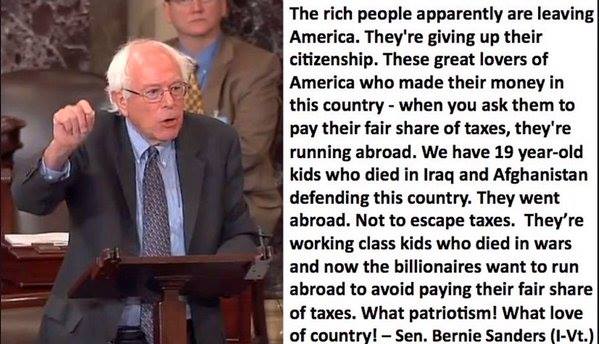

I’ve noticed that some of the people on Facebook really like Bernie Sanders. But let’s make one thing clear: this senator is a demagogue:

I’ve noticed that some of the people on Facebook really like Bernie Sanders. But let’s make one thing clear: this senator is a demagogue:

“a leader who makes use of popular prejudices and false claims and promises in order to gain power” Merriam-Webster’s Collegiate Dictionary., Eleventh ed. (Springfield, MA: Merriam-Webster, Inc., 2003).

I have myself given up US citizenship. I know lots of people personally who have given up US citizenship. I do not know a single billionaire. I am not a billionaire. I did not leave the United States to avoid paying taxes. For crying out loud, I live in Canada where taxes are much higher than they are in the United States. This man has vilified me and others like me who have become targets of the Obama administration of exorbitant fines, destroying our rights of due process and presumption of innocence.

We should remember that the colonists felt that it was unfair that Britain tax them and that is why they led a revolution and gained the independence of the colonies, thus creating the United States of America. Bernie Sanders may not realize it, but the current policy of the United States towards expats is ten times the son of the Devil what British taxation policies were against the colonists. Most of us who have relinquished US citizenship are victims not villains.

Bernie is a Socialist, a failed system all over the world and is failing here. The governments, town, county,state, and federal are so omnibus that it is as if they owned the property you bought and now they are the owners and you pay to use it thru oppressive taxes. revolutions are fought over less mistreatment than we endure. The Expats are the lucky ones. I can identify taxes that I paid last yr and it was 64% of my net income. Fair share? ”we don’t have no stinking FairShare”

There were at least 12% of sales and other hidden taxes. How can one survive on24% of the income you earned.

Not about Bernie, but I don’t know where else to bring this up. I’ve seen articles which mention that if Paul Ryan becomes House Speaker, there are indications that he will push forward with international tax reform at the earliest opportunity rather than kicking the can. I can’t find any indication of his stance on FATCA and CBT. Or is he another Republican obsessed only with corporate taxes?

And check out the Facebook American Expatriates discussion about Bernie Sanders today. Quite a few hardcore Homelanders Abroad chanting the “fair share” mantra.

Between Sanders and Trump- US politics is a total circus.

The problem boils down to CBT again.

Paying one’s fair share of taxes means not having to pay taxes in a country you no longer live and work in.

@Fred Nicely put:

Almost every other country in the world gave up CBT. I`m wondering if it was because they couldn’t catch their expats back then, or if they realised it was detrimental to their own economy?

Now we not only have computers, the NSA and every other source of spying to catch expats wherever they are, but we also have economic globalisation, and this seems to encourage CBT because of all the extraterritorial business going on?

I just posted this on Facebook :

Bernie, I like other expats would really like to know what you’re going to do about FATCA and especially citizen based taxation that is forcing us ordinary americans living, working and allready paying our fair share of tax abroad, to give up our US citizenship against our will. http://www.nytimes.com/…/an-american-tax-nightmare.html

Join the comments section : https://www.facebook.com/senatorsanders/photos/a.91485152907.84764.9124187907/10154301712637908/?type=3&theater

@Petros,

Thank you for say this. For the life of me, I can not figure out why anyone involved in this issue would have anything good to say about this guy.

Well certainly no expat in his right mind would vote for him so he can afford to make us all scapegoats for political effect,.However by just bringing up the subject of renunciations may mean that they are having some serious repercussions.

Barbara, I appreciated your post on the Congressional Progressive Caucus; I’d never heard of such a thing and now I know what their agenda is, Bernie Sanders included.

Your last post threw me off about “homelanders abroad”. What are homelands abroad? Is that what they call themselves? Are those people who live in the U.S. but is overseas for only a few years, say, teaching ESL? And if so, why do they think they should tell “Americans” who live permanently and pay taxes in another country, often as its citizens, what we owe to the USA?

@Wilton Jere Tidwell

Wilton…we expats are also paying around 65% of our money if all taxes are added up in our country of residence but where the real injustice comes in is when the US wants to tax us on top of that!! So what should the expat community be paying?? 80/85 %???? Every time I hear the “pay your fair share” I want to ask how much is my fair share for every euro I make?? Do homelanders think 85% taxation is doable?? The few things that our countries give us a tax incentive on is then taxed by the US!! Now that is truly oppressive!!

Using that logic, what about the Vermonters who attend government-run indoctrination centres in Vermont, and then move to New Hampshire, where there is no sales tax or state income tax? Sanders would be quick to point out that the U.S. Treasury funds local public schools, too, through federal grants, but these are blatantly unconstitutional, because there is no clause in the U.S. Constitution authorizing Congress to do so.

In the past, Master might make slaves learn carpentry so they can be worth more to him, forbidding them to drink booze in class so they’ll learn carpentry better, and then use that expenditure as an excuse not to free them. Nowadays it’s compulsory school attendance and drug-free school zones. Gotta make sure they learn all about how lucky they are to live in a free country.

Fair share, let’s see, gotta charge you for all those soldiers they sent into unjust, undeclared wars that put U.S. Persons overseas in danger, and gotta charge you for all those gun-toting DEA goons in bulletproof vests to intimidate you into living a healthy, drug-free lifestyle.

@GwEvil

Based on the people I know, I think that Larry Sanders might not give his brother an earful.

1) He has an employer-provided pension plan and therefore hasn’t been at risk at failing prey to the traps that people with less secure employment fall into, such as putting money into mutual funds in ISAs.

2) He did well out of the U.S., getting a free undergraduate education at Brooklyn College, a policy that was ended in 1976.

3) The people I know of that generation seem to be more clued up on how nasty U.S. taxation can be, so he might have organised things better.

@publius

But Larry can’t be totally immune to the problems that other US expats are having in the UK and elsewhere or does his socialist mantra render him totally unseeeing?

cc: Bernie Sanders AND OUR NEW PRIME MINISTER JUSTIN TRUDEAU

http://isaacbrocksociety.ca/2015/10/19/interview-opportunity-abc-news-nightline-would-like-to-interview-an-american-living-abroad-who-is-in-the-process-of-renouncing-his-or-her-us-citizenship/comment-page-2/#comment-6740570

A cousin of mine who left the States at the age of 10 months (once again, months, not years) is a tax dodger according to this fool. And she doesn’t speak a word of English and lives on a farm. Can we get this stupid man to comprehend his own fallacies? (Probably not, too stupid.)

Just wondering…

Isn’t the label “citizenship-based taxation” (CBT) a bit misleading? For instance, a green card holder is not a citizen of the United States but is still liable to US taxation due to “US Personhood.” Perhaps the meaning of “citizenship-based taxation” has evolved to mean “extraterritorial taxation” or “United States taxation” over time?

Bernie’s brother may not yet know of these problems. I was blissfully unaware of them until two and a half years ago, by which time many of you had already bern fighting this for a while. All but two of the US expats I know in Japan have no idea of this and refuse to listen to me or check into it on their own. Bernie’s brother just may not have been forced to deal with it yet.

Or, Bernie may be like my own family and just not care, thinking he brought it upon himself by leaving the homeland, that he made his own bed and thus must lie in it.

@Jan: “Homelander Abroad” is a pejorative term invented here on IBS, though I forget by whom. It refers, as you guessed, to those temporary expatriates, often on 2-year contracts, usually at executive level (well-paid, with the company or a secretary taking care of all the tax filings and other paperwork), who make no attempt to assimilate or learn the language, associate only with other upper echelon expats, and crucially have no need to set up investments or retirement accounts in their temporary overseas posting, and thus see no problem with the minor annoyance of having to sign a few extra forms for the IRS each year. I personally know many such US expats, and they are the last remnants of the expat population who think being an American abroad is just peachy keen, and what are these old fart long-termers who abandoned the exceptional Homeland moaning about?

I believe John Richardson coined the term “Homelander Abroad”

Old joke:

Hey son, stop going around asking people what state they’re from. If they’re from Texas, they’ll tell you. If they aren’t, stop embarrassing them.

Retort:

If Alaska were divided in half, Texas would be the third biggest state.

Solution:

Change “Texas” to “US.”

@Heidi

It all depends on whether he views his future demise as a short one or a long, prolonged one! His children are probably U.S. citizens, since renouncements have been rare. As such, they should be able to inherit from him without owing much in the way of U.S. taxes if he dies suddenly, since U.S. inheritance tax for U.S. citizens is extremely generous compared with U.K. inheritance tax. However, if he or the person who has power of attorney over his affairs has to sell the house to pay for an extended period of long-term care, the whole situation changes. Since he lives in the south of England, he undoubtedly will owe capital gains tax if the house has to be sold. There are various financial schemes to help people avoid having to sell their homes to pay for care (a politically charged issue in the U.K.), but they might create massive U.S. tax headaches.

The people I wonder about are Larry’s children, assuming they are U.S. citizens. They are middle aged public sector employees, so not likely to up sticks to the U.S. It doesn’t seem likely that their children would qualify to be U.S. citizens. They don’t have any firm connection to the U.S. Tax law covers people like Larry’s children, too.

@Barbara

There are a lot of Homelanders Abroad in the U.K. because of the non-dom rules which free short-term residents from full U.K. income taxation. They are probably the sort the ambassador hobnobs with. The non-doms aren’t the ones in a furore, because they don’t have to adhere to two complex tax codes. It is difficult to get people in Britain to see the downside of citizenship taxation because so many people in the U.K. really like it that the U.S. taxes the American non-doms, who might otherwise only have to pay a small percentage of their income in tax.

@Publius

I would imagine most of Larry’s estate is situated in the UK, in which case HMRC will tax it first, before the IRS gets to review it. Having US citizenship will not excuse him from paying UK estate (inheritance) tax

If he renounces and is covered the US will tax it a further 40% if his kids inherit as US citizens. If they also renounce, the estate tax will only be paid in the UK.

@Publius, “It is difficult to get people in Britain to see the downside of citizenship taxation because so many people in the U.K. really like it that the U.S. taxes the American non-doms, who might otherwise only have to pay a small percentage of their income in tax.”

Light went off in my head.

I just learned something from you and this helps explain a lot!!

You are correct, plus there are likely US Expats who comply with the USA and never ever file anything with HMRC!!!! To be honest, I have run into such folks but thought I mistook what they were saying.