Yesterday, Thanksgiving Day, UBS began the first step of complying with FATCA. How completely unhospitable, all things considered.

Americans, green card holders and non-US spouses of USCs received W9s, as well as a form which indicates they agree they will not receive protection under Swiss data laws for the information “requested or required by the IRS.” The explanation given was that FATCA begins January 2013. I wonder if they simply decided to go ahead in spite of the extension to 2014 or if it is a gigantic case of CYA in advance. The extra form suggests that this practice would normally violate privacy laws, but I don’t know if that is true or not.

Interestingly, the article states UBS previously asked USCs to tick a box, indicating their citizenship. Do any of our Swiss posters know when this began? I am curious if was a regular practice or something that appeared after the 2009 debacle.

The clients have until March 31, 2013 to comply. If they do not, ” “UBS will be obliged to end its business relationship with you.”

“The letters and forms are to be returned to UBS wealth management offices in different parts of the country, the bank unit handling the paperwork. This detail could have implications later for those who do sign the forms.

Bank employees advising clients who receive the letters have said that while, for now, UBS has opted not to refuse American clients, at some point in the future these clients may have to foot the bill for the higher cost of handling them.” It is interesting that individual USCs may be required to shoulder the costs as opposed to the bank spreading them out to all clients. I wonder if this will become a practice across the globe. If so, it will put a dent in the idea that other nationals will be outraged by being charged and demand that FATCA or the IGA be refused/rescinded, etc.

I am not familiar with Swiss law and don’t quite understand why signing a document which is open-ended (timewise) may cause legal problems. Again, would welcome comments from our Swiss Brockers that would educate us as to what type of privacy laws there are in Switzerland as well as any other info that would shed some light on implications for the future.

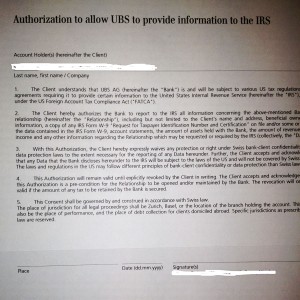

“With this Authorization, the Client herby expressly waives any protection or right under Swiss bank-client confidentiality and data protection laws to the extent necessary for the reporting of any Data hereunder. Further, the Client accepts and acknowledges that any Data that the bank discloses hereunder to the IRS will be subject to the laws of the US and will not be covered by Swiss law.”

@why don’t all the nations just say no to IGA’s and no to FATCA under any form for the banks. The best way to deal with a bully is to stand up to him. Nothing shocks a bully like resistance.

This is the dumbest piece of Congressional legislation since prohibition.

*In a sense this can be seen as good news. People now finally have a black and white document that can serve as the basis of a lawsuit. This is a clear violation of civil rights. Damages in discrimination cases can be quite high, and with a bank being the offender, and perhaps 2-3 thousand individuals affected, this could get very interesting. Really hope some of the people affected are saving this document and obtaining legal counsel.

I became a UBS client in 1996 and throughout my entire time with them – until 2009 when they threw me out for being a US person – the issue of citizenship never came up once.

Since 2009 they are just getting more aggressive against US persons. At the time I was upset when they dropped my banking services, but in hindsight I am happy to no longer have anything to with them.

*I don’t know about ticking any box. When we were sorting out a mortgage with UBS last year, the fact that I was American/British did cause a hiccup in the agreement process, but our branch manager just had to go away and check that it was still okay for the mortgage to be granted. Came back in 5 minutes with a yes and that was it. Took copies of our passports, but that’s normal anyway for these sort of things I think. That was when we were passed over to the US dealing side of the bank though.

I haven’t had this letter yet so will be interested to see if it arrives. Planning on requesting the renunciation paperwork next month to hopefully get an appointment in January 2013.

*nobledreamer, I’ve never had an account with UBS and UBS turned me down when I applied for a mortgage years ago, probably because I was a bit below the required 20% down payment. They also turned me down years ago when I applied for a job in their asset management department. So, I don’t have any experience with working for them as an employee or customer and thus have no clue about the check box option.

Looking back at some old bank account applications, it looks like I always applied for an account as a Swiss national without mentioning US citizenship (I viewed US citizenship then as being unnecessary for banking activity) and there was never a question asking me if I was a US citizen. US citizenship only became an issue when dealing with securities (which I stayed away from). As such, my accounts were never cancelled because all of my banks understood me as being only a Swiss citizen, except in those instances where I volunteered more information. I did apply for a new financial account a week ago, and there was no inquiry about US citizenship.

From a Swiss view, the current situation is simple. Swiss-American citizens in Switzerland have a US problem that they can easily terminate. If they do not terminate the problem, then they must comply with US demands. If non-US Swiss nationals don’t want for the IRS to see their financial data, then they must deny US persons signature access to their accounts. This could be a problem for mortgages, though. Non-Swiss Americans working in Switzerland, on the other hand, must do what their nationality requires of them.

Other than that, sorry, I’m near clueless on the issue.

*I’m not that au fait with Swiss laws, but I know there have been times when the Swiss court has said that you can’t do this or that because it breaks the Swiss privacy regulations/laws re the banks so an open ended agreement might be seen as breaking these. Iirc usually that’s at government level though, what banks decide individually might be completely different.

I believe that UBS “forgot” that I was American because originally my British husband opened the account and I was added on a few months later when we’d completed the house move. I’m pretty sure they took a copy of my Swiss residence permit and US passport then though, so why it wasn’t in the file I don’t know. I used the American one because my Swiss resident permit says I’m American as I entered Switzerland on that passport, not having a British one at the time. Because of that, for anything “official/legal” like bank/post accounts I use the American so that it matches the permit. Not sure, but it might cause trouble if I displayed a permit with American on it alongside a British passport.

*Looks like the Swiss banks are going after all foreigners with similar letters now. This from a posting on the English Forum re a Swiss-GB Tax Agreement due to come into force in January 2013:

“Either sign a waiver to bank confidentiality so past and future info on assets and income can be passed from by bank to the uk tax authorities, or do not authorise anything and the bank will automatically debit the account to the tune of 21-41% for assets and 27-47% for capital gains, or lastly make some kind of self-declaration.”

The bank isn’t UBS, but one of the cantonal banks I think and these have already dumped their US clients. If this keeps up it’ll be Swiss nationals only who can use the banks.

that meets up with the way the EU approached Luxembourgh and other countries which wanted to join the EU, effective somewhere back in the 2005 era (assuming the percentages are percentages of the income of each year, and not percentages of the asset value).

UBS has committed treason (not surprising following the Federal Council’s treasonous activities regarding HSBC’s release of employee names), and every employee at UBS who has participated in this enforcement of FATCA is an enemy of the Constitution and the Sovereign Swiss People and must be dealt with as such. They are right now committing an act of war against Switzerland.

Any official (police or prosecutor) who refuses to arrest or prosecute UBS employees who are participating in this is an enemy of the Constitution and Sovereign Swiss People and must be dealt with as such, as they are permitting an act of war against their own people.

What is most flabbergasting, and incriminating is that even non-US spouses are getting the treatment.

THE ENTIRE FEDERAL COUNCIL MUST RESIGN NOW!!! UBS MANAGEMENT MUST RESIGN NOW!!! YOU HAVE ALL COMMITTED TREASON!!!

I guess I do not understand the various ways in which privacy laws are applied (as opposed to how they should be applied). It strikes me as odd that Wellington could be thrown out of UBS for being a “US Person” when the citizenship question did not arise. How did they know? Medea, that is outrageous! I don’t see how they can get away with that level of withholding (?) – up to 47%! Would the people have input into this Swiss-GB Tax Agreement?

Here’s another question then. I’ve been reading about how only Switzerland has a direct democracy and am realizing how different that must be than what I’ve experienced in the US/CDA. Does it mean that everything that is proposed by the government must be put on a referendum so that the public has a say? Does it work well?

*No, not everything nobledreamer, but many things have to be approved by the people and if they say no, then the federal government has to abide by that. It doesn’t mean they can’t go away and try again or come up with another way of trying to get it approved and sometimes it will take several attempts before it will be accepted. Other things they will just say it’s not worth pursuing and drop the matter. The main thing is that here democracy works from the bottom up, not from the top down. Let me give you a personal example:

A few years ago there was a proposal to build a home for mental and disabled people here in our commune. Now Switzerland is a bit behind the times compared to the rest of the world as regards disabilities. Access to facilities like shops are usually much better than other countries, yet the disabled themselves mostly live in special homes and work together, rather than being mixed with the general public. That’s changing, but slowly.

In the UK such a proposal would go to the town council for debate and if people felt strongly enough against it there would probably be protests and inquiries sometimes going right up to government level before approval would be given, which could take years. Sometimes, even if approval is given people will still protest, holding up building work which can delay things. Here the people proposing this set up a meeting in the commune assembly hall for all the residents to come to, put their proposal to them and then the people there voted. The answer was yes, so the facility was built. No protests, no inquiries taking years to resolve.

At government level it’s quite complicated; some referendums require a simple numeric majority, but others need a majority of cantons (states) to approve the measure. Overall the Swiss vote 3 to 4 times a year on various measures, some proposed by the government, others by a particular political party or even group who’s managed to garner enough signatures for the proposal to be put to a vote.

Another example, every year in December there is a general assembly where residents approve things like the commune’s finances, whether to buy a new school bus, expenditure to expand the school, etc. These things are put forward by the commune’s council, but the people have the final say. In the UK the town council would do this without any input from the people.

Tax agreements aren’t something that would come under this system though as far as I know. It’s the courts that would say to the federal government you can’t do that because it breaks this or that law.

As for the bank knowing Wellington was American, I assume they took a copy of his passport and permit when he opened the account so it would be on record.

I received this one. Read it Saturday. Monday I called the us embassy to have an appointment to relinquish…

I got one of these. Now on top of OVDI, I have to worry about possibly having my bank accounts closed, or not paying the same rates as other people who have lawful salary accounts in Switzerland.

If we had a contest to see who is the most abused IBS US Person by FATCA-FBAR-OVDI (former US Persons included), I think Calgary411 would win, but I feel I now have a good chance at being a runner up. Here are my wounds:

I can’t take anymore. I am eligible for a third citizenship. I am currently processing the documents for it as relinquishment looks more and more attractive. What a pity. As I am an OVDI victim, I thought after all I have been through and may likely go through before OVDI is done, I could put up with paying accountants for a few more years in order to keep my US citizenship, but the bank account situation is likely the 800 pound gorilla that will break the camel’s back.

@Lisa,

I don’t know — we all have different stories; yours is as or more egrecious than mine.

I can’t imagine our bank accounts being closed in Canada not being able to get a mortgage, etc., but it could come — Switzerland is the canary in the coal mine of what may take place in all countries. In addition to your OVDI scenario with needed big accounting fees, that you now have been warned you could have your bank accounts closed or to keep them, exhorbitant fees causes undue stress. It is the gun to your head to have to obtain your third citizenship after which you would be able to relinquish US citizenship. What other choices do you have to live a useful life, based on keeping your sanity.

Thank all that’s holy that there is this site, just for the support — and of course for the education we receive from each other. I’ve just read the CBC news piece and resultant comments from my fellow Canadians http://www.cbc.ca/news/business/story/2012/11/28/banks-us-tax.html. It also appeared in Macleans Magazine article. Many of the comments are as, what do I say, ignorant as the ones I read in news articles from the shores of the USA. How many more don’t know what they are going to go through when FATCA comes to their country.

I just would like to know a simple thing. I’m not rich. I have a salary, two accounts, one for salary and another for savings. Which are the minimum requirements that we need to match to know if we must file or not? So much information everywhere and this simple thing is not clear.

*Too many I’m afraid. All I can see happening is that this will squeeze the worldwide economic recovery even more. Those people who can’t “get out” by giving up one or more nationalities will eventually find their finances so stretched that they will barely survive. Others who are based abroad temporarily will petition their companies to send them home, but that won’t increase jobs back in the US because the jobs they do aren’t and probably can’t be US based, so they’ll become unemployed and also struggle to survive.

As a US/Brit living in Switzerland I am subject to tax from 3 different countries. At least I can dump the US one, but we do pay tax in the UK as we own a house and have a dormant business there so we will probably be facing fees from our banks for the privilege of keeping our Swiss and UK accounts.

For US it’s the equivalent of $10,000 in an account at any time of the financial year. So for example if your savings account has $15,000 equivalent and then your salary one hits $10,500 one month you have to report both.

@Lisa, thank you for laying this out. Yours is truly an absurd situation, almost a poster child for everything that is wrong with the US policy of citizenship-based taxation. I don’t have any practical advice for you, but just wanted to say that I empathize. It’s awful. I’m sorry you’ve had to deal with all this.

I’ll also add that you have much more resilience than me. I gave up with all of this some years ago. A decision about which I have absolutely no regrets whatsoever, just relief.

@Oliver – The UBS letter asked one to identify themselves as US persons and if they are one, fill out a W-9 form so that UBS can report income from your bank accounts to the IRS.

If you are asking what you need to fill out in addition to sending that form back to the bank, you must realize that there are at least two more sets of forms to fill out. You will likely have to “file the form to report your bank accounts” and then the form to “declare your income to the IRS”. They are two separate things.

You file the FBAR form for reporting your bank accounts. If the highest aggregate value of all your banks accounts during the year is over USD 10,000 you must file Form TDF 90-22.1, aka as the FBAR. You must file this even if you are not working, or if the accounts do not generate any income (interest) such is the case with many Swiss salärkontos.

As for filing the 1040, the main US income tax form, for 2011, if you are single and if your income is at least USD 9500, you must file a 1040. Read the instructions for this form found on the IRS website.

The forms are filed at separate times and to separate addresses.

@Watcher – If I had known then what I know now, I would have given up earlier.

The irony in my case is that I was a US tax filer who even had line item audits twice from the IRS during the decades I have lived abroad. I passed with flying colors. I was always told everything was just fine and there was nothing else to do. No one ever mentioned FBARS. So when I found out I might have an omission, I thought it would be a simple process to correct. The biggest mistake of my life was to think, well if I owe taxes, I should pay them by following the recommended procedure.

It is not only the difficulty and cost of OVDI that I wish I had known about, but how difficult and costly it is to remain compliant. I wish I had known how my life outside of the US would be restricted by US tax considerations.

Thank you Lisa. Resuming… I’m probably better relinquishing to be able to keep my foreign accounts and not declaring anything with the IRS cause if I do so I may be completely ruined with all the procedure costs + taxes + fines. $10’000.- is a really low value, even if I’m not very much above. U$ 9’500.- per year… how absurd that can be. Someone earning that few must be living in very poor countries (including US :-P) or starving and they still want that they file tax declarations? I was earning less than that in South America and could live only with the help of my parents…

@Lisa

With all the hoopla FATCA will create, I can’t imagine how any American considering leaving the US could remain unaware of our unique tax filing responsibilities anymore, can you? I wonder how this will be received by the average homelander. My guess is there will be at least two schools, the “who in their right mind would want to leave the best place on earth anyway?” and the “You mean I’m not free to go where I please?”.

@Lisa, there are so many of us who never realised we were even supposed to be paying taxes. I left the US back in the late 60s when I was a teenager and moved to Britain with my mother. Nothing was said to her about the need to continue to fill in tax forms and she was receiving a US widow’s pension at the time. I only found out about it last year when applying with my British husband for a mortgage from a Swiss bank. The hiccup that occurred there got me checking to find out more, but that was the first time I’d heard anything about the subject. The figures people are quoting just for staying compliant horrify me, especially when they don’t owe anything. To be put in the situation you are by trying to obey the rules is just unforgiveable. I hope you soon get the citizenship you want and can dump the biggest bully in the world.

Lisa, yep, the bank account situation is the 800 pound gorilla that will break the camel’s back. That tipped the boat for me. I could have continued filing US tax returns, paying US income taxes, hiring an accountants, doing FBAR, FATCA, W9 and all of the other goodies.

But, being denied a bank account for being a US person, that was just too much for me. It is sad that I had to renounce because of such, but the vast majority of my readings are showing that such was a wise decision. The general American stateside mentality is just not expat-friendly.

@Medea

Thanks for describing that. It sounds like the people have a lot more input than we do here. The CDN govt has managed to do many things without citizens being aware of them-it really irks me that they started this “Shiprider” program 7 years ago, where US Coast Guard and CDN RCMP are able to patrol marine border areas together. This led several years later to another program that was land based; it was disbanded and reappeared as the Border Action Plan, where we now have the prosepect of US law enforcement (FBI) being able to make arrests on CDN soil. GRRRRR This drives me crazy and the govt only presented it to business/political groups with almost no public input. They appear to be doing the same thing with the IGA. It sounds to me like Switzerland has the best deal.

@Lisa,

Horrifying, truly horrifying. I don’t know how you can manage it. I agree, you definitely belong in the “top five” of worst situation ever. Has your story been published anywhere?