I think that there should be an article on IBS about the full ramifications of what FATCA and the potential IGA could do to Canada as a whole, not just from an “expat POV”. Right now all they see is “well…better you than me.” Most Canadians won’t be sympathetic until we explain what FATCA can potentially do “TO THEM”!

Agreed. I will take this on. What I would like are as many succinct comments (keep the emotional content to a minimum) on how FATCA will impact Canada and all Canadians. I encourage you to think in the short term, the medium term and the long term. I encourage you to describe things not only in a theoretical sense, but in a real practical day-to-day sense. For example, what does a loss of privacy rights really mean? What will the inability of US persons to engage in meaningful financial planning mean to Canada as a whole? How specifically will surrendering control of the banks to the IRS reduce Canadian sovereignty? What you will do to those politicians who vote for FATCA? Will there be pressure to change Canadian tax laws to be consistent with the US Internal Revenue Code? How do PFIC, FBAR, Form 8938 and Foreign Trust penalties siphon money out of the Canadian economy? Wouldn’t it be easier to simply adopt the US tax system?

How does US taxation of Canadian residents make those taxed (US persons as presently defined) a possible threat to the stability of the Canadian economy? Should Canada allow any more US citizens to immigrate to Canada? What should be done about the ones who are already here?

A commenter on this blog once said:

If you got em by the banks, their “minds and hearts” will follow!

Or, is this a case of the banks dictating to the Government. I suspect that the banks are “FATCA Complicit” in the extreme. We know that FATCA solves one set of problems for the banks. But,doesn’t it create a bigger set of long run problems for them?

What, in practical terms does it mean for the “minds and hearts” of ordinary Canadians and their politicians to follow the US? Would it make sense for the Canadian Prime Minister to take his orders from the US IRS Commissioner?

Would Canada, over time, become an “occupied power”? In theory an autonomous nation, but for all practical purposes governed by its political masters in Washington?

If Canada is an “occupied power” does it make sense to retain US citizenship? Is there any reason to renounce it under those circumstances? How would Canada look and feel as a country under FATCA domination?

Hate to sound alarmist, but the FATCA (half pun intended) is that:

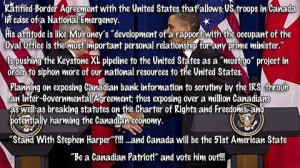

– by entering into an IGA, the Harper Government is poised to override the Consitution/Charter of Rights of Canada

– by entering into an IGA the Harper Government has expressed a willingness to change Canadian laws to accommodate the “FATCANatics” in Washington

Does the Harper Government have the legal right to enter into an agreement with the US which transfer so much control over the country to the United States? If a referendum was required on the Quebec question, should a referendum be required before turning control of the banks over to the United States?

This is a time for Canada to lead. In 2003 Canada refused to join the US in the attack on Iraq. This time Canada should refuse to join the US in sending its “FATCA Drone” into other sovereign airspace. Is Mr. Harper up to the challenge? Will he do the one thing that all politicians hate to do – I am referring to the “right thing”.

Some readers of this post may view this as extremist or alarmist. It is my hope that your comments will paint a clear picture of what is truly at stake for Canada and for ALL Canadians.

Or maybe I am completely wrong. Maybe it is possible to cede control of your banks and maintain control over your sovereignty. Isn’t there an issue of banks and sovereignty playing out in Cyprus right now? The Cyprus situation is interesting. I don’t pretend to understand all of it. But, what is clear is that it is an attempt on the part of the EU to exercise some control over the deposits – and by extension – the banks of Cyprus. There is no question that the sovereignty of Cyprus is at stake. There may be good reasons for it, (they can’t just freeload off the EU), but the fact is that control of a country’s banks is related to control of a country’s sovereignty. At least that’s what I think. What do you think?

On the sovereignty issue, here is another message from the Animal:

Stan is a prime example of why I never wanted to retain the American portion of my dual citizenship.

Thanks, The Mom and WhiteKat. Ditto.

Let’s not reward the really uninformed comment. The writer, as many a child, wants attention.

@TheMom, ditto.

@Calgary, Good point. Besides, it is a waste of time and energy.

@WhiteKat,

We’ve “been there / done that” at other sites — where we really MIGHT educate others.

In terms of the impact on all Canadians (and, more widely, citizens of other countries), one of the indicia of US personhood is a standing instruction to pay money to an account in the US. To rid yourself of the suspicion of US personhood, the evidence required in this case according to Deloitte in FAQ 16 (http://www.deloitte.com/assets/Dcom-UnitedStates/Local%20Assets/Documents/Tax/us_tax_FATCA_FAQs_061711.pdf) is filing of a W-8 BEN or W-9 plus documentary evidence establishing non-US status (whatever that means).

Canadian parents who are supporting a child at university in the US or barely making a living in NYC or taking an extended trip in the US will be suspected US persons. Perhaps a wider reaching impact would be on all snowbirds who are probably quite likely to be making payments to the US on a regular basis. Depending on the interpretation of a “standing instruction” (fixed amount/fixed interval, variable amount/fixed interval, fixed amount/variable interval, variable amount/variable interval, or perhaps merely just having payment details for a US account on file with your bank) this could conceivably cause the accounts of all snowbirds to fall under suspicion of US personhood and for all snowbirds to have to supply “documentary evidence of non-US status”. Snowbirds not fond of filling in bank paperwork could have their bank accounts reported on and/or closed.

No doubt some enterprising individual will establish the FATCA arborist service which, for a mere few hundred dollars, will “verify” that your family tree is free from American chestnut blight (http://forestry.about.com/od/diseases/tp/An-Index-of-Common-Tree-Diseas.htm).

@Stan

You may recall that Vladimir Putin mentioned while campaigning that the US is a “financial parasite” on the rest of the world. He made this comment for internal consumption but his point is valid. Consider the following ways in which the US lives off the rest of the world:

1) Current Account/ Trade Deficit: America’s current account accumulated trade deficits have totaled $7.75 trillion as of 2010. The rest of the world sends real things, like cars, machinery, oil, etc., to the US and the US sends promissory notes in return. Sounds like a perfect deal for a country that consumes more than it produces.

2) Importing trained personnel from abroad: The US is quite well-known for “attracting” trained personnel, such as scientists, medical doctors, nurses, engineers, etc. from developed and developing countries. Generally, the taxpayers of foreign countries have invested considerable sums in the training and education of these people. The US then benefits from this foreign taxpayer paid training when they arrive in the US as immigrants to work. Free-riding or freeloading are terms that come to mind to describe this activity.

– Some day I should find a quantification of the value of training and education transferred from foreign countries to the US. It would likely be staggering.

3) Citizenship based taxation: For 2011, the IRS Tax Data lists “International” individuals as paying $6.9 billion. This would be on top of what these international US citizens pay in income taxes in the countries where they live and whose governmental services they consume. Keep in mind that US embassy services abroad are pay-as-you-go and not free.

4) International Seigniorage: Simply put, seigniorage is the money that a government makes off the difference between what it costs to produce currency and its stated value. Several currencies are used abroad with the US being the largest (Canadian currency is not generally circulated abroad). A most profitable form of seigniorage is from the international circulation of banknotes. This is what Wiki has to say about international seigniorage:

“While the cost of printing banknotes is minimal, the foreign entity must provide goods and services at the face value of the note to obtain it. The banknote is retained because the entity values it as a store of value because of mistrust of the local currency.

Overseas circulation is intimately tied in with large value banknotes. One purpose of using foreign currency is for store of value, but another is efficiency of private transactions, many of which are illegal.

American currency has been circulating globally for most of the 20th century. Certainly in World War II, the amount of currency in circulation was increased several fold. However, the modern era of huge printings of the United States one hundred-dollar bill started with the fall of the Soviet Union in 1991. Production was quadrupled with the first ever trillion dollar printing of this bill. As of the end of 2008, U.S. currency in circulation with the public amounted to $824 billion and 76% of the currency supply was in the form of $100 denomination banknotes, amounting to twenty $100 bills per U.S. citizen.” …

“(An economist) Feige calculates that since 1964, “the cumulative seigniorage earnings accruing to the U.S. by virtue of the currency held by foreigners amounted to $167–$185 billion and over the past two decades seigniorage revenues from foreigners have averaged $6–$7 billion dollars per year”

Why is international seignorage of the US dollar one of my “favorite” ways that the US lives off other countries? Because it not only is profitable for the US but US $100 bills also are an enabler for tax evasion, illegal transactions, money laundering, etc., activities which the US government opposes on paper. If the US government wanted to separate itself from these illegal activities, it could do as the UK does and cease printing high-value bank notes. But I suspect the business is simply too profitable for the financially-desperate US.

I will only mention that the US is also the home to the largest amount in “non-resident financial accounts” in the world, around $2.5 trillion as I recall. Oftentimes non-resident bank accounts, as the name suggests, are owned by foreigners living abroad. Whether taxes are declared in the foreigner’s country of residence on income from these accounts is unknown and is, of course, not the concern of the US bank. And then there is Delaware, but I digress.

@Innocente,

Good comment, but wasted on ‘Stan’. I doubt he will be back.

There are many complaints about the effect that this policy is having on Americans living in Canada. I am one of those. Nowhere did I state that Canadians should pay US taxes. people with US passports who work in the US should pay US taxes. I have worked outside of the US and been exempt from US income tax for the last 8 years. Foreign earned income is not taxable. From what planet did you hitch a ride from on that non-sequiter asteroid?

Canada benefits from the US in many ways and yet in this blog I see many complaints from Canadians who are concerned that their partner/significant other are affected and therefore so are they. Most of the comments I have seen involve Canadians, so that’s where Canada comes in? What part of that did you not understand? US citizens retain their priveledges AND benefit as do their Canadian mates and still they bitch.

Why would you pay tax on foreign earned income? Why would you care if the US says you must pay tax on income earned from offshore deposits? The in initial tax having been paid on the money renders it free and clear to earn interest completely tax disconnected from the US. If that country is allowing the US to remove money or threaten to remove money or lay some claim on that money it is up to that government to say no. If you live in a country to wimpy to do so, you need to change their attitude or move somewhere else.

PS..Innocente and WhiteKat…my name is here. I fear nothing. Who do you fear?

The mom

Why bother when all the benefits of being a US citizen and then some are available to you at zero cost?

Innocente,

I doubt that the numbers on currency remain as relevant in one incremental time period as the next. !00s now hardly rank a twenty. All that stuff is voodoo created by a certain too sensitive to be named group. (not referring to the fed) The federal reserve is hardly an altruistic entity. The US is the biggest thief on the planet. More reprehensible by far is the tich on the butt of the thief. In nature, a real tick is not sentient, but the metaphorical one in this case is and should have the same burden on conscience as the other pigs on the island. Or perhaps having the island’s staus quo remain is acceptable to you.

White Kat…feel free to comment after you do the inevitable googling to catch up.

@stan hudson

My US tax accountant has it all wrong! You mean the IRS doesn’t really expect their citizens to pay US tax on the sale of their home in Canada or on their TSFA’s?

Curious, how have you been in Canada for 8 years and have no medical coverage?

Your statement:

“There are many complaints about the effect that this policy is having on Americans living in Canada. I am one of those”, left me with the impression that you lived in Canada. I realize now that you are one of the “complaints”, not one of the Americans in Canada.

That’s enough for me.

I see ConfederateH is back again. Had to use your REAL name this time? Or you using the Hudson River as part of your name? Because you seem to have your facts all wet. I’d suggest you go do some more research of your own that you insist on everyone else doing.

@The_Animal

Can guarantee that “Stan” is not ConfH

Well, pretty much his views are the same…and to me, that pretty much smacks of the fact that he, like ConfH does not need to be here.

@The_Animal

Agreed.

@nobledreamer, the Animal

I see myself in a life boat and I don’t take to someone trying to chop a hole in it regardless of how important that someone thinks it is for us to learn to swim.

“The mom

Why bother when all the benefits of being a US citizen and then some are available to you at zero cost?”

@Stan,

You have that reversed.

I have received zero benefits from being considered a US citizen by the US, but it has indeed cost me. The only benefit received was by my parents, in that my Canadian father received employment benefits (US military), allowing my birth in the US to cost them nothing. Considering my father served the US for four years, I’d call it a wash. The US did not educate me, or provide me with any other services. I’ve never had a US passport, a US job. In fact, in the early 90s, the US told me I was NOT a US citizen.

Cost at this point? Endless hassles at the border all of my life, from border agents that refused to believe I felt Canada a better place to live than the US. Then there’s the $1,200+ to renounce the fairytale citizenship this year, fee and airfare to the consulate. Now the cost to prepare endless forms to exit a system I (and numerous others) should not be in, and that I owe zero dollars to. To that you can add much time and aggravation, not to mention my whole extended family now has an extreme distaste for the US.