I promised yesterday that I would write a post to discuss the usefulness of purchasing tangible assets in order to structure one’s finances and to keep one’s business out of the banks. Here are some of the ideas I had:

- Real estate

- Precious metals

- Food

If one is wealthy it is likely that the first two of these would be the most helpful. Real estate is harder to steal. Real estate however is propped up by the banking system and is therefore in a likely bubble in Canada.

One must find a safe place for precious metals. But precious metals, unlike real estate, is actually being oversold by the banking system through the paper markets in which large holders of gold like the US treasury and the Federal Reserve bank lease their gold to the bullion banks, who in turn sell it in the gold market to keep the prices artificially low. This means that while the fundamentals for precious metals remains strong, the price continues to remain obstinately low.

Not many people have a much food on hand. In the event of an economic collapse, having foods stuffs on hand will increase one’s resilience in times of crisis–precious metals, especially gold and silver bars and coins, will serve as currency in case of monetary failure, which becomes more likely every day. Apparently, retail outlets for food do not keep vast quantities of food in storehouses, but ship directly. So if ever there is an interruption of the supply lines, once people empty the grocery stores, that’s it until things return to normal. I would recommend having several months of food on hand in the form of dried, canned or frozen food.

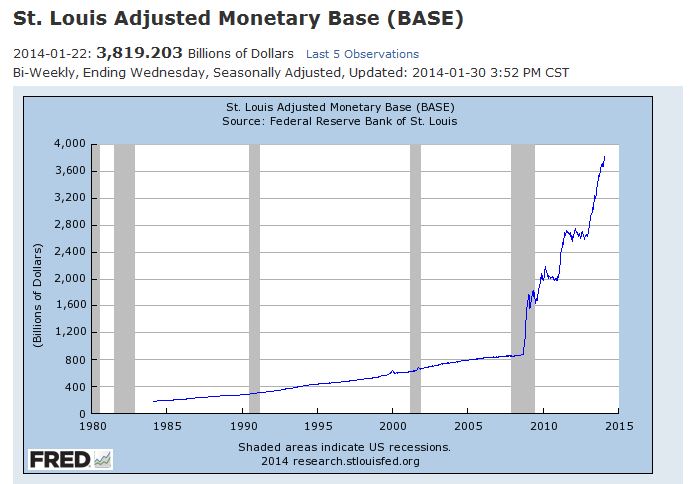

The thing to remember is that the central banks are now defrauding savers by keeping interest rates at artificial levels. They are also using quantitative easing to buy up the toxic assets of the banks. The Federal Reserve Bank of the United States is buying around $40 billion in toxic assets per month, so that its balance sheet keeps growing. The central bank makes the money to buy these assets out of nothing, and it goes into the hands of the banksters who then use this freshly created fiat money to hand themselves generous bonuses, to prop up their own failing bank sheet or to create asset bubbles in the various sectors including the stock markets and real estate. The Federal Reserve money base chart shows the current amount of newly created fiat money since 1985:

Please note that the actual amount of money in circulation has increased more than 400% since the crisis of 2008 when the Federal Reserve began to buy up the bank’s toxic assets. In addition, the Federal Reserve has become the top holder of US treasury debt, propping up the profligate spending of the US government by create new money ex nihilo. When you consider the manner in which the bullion banks are suppressing the price of precious metals, this looks like a bubble ready to burst, with the dollar plummeting in value and precious metals skyrocketing. It is not a question of if but of when, in my opinion.

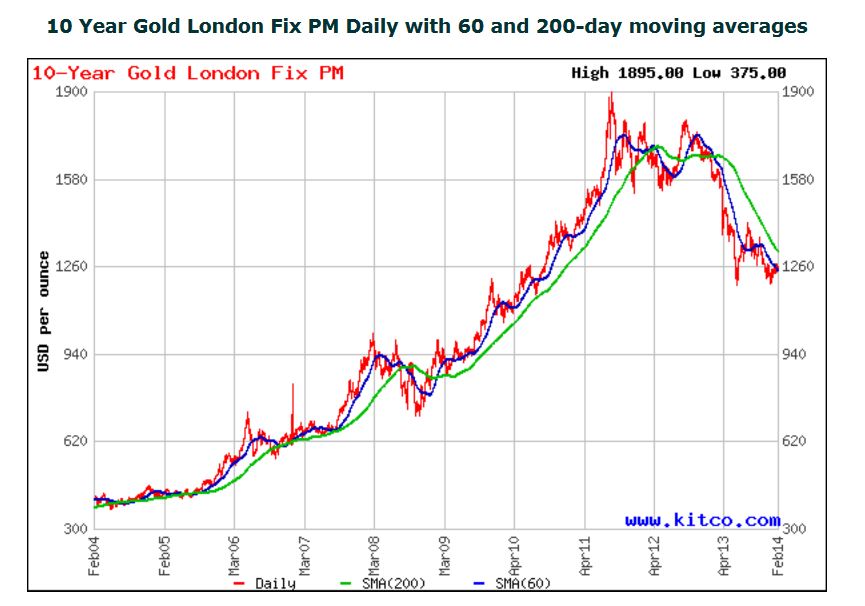

Now, gold seemed to be keeping up with the Federal Reserve money base but then has dropped off in the last two years and not kept up the pace:

Some believe this is a buying opportunity for gold. My belief is that gold has had strong fundamentals during this whole period, and that the recent weakness in price is not a correction but a suppression. One thing is clear: Russia, India, China and many other countries are beginning to reject the US dollar for the rotten currency that it is and are buying gold at a massive rate. I personally want to have some of the tangible assets that the countries with the most money still want. The final advantage is that for US citizens abroad, precious metals not held in an FFI is not a reportable asset under FATCA.

Some believe this is a buying opportunity for gold. My belief is that gold has had strong fundamentals during this whole period, and that the recent weakness in price is not a correction but a suppression. One thing is clear: Russia, India, China and many other countries are beginning to reject the US dollar for the rotten currency that it is and are buying gold at a massive rate. I personally want to have some of the tangible assets that the countries with the most money still want. The final advantage is that for US citizens abroad, precious metals not held in an FFI is not a reportable asset under FATCA.

Disclaimer: These are my thoughts. I am not a financial adviser but an ordinary lay person. Any action you take is at your own risk. Structuring is a likely crime with regard to US law, but I advise not to break any local laws in your country of residence.

Don…….everyone should stay away from gold and silver ETF’S because they usually don’t have the gold they say they do and you don’t have quick access to it. Only buy physical

Frenzy in the Gold Market: The Repatriation of Germany’s Post World War II Gold Reserves

http://www.globalresearch.ca/frenzy-in-the-gold-market-the-repatriation-of-germanys-post-world-war-ii-gold-reserves/5319287

If 1 million of us each bought only one ounce of gold that would be at 32,000 ounces per ton ……….. 30 tons total approx.

If we each bought 10 ounces that would equal 300 tons

or 10% of Germany’s gold!!!!

Just 300 tons would affect the market in a huge way. The Chinese would wonder what’s happening and the price per ounce would skyrocket.

Put a banner at the top of the site “BUY GOLD BULLION”

http://www.gold-eagle.com/article/tiny-size-gold-market

@CheersBigEars

Sounds as though Germany hasn’t repatriated its gold yet. I guess we’ll soon find out how good the US has been as custodians of their gold.

@Bubblebustin

remember those pallets of millions of dollars sent to Iraq, that sort of disappeared.

http://en.wikipedia.org/wiki/File:Gold_Spot_Price_per_Gram_from_Jan_1971_to_Jan_2012.svg

long term chart

Use the inflated adjusted dollars

@Petros

Would you, or anyone else on IBS, know if it is possible to live in Canada without a bank account? How would one cash salary and pension cheques?

Out of curiosity I asked my pension fund if it would be possible to have my pension deposited in my spouse’s account. No can do. They said that if I didn’t want to have my pension deposited in a bank account, that it might be possible to cash it at the bank branch that issued it.

How about cheque cashing services? Will they have to report for FATCA?

@Petit Suisse, Why not use your existing accounts to function in the everyday economy? True, one can structure one’s finances, but a certain amount has to remain exposed to the bankster sector.

does anyone know if CPP and OAS cheques may be at risk as ‘trust’ fund type $ ?

Prior comment:

@Petros

Thanks for the answer. I was just wondering…After seeing what Desjardins is saying to its members, I get the feeling they may be contemplating asking everybody for full disclosure of possible American 《personhood》 and they threaten to refuse service to those who refuse. I happen to have a very small chequing account with them, and don’t know how I would handle my affairs if I got closed down before I can get a CLN.

Could you take a look at their FATCA FAQ and comment? I would really appreciate it. Am I overreacting and panicking? I can’t believe how totally nonchalant and complacent they seem. I wonder if this is how the banks will “educate” their customers.

Here’s the English link:

https://www.desjardins.com/ca/FAQ/index.jsp?sectionId=2&sousCategorieId=129&categorieId=8

An article in today’s Swiss “SonntagsZeitung” describes how the large Zurich Cantonal Bank (ZKB), in particular, is applying pressure to its US citizen account holders to “come clean”, as a way to reduce the DOJ fines that it is facing. According to the article, ZKB and other banks are blocking US citizen accounts as a lever to force the USC customer into compliance or they will use the customer funds to offset expected fines, which the article notes is likely illegal under Swiss law.

USCs in Canada and elsewhere may wish to pay attention to what is happening to Americans in Switzerland. If USCs abroad have financial investments, consideration should be given to reducing these balances and closing brokerage accounts and investing in non-financial assets such as real estate. Transferring financial assets to a non-USC spouse could also be considered. Going forward, USCs abroad may wish to get along with only a current account until expatriation can take place.

The German language article is at this link. Please use your favorite translator:

http://www.sonntagszeitung.ch/wirtschaft/artikel-detailseite/?newsid=274101

The DOJ and IRS brown shirts continue their terror campaign against Americans abroad.

The more I read about this, the more and more I like the idea. As Chears said: stay away from ETFs, they’re bank-rolled by the banks. Buy bullion if you can manage to. Nobody can tax your hunk of gold or silver. Thanks, Chears for clueing me in on this. I’m seriously asking my wife to set aside some of her pay so that we can start out by buying small pure (100%) silver and gold coinage.

@Innocente

Did I not predict this?

http://isaacbrocksociety.ca/2013/12/14/most-swiss-banks-considering-ovdp-should-not-consider-wegelin-in-their-decision/comment-page-1/#comment-806853

@bubblebustin: you accurately predicted the use of customer funds to pay the fines of Swiss banks in the US-Swiss Tax Programme (or US Programme).

As reported elsewhere, the Swiss post bank, Postfinance, froze the accounts of USPs in early 2014 until they prove they are FBAR/ US tax compliant for 2013 and possibly prior years. An interview with the Swiss Post notes that Postfinance has NOT set up a reserve to pay fines under the US Programme but has set up a CHF 2.5 million (US$2.8 million) reserve for legal fees resulting from the US Programme. See first paragraph in this newspaper article (German):

http://www.tagesanzeiger.ch/wirtschaft/unternehmen-und-konjunktur/Furchtlose-Postfinance/story/16023072

Interpretation: Postfinance is planning to expropriate USP customer funds to pay US Programme fines and has a reserve for legal fees to fight USPs who do not prove US tax compliance and have their funds seized by Postfinance.

Moral of the story: As the world signs FATCA agreements, USPs abroad should not trust their bank. Even if fully US tax compliant, USPs might wish to keep as little money as possible in the banking system to avoid having a large amount of funds frozen and possibly expropriated.

Also: There is irony in the Postfinance freezing USP customer funds without notice (with the apparent intent to expropriate them to pay fines to the US) and its “service publique” charter which requires it to offer banking services to anyone resident in Switzerland.

Yikes, Innocente, I wish I was wrong! This is insane.

@Innocente

This info is very important & should be moved into a post in front because if all banks do this… we will be more screwed then we are now. There is no telling what else will be done.

I also heard rumblings of Swiss banks suing their customers to recover the fines paid out to the US. Never thought a bank in a foreign country would do this. I had deep anxiety that the US would take the info they have been given & just take what they wanted. If u disagree… u would have to use the US legal system to get it back… which would be expensive because u would have to obtain an attorney.

Because if u think about it… all foreign govts are now extensions of the IRS

I’ve been looking into buying physical gold, in particular via Scotiabank, and I see that you can get various wafer sizes etc. that fit in your pocket and you can walk away with; no paper promises.

I don’t plan on investing for my future any more via the traditional channels that the traitorous current federal government encouraged us to use but subsequently has put at risk, like RRSPs and TFSA’s etc. I REALLY hope my kid’s RESPs will be spent before the parasite USA comes knocking.

The problem is that in order to buy this physical gold, the bank not only charges a fairly hefty fee (to be expected I guess) but also any applicable taxes in the province of residence. Where I’m at, in Ontario, I have to add 13% to buy physical gold. In other words, buying physical gold is buying a commodity, not a currency. That sucks. I think it should be a currency.

Does anyone here know of any way to buy physical gold that sounds better than this? Did I read somewhere that the state of Utah has declared gold as a legal currency? Should I travel there to “exchange” for physical gold? Should I go to Alberta (better hurry) to get a good deal. If these taxes can be avoided (legally), I could see this paying quite handily for a vacation to the place of purchase.

Anyone here have any experience/suggestions as to how to buy gold (maybe silver too) in an efficient manner?

@ PierreD

I wish ChearsBigEars was still around. He’d possibly have some good ideas for you. I made an inquiry at a local Scotia Bank here a couple of years ago about silver but I walked out when I found the paperwork (Papers, please!) not to my liking. I’ll be interested to see if you get some helpful responses. Re: Utah … what about the possibility of civil forefeiture?

@EmBee & Pierre D

This is not about silver but something Chears sent me. It’s a Canadian company but appears to only be for residents in US. If anyone is interested, I suppose they could phone for more information.

BitGold Announces Platform Launch in the United States

08:03 EST Friday, Jun 26, 2015

TORONTO (Business Wire) — BitGold (TSX-V:XAU), a platform for savings and payments in gold, is pleased to announce the launch of the BitGold platform for residents of the US and US territories. As of today, US residents can sign up on the BitGold platform and buy, sell, or redeem gold using BitGold’s Aurum payment and settlement technology. US residents will also have access to the BitGold mobile app and a prepaid card when these features launch over the coming weeks. Send and receive gold payment features are not initially available in the US.

About BitGold

BitGold’s mission is to make gold accessible and useful in secure savings. The BitGold platform provides innovative solutions to the challenge of transacting with fully allocated and securely vaulted gold. BitGold accounts are free and convenient to open by anyone, anywhere* in just minutes. BitGold provides users with a secure vault account to purchase gold using a variety of electronic payment methods. All physical gold acquired through the platform is owned by the customer, stored in vaults administered by The Brink’s Company, acting through Brink’s Global Vault Services International, Inc. (“Brink’s”), which insures gold through third party insurance providers.

BitGold is a Canadian corporation with offices in Toronto, Canada, and Milan, Italy. BitGold has partnered with established professionals in bullion dealing, vault security and web security, payment processing, and is committed to best-practice systems for compliance with all applicable laws and regulations regarding anti-money Laundering (“AML”) and Know Your Customer (“KYC”).

*The BitGold Platform is unavailable to residents of sanctioned countries

For more information, please contact:

Emily Cornelius

BitGold Inc.

Tel.: 647-499-6748

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein. Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy of this release.

Forward-Looking Statements

This news release contains certain “forward-looking information” within the meaning of applicable Canadian securities laws that are based on expectations, estimates and projections as at the date of this news release. Any statements that involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Company at the time it was made, and involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others: risk factors relating to the acquisition of GoldMoney, being completion of satisfactory due diligence, settlement of definitive documentation, satisfaction of closing conditions, receipt of regulatory approvals and, generally, the completion of the acquisition on the terms as described if at all; the Company’s limited operating history; future capital needs and uncertainty of additional financing; the competitive nature of the industry; unproven markets for the Company’s product offering; volatility of gold prices & public interest in gold investment; lack of regulation and customer protection; the need for the Company to manage its planned growth and expansion; the effects of product development and need for continued technology change; protection of proprietary rights; the effect of government regulation and compliance on the Company and the industry; network security risks; the ability of the Company to maintain properly working systems; foreign currency and gold trading risks; use and storage of personal information and compliance with privacy laws; use of the Company’s services for improper or illegal purposes; global economic and financial market conditions; uninsurable risks; and those risks set out in the Company’s public documents filed on http://www.sedar.com. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. The Company undertakes no obligation to revise or update any forward-looking information other than as required by law.

View source version on businesswire.com: http://www.businesswire.com/news/home/20150626005291/en/

BitGold Inc.

Emily Cornelius

Tel.: 647-499-6748

Banks track your gold purchases. If you pay cash at Canada PMX, less than 10k CDN your name can be “walk in customer”. Not at Scotia Moccata.

Wow Petros, that’s very interesting. In the Canadian PMX FAQ page, they also mention that there is no sales tax applicable in Canada on precious metals (I wonder if I read Scotia Moccata wrong, maybe the tax is only on their service charge). I’m unable to find the part where it says I can be listed as “Walk In Customer” but I’m sure I’ll be trying soon.

Thanks to all who have responded. I believe my question is answered.

Hi,

BitGold is open to residents from all over – this press release above came out as we were previously not open to US residents.

Here is a list of all the countries we are available in – http://assistly-production.s3.amazonaws.com/210095/kb_article_attachments/58374/List_of_Supported_Countries_25_June_2015_original.pdf?AWSAccessKeyId=AKIAJNSFWOZ6ZS23BMKQ&Expires=1436212886&Signature=1ojTdLVJimYlnTCIA48oavD1rkg%3D&response-content-disposition=filename%3D%22List_of_Supported_Countries_25_June_2015.pdf%22&response-content-type=application%2Fpdf

Thanks – any questions please visit support.bitgold.com