Strange findings from a recent survey by Rasmussen Reports: when asked “have you ever considered giving up your U.S. citizenship?”, nine percent of 977 U.S. adults responded that they had:

Few Americans have ever thought about giving up their U.S. citizenship … Perhaps in part that’s because 93% consider it at least somewhat important to be a U.S. citizen, including 79% who think it is Very Important … Men are more likely than women to have considered giving up their U.S. citizenship. Democrats are less likely than Republicans and unaffiliateds to have considered it. But sizable majorities across all demographic categories have never given a thought to quitting their U.S. citizenship.

Keep in mind however that this is a so-called “national survey” — by which they mean a survey conducted throughout the territory of the State, not among a representative sample of members of the nation located both on State territory and abroad. But just think: if 9% of Homelanders have toyed with the idea of renouncing U.S. citizenship, how many Americans abroad do you imagine are considering it?

Renunciation within the United States? Not likely

As we discussed previously, the 1996 General Social Survey found that nearly 18% of native-born U.S. citizens had spent some time living abroad. However, it’s not clear how many of the 9% of people who told Rasmussen that they had considered giving U.S. citizen are drawn from among former expats who had once thought of cutting off ties to the U.S. but then instead decided to move back, and how many have never lived abroad and have no idea precisely what giving up U.S. citizenship actually involves.

The vast majority of Homelanders are most likely unaware that you have to be living abroad before you can renounce citizenship, given that even their lawyers publish articles claiming that you have to pay your exit tax before you get on a “jet plane” leaving the country. Though the Renunciation Act of 1944 allows domestic renunciations when the U.S. is in a state of war, there’s no evidence that the U.S. government has actually accepted any such renunciations since World War II, when about five thousand Japanese American internees renounced. (Many of their renunciations were later found to have been involuntary.)

From 1947 to 2010, we can be certain that the U.S. government accepted no domestic renunciations. In 2010, the DC District Court ruled that the U.S. is in a state of war for purposes of the Renunciation Act of 1944; the Department of Justice appears reluctant to appeal this ruling, likely for fear of giving a circuit court the opportunity to rule on the meaning of “state of war”. The Senate immigration bill contains provisions to repeal the Renunciation Act of 1944, probably also with an eye to closing off this avenue for a judicial opinion of precedential value on what exactly constitutes a “state of war”.

However, it’s not as simple as going to a post office and handing in an affidavit, as the “sovereign citizens” movement thinks: other judges have held that even though the U.S. may be in a state of war, USCIS — the agency responsible for administering the 1944 Act — has broad leeway to reject applicants for renunciation, or to place their applications on hold. So far, it seems that most applicants for renunciation are prisoners, and USCIS can easily stall them by demanding that they show up in person. Even without that hurdle, USCIS would most likely demand that anyone renouncing U.S. citizenship under the 1944 Act show that they have a second citizenship and would depart from the U.S. voluntarily — they had enough trouble dealing with Thomas Jolley and Garry Davis back in the 1970s.

In other words: sorry to you 9% of Homelanders, renunciation is solely a privilege for the American diaspora!

How many Americans abroad have considered giving up citizenship?

Even if only 9% of Americans abroad were thinking of renouncing citizenship, that would still be 680,000 of the estimated 7.6 million members of the American diaspora. Of course, most of them have not yet acted on this plan — based on FBI statistics, probably only about eight thousand or so Americans abroad gave up citizenship in any way last year, whether by renunciation or relinquishment.

On the other hand, it seems that as many as a quarter of new parents in the American diaspora are failing to register their babies with the U.S. consulate — either because they consider U.S. citizenship to be too unimportant to bother looking into the procedure and filling out the 20-minute paperwork, or because they have actively chosen to keep the U.S. government uninformed about their children’s existence so that the children themselves can decide whether to reveal themselves when they are closer to adulthood and better able to understand the burdens that U.S. citizenship will impose on them. Marvin pointed out a recent letter to the editor of the Los Angeles Times which illustrates this widespread phenomenon:

Re “Waiving the U.S. flag,” Oct. 14

The article on American expatriates renouncing their citizenship because of U.S. tax laws hit home.

My daughter was born in the U.S., as were her parents and grandparents. She now lives in Canada. To comply with the Foreign Account Tax Compliance Act, or FATCA, and to complete her federal Form 1040, she had to spend hundreds on assistance. In the end, she owed no taxes.

My daughter is not a corporate executive or a professional athlete. She is an instructor (not a professor) at a university. She recently gave birth to our granddaughter, who is entitled to U.S. citizenship. She has declined to file the paperwork because she does not want to subject her to the draconian FATCA.

David E. Ross

Oak Park

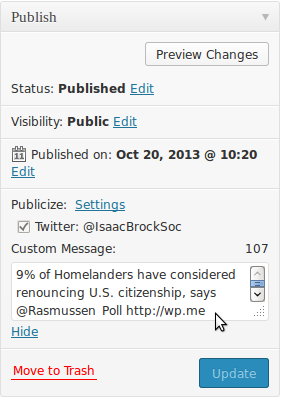

Finally, on an unrelated topic, those of you who follow @IsaacBrockSoc may notice that this post has a different tagline over on Twitter than it does here:

9% of Homelanders have considered renouncing U.S. citizenship, says @Rasmussen_Poll http://t.co/kEjzTtDji7

— Isaac Brock Society (@IsaacBrockSoc) October 20, 2013

Those of you who blog with WordPress can do this with your own posts too — just click the “edit” link under “Publicize” at the right side before you press “Publish”, and then in the “Custom message” box you can edit the tweet that gets posted.

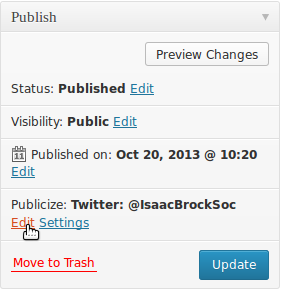

Click “edit” … |

… and then use normal Twitter syntax! … and then use normal Twitter syntax! |

Good post, Eric.

I submitted a comment to the ‘Letter to the Editor’ post in LA Times. Apparently, it didn’t make the cut. There are still zero comments showing.

Eric…

How timely! Thanks for posting this. I was just reviewing today, as a curiosity, all of the archived headlines of past Brock posts with “Citizenship” in the title (there are ~137, by the way)

I was mulling over the fact that the Citizenship subject seems to be getting more play in “some” U.S. media, and was wondering what the impacts were on homelanders reading these stories for the first time. When I think back on my life, I don’t recall ever giving my U.S. citizenship a thought, or considered what it meant for my international options until the Obama’s offshore jihad started. That certainly has changed.

On a related subject, …. A program I like to listen to in the States if an NPR station airs it, or catch on the internet when I am in NZ, is PRI’s The World.

On Friday, they ran this story…

Citizenship? No thanks, I’ll pass for now

So, adding to the discussion of the percentage that consider renouncing, think about all the immigrants that don’t want U.S. Citizenship (only 38% of those with Greencards get U.S. citizenship), it should cause thinking Americans to question, Why is that?

And thanks for the tip on “Publicize”. That is a good one. I have seen it, and wondered what it did.

Do you know if that impacts the heading that is picked up when a bitly link is created for use in a tweet?

Right now, when you create one, there is only the heading “Isaac Brock Society”, with no headline tag. I once asked Petros about that, as the old .com address came with a tagline.

Currently, the lack of a headline disadvantages the links that are created, as it does NOT automatically show up if some picks up the tweet to publish in a Paper.li publication or other blog posts. There is no headline to catch their attention. Thanks again for pointing this out, and I will experiment to see if it has any impact.

@Eric

Thank you for the effort you’re making in analyzing US renunciation numbers.

I wonder how much conducting a survey of this type just before a presidential election would skew the numbers. It’s tiresome to hear so many Americans threaten to move to Canada if their choice isn’t elected, knowing they’re clueless about the process.

@Just Me: re the bit.ly thing, I think the problem is that when our WordPress theme generates the HTML for individual posts here, it doesn’t include the post title in the <TITLE> tag for the page. I’m not sure if this can be changed from the admin interface, but here’s documentation on how to do it if you’re editing the post template directly (should be the file called single.php in one of the wp_content/themes directories):

https://codex.wordpress.org/Function_Reference/wp_title

Interesting stats, Eric. Thanks.

My first reaction was surprise that more Republicans than Democrats have thought of this, but then, Obama is in office now. I strongly suspect it would have been more Democrats than Republicans when Dubya was in the Oval Office; I know a couple of Democrats in the US who kept saying they wanted to move to Canada (before 2008) but don’t say that as much now.

So, if it’s 9% on a national survey (and we assume that’s reliable; about 1000 respondents is usually considered OK for a 3%age error margin, as long as you don’t try to break it into sub-categories), then I suspect the percent would be rather higher right now among Americans living outside the US, especially those who are aware of the FATCA express train bearing down on them. So ignoring the margin for sampling error, let’s say at least 10% of those 7 million folks, that’s potentially 700,000 people, a pretty-respectably-sized city and a hell of a workload for the State Department (and IRS if they want to process all the back 1040s, FBARs and 8854s they might get). It might even go higher, probably would — I think someone living in another country, with a home, job, and family, is going to be far more likely to think about dumping their USC than are most people currently living in the US, and I also suspect they’re far more likely actually to carry out that action instead of just saying “I’m thinking about it,” for whatever that’s worth.

@Eric…

I will see if I can understand that gibberish, as it how it appears to me at first blush, but I might make sense out of it if I try…

Just Me, thanks for the stat on the percentage of greencard holders who get citizenship. Actually changes the narrative of “more people immigrate into the US then leave for good and renounce” because though more people land in the US, few of them what to be Americans. They come for school, jobs and other things and they want to partake of the first world lifestyle, but they don’t consider themselves Americans. And yes, this does play into the other discussion that Americans don’t really see immigrants as Americans either but that is for another day.

I had always thought about leaving the US but never took the time to figure out how to do it and then suddenly I left without thinking much about my US citizenship at all. I assumed ( incorrectly) that being a dual was no big deal but in retrospect, I should have known that a country like the USA would not be okay with sharing me with another country.

To an American, there are two kinds of people – Americans and everyone else. And when dealing with America or its govt, it is probably best to know, which one they consider you. That way, you are never surprised by the outcome.

@YogaGirl

My Australian wife is in the category of those who never have gotten U.S. Citizenship. First, because it would have required her to give up her Australian Citizenship as they did not allow dual citizenship. When that changed, she started to consider it, but then along came the offshore Jihad, and that changed her opinion!

I think she will remain in the 62% indefinitely. Of course she could change her mind, but the form and the requirements to document all your goings and comings for past years was enough to put her off. And the idea of flag waving pledges of allegiance seems too bizarre. Additionally, waiting at the Immigration office to get a Green Card renewed is enough to want you to avoid the U.S bureaucracy at all costs. They have NO idea what a miserable unfriendly and inefficient operation they run. Nor do they care.

Just Me, Oh, I imagine the people who work there know EXACTLY what an unwelcoming clusterfuck they are running. It’s kinda the point. To make it taxing, degrading, expensive and a lot of work. Those who stick with it somehow prove their worthiness by doing so.

I don’t know about other countries, but Canada can’t lay claim to a user friendly immigration process either. It’s mind-numbingly slow and paper intensive. It’s also more than a tad racist, which may or may not surprise people given Canada’s incredibly diverse population.

But I think, based now on experiencing the bureaucracy of two different nations that user unfriendly in terms of time-wasting and money-sucking might be why govts – in general – tend to be rated poorly by populations forced to make use of them.

Practicality and common sense are not usually qualities that people attracted to political office possess in abundance and they are the inspiration behind much of the nonsense that ordinary citizens have to put up with.

And @YogaGirl, those in government move to the head of the line if they were not already there.

They make decisions for the rest of us, and often do not have to experience the full on consequences of the policies they enact.

For example;

Sixty percent or more of Canadians do not have an employer pension plan.

http://www.thestar.com/opinion/editorialopinion/2011/07/03/imagining_a_world_without_pensions.html

And yet, who will be making decisions on what is to be done? The (mostly) guys with the platinum plated pensions:

http://www.huffingtonpost.ca/2013/08/28/senate-pension-loophole-mac-harb_n_3830272.html

http://news.yahoo.com/blogs/canada-politics/532-568-taxpayer-watchdog-calculates-pension-benefit-retired-220840559.html

http://www.cbc.ca/news/politics/mps-urged-to-give-up-platinum-plated-pensions-1.1237799

http://www.cbc.ca/news/canada/senators-fined-for-poor-attendance-records-1.232918

I am curious as to how many of our MPs and Senators have a US connection that would make them US taxable persons?

Badger, that would be a interesting thing to know, wouldn’t it?

@Schubert1975

Consider that Canada has on average about 140 renunciations a year and has about 1/9th the population of the US’s…

The IRS and Department of Justice have been cracking down on Americans with unreported offshore accounts.

news

The penalties for not reporting a foreign bank, brokerage or hedge fund account can include prison and a civil penalty of 50% or more of the highest account balance. With a look back period of up to 8 years, those penalties can be severe.

The Bank Secrecy Act and FATCA already require Americans and resident aliens to report their foreign holdings. Compliance, however, has been spotty at best. Many foreign born Americans, ex pats living overseas and dual nationals simply don’t understand the law.

Under the next phase of FATCA, foreign banks will essentially become the eyes and ears of the IRS. Beginning in 2014, foreign financial institutions will be required to review their accounts and report any accounts that ties to the United States. That portion of the law has been immensely unpopular with foreign banks and with taxpayers too. Because some view the new law as so onerous, many foreign banks are simply closing accounts owned by Americans. Thats rough for the thousands of Americans living or retired offshore.

Rand Paul has long been a vocal critic of FATCA. In introducing legislation to repeal portions of the law, Paul said “FATCA is a textbook example of a bad law that doesn’t achieve its stated purpose but does manage to unleash a host of unanticipated destructive consequences. FATCA’s harmful impacts cover the spectrum. It is a violation of Americans’ constitutional protections, oversteps the limits of Executive power, disregards the mutual respect of sovereignty among nations and drains money from the federal treasury under the guise of replenishing it, and discourages overseas investment in the United States.”

While unpopular overseas, it is unlikely that Sen. Paul can gain enough votes to repeal FATCA. Tonight, however, many people are secretly hoping for him to be successful.

We understand that tax evasion is a problem. Unfortunately, the number of tax evaders who deliberately attempt to hide money in secret Swiss numbered accounts is quite small. Many of our clients are dual nationals or recent immigrants – hard working restaurant owners, physicians, computer programmers and store owners. These are people that have foreign accounts in order to send money “home” to family members. Unfortunately, the IRS often treats both the criminals and non-criminals alike.

According to RepealFATCA.com, a similar version of Sen. Rand’s repeal legislation is also being introduced in the House. Although supported by the banking industry, lobbyists and political analysts on Capitol Hill say the bills have little chance of success.

If you have an unreported account, there are options. The IRS is presently running an amnesty program called the Offshore Voluntary Disclosure Program (“OVDI” or “OVDP” for short). For certain ex pats living overseas, people with account values under $75,000 and those who can prove their failure to report was accidental, other better alternatives may be available.

Whatever you do, don’t wait. Once the IRS obtains your name through a foreign FATCA disclosure or otherwise, all bets are off.

We think by applying and then opting out you will lower your taxes.

FBAR penalties should never have been applied to those with legitimate accounts living outside the U.S. with zero U.S. holdings. Average expat families should not have been the target of FBAR. FBAR ought to be applied to those living in the U.S. with actual “off shore” unreported holdings. Why they cannot make a distinction between those living abroad with LOCAL accounts and those living in the U.S. who are “off shoring” when applying penalties says a ton about their aim and purpose to me.

It’s easy enough once you learn you are targeting innocent people who are not “hiding” money “Off shore” in order to “escape taxes” you do something to change that. Instead Treasury has responded by calling the harm they are causing those who would never owe any taxes a “Myth”

This is not a way to gain good faith and trust. Who would want to send in FBARS as an innocent person when they have seen the attacks and the woefully rude response to those attacks. FBARS penalties should be applied to drug lords and money launderers NOT average Canadians or other expats who haven’t lived in the U.S. for decades with foreign families.

If this is how the U.S. is going to treat it’s expats then relinquishing your citizenship to protect your foreign family is the best option to my way of thinking. The so called “amnesty” programs have done nothing to address the real harm done to minnows and krill. How is it “amnesty” if FBAR penalties will be applied even when zero taxes were ever owed. How is it “amnesty” if you have to hire an expensive tax attorney to prove you never heard of FBAR? How does one prove a negative?

@ Lance Wallach,

FATCA is not news to any of the regulars here at IsaacBrock.

You say: ” The IRS is presently running an amnesty program called the Offshore Voluntary Disclosure Program (“OVDI” or “OVDP” for short). For certain ex pats living overseas, people with account values under $75,000 and those who can prove their failure to report was accidental, other better alternatives may be available.”

OVDP is for criminals, not average, tax paying people who live outside of US, but who are considered to be ‘US persons’. Criminals do not post here. Those who do post here, and have entered prior OVDP programs have mostly lived to regret it. Some have had success with opting out, and some have entered the ‘Streamlined’ program.

What do you mean ‘we think by applying and then opting out you will lower your taxes’?? Apply to what? OVDP or streamlined? No one in their right mind who is not a US resident deliberately hiding untaxed money offshore would enter any OVDP programs other than the new Streamlined program. Opting out only makes sense if you mistakenly entered one of the prior OVDP programs designed for criminals. To recommend applying to OVDP at this point in time, and then opting out makes no sense at all, unless one is a criminal!

Canadian citizens living in Canada with US birthplace are not tax evaders, and should not enter any OVDP programs, except, PERHAPS Streamlined. Your comments are confusing to say the least, as there has been extensive discussion and research documented here on this situation already.

You say: “Whatever you do, don’t wait. Once the IRS obtains your name through a foreign FATCA disclosure or otherwise, all bets are off. ” All bets are not off! Canada will not collect FBAR penalties imposed on Canadian citizens that were assessed when that person was a Canadian citizen regardless of their ‘US person’ status. This is scare mongering, and we have had enough of that here in Canada.

@Lance Wallach

Where do you get your figure of <$75K for FBAR balances in order to be accepted into Streamlined?

Also, don't expect a quick resolution for those entering the OVD programs. I've been in OVDI for close to 23 months now and haven't heard one word from the IRS, never mind being in a position to opt out. How can opting out lower taxes – don't you mean penalties?

@All,

Lance Wallach’s post reveals how little lawyers in the ‘compliance industry’ actually understand about FATCA, FBARS, CBT, OVDP, Streamlined, IGA’s, other countries charter rights, morality, etc. Most of them should be avoided. Everything you ever wanted to know about these topics is covered here at IBS. It is scary to think that people might actually contact this person for advice when he actually recommends applying to OVDP, then backs up his advice with “Once the IRS obtains your name through a foreign FATCA disclosure or otherwise, all bets are off.”

@bubblebustin,

I was thinking the same thing re: the 75K figure, and the lowering taxes comment. Obviously, Wallach either does not have his facts straight or does not know how to communicate. In either case, these are not good attributes for legal counsel.

@Lance Wallach

I’m sorry, but this looks awfully like an attempt to drum up business, rather than engage the Brock community in a meaningful exchange.

Now that could maybe on a very, very, very good day be excused. But what can absolutely not be excused is to advise Canada resident expats to join the OVDX program. The ridiculousness of this has been hashed over ad nauseam, so suffice it to say that we know to run, not walk, away from OVDX, and from anyone peddling the nonsense that law-abiding Canadian residents who are for whatever reason non-compliant w.r.t. US taxes should join this program designed for tax cheats.

Interesting survey–although I suspect that when a “Homelander” is asked whether they want to give up US citizenship, something different comes to mind than when the same question is asked of the diaspora. For someone in the diaspora, actually giving up citizenship probably means going through the formal renunciation/relinquishment process at a US consulate. But for someone in the US, when they think of “giving up US citizenship”, they probably just are thinking of moving abroad for awhile. They probably haven’t thought ahead to actually formally renouncing as yet.

It makes sense that homelanders wouldn’t be any more aware of the difference between residency and citizenship than their own government is.

For whatever bizarre reason, Rasmussen has decided to make this survey into an annual thing:

http://www.rasmussenreports.com/public_content/politics/current_events/immigration/november_2014/how_many_are_willing_to_renounce_their_u_s_citizenship

Results are about the same as last year: 9% of Homelanders have considered “renouncing their citizenship”, whatever they think that means