn’t make) decisions with respect to the budgets, activities and policies of the organisation. Their salaries were paid by the US, just as the salaries of the delegates representing other nations were paid by those nations.

Taken together, the delegates and the member countries they represent, are, at least in principle, both the foundation and the face of the international organization. So if we don’t like what an international organisation is doing (or not doing), we can only blame the member countries and their delegates for (not) making the decisions leading to what we don’t like.

Paid staff. An organization’s paid staff (support staff, officials, personnel, employees, bureaucrats, call them what you will) make up a different organizational structure. Included among an international organisation’s paid staff are secretaries, data entry personnel, researchers, translators, managers, accountants, human resources personnel and a host of other positions similar to those of any other organisation or business.

An international organisation needs to be located somewhere, needs to have at least minimal support staff, and yet needs to remain outside a single country’s jurisdiction, in order for it to be considered “international.” To achieve this, member countries created a rather complicated set of rules designed to protect the organization itself, the delegates attending the organisation’s meetings and the staff paid by the organization. Over time, the staff rules of the different organisations were harmonised, and now many international organisations follow what is known as the UN common system. This system is based on two main principles.

Independence and objectivity. (The OAS summary missed this principle.) An individual who joins the paid staff of an international organisation agrees to work on behalf of all countries, and therefore, must be independent of any one country’s influence (the country of recruitment, the country of nationality, or the host country). In fact, in many international organizations, the individual must symbolically swear “allegiance” to the institution and all of its member countries, and “renounce” his or her nationality. Safeguards to ensure independence and objectivity were added to the paid staff conditions of employment: diplomatic status, salaries and other benefits paid by the institution and not by the country of nationality, etc. One of these safeguards was a tax exemption for staff, an exemption that covered both the country of nationality and the headquarters country of the institution.

Equality of treatment. A second principle was that all staff, regardless of their origin, should be treated equally for performing the same work. A grade salary structure was introduced, which with all its imperfections, allowed for women and men, whether from Ghana or Ireland, to be treated equally in terms of conditions of employment, remuneration and other benefits. Since different countries, including the headquarters country, tax their citizens/residents at vastly different rates, a tax exemption was the only way to ensure equality of treatment.

Consider for a moment the individual with US taint who happens to work for an international organisation, or any other individual from any other country: whose taxes would/should they pay? Would paying taxes not make these people “slaves” to the taxing country and lessen their ability to be “independent” and “international” in their work for the organization? If a person had more than one nationality and the organisation were headquartered in a third country, would he/she be taxed three times?

As the UN was created and headquartered in New York, the UN founders used the following formula: they based remuneration scales on similar employment in the public sector in New York. They then deducted the average tax paid by employees in the same New York public sector, and used the result as the non-taxable remuneration scale for staff working in the United Nations (and eventually for many other international organizations), with “tax” deducted, but no real tax paid to any one country. That solution gave the UN sufficient guarantees to allow for equal pay for equal work on the one hand and independence on the other. (Just for memory, delegates participating in the deliberations of the organisation are paid by and pay taxes to the countries they represent.)

One nation did not agree with the tax exemption as defined above. Yes, that nation was the United States, which in 1946 made a reservation to the United Nations Charter in order to “reserve the right to tax its nationals who are employed by the United Nations.” Since that time, the United States has exercised that right, and taxes those with a US taint who work for the United Nations and other international organizations all over the globe, no matter in which country the organization has its headquarters. (To my knowledge, only one international organization has escaped that fate: NATO. One might say that the US military trumps the IRS.)

For the United Nations in New York and for some other organizations, complex tax equalization arrangements were instituted. For other organizations, bilateral tax reimbursement agreements were “negotiated.”

The latter are the tax reimbursement agreements mentioned by Eric. The premise, accepted by the United States, was that the US staffperson was responsible for paying US taxes on income earned through employment with the organization. The organization was responsible for ensuring independence and equality of treatment for its US staff, and therefore had to reimburse that staff for taxes paid to the US. The US would then, on the basis of the tax reimbursement agreement, reimburse the organization for its reimbursement to the US staffperson! As might be expected with such a bureaucratic nightmare, there were many instances where not all reimbursements were made, either by the US to the organization, or by the organization to the US staffperson. Some US staffpersons saw this as unequal treatment when compared to staff of other nationalities in similar positions, and won a series of UN tribunal cases filed against their organizations. The organizations were required to reimburse the full US tax paid by the US staffperson. The United States took the position that it “did not agree” with the UN tribunal decisions, and decided not to reimburse the organizations for their additional payments. Organization staff time to manage these exceptional US tax arrangements and payments are paid for by all the organization’s member countries through the budget of the organization.

In fact, these tax reimbursement “agreements” are just like the FATCA IGAs: take-it-or-leave-it documents forced bilaterally on each organisation. They contain, as usual in US “agreements,” an escape clause: reimbursements MAY be made, “subject to the availability of appropriated funds.” They do not cover reimbursement of all the US-tainted individual’s US tax obligations, leaving other member countries to cover those obligations through the organisation’s regular budget. And because of US might, the organisations have little choice but to accept the US terms. Many have countered by hiring fewer US-tainted individuals, much to the chagrin of the US State Department. Does this sound familiar?

Over the years, the UN and other international organisations have wasted enormous amounts of time and money not only to administer this ubu-esque system put in place to cater to the misuse of US power but also to find an exit strategy. Senior officials would study, and study again, make recommendations, only to be stonewalled each time by the US. As of 2010, no progress had been made.

The US State Department, and its Bureau of International Organisations, is hopeless in all this. They are (or feign to be) ignorant of the absurd arrangements they find themselves having to administer and are often backlogged in making the reimbursements to the organisations. When confronted, State Department officials wash their hands by telling the individual to consult a tax professional. A small cottage industry (specialised compliance condors!) has developed to help organisations and US-tainted individuals with their US tax obligations. One enterprising international organisation even set up a sideline consulting business, using its in-house expertise to manage (for a fee) the US tax obligations on behalf of other international organizations.

The late Andy Sundberg believed that an opus could be written on the US tax treatment of US-tainted employees of the United Nations and other international organizations. From a slightly broader perspective, one has already been written. It is a book entitled, “Tax treatment of international civil servants,” written by Rutsel Sylvestre J. Martha, published in 2009. It is a scholarly and technical book, written by a lawyer who was Finance Minister of a small country and later Legal Counsel for an international organisation. The book provides excellent background and history, with most of the discussion devoted to US tax policies and the problems they cause, both for the international organisations themselves and for the individuals who work for them.

Does a US-tainted individual working for an international organisation have an advantage over another US-tainted individual working and living outside the US? I would answer that that is not the issue. The real issue is that both are US-tainted individuals working and living outside the US, and both are receiving unfair tax treatment from the US.

Lastly, some informal speculation on the OECD. Yes, the OECD is an international organization, but it has only 34 member countries, mostly from Europe and the five eyes English-speaking countries. Lest we think the OECD is a world organisation, or part of the UN system, Allison Christians reminds us that it is trying to “build a new international tax organization (or world tax order) to avoid the encroachment of the United Nations as a potential tax policy rival, thus ensuring the continuing global tax policy monopoly of a core set of OECD nations.”

Remember Jesse Eggert, former US Treasury official sent to the OECD as a Senior Advisor (see IBS topic “Welcome to the Party Pal: Top IRS FATCAFanatic Jesse Eggert moves to France” of 21 January 2014)? I would speculate that he has probably NOT been hired on the basis of the UN common system principles outlined above. Given severe budgetary restraints imposed on the UN and international organizations by some member countries, led by the United States, a separate, extrabudgetary process has been developed over the last twenty or so years. This process allows some countries to contribute, outside the budget supported by all member countries, to a special project or activity that otherwise would not receive sufficient funds. Often the extrabudgetary contribution consists of the “loan” of an expert to the organization, or of funding for the recruitment and remuneration of an expert. Since only one or some countries are responsible for the remuneration of the expert, there is no longer any guarantee that the two principles of independence and equality of treatment will be met.

In Mr Eggert’s case, it may well be that he continues in Paris to serve the interests of the United States. And it may well be that, bending to the US will that extrabudgetary staff positions in international organizations should not benefit from reimbursement for US taxes paid, Mr Eggert resides in France and pays US tax, non-reimbursable by the OECD. Since, by virtue of the OECD headquarters agreement with France, staff of the OECD do not pay tax on their OECD income, he cannot claim a foreign tax credit. And since many of the conditions of employment to which he is entitled, such as reimbursement of moving costs, partial reimbursements of expenses to ensure mother-tongue education for children at the duty station, etc., are considered US taxable income, his reported income level, converted from euros to US dollars, can very quickly rise above the foreign earned income credit. He may well have been surprised settling into his “offshore” experience. Unless US Treasury officials are treated like US military officials working for NATO, for whom there really is an exemption from paying US taxes ….

Apologies for such a lengthy comment on a subject that is not the main topic of this site, even if the problems encountered are similar. I hope it can quietly reside in Eric’s post on international organisations as a friendly reminder and food for thought to anyone tempted to say “They pay no taxes!”

An employer has a duty to pay its employees fairly based on the kind of job and the location where they’re working, not to make up for abuses perpetrated by third parties. When a burglar stole from my apartment, my employer had no duty to make up for it. When I was a US citizen and there were about four times when the US took extraterritorial taxation from me (legal under US law and treaties) or embezzled from me (for which IRS data entry clerk Monica Hernandez was jailed and I still have lots of trouble trying to get compensated), my employer had no duty to make up for it. If my employer were the UN instead of a private company, morally my employer still would have no duty to make up for such things.

The UN ought to set salaries based on job markets where its employees are working, just like companies do. Pay New York style salaries in New York, pay Jakarta style salaries in Jakarta, etc. I think lawyers and accountants in Jakarta get a high multiple of the average industrial wage, so let the UN’s lawyers and accountants do the same, but they don’t have to be at New York levels. And they certainly shouldn’t be paying extra to make up for taxes taken by some country other than the country where the work is being performed.

Under typical tax treaties, the source country of earned income is the country where the person performs the labour, the source country gets dibs on taxing the income earned there, and the country where the person resides gets second place if their tax rate is higher than the source country. So for a company employee or UN employee, if the person is temporarily working in one country (the source country) but normally resident in a different country, the UN just like private employers should set salaries according to the job market in the source country, except if the UN hired the person in the country where the person resides and the UN sent the person on a temporary assignment to the source country.

In all cases, extraterritorial taxation by a third country is not the responsibility of the employer. If the employee can’t stand what the US or Eritrea is doing to them, the employee should renounce. Sure it’s hard to renounce because of US fees or Eritrean intransigence, but the employer still has no responsibility to make up for it.

Now, suppose the UN takes sovereignty over its offices, camps occupied by peacekeepers, etc. Then the UN would be the source “country”. Then the UN can even get a chance to make all its employees treated equally by their countries of residence. Let the UN set income tax at a rate of 90%. Let the UN pay pre-tax salaries of some large multiple of the going rate, so that the post-tax salary (after 90% taxation) will correlate with the host city’s post-tax salaries. Tax treaties will leave nothing for host countries after foreign tax credits recognize the 90% tax that the UN took. Even the US’s tax treaties will leave nothing for the US.