With FATCA’s 1 July deadline right around the corner, many desperate non-U.S. banks are turning to technology companies purporting to offer “compliance solutions” to help them hunt down all those tax-evading, money-laundering, drug-dealing U.S. Persons abroad who sneakily disguised themselves as ordinary, law-abiding immigrants interested only in paying water bills and buying groceries. How well are these so-called “solutions” likely to perform? Well, attention to detail is crucial in both software development and tax compliance, so let’s take a closer look at the level of attention to detail that one of these compliance firms demonstrates in other areas …

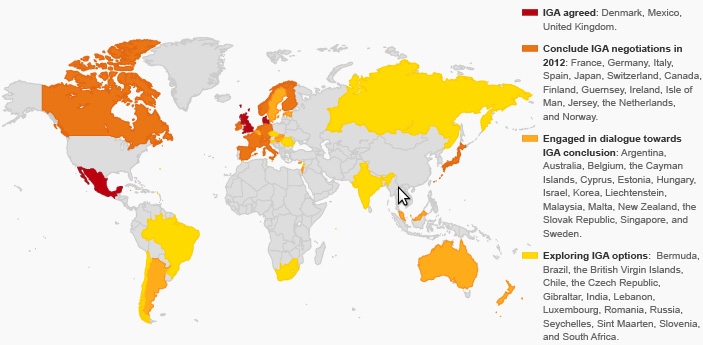

More than a year ago on Twitter, I noted this hilariously awful map of Intergovernmental Agreements posted by Thomson Reuters — apparently they thought that Tasmania declared independence from Australia, Siberia broke away from western Russia, and then Sakhalin & the Kuriles counter-seceded from Siberia, all because of FATCA. From the Internet Archive, if you don’t believe that’s a genuine screenshot:

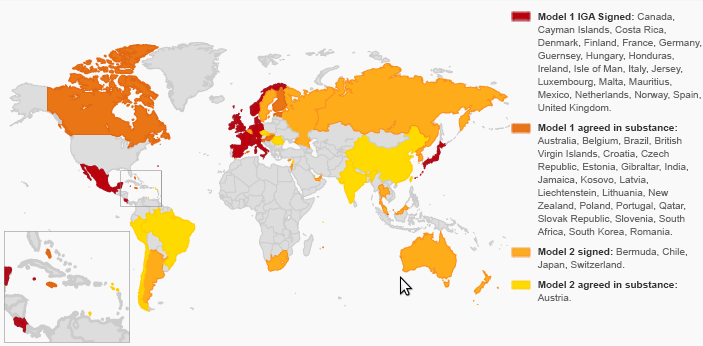

Their most recent effort is hardly any better:

“Information is accurate as of 24/04/14”, claims that page? About the only thing this map does right is that Tasmania has finally been reunified with Australia. Otherwise, it doesn’t even agree with the map’s own sidebar, let alone Treasury’s list of IGA jurisdictions. Brazil and Peru are the same “model 2 in substance” colour, even though both have actually signed (but not ratified) model 1 agreements, and Peru is absent entirely from the sidebar. Latvia, Lithuania, and Poland are (correctly) mentioned in the sidebar under the “model 1 in substance” category, but in the map they remain grey. Japan is (again correctly) mentioned in the sidebar under the “model 2” category, but is coloured in as a “model 1” country. Thailand and Malaysia are coloured in as well, for no discernible reason. And North Korea — probably the least likely country on Earth either to be interested in signing a FATCA IGA, or to be allowed to do so by Treasury — is coloured in as if it were covered by the South Korean Model 1 agreement.

You might want to dismiss these as simple oversights or slips of the mouse, but there’s more two giant errors which demonstrate pretty conclusively that “the lights are on, but no one’s home”. First, someone decided to pay enough attention to Russia to ensure that cis-Ural Russia could rejoin trans-Ural Russia, but Sakhalin, the Kuriles, Kaliningrad, and various other Russian territories are still greyed out — and of course, the actual future of FATCA in Russia is in serious doubt, with IGA negotiations stalled and McCain and Levin proposing to use the 30% withholding as another economic weapon in response to the Ukraine crisis. And then, the whole of China (except for Hainan) is for some reason coloured in as “model 2 agreed in substance”, when in reality only Hong Kong finished negotiating a model 2 agreement (after the date of that map, not before) and Beijing has finished negotiating nothing at all.

And of course, simultaneously running a news wing and a “compliance solutions” wing has had No Effect Whatsoever on Reuters’ ability to report the latest FATCA happenings in a neutral and balanced fashion, as can be seen from Patrick Temple-West quotes like “FATCA has come under fire from Americans with foreign financial accounts because they are accustomed to secrecy”, or referring to the Credit Union National Association as “[a]nti-tax advocates” for “applaud[ing] an effort by Senator Rand Paul to roll back important sections of a U.S. law designed to fight tax evasion”.

So, banks: these are the people you trust to offer you a “full service solution for FATCA compliance that can be tailored to fit any size of organization, wherever it is located and whatever the compliance challenges are” and save you from 30% U.S. sanctions? Better pray to Mammon or whichever other god you believe in that there’s no such thing as “karma”, cuz otherwise it’s gonna come back and bite you in some sensitive parts!

What happened to Israel on Map 2 list?

@Gordian: If I squint, it seems to be filled in correctly as “model 1 in substance” (though Treasury says Israel didn’t agree until after the date of that map — either Thomson Reuters has inside information, or more likely they just couldn’t be bothered to change their earlier map), but not mentioned in the sidebar. UAE is also filled in (in that case, I think incorrectly?) and not mentioned in the sidebar either.

Just looking at the final regs and its very clear that CRA got zip nada, the negotiation position was a sham!!

http://www.kpmg.com/LU/en/IssuesAndInsights/Articlespublications/Documents/final-fatca-regulations.pdf

The account exemptions? You would still have them anyway!!

The IGA is for the banksters!!

From beginning to end FATCA is a joke and without purpose.

The fact that Google has taken a hiding in European Courts gives me hope that someone in the EU will challenge FATCA in the EU courts after 1 July and declare these IGAs as discriminatory for dual citizens. The ‘carve out’ is coming.

@Don, stop using the term dual citizen as that is a term which does not exist in local law.

At best one has “clinging nationality.”

Whilst in your native country you can ONLY and SOLELY have that citizenship.

The EU Courts IMO will strike it down on the ground of discrimination against EU Citizens based on origin.

The second map is exactly the same as the version of 10/2/14 (d/m/y), which had a different list of categories and countries (you can see it in the link). That version already had many errors (several islands, China, North Korea), and they made things even worse by changing the list and keeping the same map. Their lack of attention is appalling. But the list itself is accurate considering the information from the US Treasury on 24/4/14 (d/m/y).

I made an accurate map, with better contrast and projection, updated to 5/16/14 (m/d/y).

My analysis of the list of countries so far:

I count 250 jurisdictions in the world (194 countries, 10 partially recognized countries, 40 inhabited territories, 6 external regions), of which 6 are the US itself (1 country, 5 territories), 11 have no relations with the US (4 countries, 7 partially recognized countries), and 1 has no banks (1 territory), leaving 232 jurisdictions to sign IGAs. Of these, 76 (33%) have signed or agreed to IGAs (or are territories or regions included in the main country’s IGA).

Of the original list of 48 desired jurisdictions published by the US Treasury in 2012, 42 (88%) have signed or agreed to IGAs. Of the G20, 15 (75%) have signed or agreed (including the EU, of which only Greece has not agreed yet, and the US itself).

All of these jurisdictions (including the US) represent 39% of the area, 44% of the population, and 73% of the GDP of the world.

I’m astonished at how easily the US can force the rest of the world to follow its most absurd orders.

Once again, thanks for your good work on this, Shadow Raider. What a difference between what you present and what Thomson Reuters shows!

And, I love your pointing out:

This comes from RT news regarding U.S. Banks and drug cartel money.

Now will these banks reveal all I their foreign clients to be compliant with the IGA’s?

Federal regulators in the United States are reportedly investigation no fewer than two major American banks with regards to their relationships with clients believed to be tied to Mexican drug cartels.

Reuters reported exclusively on Wednesday this week that the US Securities and Exchange Commission is probing both Charles Schwab Corp. and Bank of Americas Merrill Lynch brokerage firm because clients of those entities were linked to Mexican drug cartels.

The SEC, Reuters reported, is looking into whether the brokerages missed red flags that could indicate attempts to move money illicitly or to feed proceeds from drug trafficking and other crimes into the financial system by failing to know their customers well enough, according to the newswires sources.

Representatives for both the SEC and Merrill Lunch declined to comment, Reuters reported, but an unnamed source claimed that Schwab has already launched an internal investigation of its own.

And while the SEC did not directly assist Reuters in their report, two sources confirmed to the newswire that the investigation has so far led regulators to believe that both Schwab and Merrill accepted shell company clients registered to individuals with fake addresses.

According to those sources, the financial companies had failed to properly vet their clientele and in turn took in customers linked to illegal activities, including the Mexican drug trade.

Most of the sources in the Schwab case, one insider told Reuters, were located near the Mexican border and some were linked to drug money in Mexico.

If those allegations are accurate, then it would be far from the first time that major American banks were linked to the Mexican drug trade: HSBC paid the US government $1.9 billion last year after it was caught aiding narcotics kings, and in years prior Wachovia Corp., Bank of America and Wells Fargo were all tied to similar allegations.

This time, though, the Department of Justice might not order a hefty settlement if bankers are found to have conspired these deals, but instead prison sentences for the Americans involved. Although no US banks have been held accountable for the last major economic collapse, Attorney General Eric Holder said earlier this month that no company or individual be it a bank or otherwise is too big to jail.

Update: With the addition of many jurisdictions including several Caribbean countries, Turkey, Taiwan, Saudi Arabia, Thailand and China, IGAs have been signed or agreed by 85 of 222 available jurisdictions (the 232 I explained above, minus the 10 territories included in the main country’s IGA, which I’ve decided not to count as separate), or 38%. They fill 90% of the original desired list, and with the US, represent 90% of the G20, 50% of the area, 66% of the population, and 89% of the GDP of the world.

The list is being updated in Wikipedia, with a map.

Wikipedia’s FATCA resource is fantastic. Perhaps it should be made a new post for those who haven’t come across it yet.