Americans in Canada and their possible influence on the U.S. election.

Monthly Archives: October 2012

The Tax Implications of a Life Lived Abroad

Cross-posted from the Franco-American Flophouse.

Just Me thought it would be a dandy idea to post this here even though the video has already been circulated in the comments section. This video is quite good and deserves wider circulation. I received some wonderful mail in response to the post. I was contacted by a few of what I would describe as Quiet Renunciants. Their reflections started much earlier than mine but when I read about how they came to the conclusion that renouncing was the only sane option, I recognize my own thinking which is just a few steps behind theirs. It’s both exhilarating and humbling – I need to be reminded on a regular basis that I’m not alone and that there’s nothing particularly special about my case, my angst and my anger.

Another extraordinary resource passed along by Just Me. The Life of An American Abroad is a twenty minute video that was filmed during a tax seminar earlier this year.

An actor plays the role of a very naive American who moves to the UK to study and work and who ends up falling in love, getting a permanent residency permit, buying a house, getting married, having children, saving for retirement, and ultimately passing away in his host country.

Now if this person were from any other country in the world (i.e. not the U.S.) you know what we’d call him? An emigrant/immigrant. I find it very amusing that, for the most part, we don’t and I think that’s a problem. As Camus once said, “Mal nommer les choses, c’est ajouter au malheur du monde.” (Calling things by incorrect names is adding to the misery in the world.)

As this American tells his life story, a panel of tax advisors is there to explain to him what he has to do to stay compliant with the U.S. worldwide tax and reporting regime (citizenship-based taxation). To his horror (and mine) not one thing that he does in that life remains untouched by the IRS. Well, perhaps that is an overstatement since he is allowed to eat, breathe, and eliminate waste without the U.S. government looking over his shoulder. How generous of them.

I personally know many Americans who have experienced all the life events talked about this video and I think I’m on very firm ground here when I say that even the folks I know who think they are compliant, probably aren’t.

So I strongly urge everyone to watch this video and I mean everyone.

For those of you reading this blog who are not U.S. citizens or Green Card holders and who think this does not concern them, please think again. You are indirectly concerned because many of your governments find the American system rather admirable (the French, for example). Members of other diasporas ( French, German, Mexican, Brazilians and so on) would do well to be aware of how U.S. worldwide taxation works so they can fight efforts to have something similar imposed on them. As for those of you who are married or contemplating marriage to a U.S. citizen, best to know what you’re getting into (or the merde you are already in).

For Flophouse readers who live in the U.S. and who are still under the impression that Americans abroad are making a big deal out of nothing, watch the video and ask yourself: would you be willing to live like this? And what about your children who may one day wish to live and work abroad? Do you want them to be captive citizens shut out from all the goodies associated with globalization, unable to take that great job in Shanghai or London because no one will hire Americans anymore or because the cost of compliance with all the U.S. requirements is simply too high?

And finally for my fellow Americans abroad, I’d like you to do something for me before you click “start.” Find a quiet place, take a deep breathe, and relax. You have options. Not all of them will make you happy and some will require effort on your part. What you do with this information is entirely up to you. I fully understand and empathize with those who are renouncing. There are others who are fighting like demons: joining American Citizens Abroad and the Association of American Residents Overseas, writing letters, putting pressure on politicians, voting this year against those lawmakers who are refusing to listen, and pestering the homeland media to get the story out. And, yes, there are folks who are doing a Deep Dive and cutting all ties to the U.S., avoiding the U.S. embassy like plague-infested territory, not renewing their passports and so on. I’m not sure the last is viable given the arrival of FATCA, and I wouldn’t do it, but it’s a big big world out there and surely some of them will succeed.

Wherever you are in this mess, the important thing is that you do the next right thing and I honestly think that the only wrong answer here is to kick back and pretend it isn’t happening at all.

Geithner breaks tax laws again

The only noise from the IRS in the Federal Register for 30 October, the thirtieth day after the close of the calendar quarter, is a request for comments about Form 3468, which you fill in to take tax credits for coal, gasification, or other energy projects. There is no Quarterly Publication of Individuals, Who Have Chosen To Expatriate, As Required By Section 6039G, With Too Many, Commas In The, Title.

So Tim’s question still stands: will the “name-and-shame” list come out right before the election? Will the names of ordinary emigrants be abused in order to pump up voter outrage about all the “wealthy people fleeing America”? Or will the list be delayed until a more convenient date?

Anyway, the IRS whistleblower program is looking for information about individuals who flout America’s tax laws — especially those relating to international tax. Why not fill out a Form 211 and send it in to see if you can get 30% of what they’ll extract from Mr. Secretary of the Treasury? Sure, 6039G doesn’t specify any fines, but maybe they’ll lure him into the Offshore Voluntary Disclosure Program and then they can just make up the fines themselves.

The Influence of Expats on the Vote

There is absolutely no mention of how or if extraterritorial taxation will figure into how expats vote.

http://ca.news.yahoo.com/close-race-makes-waning-zeal-expat-vote-093828453.html

NZ To Negotiate FATCA Agreement With US

NZ To Negotiate FATCA Agreement With US

by Mary Swire, Tax-News.com, Hong Kong

29 October 2012

The New Zealand government has announced its intention to negotiate a Foreign Account Tax Compliance Act (FATCA) tax information agreement with the US.

More at:

http://www.tax-news.com/news/NZ_To_Negotiate_FATCA_Agreement_With_US____58009.html

Miscellany: IRS to Peter Dunn, “Never mind.”

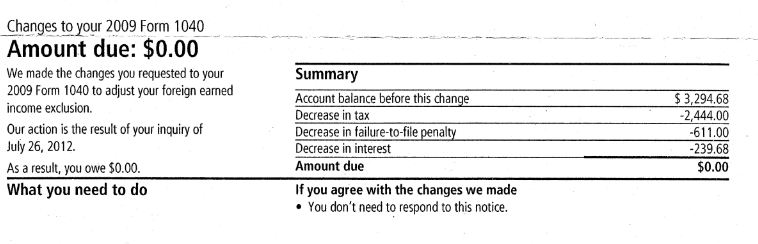

As you folks know, the IRS decided that since I didn’t fill the first part of my Form 2555 out correctly, that I must owe them a bunch of taxes. And so they sent me a federal tax bill to my Canadian address, disallowing my Foreign Earned Income Exclusion (FEIE). Today, at last, after several tries at sending them the properly filled out form, the IRS has decided that I don’t owe them anything after all. I’ve only had to deal with this 2009 tax issue for quite awhile now–readers can retrace the multiple threatening letters and bills that I received from the IRS just by clicking the above link and the links in that link, and the links in those links. The IRS has wasted its time with me. I’ve been wasting my time. I owed no tax. Zero zip nada. I am not a rich tax evader but a Canadian taxpayer and I renounced my US citizenship because I hate the hassles, the threats, and the intimidation that comes part and parcel with being an US person.

TackleTaxHavens.CA and Canadians for Tax Fairness

I have been keeping an eye on Canadians for Tax Fairness for a long time as they are closely tied and connected to several pro FATCA NGO Groups in the US such as Tax Justice Network, Global Witness, Task Force for Global Transparency and Integrity etc. One of the key people in Tax Justice Network whom Canadians for Tax Fairness is associated with is one Richard Murphy of the UK. Murphy is a highly religous and militant Quaker who has called for all US Citizens outside of the US non compliant with US tax law to be sent to jail and that non compliance by overseas US Persons is a violation on their part of the fundamental laws of nature and in the Quacker religion they will all go to hell basically.

Now, who are Canadians for Tax Fairness? Well they are basically a front group bankrolled by the major unions in Canada such as PSAC, OPSEU, CAW, NUPGE, and CUPE. (On the flip side for those who accuse me of being partisan the Frasier Institute is a front group too mostly for small and medium size oil, gas, and mining companies). On their management board are included several people we have discussed in the past such as Linda McQuaig and Neil Brooks however, I will note one of the top people is someone named Murray Dobbin who is an NDP activist who basically left the party after Mulcair’s ascension to the leadership (I wonder what type of influence they expect in Mulcair’s NDP). Overall the board of directors is a lot of prominent people in the labor movement Ken Lewenza, Erin Weir, “Smoky” Thomas etc. Now CTF has had very little to say about FATCA however I will note they have launched a new website linked to below.

Again no mention of FATCA however the website was clearly developed at some expense I suspect using union member dues. Take note Brockers who are/were members of the unions financing CTF.

David Macaray: Columnist at the Huffington Post gets a FATCA education.

If you haven’t seen it yet, you will want to read the recent opinion piece at the Huffington Post. Another application for the Isaac Brock Hall of Shame.

Rebooting Our Definition of “Patriotism”

In this piece, the author, David Macaray, cites a June New York Post article as his sole basis to rail against the “Ultra Rich” that are renouncing their citizenship. You almost wonder if it is worth trying to educate this guy about the issues via comments like we did successfully with Al Lewis and Peter Dunn. They too went down the unpatriotic renunication rabbit hole on a misdirected invective against those that give up citizenship. However, came around to a more nuanced understanding when presented with new information. Here are links to their original misguided perceptions. Al Lewis, Peter Dunn

I see David is responding to some well written comments, so he is paying attention, although I am sure he is somewhat surprised by what he is reading. You are welcome to join in.

Privacy Risks for Expats are Real

It seems that 3.6 million precious Social Security numbers have been obtained by some enterprising group of people. Data storage devices are nothing more than “mother lodes” of riches and the U.S. government seems to be incapable of closing off access.

Fatca faces delay after bilateral disagreements

From Financial News, a DowJones news website:

October 26, 2012

Sophie Baker, “Fatca faces delay after bilateral disagreements”

The Foreign Accounts Tax Compliance Act, or Fatca, was due to be introduced from next year but, according to a notice published on the IRS website on Wednesday, the deadlines have been pushed back. The original 2013 deadline for financial institutions to put compliance procedures in place has been delayed until January 2014.

More: