24 Hours Until #FBARs due & Hey! Don't 4get Ur US Person-Kids :Children,Taxes & #FBAR’s –Not Mere Child’s Play! http://t.co/eMwBFs5v91

— U.S. Expat Canada (@USExpatCanada) June 27, 2015

At one minute to midnite, there will be 24 hours left for ALL US Persons to get their affairs in order and get their FBARs filed. And don’t forget, you cannot get an extension for FBAR.

Let’s take a moment to review just exactly what it is that

FinCEN’s mission is to safeguard the financial system from illicit use and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.

“Whaaaat? My chequeing account at Scotiabank is related to possible illicit use of funds, money laundering or other crimes that will affect the financial system and even worse, the national security of the United States? That must make me a criminal.”

Let’s review what is required:

Who Must File an FBAR

United States persons are required to file an FBAR if:

- the United States person had a financial interest in or signature authority over at least one financial account located outside of the United States; and

- the aggregate value of all foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

United States person includes U.S. citizens; U.S. residents; entities, including but not limited to, corporations, partnerships, or limited liability companies, created or organized in the United States or under the laws of the United States; and trusts or estates formed under the laws of the United States.

Checking where to file, I see this on the FinCen site:

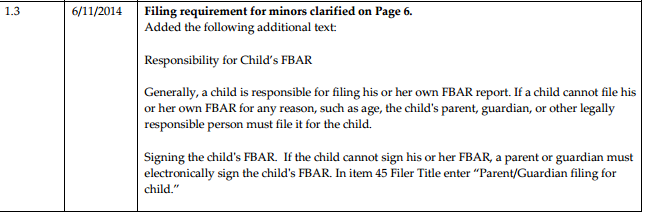

Yes indeed, you read correctly. If any of your children have more than $10,000 total of all their accounts combined then, yes, your US Person children must file an FBAR.Don’t forget your US-born adopted child. Imagine- “alien” parents helping out by filing US tax forms for their children. Now that’s looking out for your kids!

Yes indeed, you read correctly. If any of your children have more than $10,000 total of all their accounts combined then, yes, your US Person children must file an FBAR.Don’t forget your US-born adopted child. Imagine- “alien” parents helping out by filing US tax forms for their children. Now that’s looking out for your kids!

“Well ‘hey now,’ as my grandma would say, any kid can deal with figuring out how to get the pdf file to open up in their browswer – it’s a cinch for them! Oooooo lookey here, now they can do it on an

online fillable form!”

After that, all they have to do is:

- Download, open and complete your FBAR

- Validate FBAR –

- Sign your FBAR

- Save your FBAR

- Upload your saved FBAR

- Monitor your email for an acknowledgement email within 2 business days

And guess what, if your child is unable to put his/her signature on it, you, as their legal guardian, must electronically sign the child’s FBAR. In item 45 Filer Title enter “Parent/Guardian filing for

child.”

“So, let me get this straight… not only is it perfectly acceptable to have a guardian act on behalf of the child, its a requirement. Just like a new immigrant who cannot take the oath on their own, the oath is waived. However, when an adult child (or any other infirm individual) cannot form requisite intent, no one can waive the oath of renunciation for him/her or renounce for them?”

“Oh good gawd, if my kid has to file an FBAR what about…..???” yep, regular taxes too!

What Parents Should Understand

When it comes to filing their children’s income taxes, parents need to know the following:

- Legally, children bear primary responsibility for filing and signing their own income tax returns.

- Children can receive tax deficiency notices and even be audited.

- If children are otherwise required to file a tax return and their only income consists of interest, dividends and capital gains (unearned income), parents may elect to include the child’s income on their own tax returns

- Children who earn net self-employment income above the filing threshold are required to pay self-employment tax for Social Security and Medicare, even if no income tax is owed.

And make sure you know in time for next year; if your child has $2,000 or more of unearned income, they must file file an 8615 form.

Who Must File Form 8615

Any child who meets all of the following conditions:

- 1. The child had more than $2,000 of unearned income.

- 2. The child is required to file a tax return.

- 3. The child either:

- a. Was under age 18 at the end of 2014,

- b. Was age 18 at the end of 2014 and did not have earned income that was more than half of the child’s support, or

- c. Was a full-time student at least age 19 and under age 24 at the end of 2014 and did not have earned income that was more than half of the child’s support. (Earned income is defined later. Support is defined below.)

- 4. At least one of the child’s parents was alive at the end of 2014.

- 5. The child does not file a joint return for 2014

“Whew……is there anymore?” Of course!Alternative Minimum Tax

A child whose tax is figured on Form 8615 may owe the alternative minimum tax.

For details, see Form 6251, Alternative Minimum Tax—Individuals, and its handy instructions.

And here are some reassuring reasons for why your kids should start now:

As children move toward adulthood, parents face several milestone decisions. In each case, part of the decision involves a desire to help children become more independent and responsible. But, there is another milestone that parents might not anticipate, even though it will be part of almost every child’s growing-up experience and (unlike car keys and credit cards) it is legally required. It’s the filing of the first income tax return in a child’s name.

As parents should realize, income tax filing is not taught in schools and it’s not a subject that captivates teens’ attention on TV. Most children have only a dim idea of what income taxes are, let alone the specific rules they are required to meet. Therefore, the parent’s role is to initiate this rite of passage by evaluating tax-filing requirements and/or obtaining guidance from tax professionals. This article is designed as a parent’s “quick guide” to this subject. It covers the basic rules that you should know for determining when your child must (or should) file. It also offers suggestions for helping children take responsibility for their own tax chores in the future.

And just before you put the little darlings to sleep, don’t forget to read them the interactive FinCen Story, sure to warm their little hearts and give them the sweetest dreams ever.

WTFO! “rite of passage”!!!!

@Japan T

sick, eh?

You know what I say to this…. watch the bird… ohh… wait… double bird coming right at u…

US exceptionality knows no bounds / has no shame. Litigation is imperative in our countries of citizenship and residence and in the US.

Don’t forget, if none of this makes a damn bit of sense to you and you live overseas simply pay an expat accountant $5,000 a year to ensure you and your family are compliant. If you are broke and can’t afford to do this, well I guess you’re screwed and will have to attempt filing it all yourself. Beware though, fail to cross a t or dot an i and you could be fined $10,000’s of dollars. Well, when you see how rapidly the USA is deteriorating might as well just ignore all of this because in 10yrs time there probably will not be a USA as we know it or an IRS. Or you can just be like me and figure since you are never setting foot in the US for the rest of your life that they will not attempt to extradite a broke minnow who couldn’t afford to be “compliant” in the first place.

I’ve never even heard of Form 8615 before. How long has it been around? What conceivable purpose does it serve?

Barking insane.

If one keeps an account in a credit union which is FATCA exempt, the IRS will not be able to track you. This goes for children as well, who may be considered suspect US persons. In the meantime, let’s all contribute to ADCS to put a stop to all this. Please donate and try to attend the Federal Court proceedings in Vancouver August 4-5.

@calgary411

True…US exceptionality knows no bounds.

I’m not playing. I’m taking my ball and going home.

@foo,

8615 is for the kiddie tax. It’s an evil tax where children unearned income is taxed at the rate of their parents. Essentially punishing minors with investment income. This came into being because the USG feared that rich parents might offload investment income to children to get better rates. I have read there was no evidence of this happening at the time. Gift tax limits would prevent a lot of this anyway since you can’t give away too much.

It gets even worse. Most local banks refuse to provide services to children if they are burdened with citizenship that they are not allowed to renounce from, since the filing requirements for banks are too complicated and costly for kiddie accounts.

Mind-blowing.

Children will be heartbroken.

In the FINCEN story (1998), they forgot to show Canada as a HIFCA.

http://www.fincen.gov/law_enforcement/hifca/index.html

HIFCA stands for High Intensity Financial Crime Area….

Makes me incredibly angry over and over; children being responsible for reporting to an extraterritorial body whose purpose is to investigate financial crimes – merely because of their parentage or birthplace plus living outside the US and having their birthday or education savings accts in a local financial institution. Children in Canada and elsewhere around the globe held responsible (read “held hostage” by the US government) for filing the FBAR online to FINCEN – yet deemed too immature to comprehend the renunciation/relinquishment of US citizenship.

Not content to trample on adults, the US via FINCEN makes deliberate pains to state that even our children are deemed criminals before the fact – and thus must file their own FBARs:

“FinCEN’s mission is to safeguard the US financial system from illicit use by all those children living ‘abroad’,and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.”

Because even our children are moneylaundering-druglord-terror-funders – especially those with ‘foreign’ education and disability savings deemed by the US to be ‘taxable foreign trusts’ (like the Canadian RESP and RDSP).

F the US.

BTW, above is my revised version of the FINCEN mission statement – “FinCEN’s mission is to safeguard the US financial system from illicit use by all those children living ‘abroad…..”

Because that is exactly what FINCEN and the US government is saying about any of our children who have had the misfortune to inherit the UStaxablepersoncitizenserf status from us.

@Neill,

Thanks for the info. Googling, it looks like it can apply to students up to 24 years old? Crazy.

I wonder what happens if the parents are both non-resident aliens…

<>

Except maybe they can’t, even when the kid is smart enough.

After the IRS told me what my ITIN is and told me to use it, the online fillable FBAR form rejected my ITIN.

“I wonder what happens if the parents are both non-resident aliens…”

If lucky, the kid gets audited.

If not lucky, the IRS relies on its own altered records, labels the kid frivolous, penalizes the kid, and seizes the kid’s assets. The kid can sue for a refund, but the court will rule against the kid because IRS records show that the kid is frivolous.

Our governments, financial institutions and our societies in general are constantly promoting the importance of saving for our futures. Parents teach this necessity to their children. And then *one* particular government comes along and says, “Ah, but if you do save any money you have the privilege of having to tell *us* about it in exact detail every single year for the rest of your life so that we can share your information with all the alphabet agencies of our country that might think you have an evil purpose in having saved this money.”

So just why is it ,again, that saving money is a good idea? I’d be safer having spent the wad!

The image of the US government I have in my mind is that of a fibrillating heart. The muscle is still twitching but in such an unorganized fashion it is unable to perform its basic function of pumping blood. The US government is so disfunctional it has become extremely dangerous to have any interaction with it whatsoever.

That Financial Crimes Enforcement Network was the last straw for me. I used to grumble about the obnoxious paper FBAR, but when they went electronic with Fincen I swore an oath to myself that I would never file one of those things and I’ve kept that promise. To force honest people to register with an entity with such a name is abuse that must not be tolerated. Real financial criminals must laugh about it amongst themselves but its not funny to me.

We are witnessing a once great country crumble as it has totally lost its way with an out of control government. After you have abused all of your citizens and all of your friends, you have nothing left but enemies.

It’s more important for the US government that Americans be deterred from leaving the US to avoid US taxes than to allow them to live normal lives if they do.

America is anti-emigrant.

I just can’t be bothered anymore. Stuff ’em: I’m just not doing it.

@Bubblebustin

No… u are not totally correct… US is anti-emmigrant and anti-immigrant. The US just wants to keep the homelanders in and take poor immigrants who don’t care about this since they have no funds & willing to work for less then $2 an hr on jobs no americans want or receive social services… every flipping time we turn around… another form & $$ punishment… instead of the gov’t fixing the issues…. they tighten the noose to kill us all… To add salt to our wounds… our home countries are now working for them for free and more then willing to narc us out… I think the major problem is alot of people don’t know about this crap… the ones who said… Ohh… I knew for yrs & have been following the rules… are not telling the truth or hired professional help..

Litigation is more important now then ever before… we must stop this…. if not for us…. but the next generations… Donate to the Canadian litigation…. we have to stand up since we can’t rely on any gov’t to help us… we are the easy marks… no voice & no way to fight back other then court….

They can stick their forms, crazy laws, and CBT where the sun don’t shine

F’um now and forever

as a canadian citizen who left america in 1966 as a 5 year old and who in 1980 swore alligance to the queen who is now a self relinquisher american can kiss my a$$.

this is just one more reason for me to never go near the border nor submit to amerikan demands. as a tax fugitive for more than 45 years i refuse to willingly give up anything to a foreign power.

if you want me uncle sam you are going to have to come find me cause i will be damned if i am going to make it easy on you and tell you who or where i am!!!!

@US_Foreign_Person, It’s worse than what you stated. The US government is sabotaging homelanders from keeping the jobs they have and want to keep. Instead, corporations can easily, legally replace Americans with cheaper replacements recruited from overseas. Why does the US continually shoot themselves in the foot and cripple the tax base at home, and then come running to grab the money from “US persons” abroad? It’s another example of maz57’s analogy of a dysfunctional “heart” that twitches but cannot do its job of pumping blood.

I grabbed this website’s example of the hard-hit I.T. sector, where even good ol’ Disney is firing Americans to be replaced by cheaper foreigners, but I’ve read similar stories on other websites:

http://theeconomiccollapseblog.com/?s=Disney