In order for the U.S. to gain $8.7 billion, the world was forced to pay between $58 billion to $170 billion. This is the reason why neither the US Congress nor the Obama administration released any #FATCA cost-benefit analysis.

There have been varied approaches to calculate the total cost of FATCA, many of which are shown in the FATCA Wiki article. The Chamber of Commerce had estimated $1 trillion to $2 trillion, whilst Forbes had estimated $8 billion per year. Neither had shown their methods. Another guest author had derived per-capita estimates to arrive at $200 billion FATCA cost. Another author had visualized that FATCA made an American priceless, by considering the average cost per U.S. person to be located.

It has also been shown, that nearly all of the supposed gains estimated to come to the government via FATCA, would be lost because of the lost tax revenue upon U.S.-owned financial institutions overseas. So, Wikipedia has summarized that #FATCA is a big loser.

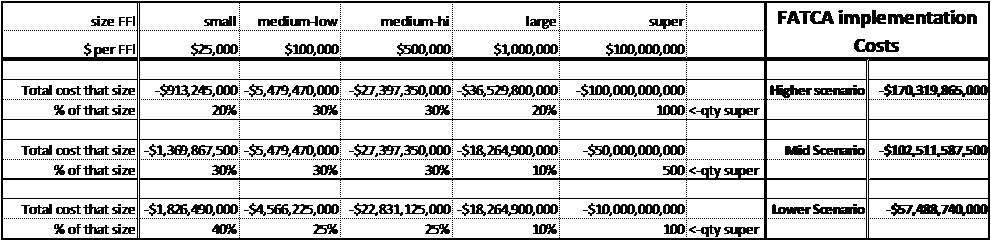

In order to verify FATCA cost estimates, this method (put forth here by a guest contributor) looks at the costs estimated for each FFI, and totals the costs for all of the FFI’s registered in the FATCA FFI registration database. The search performed after the end of 2015 yielded 182,649 FFI’s.

We know that a very large bank (but not at all the largest) such as Scotia Bank would have paid $100 million to comply. However, it is not really known how many of those banks might exist. One must assume a quantity, such as 100 banks, 500 banks, or 1000 such banks in the world.

We also know that a small FFI would pay about $25,000 for smaller institutions, $100,000 – $500,000 for medium-size institutions, and $1,000,000 for larger institutions. What we don’t yet know, is how many firms are medium, large, or small. Therefore, we must do a number of scenarios to get the total picture.

We have all the base data, we only need to make a few scenarios, and total the costs for each group of FFI size, and to get the total cost per the scenario.

So, there you have the cost of 3 different scenarios!

Now, there are a number of potential variations in each individual piece of data. However, each input value could be adjusted appropriately, the scenario could be iterated, and a more refined number could be created. However that might be done, the variations are controlled within the limits of practicality.

Please evaluate the calculations and give feedback. I’ll be glad to provide corrections and adjustments.

In any case, it would be difficult for anyone to prove that the “benefits” of FATCA outweigh the global costs. What is shown here, is that FATCA costs more than 10 times what it was said to take in.

What we do know, is that FATCA is one big loser.

The response of the USG: “Ho hum…as long as we can squeeze money out of people (who can’t vote against us) and WE don’t have to pay for it, we DON’T CARE!

So where is the outrage from the rest of the world who are getting ripped by the US????

It’s just unbelievable!

I guess the US really does rule the earth, doesn’t it Gwen!

Shocking numbers but even these are probably way way low. For example, re “$1,000,000 for larger institutions.” For example, as of 2013 Bank of Nova Scotia was publicly on the record as having spent 100 times that amount. http://business.financialpost.com/news/fp-street/electronic-spying-a-big-issue-for-banks-scotia-ceo-waugh-says (I keep citing that because the went public about it. Who knows how much other banks spent, but it’s likely to be comparable.) Actual costs worldwide could be $1-2 TRILLION.

#TheJim is correct. It was, however, included in the calculation. On the right. It depends upon how many are considered “Super” and if the “super”s might be somehow double counted by registering as an FFI under multiple names.

Regardless of which set of numbers are the most accurate, its obvious that it would have been far cheaper for everyone (including the US) if each country had simply agreed to send a flat fee every year to the IRS. Something like half a billion per country per year would add up to about 85 billion dollars annually to the US treasury, roughly ten times what they are collecting now. (Or they could pro-rate it according to each country’s GNP.)

Call it the US surcharge for permission to exist and occupy a patch of real estate on the planet, plus it would make it crystal clear for any doubters who’s the boss. (‘Course a lot of lawyers and accountants would have lost out on a lot of work, but you have to break a few eggs to make an omelet.) Using this method, there would be no need to have banks hunt down US taxable persons or have all that data flailing all over the place. That’s so messy, prone to error, and old school.

Skeptics may question how the US could have persuaded the countries of the world to agree to such an outlandish scheme. That’s easy.. sign up for this or we’ll pass FATCA.

Funny thing…I was just at dinner with a man who owns several private banks. We were talking and I said it’s been a bad year for me due to fatca. He looked at me and said ” fatca has cost my banks A LOT OF MONEY”

Given the enormous cost to implement FATCA-compliant systems, it would’ve made more sense for financial institutions to instead refuse to take on new American customers, as well as identify and close down the accounts of existing American customers. (Which is what some banks are doing, of course.)

http://eur-lex.europa.eu/legal-content/EN/ALL/?uri=URISERV:090406_1

18 Sep 2016 is the date that EU member states must implement the EU basic bank account for resident EU citizens.

It’s seems EU banks will have to offer this account to all resident citizens whether they have US-taint or not.

What a smaller bank going to do about its FATCA costs? If a country has already implemented the legislation, it may be already in force in some EU countries.

@2t2s — sounds like a potential witness!

Have these facts and the total outrage of this story been passed on to a competent and informed journalist at the CBC, radio or television, as well as the major print and online media? By calculating the number of Canadian banks in relation to the known number of financial institutions that signed on to FATCA, either directly or via IGA agreements, it should be possible to get a ballpark figure as to what FATCA actually cost Canadian banks and the Canadian economy. I have been told by one banker friend, that most of the FATCA compliance costs have been or will be progressively passed on to all clients, so FATCA is not just a problem and an injustice for US persons, but for all Canadians. This would be a great investigative news story for the CBC or any journalist for that matter.

@Killian

Re “I have been told by one banker friend, that most of the FATCA compliance costs have been or will be progressively passed on to all clients, so FATCA is not just a problem and an injustice for US persons, but for all Canadians” Correct! Also, since CRA is administering the collection of the data for their IRS bosses, the administrative costs are borne by the Canadian taxpayer, not the American taxpayer. (Has any one seen what that will cost in Canada? I recall seeing an official UK estimate of what it would cost HMRC, something in the neighborhood of half a billion pounds. Not chump change, especially since it’s an outlay that yields the Exchequer exactly zero gain.) In any case, *all* Canadians pay twice, as consumers and as taxpayers. (That’s aside from the intangible loss of sovereignty. But why bother over a musty old concept like that?)

@Westcoaster

Re:

“Given the enormous cost to implement FATCA-compliant systems, it would’ve made more sense for financial institutions to instead refuse to take on new American customers, as well as identify and close down the accounts of existing American customers. (Which is what some banks are doing, of course.)”

Yes, lots of institutions are doing that — it’s a pure panic reaction. But it doesn’t do them any good. After all, if that’s all it took, an FFI, instead of shelling out big bucks for compliance, could just write a nice letter to the IRS saying, “Hey, we don’t have any American customers and don’t accept any. Have fun with that FATCA thingee but include us out.” No dice. The FFI must *show to the IRS’s satisfaction* that it has “due diligence” in place to discover if any accounts *might* be those of US persons and collect and transfer the required data. In fact, unless they do that, how would they *know* if any of their account holders were Americans? They wouldn’t. Simply announcing “No Yanks Welcome” won’t do. So even if an FFI has not a single American customer, never had any, and won’t accept any, they’re in the same boat when it comes to compliance outlays.

@Jim Jatras

I did a bit digging: Financial institutions with less than $175 million in assets can opt out. For example, Canada’s Credential Direct no longer accepts American clients. As a result of this policy change rolled out mid-2014, their application form for new accounts now asks about US citizenship.

Credential Direct hasn’t been closing the accounts of existing American clients, but I suspect that will probably change once they can identify them.

http://www.theglobeandmail.com/report-on-business/international-business/alberta-online-bank-first-in-canada-to-shun-us-clients-amid-tax-rules/article23186804/

From the article I linked to: “Some smaller institutions are exempt from the FATCA reporting rules, including not-for-profit credit unions and cooperatives, those with less than $175-million in assets and those with no accounts exceeding $50,000.”

What could end up happening is the world simply moving away from the tyranny tied to the USD:

http://www.mintpressnews.com/washingtons-financial-currency-war-on-china-eclipsing-of-us-dollar-by-the-yuan/209126/

http://moneymorning.com/2015/06/22/the-real-reason-russia-and-china-are-dumping-u-s-debt/

Wikipedia has a lot of information on implementation costs by various countries.

https://en.wikipedia.org/wiki/Foreign_Account_Tax_Compliance_Act

That footnote [53] goes back to the esteemed and authoritative Isaac Brock Society:

http://isaacbrocksociety.ca/2014/10/20/fatca-global-implementation-costs-revealed-cross-post-guest-post/

@WestCoaster

Yes, that’s the asset threshold for deeming FFIs small local institutions and exempting them, as it was worked out first with the UK, Germany, and other European countries. The Canadian government claims it pushed the US hard to raise the threshold, I think to assets of $500 million. The Americans said nyet.

Your homework assignment is to repeat this exercise for YOUR country.

Go to the FFI list, choose only your own country, and find out how many FFI’s you have. Split them up, and compare them to any data in Wiki.

Extra credit: calculate the cost per capita and cost per US-person.

Tweet your result and or paste on social media.

This homework assignment is given to Brockers AND to other visitors and journalists.

Under the up and coming us and eu trade deal, it will possible for companies to sue governments for enacting laws that affect profitability.

I wonder what the eu financial institutions will do once the ink has dried on the deal…..

Killian: “Have these facts and the total outrage of this story been passed on to a competent and informed journalist at the CBC, radio or television, as well as the major print and online media?”

Answer: Over and over and over again. Although some of us are typing our fingers off on our keyboards (and we *have* received some recognition from the media), by and large we have been ignored. Certainly no one responsible for the outrage, no one in any position to mitigate any of it, has listened to our voices.

“This would be a great investigative news story for the CBC or any journalist for that matter.” You’re darned right it would be! CBC has been doing some good coverage for us lately but not specifically on this particular aspect of the outrage. We have an excellent contact there in the host of All in a Day and we are hoping for more on that program soon.

@Don

The timing is a bit awkward, though. Last week I finally got the dreaded FATCA letter. Let’s say that after receiving my response, the bank kicks me out. I will be very unhappy, but know that I qualify for at least one credit union, although it won’t be nearly as convenient to use it. If I decide in September to go back to my original bank, will they be required to let me back in, since there is language in there about the basic accounts not being available to people who already have accounts in the country or does mid-2016 represent a golden window of opportunity for banks to dump their existing U.S. customers?

Had all countries said no in tandem to Fatca, what exactly would the States have done? Cut the world off from their banks and investment houses? Suicidal and stupid…

Of Course It Is a Loser—The prime reason Obama did what he did is the destruction of the Middle Class. He calls those on government dole the ”middle class” and the actual middle class are referred as the evil rich who are not paying their ”Fair Share”. The second chapter of the communist manifesto is specific. Marx wanted a progressive tax on income in order to destroy the despised middle class. Obama had to redefine the middle class in order to go after and destroy the real middle class. He wants everyone to be equal—equally poor–except for the dictators which is the logical conclusion of liberalism, marxism, socialism or whatever the name put on it today. the democrats and the Republicans in name only RINO’s for short—each of them expects to prosper under the socialist dictator. It is part of their plan to squander money until economic collapse, and then dictatorship of socialists.

The undoing of the USA economy began with Ronald Reagan & “trickle-down economics”…(and we all know the one thing that always runs downhill)…

That (& economists clearly point to it) began the slippery-slope: of companies becoming more important than people & the massive greed & corruption that followed.

I posted this on the main thread re the lawsuit, but am posting this also on this thread because it is related and because it comes directly from Canadian government source – representing just some of the costs that ALL CANADIAN taxpayers have borne to implement the foreign extraterritorial US FATCA law via the IGA in Canada;

See;

‘Canada Revenue Agency’

Quarterly Financial Report

‘For the quarter ended June 30, 2015

Statement outlining results, risks and significant changes in operations, personnel and program’:

“….$4 million pertains to tax measures, including the implementation of the intergovernmental agreement between Canada and the United States to enhance the exchange of tax information….”

http://www.cra-arc.gc.ca/gncy/fnncl/r150828-eng.html