by Carol Tapanila & Tricia Moon

S. 877A of the Internal Revenue Code – “One picture/statute – Two contradictory ways of seeing it”

Note: This post will be best understood by reading the following two sections of the Internal Revenue Code:

S. 7701(1)(5) Definition – Termination of United States Citizenship

S. 877A(g)(4) – Tax responsibilities on Expatriation

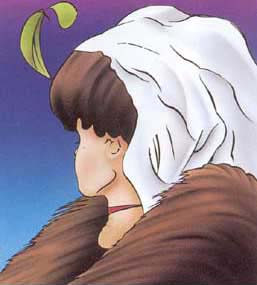

Do you see a “Young Woman” or an “Old Woman”, or can you see both?

If you can’t see both, watch this video!

The question: I lost U.S. citizenship years ago. Can the U.S. still tax me?

Nothing paralyzes a relinquished expat more than the notion of having their citizenship “restored” automatically (without their consent). For those who relinquished decades ago but who do not have CLN’s, this is becoming a major issue. How incredibly frustrating to have been warned/admonished decades ago by consular staff who failed to include the information that one “perhaps should” appear at the consulate, file forms and get a CLN. In fact, under the INA (“Immigration and Nationality Act“), neither notification NOR a CLN was required to relinquish U.S. citizenship. And in the same spirit of the government’s complete lack in taking responsibility for due diligence in advising of tax and reporting requirements before the hideous spectacle of OVDP/OVDI, once again we are the ones bearing the brunt of the problem. As usual Americans abroad are faced with both (1) “ignorance” of the law because they never knew or heard about it AND (2) Ignorance of the law because the law cannot be understood.

(1) Ignorance of the law because nobody ever heard about the law: As far as “ignorance of the law is no excuse,” have a listen to this short, incredibly simple and completely clear explanation of why the government should not get away with this. Really, can the U.S. take away the “Stop Sign” and then fine people for not stopping?

Story of the Stop Sign

“Mike” interviewed for Senate Finance Committee submission

(@ 01’35” total- 02′ 15″)

(2) Ignorance of the law because the law (S. 877A rules) cannot be understood: This frustration is captured by “Homelander_Not” in the following comment on Robert Wood’s blog

My comment on “20 Really Stupid Things In The U.S. Tax Code” @Forbes: http://t.co/E2J7W4Fyu3

— Homelander NOT (@Homelander_NOT) December 16, 2014

About the “Exit Tax” (S. 877A rules) – Do the rules apply prospectively only from June 16, 2008? Do they apply retrospectively to those who relinquished U.S. citizenship by becoming Canadian citizens in the 1970s?

The statute itself is said to be poorly written. Both sides of the fence can be quoted as saying it is/isn’t retroactive by the “plain language” of the statute. This is extremely confusing and unsettling; how is one to know who to believe? Is there even an answer to this important question?

Since Treasury/IRS have not, at this point, chosen to offer guidance, we are left with many very competent lawyers who do not read the statute in the same way. As long as the IRS remains quiet on these issues, the ways in which these advisers lead their clients become a secondary way of “making the law.” The longer the IRS is silent, the more the law is “established” by the compliance industry. (And this now includes the banks, who have no business being the arbiters of U.S. indicia determining U.S. Person-hood (or not)). The question then becomes, why should one point of view be any more (or less) compelling than another? There are many different perspectives on this issue. Why should one point of view be preferred to another?

As Homelander_NOT formulates the question:

A major concern is that people who relinquished their citizenship decades ago are being told they must formally renounce at a consulate, they must file taxes and so on. The same thing is happening with “border babies” and other types of “Accidental Americans.” The fact is, citizenship law is complex. What is true for someone renouncing today is not necessarily the same for people who have a different situation outside of simple dual-citizenship. And yet, if you read what the compliance industry is saying, this is “it” – you must become compliant, file 8854 and pay that outrageous $2350.

We would add that those who renounce U.S. citizenship today are (assuming they are “covered expatriates”) subject to the draconian U.S. “Exit Tax” rules which could trigger significant confiscation of your retirement assets. See examples here.

So, what do the lawyers suggest? Remember that the law is NOT clear and these are the perspectives of the individual lawyer.

The S. 877A “Exit Tax” rules took effect in June 2008. Could they really be understood to apply to people who relinquished U.S. citizenship before the “Exit Tax” rules even existed? Some lawyers say “YES.” Some lawyers say “NO.” Some lawyers say “NOT SURE.” Some lawyers say: “What? I don’t understand the question.”

“Fools jump in where angels fear to tread”

Few lawyers have demonstrated the courage to address this issue at all. Recently, the lawyers mentioned in this post have put forth their ideas on the subject. The difficulties involved in understanding the complexities can lead to quite a state/level of uncertainty. It is only natural to feel fearful when something is not grasped. It must be remembered that at this point NO ONE “knows.” Each person has to take responsibility for making the effort to become familiar with all the information out there and apply it to his/her situation as best one can before making a decision/taking action/going with any particular adviser. Ask your adviser why he/she interprets the S. 877A rules in the way that they do. Remember, that your choice of adviser will help shape the law! After you have read these points of view, please vote in the poll at the bottom of this post.

There appear to be at least three different perspectives:

1. No, the S. 877A “Exit Tax” rules do NOT have retroactive application because they cannot be reasonably interpreted to mean that they have retroactive application.

2. No, the S. 877A “Exit Tax” rules do NOT have retroactive application because the “plain language” of S. 877A says they they do NOT.

3. Yes, the S. 877A “Exit Tax” rules DO have retroactive application because the “plain language” of S. 877A says that they do.

Exercise: Can you decide which lawyers have which perspectives? You will probably have to read their individual posts/articles to fully understand their position. Some may have more than one perspective. Check your answers at the end of this post.

John Richardson B.A., J.D. in his post: Are You or Have You Ever Been a U.S. Tax Citizen?” introduces the problem. In a separate post he offers his thoughts on “The Plain Language of S. 877A – To Whom Does It Apply“. This matters because if S. 877A applies, then the “Exit Tax” rules apply.

The interpretation of “retroactive confiscation” includes the following three fantastic assumptions:

1. Fantastic – The idea that the U.S. Congress (remember that’s where the law comes from) intended to retroactively confiscate the retirement assets of former U.S. citizens (living outside the United States) is fantastic. 2. More Fantastic – The idea that the retroactive confiscation of wealth could have been intended without that specific intention clearly conveyed in the statute (which was buried in a section of the “HEART Act”) is more fantastic. 3. Most Fantastic – The idea that a former U.S. “citizen” should have to consult a lawyer to determine whether the law (which nobody would even imagine exists) should be interpreted as confiscation of (“post U.S. “Citizen”) assets is the most fantastic.

Virginia La Torre Jeker J.D. Part I: Living in the Past: Citizenship “Relinquishments” – Am I Still a US “Tax Citizen”? Part II: Living in the Past: Citizenship “Relinquishments” – Am I Still a US “Tax Citizen”? Part III: Living in the Past: Citizenship “Relinquishments” – Am I Still a US “Tax Citizen”?

Today’s Part III of the post also sets forth the premise that the manner in which legal professionals interpret a particular law will impact how that law is interpreted by other professionals, which in turn will help shape the future evolution of that law. With that as the touchstone, prudence is advised when it comes to interpreting the backward reach of the relevant Internal Revenue Code Sections — Section 877A and 7701(a)(50). Caution is necessary lest the tax professionals, themselves, create a situation where one professional blindly follows the next resulting in a scenario where, without the requisite aforethought and due consideration, the provisions come to be applied retroactively.

Michael J. Miller Expats Live in Fear of Malevolent Time Machine COMMENTS ON THE TAX STATUS OF CERTAIN EXPATRIATES These Comments address the need for guidance regarding the tax status of individuals who expatriated on or before June 3, 2004.

For persons whose CLN shows a loss of citizenship date that is on or before June 3, 2004, section 877A should not apply. Even if the CLN is received today. I’ve discussed this with people at the IRS and they’ve informally stated that they agree.

***

Furthermore, since the 2004 Act quite deliberately included a “grandfather rule” for individuals who expatriated (within the general meaning of that term) on or prior to June 3, 2004, it’s extraordinarily difficult to imagine that the 2008 Act would have been intended to reverse that treatment.

Roy A Berg, JD, LL.M (U.S. Taxation), TEP FATCA, Cure for US Place of Birth

Exhibit 1 Explanation of Reason Account Holder Does Not Possess a Certificate of Loss of Nationality Despite Having Relinquished U.S. Citizenship This is a very-well drafted suggestion for FFI’s to accept in lieu of a CLN.

Under a literal interpretation of current law Mr. Maple Leaf’s U.S. citizenship is terminated for nationality purposes in 1981. However under HEART, termination of his U.S. citizenship for tax purposes is determined under section 7701(a)(50)(A), which sends us to section 877A(g)(4). Under section 877A(g)(4), Mr. Maple Leaf’s U.S. citizenship is lost on the earlier of:

1. The date in 2015 on which he submitted a statement that confirmed a prior expatriating act (i.e., becoming naturalized in and formally declaring allegiance to Canada); or 2. The date in 2016 on which his CLN was issued. Because his submission to the Department of State antedated the issuance of the CLN, his tax-citizenship terminated in 2015. Thus, Mr. Maple Leaf is liable for tax and reporting obligations from 1981 through 2015. Further, since Mr. Maple Leaf and the Department of State did not concurrently consider his U.S. citizenship to have terminated, he will not be relieved of tax obligations under D’Hotelle de Benitez Rexach or Revenue Ruling 92-109 until 2015.

Mr. Berg’s interpretation of “retroactive application” is strongly supported by California tax lawyer Patrick Martin.

______________________________________________________

A discussion among Roy Berg, Michael Miller and Patrick Martin …

Okay, you have had the opportunity to read what various lawyers say when they WRITE in a non-interactive way. Interestingly, a recent interactive DISCUSSION on this topic took place on a blog between three of the lawyers mentioned above. The discussion demonstrates the total lack of agreement. You can read the comments here. What do you think?

______________________________________________________

Possible answers to which lawyers have which perspectives?

1. No, the S. 877A “Exit Tax” rules do NOT have retroactive application because they cannot be reasonably interpreted to mean that they have retroactive application.

Michael Miller, Virginia La Torre Jeker, John Richardson

2. No, the S. 877A “Exit Tax” rules do NOT have retroactive application because the “plain language” of S. 877A says they they do NOT.

Virginia La Torre Jeker, John Richardson

3. Yes, the S. 877A “Exit Tax” rules DO have retroactive application because the “plain language” of S. 877A says that they do.

Roy Berg, Patrick Martin

________________________________________________________

Conclusion – if there is one …

The application of the S. 877A rules is so unclear that, as was previously reported at the Isaac Brock Society, the American Bar Association has asked the IRS for a ruling on the correct interpretation.

What do you think? Do you see how the interpretation of the S. 877A rules can be seen as both the “young woman” and the “old woman”?

The message is: Caution is warranted!

You should take whatever step (or not) that you are most comfortable with. The interpretations of the lawyers/accountants, etc. are just that – their own interpretations. Hopefully, the IRS will answer the American Bar Association. Till then: Good luck. You are in uncharted terrain.

It strikes me that the very fact that lawyers disagree on this, and that the IRS has failed to issue a ruling to clarify it, makes it most unlikely that the retroactive interpretation could stand the test of courts.

When I filed for and received my CLN in 2012-2013 (for a 1970s relinquishment) and refused to follow that up by contacting the IRS, I was worried for a while about whether they might apply 877A to me. But I have decided that, having lived outside the US for almost 50 years and having been a resident Canadian citizen for almost 40 years, I am simply NOT going to let worry about an unclear and unfair US law spoil my remaining years. I have not visited the US since then and will limit any future visits to as few and as short as possible. I advise others in a similar situation to do the same. My slogan: “877A No Way! Form 8854 No More!”

@AnonAnon

I agree. Utterly ridiculous for you to see it otherwise.

Shortly after I first heard about all this in fall 2011, it was clear to me that I did understand and that under no circumstances could I or would I, place my CDN family in financial peril by risking FBAR penalties or some ridiculous amount of “in lieu of” penalties within OVDI. I was prepared to do nothing if required and was prepared never to cross the border again. Fortunately for me, I could afford to renounce; OVDI 2011 was closed, Fact Statement 2011-13 appeared. I have never regretted coming to the decision rather quickly (renounced within 3 months). Not wealthy enough to worry about 877A. Even though there have certainly been relaxed procedures since the reign of Shulman (I still seethe at the thought of him and his endless threats and overly vicious nature), in a way, it seems to be a harder decision. ??

Should anything come up, change etc, I will not comply with anything further from the US.

I think there’s an angle to the problem that none of the lawyers seem to have considered.

First, some background (derived from Michael Miller’s “Malevolent Time Machine” paper, but confirmed by my own reading of the statutes):

A pre-2004 relinquishment would have been governed:

i) for citizenship, under the Immigration and Nationality Act of 1952, P.L. 414 (the INA); and

ii) for taxation, under The Foreign Investors Tax Act of 1966, P.L. 89-809. Under these two statutes, upon committing an INA-based relinquishing act a person immediately ceased to be a U.S. citizen. And lacking citizenship, simultaneously one became not taxable as a U.S. citizen.

The principle of “no U.S. citizenship = no citizenship taxation” persisted through U.S. law until 2004. Citizenship and citizenship-based tax obligation were first uncoupled under The American Jobs Creation Act of 2004, P.L. 108-357. This created a new form of citizenship: citizenship for taxation purposes. And that set the stage for a complete re-definition of relinquishment.

But jump back one year to the 2003 report of the U.S. Joint Committee on Taxation (the JCT report, JCS-2-03). The JCT report was written in part to review citizenship and tax laws of the time in an authoritative form easily readable by legislators (not lawyers).

In describing the then-current citizenship and tax relationship, the JCT report (p. 209) stated:

“Under present law, the Immigration and Nationality Act governs the determination of when a U.S. citizen is treated for U.S. Federal tax purposes as having relinquished citizenship.”

In describing loss of citizenship by relinquishment, the JCT report (p. 51) stated:

“the loss of citizenship is effective on the date that the act of relinquishing citizenship is committed, even though the loss may not be documented until a later date.”

On the documenting of relinquishment, the JCT report (p. 51) stated:

“There is no obligation for an individual to obtain a CLN [Certificate of Loss of Nationality] or otherwise notify the Department of State of relinquishing one’s citizenship.”

The quotes make clear three points:

1. Pre-2004, INA-based relinquishment extinguished both citizenship and citizenship-based tax obligation;

2. Relinquishment was whole and complete upon committing the INA-based relinquishing act. “Effective date” for the relinquishment was even specified;

3. Documentation/notification is no part of relinquishment, nor its effective date. Mere notification may occur any time later (if at all).

In sum, pre-2004 INA-based relinquishment instantly and completely extinguished U.S. citizenship and all citizenship-based tax obligation independent of any “notification event”.

The problem for someone who relinquished pre-2004 and is now attempting to document is that a new definition of relinquishment has been established. Code Section 877A(g)(4) under The Heroes Earnings Assistance and Relief Tax Act of 2008 now defines relinquishment for taxation, not as the committing of the INA relinquishing act itself, but as the documentation of the commission of the INA act…. the notification event.

So here’s the thing. It is true that for tax citizenship, since 2004/2008 all relinquishments must be notification events. However, that does not mean that all notification events must be relinquishments, especially if tax citizenship is something you did not have. There’s a seemingly obvoius angle all the lawyers (and especially Mr. Berg) appear to have overlooked.

I appreciate that if the notion that some notification events are relinquishments while others are not has escaped the lawyers, it might not be readily apparent to an IRS staffer, or even a judge.

Comments welcome.

reminds me of the Mark Twain quote:

“The researches of many commentators have already thrown much darkness on this subject, and it is probable that if they continue we shall soon know nothing at all about it.”

Take a look at these clauses in Marks and Spencers bank run by HSBC for a current account.

. You are responsible for complying with your tax

obligations (and Connected Persons are

responsible for complying with theirs), such as

payment of tax and filing of tax returns, in all

countries where those obligations arise relating

to the opening and use of accounts and Services

provided by any member of the HSBC Group.

Some countries’ tax laws may apply to you even

if you do not live there or are not a citizen of

that country. No member of the HSBC Group

provides tax advice or is responsible for your tax

obligations in any country, including in

connection with any accounts or Services

provided by any member of the HSBC Group. You

should seek independent legal and tax advice

If you do not give us Tax Information about you

or a Connected Person when we request it, we

will have to make our own decision about your

tax status. This may result in us or any member

of the HSBC Group reporting you to Tax

Authorities, withholding any amounts from

products or services you have with us and paying

those to the appropriate Tax Authority.

Authorities” includes any judicial, administrative, public

or regulatory body, any government, any Tax Authority,

securities or futures exchange, court, central bank or

law enforcement body, or any of their agents with

jurisdiction over any part of the HSBC Group;

“Connected Person” means any natural person or legal

entity (other than you) whose information (including

Personal Data or Tax Information) you provide, or which

is provided on your behalf, to any member of the HSBC

Group or which is otherwise received by any member

of the HSBC Group in connection with the provision of

the Services. A Connected Person may include any

guarantor, payee or any other persons or entities with

whom you have a relationship that is relevant to your

relationship with the HSBC Group;

“Tax Authorities” means UK or foreign tax, revenue or

monetary authorities (for example, Her Majesty’s

Revenue and Customs);

http://bank.marksandspencer.com/pdf/CLTermsAndConditions.pdf

HSBC is being very careful not to single out US citizens, or mention the IRS in any shape or form.

HSBC if you don’t cooperate will make their own determination as to who your account information is passed on to whether you like it or not.

I think in the UK a anti-FATCA lawsuit would have to focus on HMRC, the UK Government, and finally a Financial Institution. Clearly, ‘backroom data discrimination’ is taking place. Someone needs to get a bank in an open courtroom to explain the process how the data is handled from capture through release. Question the bank as to which countries are requesting this information and which countries have received it and how many times.

If a picture could be painted that all US citizens are captured and sent to the HMRC while just a handful to other countries it may paint an interesting picture.

When I return across the pond the battle must be waged.

@Don or @Admin

Could Don’s comment re: HSBC be transferred to or duplicated in “bank” thread too please? Thanks.

http://isaacbrocksociety.ca/2014/06/26/please-provide-in-this-post-questions-big-canadian-banks-will-ask-new-account-holders-on-july-2-2014/

Great post!

Two comments:

Let’s say that Ms Maple Leaf relinquished US citizenship in 1990 with intent to lose US citizenship and has subsequently done nothing to “re-gain” US citizenship. In 2014 she applies for and receives an official CLN, certifying her loss of citizenship in 1990. She does absolutely nothing further regarding any kind of tax filing, exit tax paperwork, etc. Ms Maple Leaf is a Canadian citizen resident in Canada with no US economic assets or income.

1) Has there been any actual judgement establishing kind of precedent this issue in US Court of Law. Have any cases like Ms maple Leaf’s been brought before a court, and if so what was the judgement?

2) What is the conceivable mechanism for enforcing a US “Exit Tax” claim against Ms Maple Leaf in a Canadian court?

She has been protected from any kind of Tax Treaty CRA Assistance in Collection since becoming a Canadian citizen in 1990. CRA can’t help the US government collect from Ms Maple Leaf, and since she has no US-based assets or income, she is immune from US lien.

Imagining that the IRS somehow find their way into a Canadian court to seek a judgement or enforcement of a US judgement against Ms Maple Leaf; how will that play out?

As a Canadian Citizen, Ms Maple Leaf is protected from Canadian Government assistance in collection under the Tax Treaty, which has force of law and precedent. Would a Canadian court enforce a foreign country’s dubious and unusual “Exit Tax” claim against a long term Canadian citizen who is protected by a Treaty from exactly that kind of claim?

To your first question..Not that anyone here has mentioned so far.

Second question- they have no way to enforce acclaim. Mor ethan that, they don’t have enough information to establish a claim.

@Duke of Devon

It sounds like Mr Berg is advising Canadians who relinquished decades ago to file and pay US so-called “Exit Taxes”. (“so-called because they actually exited US residence and citizenship decades ago…)

Is he also informing them that there is no actual precedent based upon judgement to support them doing so – and they are also essentially judgement proof in Canada?

There is widespread agreement that Mr. Berg is a compliance condor. To be completely fair to him, in order to be approved by the IRS, he is obliged to advise in that fashion. Doesn’t mean you need to take his advice.

@EmBee

just posted Don’s comment as you requested.

@Duke

You have a good point about IRS (via Circular 230) and that one needn’t take any particular advice. But I would think the same holds true for the lawyers with the opposite viewpoint.

On this issue, I think I finally agree with you. The only people with problems are the ones in the US tax system. Doing nothing for now may be best. Better that IRS sort this out so all are treated equally and fairly.

Been reading the most recent document from Arvay-2015 05 08 Plaintiffs’ Memorandum of Fact and Law_summary trial.

There are some really interesting points about the Tax Treaty in relation (how it limits) to the IGA as well as information regarding previous cases where the US tried to collect via CDN courts. Gives one the strong impression that US is not necessarily going to do what it expects regarding “US Persons” in Canada.

@Shovel

Good observations. Perhaps the links to papers listed in this post don’t address the notification issue, however it has been covered before. I am certain all of these lawyers are very familiar with it as it is key. I will try to find you the links.

@Wondering

You might find the Chua case worth reading.

In November 1977, the Applicant became a permanent resident in Canada. At that time,

she was a citizen of Malaysia, the country of her birth. In 1980, the Applicant purchased a family residence in Vancouver, B.C. This residence was the Applicant’s Canadian home from 1980 through 1984, when she sold it and replaced it with her current residence also in Vancouver. In 1981, the Applicant and her husband acquired a residential vacation property in Hawaii,

U.S.A. The Applicant disposed of her interest in this property in 1986 and remitted withholding

taxes to the IRS at the time of her disposition. In March 1988, the IRS refunded part of the remitted withholding taxes to the Applicant. On October 31, 1990, the Applicant became a citizen of Canada.

On July 9, 1996, a Revenue Canada official advised the Applicant that the IRS had

requested that the Respondent help collect the debt, then totalling US$273,986.44, and that

Revenue Canada had accepted this request for assistance. Following correspondence between

the parties, on June 18, 1999, Revenue Canada obtained a Certificate of Judgment from the

Federal Court, Trial Division certifying part of the debt. On June 23, 1999, Revenue Canada

filed the Certificate in the British Columbia Land Title Registry against the Applicant’s British

Columbia property. On June 30, 1999, the Applicant filed a Notice of Application in the Federal

Court, requesting judicial review of the Respondent’s decision to take collection action.

On July 20, 1999, Revenue Canada obtained a Certificate of Judgment from the Federal

Court, Trial Division certifying an additional $49,204.17 of the debt against the Applicant.

It gets complicated but if I understand correctly, in the end, the court ruled that Section 15 of the Charter was violated.

2000 CarswellNat 1826

Federal Court of Canada — Trial Division

Chua v. Minister of National Revenue

pp 143-168

2015-05-08-Plaintiffs Memorandum of Fact and Law summary trial

And this is an interesting comment from a discussion back in 2012:

https://www.linkedin.com/grp/post/3694878-178452436

Patrick Johnson

@Tricia, “Gives one the strong impression that US is not necessarily going to do what it expects regarding “US Persons” in Canada.”

Splain?????

@George

I meant that unlike the giving in/signing on to the IGAs, should the courts become involved, it won’t be so easy for the US to just get what it wants. I don’t think they can threaten our courts the way they threatened our legislators.

We hope not, Tricia Moon!

Anyone care to speculate what might happen if an undocumented relinquisher fell victim to the substantial presence test?

Very high-level IRS personnel have privately confirmed that the IRS will NOT retroactively pursue people who relinquished pre-2004. They cannot put it in writing, because to so do would be in conflict with the direct language of the legislation.

They believe there is zero chance that they could win a court challenge. The idea that the legislation could retroactively confer citizenship and tax liability on ex-citizens, going back decades, is absurd, and they understand that clearly. How could someone who lawfully relinquished in 1980 be re-instated as a citizen in 2008, and be liable for taxes and reporting during 28 years they were not citizens? It beggars belief, and the IRS dare not go there.

Please note that there are certain laws that were in effect from 1994 that may impact people relinquishing after 1993. Anyone relinquishing from 1994 – 2004 MAY have had some exit tax issues, depending on their personal income levels and affairs. Anyone relinquishing after 2004, and especially after 2008, definitely have issues to address.

@Rooboy. I believe you are absolutely correct. They would, IMHO have no chance of winning such a court challenge. If they did, the country and its justice system would appear beyond ridiculous. Besides that, if such a situation existed that they could reinstate citizenship and back taxes, imagine the backlash and the complications that would ensue from the need to unwind long ago settled estates!

I would also say that when comparing Roy Berg’s opinion vs Miller’s, one needs to consider which of the two has an apparently obvious conflict of interests.

Pingback: Annex I of the Canada U.S. #FATCA IGA is an aid in interpreting whether the S. 877A rules are retroactive | Alliance for the Defence of Canadian Sovereignty

@BB

I suppose, worse case scenario, they COULD get hammered for the timeframe back to relinquishment date. But given Streamlined and all that, bet IRS would accept a “compromise.” Then again, if the relinquishment were decades ago, also quite possible not even in the system. Doubt IRS would attempt proving the citizenship and trying to go back, etc

What do you imagine?

@Tricia

I believe that snowbirds who haven’t made a timely filing of the closer connection form 8840 or made the necessary treaty election failing that, would be subject to the 5% FBAR penalty for US residents under the Streamlined Program. If that’s the case, I would think that anyone with a claim for relinquishment prior to 2004 under these circumstances would feel pretty motivated to have it documented, BUT, I also could see State making the case that our hapless snowbird wished to take advantage of the residency afforded to US citizens because he failed to file the 8840. The fact that this hypothetical snowbird has travelled to the US on a Canadian passport ONLY since relinquishing may rule in his favour though. Who knows what other kinds of ridiculous scenarios will develop as a result of the US’s punitive, convoluted tax and citizenship laws.

@BB

Ok. I didn’t think of what you asked being in terms of a relinquisher who was a snowbird. There is a very tricky issue with snowbirds (not presumed to have been former USCs) not fitting in either of the streamlined programs due to a mismatch of definitions between US depts. Will have to look around-believe we had a post on it a while ago and it is one emphasis in the Information Sessions.