Yesterday, Thanksgiving Day, UBS began the first step of complying with FATCA. How completely unhospitable, all things considered.

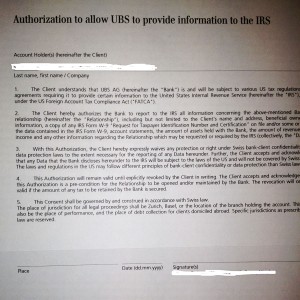

Americans, green card holders and non-US spouses of USCs received W9s, as well as a form which indicates they agree they will not receive protection under Swiss data laws for the information “requested or required by the IRS.” The explanation given was that FATCA begins January 2013. I wonder if they simply decided to go ahead in spite of the extension to 2014 or if it is a gigantic case of CYA in advance. The extra form suggests that this practice would normally violate privacy laws, but I don’t know if that is true or not.

Interestingly, the article states UBS previously asked USCs to tick a box, indicating their citizenship. Do any of our Swiss posters know when this began? I am curious if was a regular practice or something that appeared after the 2009 debacle.

The clients have until March 31, 2013 to comply. If they do not, ” “UBS will be obliged to end its business relationship with you.”

“The letters and forms are to be returned to UBS wealth management offices in different parts of the country, the bank unit handling the paperwork. This detail could have implications later for those who do sign the forms.

Bank employees advising clients who receive the letters have said that while, for now, UBS has opted not to refuse American clients, at some point in the future these clients may have to foot the bill for the higher cost of handling them.” It is interesting that individual USCs may be required to shoulder the costs as opposed to the bank spreading them out to all clients. I wonder if this will become a practice across the globe. If so, it will put a dent in the idea that other nationals will be outraged by being charged and demand that FATCA or the IGA be refused/rescinded, etc.

I am not familiar with Swiss law and don’t quite understand why signing a document which is open-ended (timewise) may cause legal problems. Again, would welcome comments from our Swiss Brockers that would educate us as to what type of privacy laws there are in Switzerland as well as any other info that would shed some light on implications for the future.

“With this Authorization, the Client herby expressly waives any protection or right under Swiss bank-client confidentiality and data protection laws to the extent necessary for the reporting of any Data hereunder. Further, the Client accepts and acknowledges that any Data that the bank discloses hereunder to the IRS will be subject to the laws of the US and will not be covered by Swiss law.”

Pingback: How #FATCA affects US citizens abroad | US Taxation Abroad

I’m dual and I’m renouncing January 14th.

I’ve being reading too much information to be sure about what it is true or not, but can someone can confirm what I understood reading information about form 8854:

“Exception for dual-citizens and certain minors.”

“Dual-citizens and certain minors (defined next) are not subject to the expatriation tax even if they meet (1) or (2), earlier. However, they still must provide the certification required in (3), earlier.”

Point 3 mentioned:

“3. You fail to certify on Form 8854 that you have complied with all federal tax obligations for the 5 tax years preceding the date of your expatriation.”

I never filled any tax form. So I must:

1) Fill form 1040 for the five last years and provide the certification

or

2) Fill form 8854

And I’m pretty sure that I don’t owe them a lot cause I didn’t earned US$ 92’000.-

Wait a second!!!

“3. You fail to certify on Form 8854 that you have complied with all federal tax obligations for the 5 tax years preceding the date of your expatriation.”

Expatriation, not renouncement!!!

Last time I was in USA it was in 1999 and at the time I earned less then US$ 9’000.- cause I were dependent of my mother.

So I don’t need to fill this one.

@Oliver- the date of your expatriation is not the date that you move away from the U.S. The expatriation date is the date that you committed an expatriating act eg. renouncement/relinquishment.

As for your previous question the rule is that you have to have been born a citizen of both countries and after your renouncement you must be liable for tax in the other country of your birth, in order to not be liable for the expat tax.

If you renounce by the time that you are 18 1/2 then you have no tax filing obligations at all. This is why it is actually most advantageous for the young to renounce.

@ Oliver

As RecalcitrantExpat points out, for tax purposes your expatriation occurs the day you renounce. If you renounce January 14th, your last day as aUS citizen will be January 13th.

A person who became a dual citizen at birth can skip part 3B of the 8854 and not be subject to exit tax if they certify that they have been tax compliant for the past 5 years.

I’m not clear if you’ve been a dual citizen since birth. If you became a dual citizen later in life, you probably will not be subject to exit tax but you’d still have to fill out part 3B. The exit tax kicks in for people: (1) who have assets over $2,000,000 USD or (2) have had an average tax liability — that is they paid or owed taxes — of more than something around $145,000 USD on average in the past five years (I forget the exact amount, it’s in that ballpark). With income under $92,000, your tax liability, if any, would be well below that.

A person certifies that they have been tax compliant for the past five years right on the form 8854 itself. If you renounce in 2013, you have until June 15th of 2014 to file your 8854.

You don’t have to be tax compliant for the past five years at the time you renounce. You have until you sign your 8854 to do that.

Also by June 15th, 2014:

@Lisa, agree with nobledreamer – truly a horrifying story. And so insane for the IRS to pursue someone based on phantom gains of currency – and on mandatory pension accts – where there can be no personal control over the gains or the asset. How they can continue to justify this, and how the US can allow this to hang over people for several years, is beyond me. Pursuing the krill, the minnows and the jaywalkers, while the US domestic banks continue to rake in profits from deliberately providing bank secrecy to non-residents, and from committing truly deliberate and significant crimes under the BSA http://triblive.com/news/allegheny/2825138-74/tax-united-states-secrecy-money-countries-havens-accounts-foreigners-haven#axzz2Dp6WIFym .

Crap… what borders me it’s that I didn’t declare my incomes. The last 6 years I had income that according to IRS rules should be declared, but it doesn’t reach the minimum amount to be taxed – US$ 92’000.-. Before that I never had an income above the minimum limit to fill taxes. So, yes, my taxes are not in order, but how can I regularize this if the only way is a fastidious and expensive process for just saying: “I don’t owe you anything, leave me alone.” Don’t want to loose my few savings over this process.

@Oliver- You ask a very good question but you have to understand that none of us on here are qualified tax advisors and so we can’t really give you tax advice. Your best route of action is to either try to understand the U.S. tax code yourself or else go to a tax consultant who is registered with the IRS to complete U.S. taxes.

*But don’t let him enroll you in the OVDI program. Just tell him you want to become compliant as you’ve renounced and provide him with the paperwork to do that. The OVDI has gotten a lot of people into situations they should never have been put into so stay away from it.

*Oliver, if I was in your situation, then I’d probably do the following. Use one of the online free file services to file your 2012 taxes. I did a review of them here. These will walk you through the process and let you file without paying a penny. Within a week of e-filing, you should get a status update that your filing was approved. Use that then as a template for the years 2008 to 2011, which you will have to manually fill in and send in via snail mail. For each of these, you’ll need to write at the top of each 1040 the following: “FILED PURSUANT TO SEC. 1.911-7(a)(2)( i)(D).” This will ensure that the IRS will accept the foreign earned income exclusion. Afterwards, file FBAR for 2012. For questions, call the IRS directly. When talking to them, be nice, patient, give them what they want and respond quickly. Don’t delay anything or refuse to give them anything that they want. Here are some guides which might be of assistance:

The Expat’s Guide to U.S. Taxes – JANE A. BRUNO, J.D.

Expatriate’s Guide 2012 to U.S. Taxes – Barron Harper « The Taxbarron »

Your US Expat Taxes Simplified – GREENBACK Expat Tax Services

TurboTax for Expats – http://www.inf.usi.ch/nystrom/turbotax.htm

The Foreign Tax Credit (FTC) Explained – http://www.aca.ch/ftc.htm

Tax Guide for U.S. Citizen’s and Resident Aliens Abroad – IRS Publication 54

Foreign Tax Credit vs FEIE under the new law – James G.S. Yang

American Expat Tax Saving Strategies – Noto Financial Planning.

I’ve always done the taxes on my own for no more than $100 per year and haven’t had any issues. A few months ago, I filed 2008 and 2009 using the steps I described above. Most internet publicans highly recommend that you spend thousands for a tax adviser/lawyer.

Thank you swisspinoy. One of the best, if not the best advice, that I read since I’ve started researching.

Found too a very good web site yesterday about renunciation. And the address is so simple: http://renunciationguide.com

The main point that I found about it, and which scared me a little bit was the fact that if you are not compliant with the IRS, your renouncement could be invalidated as said some bloggers.

That’s not true. After renouncement, the state department informs the IRS the names, but the IRS is not even allowed to inform other departments about the tax details.

One last simple question swisspinoy. When they talk US$ 92’000.- it is the point 1. in the Salary Certificate or point 11.?

Never mind. I will try turbotax as the on-line version will be available tomorrow.

*Oliver, it’s probably point 11. It’s the amount after all mandatory deductions. $92000 basically applies to the amount of money that was deposited into your bank account by your employer. However, some accountants probably include the 401k to avoid double-taxation at a later date.

401k ?

Lol, if its point 11. I’m really assured that I’m below the 92 k limit. And I still can deduct the apartment rent if I’m not wrong.

But does the FBAR has something like the “FILED PURSUANT TO SEC. 1.911-7(a)(2)( i)(D).”

I’ve seen that with this they are not very flexible. I don’t even have Chf 15 k in it…

@Oliver, If you never filed a US tax return while residing abroad and owe little or no tax, maybe you should use the IRS “streamlined” compliance procedure. Also, keep in mind that the $92,000 exemption is only for wages, it does not include income from pensions or investments.

*Oliver, the apartment rent probably falls under the Housing Exclusion. But, you won’t need to worry about that if the earned income you received is below $95,100 for 2012.

As for FBAR, the fines probably only apply to those who joined the OVDI program. Otherwise, I believe that one would get a warning first if there is a problem. If you like, you can send them the past 6 years with a note attached stating some like “I didn’t know that I had to file these”. I sent my first FBAR (and last) for 2011 around June or so with no note attached and haven’t had any issues. If you like, you can file FBAR here to save on postage: http://bsaefiling.fincen.treas.gov/main.html

Thank you both for all these tips.

I think I’m going streamlined way. Just need to check if I still have six years of bank account documents. Since I have signature over my wife and kids savings accounts thats a lot of paper. Are we required to attach these?

@Oliver, The FBAR instructions don’t ask you to attach anything to the form, but they say that you have to keep records for the information reported. Accounts where you have signature authority also have to be reported.

Since you seem to be new to all this, here is a general advice: read the instructions. It’s daunting, but necessary. If there is anything you don’t understand, don’t dismiss it unless you are sure that it doesn’t apply to you. Don’t be afraid to also read the actual US laws that the instructions sometimes refer to.

One thing I don’t know is whether you could certify tax compliance for the previous five years if you go through the streamlined procedure, since it only asks for tax returns for the previous three years. The whole five-year certification requirement on form 8854 is strange since the general statute of limitation for tax forms is only three years anyway. Does anyone know more about this?

Reuters reports that Switzerland signed a FATCA agreement today of some kind. No further details are available:

http://www.reuters.com/article/2012/12/04/swiss-tax-fatca-idUSL5E8N46P720121204

*It’s an update to the agreement they came to in June. This basically exempts the cantonal banks from FATCA and its costs. Not releasing any details until Parliament has approved it though. It should mean that US citizens will be more acceptable to these banks and they can have accounts again – providing they sign the relevant disclosure agreements.

On further note:

“GenevaLunch was told by a spokesperson at the Swiss federal data protection office last week that Americans and US persons who do not cooperate with their banks’ demands that they sign papers allowing their data to be shared with the US are not covered under Swiss data protection laws, which include banking secrecy. They are choosing not to sign the papers, and choosing to remain with the bank. Alternatively, they can take their financial business elsewhere or cut their US connections.”

http://genevalunch.com/blog/2012/12/04/switzerland-to-announce-fatca-tax-deal-with-us/

Following is a partial translation from an article in this evening’s Neue Zürcher Zeitung on the FATCA agreement:

“A new impetus to resolve the tax dispute?

Switzerland and the United States have initialed a FATCA Agreement. Swiss financial institutions are to provide information on U.S. customers to the IRS starting in 2014. For local banks and funds, there are simplifications.

by: Christoph Eisenring, Washington

Switzerland swallows the FATCA toad. With the Foreign Account Tax Compliance Act (FATCA), the American government locks in the world‘s financial institutions in the fight against tax evasion by requiring that they must provide information on American customers to the U.S. IRS. The Americans are thus outsourcing the hunt for tax evaders to third parties. They are able to do this only because investors cannot afford to bypass the world’s largest capital market afford. In the original version, FATCA threatens non-cooperating institutions and customers with a withholding tax of 30% on revenues from U.S. securities. On Monday, the United States and Switzerland initialed an agreement that permits a simplified implementation. The agreement is to be brought to the Federal Parliament in the summer and autumn. Providing it does not go to a referendum, it could enter into force in early 2014.

…

Relief for a quarter

What are the major simplifications? The Swiss model stipulates that social security, pension and property and casualty insurer are exempt from FATCA. Mutual funds and local banks benefit from simplification. They must register with the IRS, but are exempt from the extensive reporting requirements. As local banks institutions can apply where no more than 2% of customer deposits are from outside Switzerland and the EU member states. With the quasi-extension of the home market Berne sought to prevent Swiss institutions from being at a competitive disadvantage compared to those of the EU. In return, local banks may not decline as U.S. expats as customers. On this topic the US government has received complaints of American Citizens Abroad. This organization had complained that American citizens were having trouble in the host country to open accounts. Among the 312 Swiss banks, 66 regional banks and savings banks and 24 cantonal banks will be considered as local banks. This would allow about a quarter of the institutions to benefit from the local bank status.”

http://www.nzz.ch/aktuell/wirtschaft/wirtschaftsnachrichten/neuer-schwung-fuer-die-loesung-im-steuerstreit-1.17868397

*Oliver, a good article on FBAR just got published yesterday:

*@SwissPinoy, just read Just Me’s thoughtful comment as well as Robert Wood’s understanding response. Encouraging!

*It’s to do with having the Swiss cantonal banks, the ones who have been chucking out US citizens, exempted from FATCA and the costs of its implimentation. Details won’t be released until it’s approved by Parliament, but it looks like it’s going to be accepted. It’s just a small update on the agreement the US and Switzerland came to back in June. Hopefully, it might mean these banks will start accepting US clients again – providing they sign the disclosure agreements of course.