I think that there should be an article on IBS about the full ramifications of what FATCA and the potential IGA could do to Canada as a whole, not just from an “expat POV”. Right now all they see is “well…better you than me.” Most Canadians won’t be sympathetic until we explain what FATCA can potentially do “TO THEM”!

Agreed. I will take this on. What I would like are as many succinct comments (keep the emotional content to a minimum) on how FATCA will impact Canada and all Canadians. I encourage you to think in the short term, the medium term and the long term. I encourage you to describe things not only in a theoretical sense, but in a real practical day-to-day sense. For example, what does a loss of privacy rights really mean? What will the inability of US persons to engage in meaningful financial planning mean to Canada as a whole? How specifically will surrendering control of the banks to the IRS reduce Canadian sovereignty? What you will do to those politicians who vote for FATCA? Will there be pressure to change Canadian tax laws to be consistent with the US Internal Revenue Code? How do PFIC, FBAR, Form 8938 and Foreign Trust penalties siphon money out of the Canadian economy? Wouldn’t it be easier to simply adopt the US tax system?

How does US taxation of Canadian residents make those taxed (US persons as presently defined) a possible threat to the stability of the Canadian economy? Should Canada allow any more US citizens to immigrate to Canada? What should be done about the ones who are already here?

A commenter on this blog once said:

If you got em by the banks, their “minds and hearts” will follow!

Or, is this a case of the banks dictating to the Government. I suspect that the banks are “FATCA Complicit” in the extreme. We know that FATCA solves one set of problems for the banks. But,doesn’t it create a bigger set of long run problems for them?

What, in practical terms does it mean for the “minds and hearts” of ordinary Canadians and their politicians to follow the US? Would it make sense for the Canadian Prime Minister to take his orders from the US IRS Commissioner?

Would Canada, over time, become an “occupied power”? In theory an autonomous nation, but for all practical purposes governed by its political masters in Washington?

If Canada is an “occupied power” does it make sense to retain US citizenship? Is there any reason to renounce it under those circumstances? How would Canada look and feel as a country under FATCA domination?

Hate to sound alarmist, but the FATCA (half pun intended) is that:

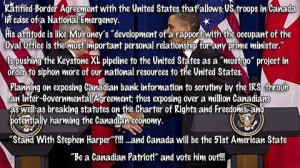

– by entering into an IGA, the Harper Government is poised to override the Consitution/Charter of Rights of Canada

– by entering into an IGA the Harper Government has expressed a willingness to change Canadian laws to accommodate the “FATCANatics” in Washington

Does the Harper Government have the legal right to enter into an agreement with the US which transfer so much control over the country to the United States? If a referendum was required on the Quebec question, should a referendum be required before turning control of the banks over to the United States?

This is a time for Canada to lead. In 2003 Canada refused to join the US in the attack on Iraq. This time Canada should refuse to join the US in sending its “FATCA Drone” into other sovereign airspace. Is Mr. Harper up to the challenge? Will he do the one thing that all politicians hate to do – I am referring to the “right thing”.

Some readers of this post may view this as extremist or alarmist. It is my hope that your comments will paint a clear picture of what is truly at stake for Canada and for ALL Canadians.

Or maybe I am completely wrong. Maybe it is possible to cede control of your banks and maintain control over your sovereignty. Isn’t there an issue of banks and sovereignty playing out in Cyprus right now? The Cyprus situation is interesting. I don’t pretend to understand all of it. But, what is clear is that it is an attempt on the part of the EU to exercise some control over the deposits – and by extension – the banks of Cyprus. There is no question that the sovereignty of Cyprus is at stake. There may be good reasons for it, (they can’t just freeload off the EU), but the fact is that control of a country’s banks is related to control of a country’s sovereignty. At least that’s what I think. What do you think?

On the sovereignty issue, here is another message from the Animal:

don’t forget that the IGA requires banks to look for “indicia”. “Indicia” in most of the IGA’s includes people who (for example) use a post office box (fully Canadian or UK or wherever). Anyone who has those “indicia” will be contacted to sign a document which states that they are not a “US person”.

@Mark Twain

It used to be the great “Fox Hunt”. Now, its the US person “FATCA Hunt”. The rewards are great for the Whistle Blowers. Just think: any US person could be a Whistle Blower’s “Retirement Plan”.

This is too abstract. If the Tories did sign an IGA, the NDP would be clever to treat it as a once-in-a-generation opening. They’d need a series of TV commercials featuring middle-income Canadians with some tangential connection to the US and the elaborate and punitive tax consequences of some aspect of their lives. Small business ownership is a good one, given the entanglements of Form 5471. “That’s what the American IRS wants to do to Bill. Stephen Harper want to help them. Help Canada’s New Democrats stand up for Canadians.”

You could plan it as a series, starting with “Who *is* an American?”

“Ho, ho! *I’m* not an American!”

“That’s what Bill thinks, but the US disagrees.”

(Working with this kind of argument would also be useful for the NDP’s reputation as, potentially, heavy-handed statists.)

Having imagined all this, I really think the Tories see this coming, and will go to some length to avoid putting their heads into that particular noose.

if your question is “who will pay?” the answer is everyone will pay something toward this effort.

the estimates are $100 million per major bank roughly $600 million and an equal amount for all other financial institution for a total of $ 1,200 million to implement FATCA in Canada and 20% annual recurring cost to maintain these systems or $ 240 million annually. Financial institutions can apportion these costs to all accounts or apply these costs to accounts specifically of USP’s either way this will affect at least 1 million Canadian families. This money will be in addition to any compliance costs associated with filing US taxes and reporting requirements. Instead of catching homeland tax cheats, this will be a wealth transfer from law abiding Canadian families to the FATCA Compliance Cartel and result in little if any benefit to the US treasury.

We need emotional content:

http://www.youtube.com/watch?v=QU9SsTwY5nU

Very important to keep this in mind. We will not win the battle without emotional content. And we mustn’t take our eyes off our opponent.

‘Regular’ Canadians with US indicia will be expected to have to prove to Canadian financial institutions that they are not USP’s. How far will the financial institutions go in having their customers prove that they are NOT either a US citizen or green card holder, to have to PROVE A NEGATIVE? Going through my mother’s papers yesterday, I found a document issued by the USDOJ-Immigration and Naturalization Service in 1975 that stated that my mother had not taken US citizenship or permanent residency while living in the US. The document, obtained by my mother at the cost of $3USD’s was to prove to Canadian immigration officials that she remained a registered alien during her years in the US. Expect ‘regular’ Canadians to have to do the same for the banks, if not, then the banks aren’t doing their job in substantiating their customers status. The same should go for the children of US citizens, even if they were born in Canada. Prove that your children are not US citizens!

This is a great idea. And I do think you need to stir emotions and focus on the effect of FATCA in any media campaign. For example, the effect on families having joint accounts where on spouse is a Canadian Citizen/USP and the other is not, the fact that having a Canadian citizen/USP as a director or executive in a Canadian company with signature authority will open up and rewuure the account be disclosed with details to the IRS, the inherent discrimination and treatment of a subset of Canadian citizens differently than other Canadian citizens all because of a US mandate and ultimatum.

The UK threw 250,000 of its residents including UK citizens under the bus without a full and fair debate of the effect of FATCA. Canada risks doing the same to 1,000,000.

As I have suggested in other posts, Issac Brock needs to gather the best and brightest and prepare and facilitate a multifaceted campaign in the media, via lobbying and if an IGA is entered into, in the courts to protect the rights of Canadian citizens to be treated equally.

My recurring nightmare.

Mine too, Calgary411. The Canadian government MUST NOT allow their own, born on Canadian soil citizens to be turned in to the IRS even though they are also US citizens, yet in order for FATCA to be thoroughly and completely executed, they must!

One further thought…if Canada signs an IGA whereby Canadian banks must find and report US Person accounts and details to the Canadian tax authority who then provides that information to the IRS, it is the Canadian taxpayers (all of them) that must pay for those costs. The US has not, to my knowledge, ever offered to pay for the costs of this reporting. Canada does not acheive any revenue recognition for providing this ‘service’ to the US Government, it just avoids having its compliant banks not have 30% withholding of US source income/dividends, etc.

Watch out, perhaps the Canadian Government will catch onto this and ‘charge’ the US Government a commission for the service!

@Steve Klaus

‘Service fee’ or ‘bounty’?

@Steve Klaus

“The US has not, to my knowledge, ever offered to pay for the costs of this reporting. “

No, of course they haven’t. Not just in Canada, but everywhere are governments and banks expected to foot the bill (hundreds of millions) for the “privilege” of investing in the USA. It’s the american way.

FATCA woes for US au pairs in Switzerland : They were never going to be happy in Switzerland about the FATCA legislation that will be used to hunt down people avoiding US taxes, but it’s a surprise to hear that some Swiss burghers are feeling sorry for a group of US citizens who have become part of the fabric of society there – au pairs

http://www.bankingtech.com/77122/fatca-woes-for-us-au-pairs-in-switzerland/?utm_source=rss&utm_medium=rss&utm_campaign=fatca-woes-for-us-au-pairs-in-switzerland&utm_source=twitterfeed&utm_medium=twitter

Steven Toscher and Edward Robbins join other former U.S. Department of Justice and Internal Revenue Service officials in requesting the Supreme Court to Uphold the Taxpayers Fifth Amendment Rights and Preclude the Use of Grand Jury Subpoenas Requiring the Production of Foreign Bank Records

http://www.taxlitigator.com/main/images/stories/Amicus.pdf

Consider how FATCA is wreaking havoc on the economies of other nations – really quite spectacular! The U.S. should be proud of itself – check this out.

http://renounceuscitizenship.wordpress.com/2013/02/05/fatca-wreaking-havoc-on-the-economies-of-other-nations/

Isn’t FATCA an attack on human freedom everywhere?

http://renounceuscitizenship.wordpress.com/2013/01/06/fatca-and-the-end-of-human-freedom/

What’s never reported is how many chairs have been thrown over FATCA.

@Mike T. re your earlier post http://isaacbrocksociety.ca/2013/03/26/what-fatca-will-do-to-canada-and-canadians-who-are-not-us-persons/comment-page-1/#comment-246923

This is interesting wording – not just for this particular issue, but for the whole way in which we are being treated just for living normal lives outside the US (with FBARs, and now FATCA, presumed guilty annually until our filings demonstrate otherwise):

Read the whole thing, but also;

See page 6

from;

No. 12-853

IN THE Supreme Court of the United States

_________

T.W.,

Petitioner,

v.

UNITED STATES OF AMERICA,

Respondent.

________

On Petition for a Writ of Certiorari

to the United States Court of Appeals

for the Seventh Circuit

________

BRIEF

AMICI CURIAE

OF FORMER OFFICIALS

WITH THE DEPARTMENT OF JUSTICE, TAX

DIVISION, AND INTERNAL REVENUE SERVICE

IN SUPPORT OF PETITIONER

………………”The policy rationale behind the Fifth

Amendment reflects many of our society’s most

fundamental values, including “respect for the

inviolability of the human personality.”

Murphy v. Waterfront Comm’n of New York Harbor, 378 U.S.

52, 55 (1964). In particular, courts have repeatedly

expressed unwillingness to subject those suspected of

a crime “to the cruel trilemma of self-accusation,

perjury or contempt.” Pennsylvania v. Muniz, 496 U.S. 582, 596 (1990);

Doe v. United States, 487 U.S. 201, 212 (1988).

Additionally, the Fifth Amendment reflects our society’s sense of fair play, which dictates

“a fair state-individual balance by requiring the

government to leave the individual alone until good

cause is shown for disturbing him and by requiring

the government in its contest with the individual to

shoulder the entire load.” 8 WIGMORE, EVIDENCE 317

(McNaughton rev., 1961). In other words, it is the

government’s duty to do the groundwork in collecting

incriminating evidence against the accused, rather

than short-cutting its obligations by obtaining

incriminating information from a target of a criminal

investigation. “…….

And the publications at this link (the publication list from one of the firms of one of the ‘amicus curiae’ in this case, are very relevant to readers at IBS on various issues; http://www.taxlitigator.com/main/index.php?option=com_content&task=view&id=12&Itemid=26

@badger …….being treated just for living normal lives outside the US…….

I am a born Canadian citizen married to a USP, who also became a Canadian citizen many years ago. I have earned 3/4 of our income and assets. All our holdings are joint. FATCA considers these accounts and investments US accounts. Please list this type of imperialistic overreaching attitude on the part of the US as a major infringement on Canadian citizens whose lives are at risk of being totally destroyed.

Canadians who have adopted children, and are considering adopting children who were born in the US are faced with “…difficult decisions in the years ahead. The reasons for this are complex, but families basically have three options:

A. Parents and their adopted children can comply with the US legislation. This seems like the prudent approach, as explained further below.

B. Have the child renounce his or her US citizenship. Of course this is not a decision that should be taken lightly. The catch is that you cannot renounce your US citizenship unless all your tax returns are filed, all the financial asset disclosure statements (FBARs) have been filed, and all US taxes and penalties are paid to the IRS.

C. Parents and the adopted child could simply not comply. As the Globe and Mail articles point out, many US citizens living in Canada are confused as to what to do, and some have stated that they do not intend to comply because of the exposure to high rates of taxes and penalties. This reason does not make sense for an adopted child. The chances of them having complex or large assets at this stage in their life are small. It does not make sense for adopted children to choose this route.”

http://www.sunriseadoption.com/adoptive-parents/what-all-adopting-parents-in-canada-need-to-know/important-information-for-all-canadians-who-have-adopted-a-child-from-the-usa

Oh yes, Canadian mothers considering in vitro fertilization: the US being the world’s largest exporter of human sperm, you better have your zygotes certified “US citizenship free”.

This is a concern because some children are being denied US citizenship when American mothers cannot confirm that donors were US citizens. I would not put it past the same government in its support of the rule of law to try and tap their citizens offspring for tax revenue.

“JERUSALEM – Chicago native Ellie Lavi could not have been happier when she gave birth to beautiful twin girls overseas.

She found that the U.S. State Department did not share in her joy when she went to the U.S. Embassy in Tel Aviv to apply for citizenship for her children.

An embassy staffer wanted to know whether Lavi got pregnant at a fertility clinic. She said yes and was told that her children were not eligible for citizenship unless she could prove that the egg or sperm used to create the embryo was from an American citizen.”

http://usatoday30.usatoday.com/news/world/story/2012-03-19/in-vitro-citizenship/53656616/1

Canadians pay nothing for a great deal of good received from simple proxy,ity to the US, which they see, through rose colored glasses issued by their government, as a war mongering, less well educated, less healthy, blah, blah, blah country. If increased economic seperatness is what Canadians want, then we would probably not be averse to charging the mileage fees for driving on our roads (no, they are not paid for by gasoline taxes), tax their use of medical services in the US, your actual, not rose glass filtered 2nd tier/fee for service resource (if you bought some more CAT scanners and MRIs the price would be a bit less per unit for everyone), tax thru shipments of all goods from outside the US, (your interior would not exist without our [non Canadian supported] transportation infrastructure, recover damages equal to the loss by families of those killed in the Vietnam War (every Canadian dodger equated to some other non dodger killed), charging for our portion of the militarily provided security of the northern part of North America (check the per capita expenditures, or maybe the per acre expenditures), tax every Canadian student not paying out of nation tuition at any university…they all benefit from our infrastructure, charge for each flu treatment required by those who get sick via a Canadian allowed new strain, charge at least a token rent from the snowbirds, etc. I suppose really, it’s moot because when the warming reaches a certain point the US will more or less annex Canada, with an almost certain separate deal with Quebec remaining independent.

Biggest trading partner…if 330 people produce the equivalent of 100 dollars per year per person and 30 of them disappeared the net to the remaining 300 would change not one iota.

To sum…we don’t need you. You do need us. We carry you on our backs vis a vis advanced health care, transportation and security. We actually should absorb you or get rid of you, you freeloading, ungrateful cultureless, First Nation apartheiding little rat nest.

Stan,

Perhaps you posted your comment on the wrong website. This is a website for AMERICANS(and green card holders) living outside of USA who are upset with USA tax policy specifically citizenship-based taxation and FATCA.

Why are you dissing Canadians and Canada?

Stan,

It seems you think everyone living in Canada, not just those of us unfortunate enough to also be American, should pay US taxes.

Why not go a step further and make everyone in the world pay for having the privilege of living on the same planet as the USA?

For example, an asteroid might be on a trajectory towards earth and everyone in the world would benefit if USA shot it down. That convinces me. Maybe instead of waiting for FATCA to penalize all Americans living in Canada (or living in Mexico or France or UK, etc) who have ‘secret undisclosed’ bank accounts in the country they live in, everyone in the world should just donate a portion of their retirement and education savings directly to the IRS. Its the least we can do.