Yesterday, Thanksgiving Day, UBS began the first step of complying with FATCA. How completely unhospitable, all things considered.

Americans, green card holders and non-US spouses of USCs received W9s, as well as a form which indicates they agree they will not receive protection under Swiss data laws for the information “requested or required by the IRS.” The explanation given was that FATCA begins January 2013. I wonder if they simply decided to go ahead in spite of the extension to 2014 or if it is a gigantic case of CYA in advance. The extra form suggests that this practice would normally violate privacy laws, but I don’t know if that is true or not.

Interestingly, the article states UBS previously asked USCs to tick a box, indicating their citizenship. Do any of our Swiss posters know when this began? I am curious if was a regular practice or something that appeared after the 2009 debacle.

The clients have until March 31, 2013 to comply. If they do not, ” “UBS will be obliged to end its business relationship with you.”

“The letters and forms are to be returned to UBS wealth management offices in different parts of the country, the bank unit handling the paperwork. This detail could have implications later for those who do sign the forms.

Bank employees advising clients who receive the letters have said that while, for now, UBS has opted not to refuse American clients, at some point in the future these clients may have to foot the bill for the higher cost of handling them.” It is interesting that individual USCs may be required to shoulder the costs as opposed to the bank spreading them out to all clients. I wonder if this will become a practice across the globe. If so, it will put a dent in the idea that other nationals will be outraged by being charged and demand that FATCA or the IGA be refused/rescinded, etc.

I am not familiar with Swiss law and don’t quite understand why signing a document which is open-ended (timewise) may cause legal problems. Again, would welcome comments from our Swiss Brockers that would educate us as to what type of privacy laws there are in Switzerland as well as any other info that would shed some light on implications for the future.

“With this Authorization, the Client herby expressly waives any protection or right under Swiss bank-client confidentiality and data protection laws to the extent necessary for the reporting of any Data hereunder. Further, the Client accepts and acknowledges that any Data that the bank discloses hereunder to the IRS will be subject to the laws of the US and will not be covered by Swiss law.”

*This isn’t going to help encourage Swiss banks to accept Americans more readily:

http://www.bbc.co.uk/news/business-20907359

What is clear is that the US will stop at nothing to squeeze every possible dime for itself. How awful, a bank older than the US itself is forced to close. Yes, they are guilty. Question, why couldn’t they also opt for “deferred prosecution” and thus, avoid the personal liability issue?

I do hope none of our dear “Swissies” live in Dallon? How awful that this has happened in a place which seems so peaceful.

So it is done.

Not really an interview. Just questions as: “Did you read all the papers?”, “Do you understand everything?”

The consul read all the text (very long, poor man) while you stand with your right hand lifted. And at the end he asks you to say “I do!”

And $ 450.- more poor.

Now I have to wait two or three months to get the papers back… heard that at other places it takes two to three weeks…

Good for you! Hope you get your CLN soon.

*Oliver, well done. I go on the 4th March for my bit then get to start on the tax side of things. Don’t worry even a couple of months is better than many places.

*Oliver, congratulations! Paying $450 to buy freedom is worth every penny of it and far less expensive than paying tax preparers to show no tax due.

Oliver,

Congratulations and thanks for reporting here. Can we add your experience to the database we have for Renunciations & Relinquishments at http://isaacbrocksociety.ca/2012/03/14/pdf-compilation-of-relinquishment-and-renunciation-data-as-reported-on-isaac-brock/ and to the Consulate Report Directory at http://isaacbrocksociety.ca/2012/03/24/consulate-visit-report-directory/ to help others in their decisions for course of action?

The information that is reported on the database is:

Date of Request for Appt;

First Appointment;

Second Appointment (if required, otherwise N/A);

CLN Received Date;

Date of CLN

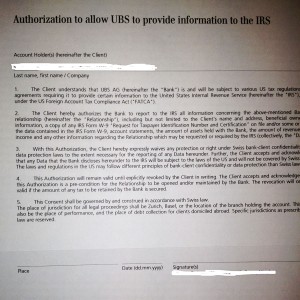

UBS is currently circulating a follow-up letter to its “recalcitrant” US Person customers who have not signed a W-9 and a letter called “Authorization to Allow UBS to Provide Information to the IRS” (see above). A translation of the letter:

May 2013

Dear

Already in November 2002 you received IRS documents from UBS.

Unfortunately you have not yet sent them back or sent them back incorrectly. The corresponding deadline of March 31, 2013 has run out.

In order to avoid the underway closure process we request that you return to UBS the signed documents by month-end June 2013 at latest.

Please note that FATCA affects all financial institutions in Switzerland and even abroad. UBS is one of the few banks that is attempting to retain customers with US Status by continuing bank relationships through disclosure.

Friendly greetings,

UBS AG

Didn’t tell you, because I’ve reported my renunciation process where calgary411 asked me to. Took exactly a month to receive the confirmation. And after what I just saw in the news today, I’m so relieved that I did it. The swiss government literally put their pants down and told US “Fu..k us !!!”

and us as in we, not as in U.S. just to be sure that there is no misunderstanding.

@Oliver,

There is no misunderstanding. We here at IBS, all know who is being ‘fu$&ed’ and it isn’t the US.