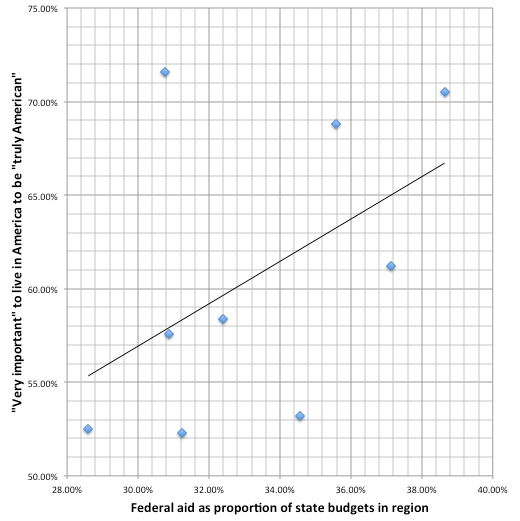

Inspired by a recent TaxProf Blog post showing the percentage of each U.S. state’s general revenue which consisted of intergovernmental revenue (primarily federal transfers) in 2011, I went and re-did the same calculation for each U.S. census region based on 2004 budget data, and graphed it against the proportion of native-born GSS respondents that year who lived in that region as teenagers (GSS question REG16) and stated that it was “very important” to live in America most of your life in order to be considered “truly American” (GSS question AMLIVED). As you can see from the graph, the two variables are somewhat correlated, with an R2 of 0.23.

(Edit: Because I made a data entry error, an earlier version of this post left out the South Atlantic region, which is a major outlier — far more anti-emigrant than their low proportion of federal aid would otherwise predict. Without them in the mix, the R2 would be 0.60).

Every one percentage point increase in the proportion of federal aid in the budgets of states in the given region was associated with a 1.13 percentage point increase in the number of people from that region stating that it was “very important” to live in America most of your life in order to be considered “truly American”. (It would have been nice to do a more granular breakdown, but unfortunately the GSS doesn’t provide state-level information on respondents.) In otherwords, the less able your state is to fund its infrastructure and social aid budgets by taxing people who actually live there, the more likely you are to consider Americans abroad to be un-American — no doubt because so many of their tax dollars go towards funding some Sino-Euro-Canadian socialist plot to take over the world, instead of the roads and schools that you use and they don’t.

And for those who are still convinced that this is all Kang’s fault and we can save the nation by voting for Kodos, note that this is a bi-partisan phenomenon. Regions with a higher-than-average proportion of people who consider Americans abroad to be un-American include the mostly Democratic Mid-Atlantic (home of Ex-PATRIOT Act sponsor Chuck Schumer) and the mostly Republican West North Central (whence Chuck Grassley who repeatedly attempts to kill the Foreign Earned Income Exclusion to provide more pork for his constituents, as well as Ex-PATRIOT Act co-sponsor Tom Harkin).

The raw data is presented below as an HTML table for your convenience. All monetary amounts are in thousands of dollars.

| Region | General Revenue | Intergovernmental Revenue | Revenue Percentage | AMLIVED “Very Important” | |

|---|---|---|---|---|---|

| 1 | New England | $66,339,754 | $18,969,690 | 28.59% | 52.50% |

| 2 | Mid-Atlantic | $196,728,420 | $73,036,257 | 37.13% | 61.20% |

| 3 | East North Central | $182,950,961 | $56,489,558 | 30.88% | 57.60% |

| 4 | West North Central | $76,921,109 | $24,929,324 | 32.41% | 58.40% |

| 5 | South Atlantic | $198,840,101 | $61,180,485 | 30.77% | 71.60% |

| 6 | East South Central | $68,030,827 | $26,287,987 | 38.64% | 70.50% |

| 7 | West South Central | $115,887,832 | $41,243,067 | 35.59% | 68.80% |

| 8 | Mountain | $66,251,827 | $22,894,741 | 34.56% | 53.20% |

| 9 | Pacific | $206,042,957 | $64,351,204 | 31.23% | 52.30% |

| National total | $1,177,993,788 | $389,382,313 | 33.05% | 60.90% | |

I will add that Jack Reed is from Rhode Island/New England so I am not sure there is a direct correlation. We could talk about how Rhode Island is much poorer than Massachusetts which might have something to do with it. Massachusetts though at the moment lacks a permanent Senator itself other than Elizabeth Warren of anti Wall Street fame.

This may be an artefact of the lower education, greater inequality and poverty and Southerness of the rankings.

@Joe Smith: yeah, education definitely has a big influence: 81% of native-born who didn’t finish high school said “very important” to live in America most of your life to be “truly American”, vs. 42% of native-born college graduates (AMLIVED v DEGREE, filter BORN(1);YEAR(2004)).

But there’s still quite a bit of regional variation too (e.g. 58% of Pacific non-college-grads said “very important”, vs. 80% of South Atlantic non-college-grads).

this show that most regions are addicted to spending other people’s money. it then becomes easier to justify extraterritorial taxation of “less than real Americans” so as to not harm “real Americans”

Oops, I hit “post” too quickly”. Looks like the correlation’s weaker than I thought. Without the South Atlantic in there it’s a lot stronger. Wonder why they’re such a major outlier.

@Eric, With or without the South Atlantic, the correlation is very weak. I don’t think you can draw any conclusion from this data.

Besides, the fact that they consider Americans abroad as less American isn’t necessarily a bad thing. They are probably less prone to tax Americans abroad if they view them as foreigners.

@ShadowRaider, re; “…the fact that they consider Americans abroad as less American isn’t necessarily a bad thing. They are probably less prone to tax Americans abroad if they view them as foreigners…”

Unfortunately, they have demonstrated that they are perfectly able to hold internally inconsistent beliefs at the same time – as in, Americans abroad are less American, so we won’t offer them all the right to vote, or any effective representation, or avenue for their concerns, but at the same time, all ‘Americans’ should pay American taxes, so anyone we deem to be American should be hounded wherever they live. And their foreign born dual children too. Those ‘US citizens abroad’ with intellectual/cognitive disabilities deemed legally incompetent, are judged by the US as unable to understand enough to renounce or relinquish said citizenship, yet at the same time deemed equally responsible and liable to the US for US tax and other financial reporting and so must continue to be taxed by the US on their Canadian disability savings for life regardless.

US homelanders and the US government have the same ability as the White Queen in Alice Through the Looking Glass – to believe “six impossible things before breakfast”.

“Alice laughed. “There’s no use trying,” she said: “one can’t believe impossible things.”

“I daresay you haven’t had much practice,” said the Queen. “When I was your age, I always did it for half-an-hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.”” Lewis Carroll

http://en.wikiquote.org/wiki/Through_the_Looking-Glass

Hicks are hicks. They’re dumb. And they vote for the likes of Mr. Grassley.

Prof. von Koppenfels surveyed 748 American expatriates to determine their “home state”. Below is a comparison of sampled expatriates by “home state” to state population of total US population. Iowa supplied a disproportionate 2.8% of the expats while its population at 3.0 million was 1.0% of US population. Grassley is a US Senator for Iowa. Go figure.

In reviewing this comparison, I see correlations between level of education as an enabler to become an expatriate and lack of job opportunities in some states as a cause, i.e., more better educated people than available good jobs in the state. Note: there is an implicit assumption that this data is representative of the expat population.

Expat Population by State of Origin

State 2010 Population* State Pop/ Total Pop* Expat % % Pts +/- % Diff

MA 6.5 2.1% 6.8% 4.7% 223.1%

IA 3.0 1.0% 2.8% 1.8% 188.2%

CT 3.6 1.2% 3.1% 1.9% 165.9%

OR 3.8 1.2% 3.0% 1.8% 143.8%

NY 19.4 6.3% 12.6% 6.3% 100.6%

CO 5.0 1.6% 3.1% 1.5% 91.5%

MN 5.3 1.7% 3.0% 1.3% 74.8%

WI 5.7 1.8% 3.0% 1.2% 62.5%

MD 5.8 1.9% 3.0% 1.1% 59.7%

WA 6.7 2.2% 3.3% 1.1% 52.1%

IL 12.8 4.1% 5.8% 1.7% 39.9%

PA 12.7 4.1% 5.2% 1.1% 26.4%

CA 37.2 12.0% 12.2% 0.2% 1.3%

NJ 8.8 2.8% 2.8% 0.0% -1.7%

NC 9.5 3.1% 3.0% -0.1% -2.5%

OH 11.5 3.7% 3.5% -0.2% -6.0%

MI 9.9 3.2% 2.8% -0.4% -12.7%

FL 18.8 6.1% 3.2% -2.9% -47.4%

TX 25.1 8.1% 4.0% -4.1% -50.8%

Listed States 211.1 68.4% 86.2%

50 States+DC 308.8

*-Wiki

**-A. von Koppenfels data, p. 17

http://www.bsmlegal.com/PDFs/vonKoppenfels.pdf

Below is the same ranking of states as above with an added column “Income Rank”. Generally, there is a higher correlation of expats originally from US states with higher incomes and a lower correlation of expats originally from US states with lower incomes. “Income Rank” might also be used as an imperfect proxy for education level:

Examples:

MA, which ranks #5 in state income, supplies a disproportionately high percentage of expats: 6.8% of total US expats vs. 2.1% of US population.

FL, which ranks #37 in state income, supplies a disproportionately low percentage of expats: 3.2% of total US expats vs. 6.1% of US population.

Expat Population by State of Origin

State 2010 Population* State Pop/ Total Pop* Expat % ** Income Rank 2011*

MA 6.5 2.1% 6.8% 5

IA 3.0 1.0% 2.8% 24

CT 3.6 1.2% 3.1% 4

OR 3.8 1.2% 3.0% 29

NY 19.4 6.3% 12.6% 16

CO 5.0 1.6% 3.1% 15

MN 5.3 1.7% 3.0% 11

WI 5.7 1.8% 3.0% 21

MD 5.8 1.9% 3.0% 1

WA 6.7 2.2% 3.3% 12

IL 12.8 4.1% 5.8% 18

PA 12.7 4.1% 5.2% 23

CA 37.2 12.0% 12.2% 10

NJ 8.8 2.8% 2.8% 3

NC 9.5 3.1% 3.0% 39

OH 11.5 3.7% 3.5% 35

MI 9.9 3.2% 2.8% 34

FL 18.8 6.1% 3.2% 37

TX 25.1 8.1% 4.0% 25

Listed States 211.1 68.4% 86.2%

50 States+DC 308.8

*-Wiki

**-A. von Koppenfels data

It’s only right that we should be punished for our un-Americanness by taxing us.

@bubblebustin, to them, it’s only right that they tax and penalize us, for being un-American, or for being American, for the ‘privilege’ of living ‘abroad’, for ….. They don’t give a damn for reason or ethics, they just want to tax us period.