An author, John Gaver, has recently opened a window to allow “the real story”

Here is how he responded to some multiple blasts from one of our colleague dissidents:

@… @kred65 @… Tell me how that story can be written 2 address the reader’s question “How does it affect me?” & I will.

This gives an opening to either present US citizens in a good light, or to present the administration in a bad light, depending upon how the author skews the information.

Here is the incorrect information he provided in his article, which ellicited some nasty feedback from Brockers and others

http://www.examiner.com/article/obama-drives-record-10-000-wealthy-u-s-taxpayers-to-renounce-citizenship

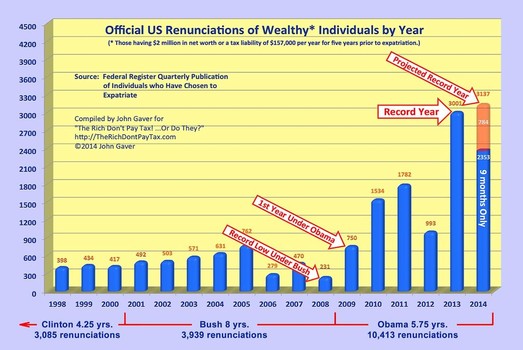

“It’s official. Obama has achieved the ominous distinction of becoming the first U.S. president to have had more than 10,000 very wealthy taxpayers renounce their U.S. citizenship under his watch. Worse yet, he still has two more years to run these numbers far higher. According to the combined “Quarterly Publication of Individuals, Who Have Chosen To Expatriate” reports published in the Federal Register, since Obama assumed office the exact number of so-called, “covered expatriates,” on September 30, 2014, was 10,413.

It’s important to emphasize that these lists represent only wealthy expatriates. Under covered expatriate” (Note: 1) is is any expatriate who had a net worth of at least $2,000,000 (in current dollars) on the date of expatriation or had incurred a tax liability of $157,000 per year (based on 2014 dollars and adjusted annually) in each of the five years prior to expatriation. The IRS reports that the top 1% of income earners pay income tax at an average rate of 23.5%. So using that tax rate, an individual with such a tax liability would have to earn in the vicinity of $668,000 per year or roughly double the income floor to be in the top 1% of income earners.” ………….

The author incorrectly attributes all the elements in the federal register as being covered expatriates. This has a negative impact upon those renouncing/relinquishing or those thinking about doing such. He goes on to rightly attribute those renunciants as having formerly been productive US citizens and rightly dumping on the administration and his 2010 Congress butties.

For anyone with a hard stomach this might be an opportunity to get your story across. You should look at his past articles and his speaking podium and participate accordingly. You should consider what information you trust to provide and expect what slant he normally wants to present.

Here is his byline in twitter:

Author: The Rich Don’t Pay Tax! …Or Do They? Original Intent Conservative. Purveyor of impeccable reason. Insane Genius (well at least half). Texas… Where Else? · therichdontpaytax.com

Be aware that correcting his assumption upon all renunciants being rich might blow the byline he uses in these articles, so he won’t go down without kicking. Also be aware that he shares a similar opinion of the administration & Treasury that most Brockers possess. So, he’s sympathetic in one way, but wrongly informed on another.

You can find him posting many of his own articles up on his facebook page;

https://www.facebook.com/john.gaver.9?fref=ts

There is also an opportunity to learn him up about the facts upon what the list at the Federal register contains, and it is not covered expats. For that background, many of you are very aware of how this has counted and many are able to search through Brock to find Eric’s articles. The latest summary of all that data was in this post, which had some additional clarifications by the participating commenters.

http://isaacbrocksociety.ca/2014/10/26/cooking-the-books-at-the-federal-register-what-has-the-executive-branch-been-feeding-you/

Maybe this post will generate one email to him, maybe a hundred emails, who knows.

His email is : jgaver AT actionamerica.org

His twitter is : @OrigIntent

He has the same article on his own webpage

http://therichdontpaytax.com/blog/?p=688

His message is always that the rich are always contributors to govts.

@Mark Twain,

>His message is always that the rich are always contributors to govts.

Err, unlike his message about only the rich being on the ‘name and shame’ list he is right about that (assuming he is saying it). Close to half of the ‘salt of the earth’ people aren’t paying any federal income tax. They pay payroll taxes but because the payouts are structured to pay out more to the people who paid in the least they get more out than they put in. Some significant proportion of those ‘salt of the earth’ people file their taxes just to make a profit from the IRS with the earned income tax credit. That’s a refundable tax credit that can pay out more than the filler paid in in taxes.

Even if you go all crazy on the ‘Romney is only paying 11% of his income on taxes’ you have to remember that it’s a shed load of money he is paying and his rate is way higher than what most pay.

It’s not actually the governments money.

@ Neil – Funny (not) how that fact was glossed over by Obama and the Dictocrats. I have been (and am) visiting the US these last two weeks through the mid term elections. The more I have reflected on it the clearer it is to me that there is no ‘collateral damage’ (it is all intentional) and that Obama has no remorse or sympathy for US Persons as the government here defines them, nor any inclination to change CBT. This will only happen if he is forced or when he is out of office. Having said that, being in 3 states these last two weeks has again illustrated to me that this is a great country with a lot of great people but with a bunch of myopic leaders in DC.

The mistake most people make about the current administration and the fourth unconstitutional branch he is served by is that he is trying to redistribute their wealth to give it to the poor. No, that is the method he uses to reduce everyone to the poverty level so that they are servants of a Socialist dictator style government. Overtaxing those living abroad is a way to get them to renounce, because he fears they will repatriate and not be indoctrinated in the Servant ways of socialist dictatorship.

This president was raised and educated by hard line socialist grandparents and mentors. He uses Saul Alinsky’s play book. Black is white, bad is good, loss is win and every other thing that happens is to be treated as having gotten his way.

I was raised by avid socialists and I know their play book. I can hear my fathers voice saying the thing Obama says. You must fool the willing idiots to get the socialist state started and after it is started then you belittle and ridicule anyone who disagrees. You pretend to agree in public, but in private you do the opposite and soon you will have enough power to subdue anyone who doesn’t agree to socialist practices. We are about where Lenin and Stalin were when they got elected and when their terms were up they had control of the Apprachic (the fourth unconstitutional branch of government) so no matter who thinks they are in charge, governmental workers who have protection from firing, by calling themselves civil servants, will carry on the socialist programs with or without official approval.

Calling themselves civil servants is just another way they work Who can object to a servant or social justice or anything else where they name it a name that sounds good, but is inherantly bad.

This bunch is hell bent on putting an end to the last best hope of mankind, by making it into a soviet style state. Be afraid, be very afraid.

When I pointed out that John Gaver’s research was done pre-FATCA he replied:

I wonder how he selects those “100 or more names”? I wonder if when he selects a name but can’t find any information about that person’s wealth, does he strike it off his list and go on to the next name. If that is the case then he will not have a fair assessment because those people he can’t find anything on will be the ordinary, non-wealthy types whose names just don’t end up on searchable lists. We’ll see what comes of this. I just know my husband is not wealthy, not a covered expatriate, not a renunciant either (he relinquished) and he is on the name and shame. John Gaver is good about some things but he is very committed to what I believe to be his flawed theory about who are renouncing their US citizenship.

Eric would be perfect for responding to John Gaver. Calling @Eric!

Pssssssst! For all you Faebookers, John Gaver is commenting on Keith’s post of “I Am Canadian” on the American Expatriates Facebook page. he wrote:

“Great article. The U.S. government is becoming desperate to get their hands on anyone’s money, so they can continue their wild spending spree. As P. J. O’Rourke famously said, “Giving money and power to government is like giving whiskey and car keys to teenage boys.” But when people with money “LEGALLY” leave IRS jurisdiction, thus reducing their tax base, the U.S. government starts grasping at the money of anyone and everyone – rich or poor – who has managed to “LEGALLY” escape their jurisdiction. Fortunately, some governments are beginning to make noises, though still somewhat muffled, that suggests that they may be about to tell the U.S. government to take a flying leap. The unfortunate part is that it will take a number of those governments, acting in concert, to make anything like that work. Even more unfortunate is that U.S. expats, be they intentional or unintentional, have little to no voice or political power.”

I was born in Tennessee and moved to IL after high school. Tennessee recently passed a law saying anyone who was born there owes them taxes every year.

Do you think we have a case for the Supremes? I was fooling no state would be that dumb. Why haven’t you expats brought a case against FATCA to a court. Oh I forgot, you don’t have standing in any Federal District Court because you don’t live here and I don’t have standing because I do live here. Isn’t that the premise explained in the Movie—Catch Twenty Two?