NB:TORONTO Consulate is verifying Social Security Numbers when Applying/Renewing Passports

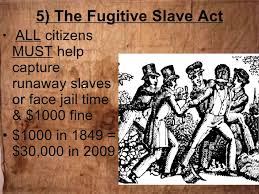

Condors #AKA Bounty Hunters chase “U.S. persons” – FATCA = Modern Equivalent of Fugitive Slave Act

All condors MUST assist with the enforcement of CBT law on Americans abroad or face Circular 230 sanctions – just doing their job!

Bob Jones on American Expatriates Facebook: “CBT is the modern form of slavery”

December 12, 2011 – “We can’t trust the IRS, but can we trust the accountants and the lawyers?” – Early Isaac Brock Society

We can't trust the IRS – But can we trust the accountants and lawyers? http://t.co/bt6AXQ0Gyt

— U.S. Citizen Abroad (@USCitizenAbroad) August 26, 2015

The post is a comment responding to the blog post – IRS issues Fact Sheet For U.S. or dual citizens residing outside of the U.S., to which Petros commented : They [the IRS] can’t be trusted when they talk about reasonable cause, because they don’t really indicate what reasonable cause is. As I said in the post – the trust issue is huge. But, the trust issue exists with respect to both the IRS and the accountants and lawyers who have been involved in this (often giving advice that was clearly of benefit to the accountant/lawyer and not necessarily to the client).

November 26, 2014 – Form People – “Beckon you to enter their web of sin” https://twitter.com/USCitizenAbroad/status/636688896210923520

FORM PEOPLE to the tune of “Goldfinger” Form People They’re the ones The ones with a vampire’s bite A scary sight Such a cold people Beckon you to enter their world of fines You must decline Bafflegab they will pour in your ear But their words can’t disguise what you fear For the clever ones know how bad this ends It’s the kiss of death to befriend Form People Clever ones, beware of their deeds untold Their hearts are cold Bafflegab they will pour in your ear But their words can’t disguise what you fear For the clever ones know how bad this ends It’s the kiss of death to befriend Form People Clever ones, beware of their deeds untold Their hearts are cold They love only forms Only forms They love forms They love only forms Only forms They love forms Even though Canadians rounded up and turned over by FATCA to the IRS are advised NOT to go to these people for help, for example, on whether they should or should not comply with laws of of a foreign government, or whether they are in fact a U.S. person, some will go stampeding to “Form People” for that first pass advice. Form People (also known as “compliance condors” or “compliance vultures”) are mostly honest and hardworking, but they live in a special world — a world in which forms are sacred. “Tricia and Stephen, You are absolutely right when you say that “Wonderful World of Forms, Threats and Penalties” is completely normal from the perspective of the Compliance Condor. In fact, for most of them, the completion of forms is the fundamental obligation of citizenship (or at least U.S. citizenship). Furthermore, very few of them see the system of taxes, forms as penalties as being immoral. They just see it as normal. One could say that the Compliance Condors work “within the system”. But, the truth is that the Compliance Condors “Are The System”. They make it work. They shape the law. They shape the expectation of the law. Once one Condor begins filing a specific form (example 3520 for the TFSA) the other Condors are sure to follow. Because Condors are “Inside The Form” looking only at the Form, they can’t imagine what it means to be “Outside The Form” looking in. They can’t see the immorality, the injustice, the waste of human resource and the dehumanizing of the individual. In fact the Compliance Condors “aid and abet” each of these things – they take pride in doing it. But, there’s much more. In the “Form Industry” there is a hierarchy of forms. Those who are most experienced assist with the most complex forms. Imagine the day in the life of a Compliance Condor when he/she reaches the point where he is assigned a 5471 [anyone out there own a Canadian (i.e. “foreign”) corporation?] or an 8621 [how about a single share of a passive investment company?]. After all, those who are most junior would start with an FBAR or perhaps a schedule B. The value of a Compliance Condor is a function of the forms to which he is entrusted. His sense of “self worth” is defined by the form that he is assigned. A Compliance Condor would start the day by looking the mirror and saying: “In forms we trust”. The most dedicated Condors dream of Forms. But, they do more than dream about Forms. Because their identity is a function of their forms, many of them go further than dreaming about forms. Those who are most dedicated actually dream about being specific line numbers on different forms . In social settings they confide about their dreams to other Condors. In the industry, these are known as “Form Dreams”. So, yes when the Compliance Condors write about FATCA, FBAR and other sacred instruments of confiscation, they are being sincere. They believe are being helpful. They are NOT being dishonest And above all else, they are simply writing about the world they way they see it and the way they experience it. And that Dr. Reader is exactly the problem! P.S. Avoid “Form Crime” – The Compliance Condors will love you!” — THIS SAINTLY MAN, revered by all FORM PEOPLE (and by the happily IRS compliant worldwide), is the CREATOR of the FORMS:

August 26, 2015 – IRS Bounty Hunters Coming To Canada” https://twitter.com/USCitizenAbroad/status/636683815046410241

@ Bubblebustin I think this is not the first time you provided grist for my paradoodling mill … “Condor” — a parody of “Snowbird” Beneath the FATCA mantle cold and mean The condor lies awaiting For new clients to be seen The condor sings the song he always sings And speaks to them of taxes And the penalties they bring When we were young Our minds were young then too Anything our MPs told us That’s the thing that we would do But now we see such emptiness within And the thing that we want most in life Is challenge them and win Spread your condor wings and fly away And take that FATCA with you Where it came from one dark day MPs who once we trusted were untrue And if they could, we think that they should Fly away with you Good sense within our reason seems to say That he’ll try to break our spirits down Should he decide to stay So U.S. condor We encourage you go To that land across the border Where bad legislation grows Spread your condor wings and fly away And take that FATCA with you Where it came from one dark day MPs who once we trusted were untrue And if they could, we think that they should Fly away with you Yeah, if they could, we think that they should Fl-y-y-y-y away with you

EmBee’s paradoodles are always in perfect form!

Condors (AKA Formpeople) strike again. Gwen and Ginny’s lawsuit is making the news in strange ways:

In “New tax rules could erode financial privacy. Security fears; Global authorities to begin sharing sensitive data.”

http://www.thestarphoenix.com/business/rules+could+erode+financial+privacy/11320728/story.html

Saskatoon Star Phoenix states “The plaintiffs, Gwen Deegan, a graphic designer from Toronto, and Ginny Hillis, a retired lawyer from Windsor, are seeking to permanently prevent the minister of national revenue from disclosing to the U.S. government the private banking information of Americans who are also Canadian citizens or residents.”

Even Roy Berg admits about FATCA and OECD “Lots of personal financial data will be exchanged over the Internet. That is a big, tempting target for cyber-criminals and state-sponsored cyber-criminals. No one’s talking about the security of the data.”

@Pat, if cyberhacks wanted Asley Madison data, surely jihades will hack into a nice database of Americans overseas.

Best case they will be subject to financial crime.

Worst case…..stalked and killed.

Before clicking Pat’s link I originally posted a comment saying it was nice to see the Star Phoenix, who is now on our pr list, (Thanks LM) joining the mix.How perfectly horrid to see them repeating the dreadful article from the Financial Post. It is difficult to imagine why FP could not even print ADCS’s name in connection with the lawsuit. Nevermind the irresponsibility of both the paper and those interviewed, to suggest that FATCA and OECD are the same.

Article is a perfect example (though I am not sure it is willful) of how misconception is spread and when multiplied, can be so horribly destructive. Examples:

1)we will be responsible for the economic calamity that ensues should the US be so bold as to impose their threats upon Canada

2)tax cheats, which those US Persons living outside of the US most certainly are, are the cause of all this expensive and intrusive action

I am curious as to why conflicts of interest are not disclosed when people are interviewed. Readers see these people as “experts” without realizing they are not coming from a neutral point in the situation. I am not accusing anyone of anything here but this is rather standard in other situations in life, why not here?

Tricia,

A financial conflict of interest can be defined as a situation in which financial considerations have potential to compromise professional judgment and objectivity.

A financial conflict of interest does not at all equal misconduct.

The way to deal with a potential financial conflict of interest is disclosure:

In the situation of a professional person (e.g., a cross-border tax lawyer, expert witness in court) opining on FATCA legislation for example, the professional person doing the interview has the obligation to the public to disclose, first and upfront in the interview, that he/she has a financial interest in the outcome of the topic that is discussed.

@Tricia

I am no economics expert; however, I must say, should the United States sanction Canada for non-compliance to enforce Fatca, the Canadian economy would simply re-adjust to a new reality and carry on. But Canada is not Russia nor China but a pacifist neighbour to the north. Will the U S of A really impose a financial sanction against Canada? It will be very interesting to see how this pans out at the end…

Ah, disclosure, transparency — the missing link in so many rights lost.

Duality –

Canada is not Russia nor China but a pacifist neighbour to the north

Wow. Canada pacifist? Drink Canadian koolaid and die!

Harper shills for US Mideast murdering, shipping Canadians off to do the master’s bidding.

I think you need to volunteer for murder duty so you can get an education.

@usxcanada

Canadian expatriates here in Europe have presented themselves as being mild and peaceful, and they have always had my sympathy. On the other hand, Canadians are proactive and reactive when they have to be (e.g. rejection of Fatca), and this I like even more.

Perhaps my perspective on Canadian foreign policy is a bit dated? I would like to think that Canada is still like Japan, a pacifist (which, may I remind everyone, is a good thing).

We can both agree that Harper is worse than a muppet… he’s a write-off! His IGA is effectively a Fugitive Slave Act in disguise.

“I would like to think that Canada is still like Japan, a pacifist (which, may I remind everyone, is a good thing).”

Not any more. Well the upper house is expected to take no action on the “security” bills, but then 60 days after the lower house passed them, they’ll return to the lower house where they’ll easily get the two-thirds majority they need to pass a second time and become law.

The “security” bills overturn the constitution’s Article 9, which was the pacifist article. Dishonest Abe figured out he wouldn’t get enough votes to amend the constitution, so he “reinterpreted” it instead. Then when his selected constitutional scholar agreed with other parties’ selected scholars (and nearly everyone else) that the bills are unconstitutional, he has to find a different constitutional scholar instead.

Well, when China wants a war and Abe wants a war, maybe he’s the man for the job.

Recently, some survivors of Hiroshima expressed their unhappiness about Abe’s constitutional position on pacifism. The Japanese public seem to be on one polar extreme whilst Abe on the other end. Do you see a parallel paradigm in Canada? Harper doing his own thing on one end, the rest of the affected public protesting on the other? Typical political maneuvering…

@ Duality

Yes, and here’s a report of a protest which backs up your comment. The Japanese people want peace while PM Abe wants legislation passed to authorize overseas non-defensive military actions. He turns a deaf ear to the voices of his people, just like Harper does.

http://rinf.com/alt-news/latest-news/japan-tens-thousands-anti-war-protesters-reject-return-militarism/

I see a bright red headline here about the Toronto Consulate verifying social security numbers when renewing passports but I see no further information about this and no discussion. Does this mean they are refusing to renew a passport if the applicant does not have a social security number? Are they forcing people to apply for an SSN before they can apply to renew their passport? If so, has this practice spread to other consulates to anyone’s knowledge? Has it become official policy?

I’m curious too about the Toronto Embassy checking the social security number. I recently spoke with two different individuals who claim they are traveling across the border using a permanent residence card both by air and car. They both say that they have never been hassled. By the way, we don’t know what we are talking about and are getting bad advice. The US isn’t interested in us according to them.

If US law requires you to fabricate a social security number, obey. Fabrication of a social security number used to be illegal and punishable, but now it’s mandatory, and failure to fabricate one is punishable. Diamond v. United States, Fed. Cir. No. 2013-5036, Dkt. 29-2 (decided September 12, 2013, rehearing denied October 22, 2013, cert. denied).

Toronto will be visited by Moodys condors: Roy-the mugger Berg and his sidekick, Alex-the-fleecer Marino.

Complimentary seminar presented by: Roy A Berg JD, LLM (US TAX) and Alexander Marino JD, LLM (US TAX)

http://www.moodysgartner.com/learning-tax/toronto-seminar-renouncing-your-us-citizenship/

Their presentation is not recommended… unless you want to see them herding many who relinquished decades ago into today’s full compliance mill. With their Toronto presentation being at the Royal York Hotel, Moodys is trolling for a certain demographic, i.e., the elderly and wealthy experiencing their OMG moment.

Beware of ‘Complimentary’ seminars which in the end are not really ‘free’ – they are teasers to enlist anxious and very frightened people who are then massaged into feeling that the condor is their one true champion and advocate and understands just what to do to save them.