An interesting item found on the Expat Forum today. A commenter writes (emphasis mine):

Got this from Metrobank today. This indicates that the IRS wants gross receipts and withdrawals or payments, even though I no longer have an account with Metro. Has anyone else got something like this from other banks?

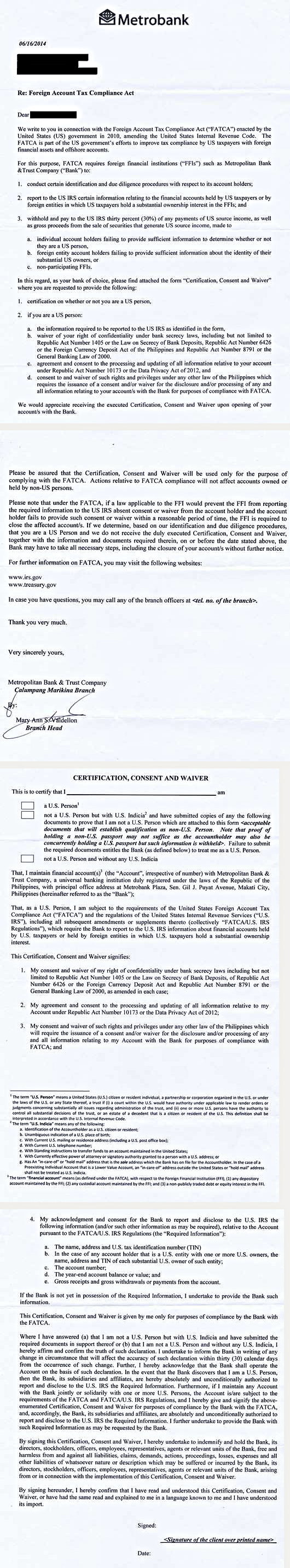

Here is the redacted form letter the commenter received:

I would think that such a request sent to a former bank customer might be possible if that ex customer recently closed his/her account and had indicia of being a US Person. Otherwise, I don’t know why an ex customer would get such a letter.

I generally ignore everything from a financial institution at which I formerly had an account. One would think that they do that because they haven’t updated their mailing lists.

I can’t wait till this is applied to home landers so they can finally see what is so wrong with this. I haven’t got any such letter from any bank but, if I did I’d be taking that straight to a lawyer and would not sign it in the way it is now worded. I would take out and initial any such line that includes statements that I would not hold the bank accountable if my information is shared. I would not agree to waive my privacy rights under the laws of my country either.

This is bizarro world where only home landers can expect not to be treated like criminals for banking purposes. It’s a bridge too far and the reason I relinquished my citizenship. I have no intention of being treated as an assumed criminal and not being protected by the laws of my own country. Anyone who thinks this is the right way to do things is usually someone not asked to waive their rights. I feel these other nations need to start pushing hard for full reciprocity or just drop the whole thing. The U.S. has already broken the IGA agreement by not reciprocating or giving any indication they intend to do so.

This commentary, August 1: Now comes the fallout — The “tangled web” FATCA has woven for all Americans, is one attempt to wake up the homelanders to see the blowback that will occur in the USA — take off on James Jatras’ latest.

Thanks for finding this, JC: http://isaacbrocksociety.ca/2014/08/01/must-listen-interview-with-sencarllevin-corporate-inversions-renouncing-citizenship/comment-page-1/#comment-2445327

I got such a letter from an FFI from whom I closed an account years ago. Turns out they had “made a mistake”… you can’t blame them. They are acting under a case of “legal duress”…

Not a myth, Mr. Stack: take a look at question 1:

https://www.cembra.ch/en/savings/medium-term-notes/apply/

So this seems to be kind of a new ‘wrinkle’: The banks are ‘forced’ to close the accounts of those with US indica that do not respond to letters that force the account holder to sign away their privacy and other rights? Am I reading this correctly?

Is this the case in Canada too? Where would my meagre pension check be sent; how would it be possible to cash it? How would I pay my bills? How would I live? 0.3% of the Canadian population forced out onto the street? Surely this cannot be.

Help me out here, please.

Heironymus

hieronymus – don’t worry! just sign the papers and your acct will not be closed. trust the stack.

it’s all explained here: http://www.fin.gc.ca/treaties-conventions/pdf/FATCA-eng.pdf

@notThatTara:

Ah, 47 pages of dog excrement — EXCELLENT! Is the Bank of Canada considered a participating FFI? October is coming up — limit exposure by buying CSB’s/CPB’s ?

H.

The only word that comes to mind – Bollocks. If this person is dual Filipino / US why don’t they go after the Filipino Government for signing the IGA for discrimination?

I also received a letter from a UK based bank in Asia for a closed account. I contacted the bank who said to ignore it. The account had not been opened using a US passport but the bank was in a country other than my country of residence. The catch 22 was that the letter said that if I did not object to the change of account terms that the bank could report and comply with FATCA I was deemed to accept the terms that said they would report! In the end I did not respond to the letter for that closed account – just leaves so much doubt about what the bank will really do.

My view for the foreseeable future is that it is better to not self disclose or sign any waivers or consents. Banks are over complying, no one knows how this reporting will happen or how FUBAR it will be in May 2015. I take this view thus relagating my accounts in my country of residence where I am a dual to be simple savings and checking accounts with no opportunity to open a new account or even a fixed deposit. Also my view does not change given that the accounts are already reported on my US return and FBAR.

Btw I fully expect after the reporting begins by the FFIs that the IRS will start sending letters to the banks listed on the US return and FBAR if the US Person is disclosing but the bank is not reporting because there is no apparent indicia of US Personhood.

@CCC: Cembra Bank is, of course, the former GE Money Bank. GE Money Bank had a strict policy against US Persons as customers and Cembra, which is still approx. 40% owned by GE Capital, continues this discriminatory policy.

Americans and other US Persons are “unerwünscht” at Cembra Bank and, yes, Robert Stack is a propagandist:

“Myth No. 2: Some claim that U.S. citizens living overseas will become outcasts in the international financial world.”

If one is no longer a US person, I wonder if it is wise to proactively inform banks that might have historical indicia, or wait for a contact from the bank? Or would it even be best to simply close accounts that might have historical indicia and then open new accounts using proof of not being a US person?

@TokyoRose – My gut tells me the best thing would be to close the account and open a new one as a non US Person. One concern is that one a nation’s central bank is advised someone is a US Person that it might be hard to ‘erase’ that identifier. But I would think better to start fresh.

If it wasn’t so expensive, I would love to take a full page in the New York Times or Washington Post as an open letter to Obama too lay these myths out and paint a real picture of reality.

@Steve

Thanks. I wonder if the banks here in Japan will be asking for confirmation of non US person status when closing an account. The banks have been pretty vague so far on their websites, but the life insurance companies have been a lot clearer, saying they will confirm status when:

1. Opening a contract

2. Changing the ownership name on a contract

3. Making payment (to the owner) at completion of a contract

It’s my understanding that in Canada, even if a recalcitrant account holder, no requirement to close the account. Also recall something odd/ironic regarding non-discrimination of US persons. LOL

I remember that in IGA countries if you don’t sign you are reported. I wonder how many non-US persons will sign the US papers in English (w8’s or w-9’s)? If one doesn’t understand English and won’t sign then one is reported to the IRS.

When you read that letter it’s got so much IRS jargon, you’d think the IRS gave the bank a canned letter to send to their customers.

Not to mention the bank’s customers having to pay for this mailshot through higher fees.

This bank is doing what the regulations require, and that is called CDD, or Customer Due Diligence. Remember, FATCA assumes everyone is a U.S. Person unless they certify they are NOT, and so as financial institutions gear up, there is going to be a lot of outreach like this. The response from customers will not be great, and so the bank will have to do it over and over again, to prove to our FATCAnatics that they are being diligent in searching U.S. Persons out. The customer service experience is NOT going to be a good one.

This podcast is good to listen to to understand the magnitude of the effort, that is probably just now dawning on some of the FFIs that thought the IGAs would make life simpler for them. The joke is on them.

http://bit.ly/1qDw4Kj

This bank is doing what the regulations require, and that is called CDD, or Customer Due Diligence. Remember, FATCA assumes everyone is a U.S. Person unless they certify they are NOT, and so as financial institutions gear up, there is going to be a lot of outreach like this. The response from customers will not be great, and so the bank will have to do it over and over again, to prove to our FATCAnatics that they are being diligent in searching U.S. Persons out. The customer service experience is NOT going to be a good one.

This podcast is good to listen to to understand the magnitude of the effort, that is probably just now dawning on some of the FFIs that thought the IGAs would make life simpler for them. The joke is on them.

http://bit.ly/1qDw4Kj

and when he speaks of the previous podcast, here it is…

http://bit.ly/1jYrnYC

@TokyoRose

I contacted all my banks after renouncing US- and acquiring non-US citizenship to inform them that I am no longer a “US person” and forbid them to provide any US agency with information pertaining to myself or my accounts. I also provided (some at the banks’ subsequent request), opies of my national (non-US) ID, my CLN and a W-8BEN (certifying non-US status). I also followed up on each to receive confirmation that the bank had processed the documentation and updated my status correctly.

If you have any US indicia (like US place of birth), you will probably be contacted anyway, so simply opening a new account is not likely to solve the problem. I personally don’t like leaving these kinds of things to chance and prefer to assert my status pro-actively.

@ notamused

Thanks for the comment. I’m not sure yet what the banks in Japan are going to be asking. My wife just opened an account at Japan Post Bank in mid July and was not asked anything about nationality, and I’ve been looking at some online bank application procedures, and they simply have a checkbox for “I’m not a US person” and most of the ID they accept would not have any US indicia (Japan residence cards and passports do not indicate place of birth). So I’m thinking that once my CLN comes (consulate said to expect it in Oct), and I’m completely confident, I’ll try opening an account at a new bank. I worry a bit that no matter how much I prove to my current bank that I’m no longer a US person, some data search might end up automatically sending the info to the IRS anyway.