Internal White House emails obtained by BuzzFeed appear to show that the White House knew shortly after the crash Thursday that there were not 23 Americans aboard the plane, as had been widely reported on Thursday.

President Barack Obama made very brief remarks about the crash on Thursday afternoon before a pre-planned speech in Delaware.

‘Obviously the world is watching reports of a downed passenger jet near the Russia-Ukraine border. And it looks like it may be a terrible tragedy. Right now we’re working to determine whether there were American citizens on board. That is our first priority,’ he said.

It is tragic that this young man was on the Malaysian MH17 plane and now gone.

If this were so many of our families, we would hate to have our children identified as a US citizen at all, let alone a possible pawn, a pretext for aggressive posturing towards Russia, (and a possible reason to go to war).

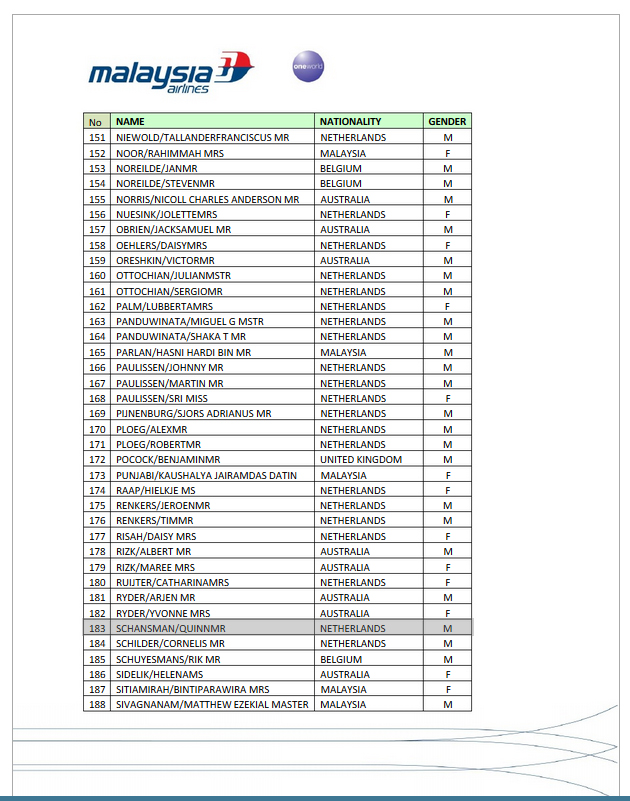

Quinn Lucas Schansman’s citizenship status would be like the many others: “Accidental Americans” born in the US but who left with their other citizenship parents as infants or young children to live in other countries — raised in and with the cultural identity of the country still lived in. From the above news article:

[Quinn’s family is from Hilversum (the Netherlands) in the north of the country. It was not immediately clear where his family was from in the United States.]

Was Quinn in the count of those who died from the Netherlands?

There is a report that the US State Department has been instructed to look over the passenger manifest with a fine-tooth comb to see if there are any further dual citizens.

‘The Animal’ (who sent this to me) and I can see the ramifications for our own children. We know as we have been told:

“You are American until we tell you you aren’t”

My children and The Animal and his US-born wife’s children were born in Canada (but to US citizen(s) – how hard would it be to pin that US citizenship label on them?

This (I think exploitative) news story gives even more reason to have only citizenship we want to be identified with, excluding automatic “dual” U.S. citizenship status passed on to our children. With the qualifications to be able to claim such, should they not have that choice to make when they are adults and with ‘requisite mental capacity’ to be able to do so? Until then, hands off labeling our children.

[I have to ask myself, “If it were my child born and raised in Canada that was the victim of such a tragedy, would I want him or her identified as a US citizen or even a dual “US/Canada” citizen?” My answer to myself is “NO”. Others, though, might wish that US/Canadian duality highlighted in some news story. Interesting question to ask ourselves.]

Or, at least that’s the way I see it.

Hi, Sasha.

Whatever I think is irrelevant. I don’t know. None of us know. It is all speculation. But, I do think it not a hard task for any query of “Canada?” in a US passport database to instantaneously produce all Canadian addresses for US passports. There may be a slight chance that an expired passport would not be so easily recognized but I wouldn’t bet next month’s rent on it. Their first correspondence with those US passport holders might be a friendly ‘just making you aware of your responsibilities for US tax and reporting compliance since US passport holders are subject to US citizenship-based taxation law’. That might be threat enough. (Return to Sender — Moved — Forwarding Address Unknown?).

Are you asking if the IRS would ask the CRA of your updated contact information (as a person holding an expired US passport), would CRA comply? Again, I have no idea. Our banks and the CRA are now arms of the IRS — how far they will go in their duties to the US is not known.

Know that you are communicating with a jaded 70 year-old, raked through the coals, and who has lost any trust in either the US government or the Canadian government protecting its people. I realize that I have no real government representation (as my MP is a Conservative) — saying that, I was represented well by NDP and Green MPs not from my province or city. I have little confidence in the word of the Harper government as I know that they negotiated with the US for a couple of years, behind closed doors, to finally sign an intergovernmental agreement with the US. They then purposely hid the implementation of that IGA in the omnibus Bill C-31 and voted in lock-step to pass that bill and thus remove the rights under the Canadian Charter of Rights and Freedoms for one million Canadians and their families. Their press release of the royal assent given to Bill C-31 did not even make mention of the US FATCA IGA implementation legislation that made our banks and our CRA arms of the IRS and on July 1, 2014, deeming *US Persons* in Canada second-class to any other Canadians no matter those others’ national origin or the national origin of their parents. I have no faith in the promises made by either government or that what we have today will be what we have tomorrow.

That is why I will continue to donate as much as I can to Alliance for the Defence of Canadian Sovereignty (http://www.adcs-adsc.ca/). I think litigation is our only path to justice and return of the rights that were taken away from us. I also believe Canada should remain a sovereign country, not taken over by US law (tax or otherwise).

What I’m saying, I guess, is we can’t pin our futures on slim hopes and should have a Plan B and perhaps a Plan C as to what we might do to protect ourselves and our families.

Others will be more optimistic than I. Stick with us, Sasha, and try to learn as much as you can what other options you might have. There are lots here who will help give you information and views so you can make your own decisions what you will do. Many will give you more optimistic support than I just have. (And, tomorrow I may be in a better frame of mind.)

Oh calgary411, I can so relate to what you say. Some days I feel optimistic, thinking that surely the IRS will focus on big fish, not minnows; other days I start to panic, knowing that I have no way out. Renouncing will cost me greatly as I own a business with my non-U.S. husband. It is our livelihood that we have worked very hard to build and I am not about to risk our retirement by renouncing. I applied for a U.S. passport later in life as the job I wanted would only accept applicants from dual citizens due to the difficulty in border crossings after 9/11. I used the passport only as a travel document and haven’t used it since as I was not born in the U.S. Because I cannot relinquish, my only option is to stay “under the radar”. So, I don’t really have a plan B or C . . . though I really like your Return to Sender — Moved — Forwarding Address Unknown – suggestion! My greatest fear is that the Harper gov’t will betray us further by allowing Canadian banks to freeze our bank accounts for the IRS. It’s a horrible way to live . . . and so unfair to my non U.S. husband.

I agree with you that donating to the ADCS is the best chance we have and I will continue to give what I can.

Thanks so much for your insight and sharing.

Sasha, that people like you and your husband are criminalized by US FATCA law and US citizenship-based taxation and have such threat over you of losing what you have built in your own business (the epitome of very contributing citizens of the Canada that is our home), like all of us here, is what is criminal. You’re absolutely correct — what a way to live with such fear, condoned by the Harper government.

(Your very long and unlikely shot might be proof of a requirement to have a U.S. passport for a job you applied for, but I presume did not take?)

Your story and every other I hear gives me my resolve to fight for the “us” until I can fight no more. Thanks for you and all others who keep on giving to the ADCS so a challenge can go ahead. It is abhorrent that we are forced to do this in the first place and even more so that the “big boys” with US indicia cannot / will not stand up to lend their support, also because they and their families and their livelihoods and what they will pass on to their children are very much threatened. We cannot even gather enough people for a meaningful protest as people are just too fearful of being identified. What a nightmare!

@ calgary

@ yogagirl

Actually, I was offered and accepted the position. I worked there for about five years. The position involved a lot of travelling throughout the U.S. but I was paid by a Canadian company. When applying for the U.S. passport, I had no idea of the tax implications. Even if I had been aware, there is no way I would have believed that I would have to pay taxes to a country which provided me with nothing in return – eg, no services, benefits etc.! It’s just not logical . . . nor ethical! Because I was born in Canada, I have no need to ever renew my U.S. passport, which expired about ten years ago.

Wow, Sasha, that Canadian company was pretty negligent for not having known and told you, especially since they basically head hunted dual citizens to fill the positions!!!

@ Bubblebustin

I suspect the Canadian company had no idea about the U.S. overreaching tax law . . . the same as most US citizens abroad have no idea. My hope is that the more people who discover what an arrogant, mafia, money-leaching country the U.S. has become, there will be a lot of outrage.

Sasha, does your bank know you are a dual? Are there an indicators to make them suspect? If not, you will very likely be over-looked in terms of FATCA, however, since you had a US passport and used it, I would guess you are in the US Border Patrol’s system and you do exist in the State Department’s database. This is the US we are talking about and though they might not have a very efficient system for sharing data between their agencies, they are certainly working overtime to correct this.

If you don’t have a US birthplace and you don’t have much to do with the US, I suppose you could go underground. Stands to reason that the USG will still not be able to dig up as many ppl like you as they hope with FATCA, but I wouldn’t count on that as my plan B if it were me.

You might want to consider seeking some expert advice and then making plans from there. Oh, and vote in 2015. Personally, I don’t believe that the Libs or the NDP will prove to have more backbone than the Cons where the US is concerned but they might be less willing to make stealing our sovereignty as easy to do as the Harper govt has. That’s about the best we can hope for short of another global economic collapse, which will make it harder for the US to do anything beyond its own borders though it would suck an awful lot for us too.

I have no great hope for legal fixes or legislation going away. The US has put too many ideas into the heads of other broke govts for things like GATCA/FATCA to go away now.

Sorry, Sasha, I’m not so magnanimous about what the Canadian company did. It seems almost predatory to target employees who can bypass Homeland Security concerns without having looked into all aspects of dual-citizenship. Will the IRS be as forgiving of you?

Bubblebustin, I can’t blame companies for wanting to bypass DHS but I agree with you that they weren’t looking out for employees like Sasha. An important lesson for duals to remember that no one is looking out for them.

Sasha,

It is my feeling that the masses will not get that message (what an arrogant, mafia, money-leaching country the US has become!) until the media does the job the media should be doing of passing on complete awareness of what awaits *US Persons* in Canada via US citizenship-based taxation and the omnibus legislation passed by the Harper government, without any light shone on what was happening, to have US law override Canadian law to remove the rights of one million Canadians and their families — discrimination by national origin.

Until the media does its job, people like those at Isaac Brock and Maple Sandbox come off as some kind of weirdos. As I’ve thought and said before, the issue has to be recognized in the media before it is accepted by the average person, US or not.

I really think it is by design that this has happened the way it has. I really do.

Calgary411,

The media is never going to step up. Ever. They are collaborators of the highest order.

Just like our MPs are shills for the party line.

Duals will continue to find out the hard way and they will education each other. Sadly.

I agree that company and others like them were looking out for their own interests, not the interests of their employees — and will never be accountable for doing so. The “duals” can’t REMEMBER that no one is looking out for them, until they LEARN no one is looking out for them — the job of our media. Most haven’t a clue what US citizenship-based taxation law is and why it would concern them.

Perhaps karma is that companies that thought they would be more effective in looking for employees that could help them with their US passport ease of crossing the border now will be implicated on turning over their own financial records to the US as some of such employees may have put them in the eye of the FATCA storm by their association with a *US Person*.

YogaGirl,

We commented at the same time with the same thoughts. We have one tough job without the help of media. But, more and more are learning.

The only thing America’s dirty little secret, CBT, has (had) going for it is that no one knows (knew) about it. Fortunately for us, bad news travels fast.

I went to a party on Saturday and mentioned US taxation. There were 3 US persons who overheard me (none were related to each other) and all knew about the situation. I don’t feel so much like a teller of conspiracy theories any more.

Look, if our own government is willing to throw its citizens under the bus and say, as Gerald Keddy does, that we should be looking after our US tax obligations anyway, is it really that much of a stretch for companies to assume the same, especially if like our government it’s convenient (and profitable) for them to do so?

Not a stretch at all, bubblebustin. I have in mind the many working for Canada’s / Alberta’s oil and gas companies that work jobs both side of the border. I’m thinking also of the *US citizens*, many of them veterans of US wars, that have been (at least in the past) wooed by the Alberta government and the companies themselves to work as oil patch tradespersons / labourers (vs the upper management jobs for which tax preparation may be a perk of the job). Would these companies or the US and Canadian governments have been fully transparent to these perspective employees on what their US tax and FBAR reporting AND Canadian tax responsibilities would be? Could this be called exploitation rather than opportunity?

bubblebustin,

Kudos to the underground getting the information out there!

Sasha

You now need to renounce or relinquish

Relinquishment can bé documented or undocumented

The simplest relinquishment could bé accepting municiupal employment

It could also bé unpaid but in a formal position with the council or similar

Sasha

Here is your problem succinctly

Until the passport you did not know your status with certainty but after it became certain

You will not get tripped up by place of birth

However many places are asking Are you a us citizen

Until you renounce or commit a relinquishing act you have to answer yes

If you do not want to renounce and get a cln you need to get another citizenship or any government employment even if its brief

There will bé some in canada who are eligible for registration as irish or british which would bé a relinquishment if done with intent

george,

If only your solution were that easy. Sasha would still have US tax and reporting compliance issues to deal with after renunciation or relinquishment. She does not have anything going back in time for which she can claim a relinquishment as far as I know. She would be completely outing herself and placing her family and her and her husband’s business at financial risk with renunciation. There is really not a lot of good choice for Sasha. I, too, might wait it out.

I don’t know if it can be called exploitation, but we all know that a US taxpayer living in Canada needs to be paid more to receive equal pay to any of his fellow workers, don’t we Calgary411. Unfortunately, a Canadian company can’t be punished by the IRS for being wilfully blind about an employees US tax filing obligations.

I don’t “know” if it can be called exploitation…

@ george

Thanks for so succinctly outlining my situation! What you say makes a lot of sense. I love the idea of acquiring another citizenship, followed by relinquishing my U.S. citizenship. Although my grandparents were British, I believe one must have a British parent in order to secure citizenship there. That leaves getting gov’t employment or saying “no” when asked if I am a U.S. citizen, though I realize the latter could result in perjury charges.

@ Calgary

I did not realize that relinquishment also involves US tax and reporting compliance. I thought that was only required in renunciations. Thanks for clarifying. Is the exit tax the only difference between the two? I did work for the provincial government many years ago, but this was prior to my obtaining a U.S. passport, so the required “intent” is not there. Staying off the radar – and donating to the ADCS – may be my best approach.

Sasha,

You can read about back-dated claims to relinquishment before legislation changed and also claiming relinquishment with more recent qualifiers, i.e. becoming a citizen of country with the intent of giving up US citizenship (after which you must do nothing ‘US’) or working for a government agency: http://isaacbrocksociety.ca/2012/06/19/if-your-expatriation-date-is-before-2004-the-rules-are-different/.

http://isaacbrocksociety.ca/2012/06/19/if-your-expatriation-date-is-before-2004-the-rules-are-different/comment-page-6/#comment-1032833 gives important links for further reading.

The Exit Tax can apply to either renunciation or relinquishment. It is determined by your last official IRS Form 8854, that you certify that you are compliant with the requisite number of years of US tax compliance and determines your net worth and other things that may deem you a “covered expatriate” and subject to the Exit Tax. IRS instructions for filing for 2013: http://www.irs.gov/pub/irs-pdf/i8854.pdf and http://hodgen.com/category/exit-tax-book/ gives clear information on Form 8854 and the Exit Tax.