I promised yesterday that I would write a post to discuss the usefulness of purchasing tangible assets in order to structure one’s finances and to keep one’s business out of the banks. Here are some of the ideas I had:

- Real estate

- Precious metals

- Food

If one is wealthy it is likely that the first two of these would be the most helpful. Real estate is harder to steal. Real estate however is propped up by the banking system and is therefore in a likely bubble in Canada.

One must find a safe place for precious metals. But precious metals, unlike real estate, is actually being oversold by the banking system through the paper markets in which large holders of gold like the US treasury and the Federal Reserve bank lease their gold to the bullion banks, who in turn sell it in the gold market to keep the prices artificially low. This means that while the fundamentals for precious metals remains strong, the price continues to remain obstinately low.

Not many people have a much food on hand. In the event of an economic collapse, having foods stuffs on hand will increase one’s resilience in times of crisis–precious metals, especially gold and silver bars and coins, will serve as currency in case of monetary failure, which becomes more likely every day. Apparently, retail outlets for food do not keep vast quantities of food in storehouses, but ship directly. So if ever there is an interruption of the supply lines, once people empty the grocery stores, that’s it until things return to normal. I would recommend having several months of food on hand in the form of dried, canned or frozen food.

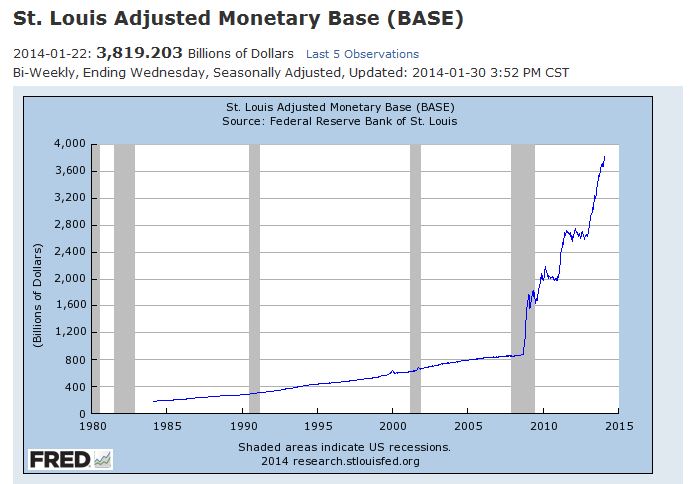

The thing to remember is that the central banks are now defrauding savers by keeping interest rates at artificial levels. They are also using quantitative easing to buy up the toxic assets of the banks. The Federal Reserve Bank of the United States is buying around $40 billion in toxic assets per month, so that its balance sheet keeps growing. The central bank makes the money to buy these assets out of nothing, and it goes into the hands of the banksters who then use this freshly created fiat money to hand themselves generous bonuses, to prop up their own failing bank sheet or to create asset bubbles in the various sectors including the stock markets and real estate. The Federal Reserve money base chart shows the current amount of newly created fiat money since 1985:

Please note that the actual amount of money in circulation has increased more than 400% since the crisis of 2008 when the Federal Reserve began to buy up the bank’s toxic assets. In addition, the Federal Reserve has become the top holder of US treasury debt, propping up the profligate spending of the US government by create new money ex nihilo. When you consider the manner in which the bullion banks are suppressing the price of precious metals, this looks like a bubble ready to burst, with the dollar plummeting in value and precious metals skyrocketing. It is not a question of if but of when, in my opinion.

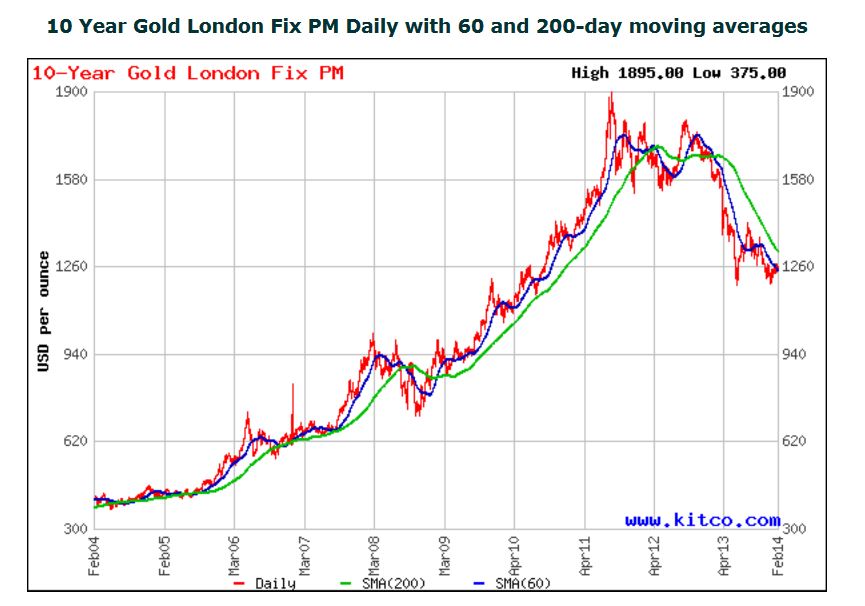

Now, gold seemed to be keeping up with the Federal Reserve money base but then has dropped off in the last two years and not kept up the pace:

Some believe this is a buying opportunity for gold. My belief is that gold has had strong fundamentals during this whole period, and that the recent weakness in price is not a correction but a suppression. One thing is clear: Russia, India, China and many other countries are beginning to reject the US dollar for the rotten currency that it is and are buying gold at a massive rate. I personally want to have some of the tangible assets that the countries with the most money still want. The final advantage is that for US citizens abroad, precious metals not held in an FFI is not a reportable asset under FATCA.

Some believe this is a buying opportunity for gold. My belief is that gold has had strong fundamentals during this whole period, and that the recent weakness in price is not a correction but a suppression. One thing is clear: Russia, India, China and many other countries are beginning to reject the US dollar for the rotten currency that it is and are buying gold at a massive rate. I personally want to have some of the tangible assets that the countries with the most money still want. The final advantage is that for US citizens abroad, precious metals not held in an FFI is not a reportable asset under FATCA.

Disclaimer: These are my thoughts. I am not a financial adviser but an ordinary lay person. Any action you take is at your own risk. Structuring is a likely crime with regard to US law, but I advise not to break any local laws in your country of residence.

Of that, one can pay off the mortgage on home and all else.

Forced investment choices courtesy of Uncle oSAMa

Otherwise, your analysis matches anyone who is not selling the lamestream line

*Real Estate*

I am not sure but I think that the expenses for maintaining the property can’t be written off. What I mean is this… I think in the states… if u own property that is leased (rented) out then the income generated from that property is taxed fully and you can not lower the income amount when u make improvements or have expenses (ie, property taxes, insurance, mortgage payments).

But the problem is… if u structure yourself incorrectly or if the rules change (which I am pretty sure that will happen) u can be screwed over more. We made some really stupid decisions the last couple of yrs without knowing about this *fatal* crap. We sold a property in another country we had legal residence in… not in the US or Canada… which had no capital gains… didn’t know if we would stay there so we just dumped it into an account & we would decide later. Big mistake. We are now on the hook for the rental money rec’d…taxes were paid to the gov’t where the property was… capital gains on the sold item… & to top it off… we are totally screwed because we dumped the proceeds in an account.

@Petros

Thanks for this Post… I myself am not a financial whiz. I do have investments after my husband died.

For young people I think what I and my late husband did was borrow a thousand dollars every year, each of us to buy a $1000 RRSP…(tax deductable the interest on the loan). and do it again and again. Plus have life insurance… If you are an American person get the one you can’t cash in. when you stop it stops but if you are “lucky” and die young unexpectedly your spouse and family have a nice lump of cash. My husband died at 54 . I used the life insurance as a down payment on the first house I ever owned. We rented

If you are old like I am now , I read it really is better to rent.

Also I read a lot. Before the bank crash in the usa I read of rumours. I got out of USA stock and mutual funds. Didn’t lose much when that happened. Read and go on the gut feeling.

Also if you visit foreign lands..put some money in their currency.

I wonder if it raise flags if I put money in my credit card and have a credit balance. and then charge away til it is depleted. I would like some feed back on that.

I wish I had put some of my money in CSB last October. I hesitated.

@US_Person_Foreigner, agreed. Excellent points. I would say however that the main advantage of having real estate instead of a bank account is that you don’t have to report real estate to the US government because you know that the Canadian government is going to rat your financial accounts. Real Estate like all tangible assets are not reportable to the IRS–yet.

As I said, though, I think CDN real estate is a bubble and would be careful about it. Still, having one’s financial life ratted out to the IRS is a major concern.

@Nothernstar, all foreign currencies are subject to the same debasement as the US dollar as described in the main post. I’ve had foreign currencies and by the time I return to the country: (1) the buying power has dropped; and/or (2) the currency no longer exists and if you are lucky you can exchange it at a bank for the new currency. If you are not lucky, the currency becomes completely worthless.

Ultimately this is why tangible assets have more sustaining value than currency.

I would also be reluctant to borrow money to buy financial assets like an RRSP portfolio. This is exactly what the banks want you to do, and they actually have articles in the bank-sponsored publications like the National Post and the Globe and Mail, about borrowing money for RRSP contributions. Watch for them, they will be coming up very soon–it’s called RRSP season. They don’t usually tell you that you can ask for a reduction at source from the CRA and that way you can have enough cash to make the RRSP contribution because it’s not being withheld by your employer.

@Petros says:

No the property for sure is not reported.. but any income is.. We like projects so we buy a place for inexpensive then we fix it up (never said we were good at it.. just saying it didn’t blow up… lol) So we got a big problem with the capital gains issue there. CRA will throw your butt under the bus just like canada is changing the flag from maple leaf to stars & stripes

@US_Person_Foreigner

The gain would not be reportable under FATCA. Only the highest balance on the account. Unfortunately when doing business like this, you have to have access to bank accounts.

The best thing if this is the business you are in is to relinquish US citizenship before doing any big transactions.

@Petros

As for currency. I was thinking of British pounds….I really do not that will become worthless.

As for the RRSPs…that was done in the 80s and 90s and being I and my husband were not rich, did not even own a home and were raising 2 kids. Both of us working…there was not much money left for saviings. The RRSP was a tax saving and also we could deduct the interest in from our income tax filing.

It may not work for everyone.. I have been told that buying a home can be good and it was for me after my husband died.. I made a small profit, under the US limit. .

Now I am being advised not buy a house at my age. What other tangible assets would you suggest. I am interested in knowing. The major bulk of my savings is in RRSPs…which seems to be safe so far from the USSA.

@Petros

We are totally not in that business. We purchase a home for ourselves in the country we reside in. Old school habit of getting legal residence card… many of us old timers get them so we can come in & out easily & all taxes are paid for what we make there. We are 100% canadian… canada allows us to leave & come back as we want because I view Canada as my real home. I pay all taxes in canada if I owe anything which is fair cause that is where its made. Because of this stupid GC crap… what use to be a wonderful adventure has become a dang noose we are trying to paw out of… When we leave a country… we don’t liquidate… we do leave some there… such as regular banking nothing complicated so when we go back… we have local money & a place. Here is a piece of advice to anyone who does this… DON’T … take everything u have with u

For Gold, go to http://www.jsmineset.com. They can provide offshore storage in Singapore for example if someone wants to go down that route. There may be some ‘goldbugs’ who have storage in Canada.

@Northernstar, British pound is not a good currency. I would have some if Britain were one of my countries where I could escape to. Gerald Celente for example keeps some foreign cash on hand for when he escapes America.

Your RRSP is probably as safe as anything for right now. Nevertheless, having some precious metals on hand is an insurance against economic collapse. Remember, I’m not giving advice, but expressing my lay opinion. The only trustworthy adviser is someone who can see the future and would faithfully relay that info to you. I can’t do that because I’m not able to see the future. I can only look at what has happened in the past.

No one can predict the price of gold because it is affected by events which are impossible to predict. Still, it’s useful to have not as something that will go up in value but as something that will have some value, so it’s useful as a small part of one’s assets.

Cash (domestic or foreign) held in a safe deposit box or at home is not reportable, though large deposits/withdrawals/purchases may cause problems. Home storage must be done after considering risks of theft, fire, forgetting where the money is hidden, dying without anyone knowing where the money is, destruction by humidity, insects, mice, etc.

Food: Always a good idea to have some extra in case of disruptions such as snowstorms or power failures (if there’s no electricity the stores will close because cash registers don’t work, and even if they did, without enough light in the store there is a safety/liability issue.) Personally I don’t “store” food but simply keep more of everyday things that I normally use, then use the oldest first. I do this with canned items, rice, pasta, etc. not frozen food because of the risk of food spoiling during a prolonged power outage.

Real estate: if it’s rented out the income must be reported though even if income was unreported, it is not subject to FBAR (important consideration for those opting out of OVDI.)

US taxation of real estate depends on whether it is rented out, used as a vacation/second home, or primary residence.

For rental real estate current expenses (RE taxes, repairs, maintenance) are deducted from rental income; there’s a form for this. Capital improvements are not deducted but they increase the cost when it is sold. So if you buy a house for 100K, add a room for $20K, and sell it for $130K (net of real estate agent commission) you have a capital gain of (130-120) or 10K.

As to credit card balances, you can overpay. The company will keep the overpayment and deduct new purchases, but if there is still a credit balance in the account after a couple of months they will send you a check.

Re: Real estate vs. precious metals (bullion, coin, etc.)

1. As you’ve stated, Canadian real estate is likely in a bubble. Not a good time to buy.

2. Owning real estate invariably means paying property taxes. OK if there’s sufficient appreciation; not OK if valuations are flat or declining. Besides, local taxing authorities can change the tax rate at will, invariably in an upward direction.

3. Real estate is about as illiquid as you can get. Tough to find a buyer with money, massive commissions to sell. Can’t sell just some of your position; it’s all or nothing.

4. Precious metals don’t pay a dividend but are a great hedge for when things really go down the tubes. You can break up your investment into small increments that can be bought incrementally, and likewise sold incrementally when the time comes.

5. It’s a heck of a lot easier to store precious metals. A lot of value in a compact space. However, more vulnerable to theft than real estate.

6. Many older people (you know, the people with assets) already own their own home. That’s OK, everyone needs a place to live, but it’s probably better to diversify with precious metals rather than own more property.

All four of them were in swaps/derivatives, but at the same time, JP whistleblower admitted JP Morgan manipulates gold and silver trading.

http://rt.com/business/russell-investments-chief-economist-dead-564/

What, are they worried about little old Greece, Spain, and HSBC–just because their balance sheets are better than USA? Do you suppose they have run out of ideas? Do they not believe that they can keep printing 85 billion green pieces of paper each month, whilst the other western govts print up like amounts? Do they not believe that the countries that are all funding our trade deficit will forever except freshly printed paper in exchange for giving us their hard assets? We solved those problems with Libya and Iraq (hint, google “gold” and the names of those countries–from that you will figure it out), didn’t they believe we could solve it with Iran & its trading partners China & Russia? Won’t the money they are stealing from US citizens abroad cover it all?

How long will the Greatest Ponzi Scheme in the History of Mankind hold out?

I was out walking the dog today and thought of another tangible asset…..a classic car. Way more fun than some of the other stuff too. You could drive it on nice days while smiling about how you beat the IRS! But storage could be a problem; not a good idea to park it in the back yard under a tarp.

I have almost $10K invested in designer scarves. It just occurred to me what a brilliant investment that was.

@Northernstar

Re: putting your credit card in a credit balance

I am ex-financial industry. Putting the credit card in a massive credit balance is not considered a normal transaction; moreover, it may appear to your Bank that you are laundering money. Customer service staff are trained to look for this type of transaction, flag it, and report it without your knowledge.

As soon as you put your credit card or line of credit in a credit balance of $1000 or greater, it sets off red flags at the Bank. I would advise against this course of action.

@OMG, Nice to hear from you after so long. I wish the circumstances were better. As for the scarves, may be. LOL. ’tis tangible, but is it an asset? Depends on its resale value.

Oh my God. Years ago when I was traveling in the UK I put my credit card in a high credit balance before I left Canada for the trip. My limit wasn’t that high and I was staying at expensive hotels as well as buying expensive scarves. They probably flagged me. Wonder what they thought of my purchases.

Well the scarves may soon be worth more than the US dollar. At least you can wear ’em! And they’d look cool while you’re driving your old car!

Hi Petros, anything that doesn’t end up in the hands of the IRS is an asset to me!

I like the creativity of this new thread! I wonder how difficult it would be for one of us to open up an IBS Credit Union (non-profit, of course) …

What ever happened to Germany’s request to have their gold handed back to them by the US? Could that be an additional source of aggravation for the Germans?

Mark Twain

“Of that, one can pay off the mortgage on home and all else.”

Why? If the whole system is coming apart why pay to the banks that caused it. Take a mortgage holiday ;-)))