cross-posted from citizenshipsolutions.ca

If @SenTedCruz had NOT renounced CDN citizenship he could have escaped US S. 877A Exit Tax https://t.co/vHaMojxgzM pic.twitter.com/QuAVA8qfx1

— Citizenship Lawyer (@ExpatriationLaw) February 16, 2016

Ted Cruz was born in 1971 in Canada. He was therefore born a Canadian citizen. He claims to have been born to a U.S. citizen mother and was therefore a U.S. citizen by birth. (Whether he qualifies as a “

natural born citizen” is a different question.) As a Canadian citizen he had the right (prior to renouncing Canadian citizenship) to live in Canada. Had Mr. Cruz, moved back to Canada, he could have avoided the U.S. S. 877A Exit Tax. Incredible but true. It will be interesting to see whether Mr. Cruz regrets renouncing his Canadian citizenship. As you will see, by renouncing Canadian citizenship, Mr. Cruz surrendered his right to avoid the United States S. 877A Exit Tax.

Here is why …

The S. 877A Exit Tax rules in the Internal Revenue Code, are the most punitive in relation to U.S. citizens living outside the United States (AKA Americans abroad). To put it simply, with respect to Americans abroad, the S. 877A Exit Tax rules:

– operate to confiscate assets that are located in other nations; and

– operate to confiscate assets that were acquired by U.S. citizens after they moved from the United States.

There is not and has never been an “Exit Tax” anywhere else that operates in this way. The application of the S. 877A Exit Tax to assets located in other nations, is both an example of “American Exceptionalism” at its finest and a strong deterrent to exercising the right of expatriation granted in the “Expatriation Act of 1868“.

But, the “Exit Tax” applies ONLY to “Covered Expatriates” and “dual citizens from birth” can avoid being “Covered Expatriates”

…

As has been previously discussed, the Exit Tax applies ONLY to “ covered expatriates“. There are two statutory defenses to becoming a “covered expatriate”. This post is to discuss the “dual citizen from birth” defense to being treated as a “covered expatriate”. I have discovered that this defense is NOT as well known or understood as it should be.

The statute granting the “dual citizen from birth” defense to “Covered Expatriate” status reads as follows:

(g) Definitions and special rules relating to expatriation

For purposes of this section—

(1) Covered expatriate

(A) In general

The term “covered expatriate” means an expatriate who meets the requirements of subparagraph (A), (B), or (C) of section 877(a)(2).

(JOHN RICHARDSON NOTE: THIS MEANS THAT THE PERSON HAS MET ANY OF THE INCOME TEST, ASSET TEST OR COMPLIANCE TEST.)(B) Exceptions

An individual shall not be treated as meeting the requirements of subparagraph (A) or (B) of section 877(a)(2) (JOHN RICHARDSON NOTE: ONE MUST STILL MEET THE 5 YEAR TAX COMPLIANCE TEST TO AVOID BEING A COVERED

EXPATRIATE) if—

(i) the individual—

(I) became at birth a citizen of the United States and a citizen of another country and, as of the expatriation date, continues to be a citizen of, and is taxed as a resident of, such other country, and

(II) has been a resident of the United States (as defined in section

7701(b)(1)(A)(ii)) for not more than 10 taxable years during the 15-taxable year period ending with the taxable year during which the expatriation date occurs, or

Okay, it’s not quite as simple as it looks. Here are the requirements:

(1) Became “at birth” a citizen of the United States AND a citizen of another country

This means that one was born in the United States and acquired dual citizenship from your parents or you were born outside the United States to American(s) abroad.

(2) As of the expatriation date (the date you relinquished U.S.

citizenship you continued to be a citizen of THAT specific country that you acquired dual citizenship from birth.

(3) You are taxed “as a resident” of the country referred to in paragraph (2) above.

Note that this says “taxed as a resident”. Does that you mean that you must reside in that country? What if the country does NOT impose taxes on its residents?

(4) Has not been a U.S. resident (as defined in the Internal Revenue

Code) for not more than 10 of the last 15 years.

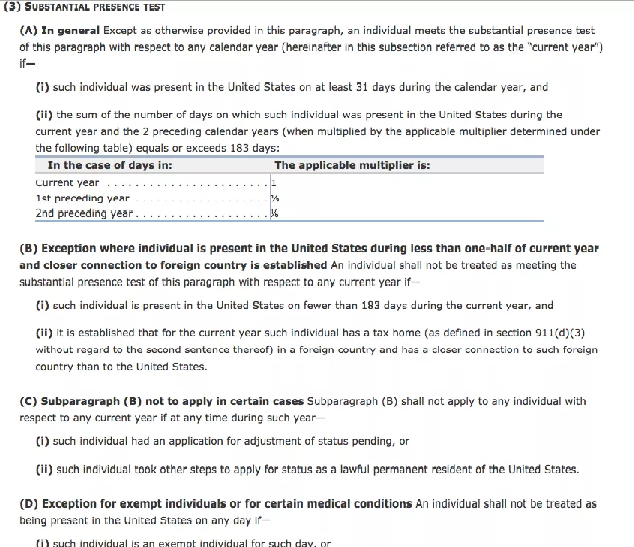

This means that the person has NOT met the requirements of the “substantial presence test” which is described as follows:

This is a punishment for NOT having been born a “dual citizen”

Here is why.

In the current environment of FATCA, FBAR, CBT, PFIC, OVDP, Streamlined, Foreign Trusts, etc., the vast majority of Americans abroad:

A. Are finding it very difficult to exist as a U.S. tax compliant U.S. citizen abroad. Those Americans abroad who are compliant with U.S. tax laws have agreed to live life under extreme disability. See: “How To Live Outside The United States In An FBAR and FATCA World“. Remember that “When an American is in Rome, that American must live as a Homelander”.

B. Are feeling that they are forced to renounce their U.S.

citizenship. (See the series of posts by Rachel Heller where she discusses her “renunciation”

experience. Of particular interest is her post 5 – “The Irony Of Renouncing Under Duress” – where she addresses the issue of whether her renunciation really was voluntary.)

Those Americans abroad who were NOT born “dual citizens” will be subject to the Exit Tax if they become “covered expatriates”. Therefore, they are under pressure to BOTH renounce U.S. citizenship and to renounce before they become “covered expatriates”. In other words, they must “get out now!”

Those Americans abroad who WERE born dual citizens, do have to deal with the compliance problems but do NOT have to fear becoming a covered expatriate (assuming that they meet the “U.S. tax compliance test).

Therefore, it is easier for those who are “dual citizens from birth” to remain U.S. citizens (for at least a longer period of time). This post has been partly motivated by the interesting discussion by a young woman in the UK who was born a dual U.S./U.K. citizen who is dealing with her discovery that she must file U.S. taxes.

Think of it:

S. 877A of the Internal Revenue Code is most punitive with respect to American citizens who where NOT also born citizens of another nation. As I have repeatedly said, when it comes to this kind of injustice:

#youcantmakethisup

By the way, if you would like to see the brutality of the Exit Tax in action and how it discriminates against those who were NOT born dual citizens, read these examples of “ The S. 877A Exit Tax In Action – 5 Examples (including the effect on those who were NOT born as dual citizens”).

Conclusion …

Those who were born dual citizens may have “won the birth lottery”! But, Ted Cruz doesn’t seem to have realized this.

@ Patricia Moon says:

“I have spent time reading about this and have yet to truly grasp it.”

Tricia, I’m still struggling with it as well. Is the Expatriation Gift Tax (via Notice 97-19) more or less favourable for valuations? My gut instinct says it’s less favourable, but it may depend on the individuals circumstances. Take a foreign defined contribution pension from a normal company pension scheme where the individual has a basis in the pension if they’ve been compliant and declared the contributions as taxable income on past yearly 1040’s.

You first decide if you are able to gift that particular type of pension. There’s very little information out there, but what I’ve found indicates yes, it is subject to valuation under the Expatriation Gift Tax rules. Under the Expatriation Gift Tax, you must use the “fair market value” of the pension for the balance sheet. That means no exclusions of any kind and therefore it’s a high value. If you’re over the $2M threshold, then you calculate your tax due on the “ineligible” pension (deferred compensation rules) using the Estate Tax. But as those calculations are for selling the pension and declaring gains (rarely done), are you able to deduct your basis and arrive at a lower taxable value since it’s a foreign pension? Note: John’s examples show such a pension being taxed at full value, at ordinary rates, but that may be due to not having a basis in the pension.

The same with a primary residence and the pretend sale. It’s the full fair market value via the Expatriation Gift Tax on the Part V balance sheet, but for the calculation of the taxable amount, you may deduct your basis. And then along comes NIIT. The NIIT propaganda always claims you won’t pay NIIT on a personal primary residence, but when you examine it closely, you find that’s true only for the amount that was excluded by the normal rules of Section 121, exclusion of gain from sale (the $250,000 MFS and $500,000 MFJ). Any gain above that exclusion is taxed for NIIT.

Again, the warning: these are my interpretations of the rules, and like iota, I am not a compliance condor, just the average punter.

It’s simple really. If you are not born a dual citizen, or if you were and not resident in the “other” country, then do everything you can to avoid being a covered expatriate and the Exit Tax. If you were born a dual and are resident in the other country, you’re home free, that is aside from the $2,350 fee, the past 5 years returns, and any cost to complete those. So, nothing new there.

It appears the Gift Tax gives higher values, thus making one nearer to the threshold and a covered expatriate and thereby having to calculate tax due, although the taxable amount may be more in line with normal tax filing standards.

@OAP

Part of my problem with all this is that I simply don’t understand much about pensions (I don’t have one). I can’t tell if they are giftable or not (I would expect not but that is worth beans…..). It seems to me that using Gift Tax valuation is not favourable but there is so much inconsistency……..the point is if one is not born dual you have some very hard decisions to make and not being “covered” is critical.

I still think IF this proposal comes to pass, most are looking at only the $2350 fee. No US income, can fill out all 1040NRs with zeros. No compliance fees. Filing as non-resident alien does not involve “foreign” funds so no FBAR etc, no information returns, no penalties. Given the fact the US has done very little to relieve this situation over the past 4 years, I still think “get out while the going is semi-good” still applies. Not trying to scare, just an assessment that I don’t trust the US to do the right thing.Is it right? No. Is it necessary? Depends upon whether one can stand the situation.

@ Patricia Moon says

“I still think IF this proposal comes to pass, most are looking at only the $2350 fee.”

Here’s where we find I’m more cynical than you.

If we’re talking about the Obama Budget Proposals and the text put up by MuzzledNoMore on the other thread, I find the wording of the text very dubious. If you interpret the text as ‘accidentals’ not being subject to 877A IN ANY WAY, great. Take a look at the shaded portion in the main post. That interpretation requires a rewrite (or addition) in (g)(1)(B) EXCEPTIONS (added for ‘accidentals’) which would state something like: ‘accidentals’ are exempt from the 877A exit tax, AND ARE NOT REQUIRED TO COMPLETE 8854, PART IV, SECTION A, LINE 1 USING FORM 1040, BUT FORM 1040NR INSTEAD AND WILL FILE THE RETURNS AS NON-RESIDENT ALIENS. The new text would then follow.

Another interpretation of the text could be: Currently, those already exempt from the 877A rules, namely those born abroad and resident in the other country, still have to file the past 5 years of tax returns. ((C) is currently not included in the exceptions. See JOHN RICHARDSON NOTES in the shaded portion). Even if they, via the 8854 Part V balance sheet or 5 year average, meet the thresholds for covered status they are nonetheless exempt from being a covered expatriate and are not required to do filings for the Exit Tax. One could interpret the Obama Budget text as replacing the text already existing in the (B) Exceptions. The text takes the same format, only the wording is different.

BUT….most importantly, remember, the 5 years of filings are not part of the 877A ‘exit tax’, they are part of 8854 and (C) of section 877(a)(2) and only determine if one would be subject to the exit tax. The 1st line wording of the Budget Proposal explicitly says “provide relief to so-called “accidental Americans” from the section 877A “exit tax” on expatriation”. It does not say “877A ‘exit tax’ and the 5 years of past returns of 8854 and section 877”. (Remember, 877 and 877A are two separate sections of the Code.)

This interpretation would then match exactly (save the different wording) with the current regulations for those born dual and resident in the other country. They would now fall under the new text with no real difference to their current situation.

Again, I would hope I’m being overly pessimistic about this, and you are correct in your assessment. Unfortunately, I’m still sceptical about what is (poorly) written in the Budget Proposal for the reasons above.

Colour me a reluctant cynic, trying not to let what I would prefer the text to say over what it explicitly says. See what too much filing of IRS tax forms does to a person.

Oops, got the bolding wrong. Forgive me, it’s late over here and past my oldies bedtime.