Monthly Archives: October 2014

Approaching GATCA? “Foreigners” (and not just U.S. foreigners) in Israel finding themselves ensnared …

…He was asked to sign a declaration that the account and all the money in it had been reported to the tax authorities in his home country and he had paid everything that was due on it.

The man refused and then came the next surprise: The bank refused to let him withdraw his money. He explained that he didn’t speak Hebrew and wanted the declaration to be read and translated by a lawyer. He reminded the bankers that he was a client of long standing and had been told when he opened his account that he would not be asked questions like that. It was all to no avail.

…

Related (from another Brocker):

I remember reading a lawyer wrote that all the g7 wanted fatca type reporting…the u.s took the lead…the rest will follow..the Israel has fatca type arrangements with Europe…probably the igas crush everything related to privacy so it’s easier now.

Here is the fax of Bank Hapolaim, an Israeli bank, requiring Canadians and EU member residents and/or immigrants (or CFCs) from those locations sign away their rights similar to US citizens: Israeli Bank(s) Declaration — shall apply with respect to any existing Account and any future Account, if relevant

The Real Intent of #FATCA: You are not “Collateral Damage” — You are the Target

Telling your Congressman or your media contact that you are “Collateral Damage” has no effect. Your Congressman doesn’t give a sh_t—because you are not collateral damage—you are the target.

This article is a cross post from: http://samuelclemmons.wordpress.com/2014/10/27/the-real-intent-of-fatca-you-are-not-collateral-damage-you-are-the-target/

The term “collateral damage” shows up in all the articles, all the pleas to Congress, and in the Talking Points of Lemmings Abroad. It’s not really a damaging label—unless you believe it to be true and don’t plan otherwise.

Let’s stop talking about FATCA’s “collateral damage” and start discussing real intent. FATCA is the enforcement tool to collect IRS taxes and penalties from non US residents receiving no standard government services (schools, roads, education, or social welfare). FATCA talking points contradict the administration’s own statements upon FATCA intentions.

FATCA funded the 2010 Jobs for Mainstreet Act–a domestic jobs bill. It purports to collect $8.5-$8.9 billion of tax and penalties over ten years, by identifying previously-undertaxed US citizens overseas. It demands the world’s banks to aggressively identify their residents who are US citizens, forwarding their identities to the IRS for taxation and penalties.

FATCA aggressively enforces the US’ globally-unique taxation system, which uniquely taxes-up its non-resident US citizens to the highest of the tax rates of their residence country or US. This includes any previously under-taxed non-US retirement products, unemployment benefits, home sale gains, and anything above $95,000 earned in countries like UAE (UAE’s high corporate tax eliminates personal tax).

Cheryl’s claim for relinquishment based on INA 1952 350: The case of a dual citizen at birth

I asked Cheryl to share her story, as I thought it is important for others to see her claim to have relinquished US citizenship despite having dual citizenship (USA/Canada) at birth. It may be very helpful to others in a similar situation.

I asked Cheryl to share her story, as I thought it is important for others to see her claim to have relinquished US citizenship despite having dual citizenship (USA/Canada) at birth. It may be very helpful to others in a similar situation.

Cheryl’s Citizenship Story

I was born in the U.S. to Canadian parents although I didn’t know that for many years. I was the only member of my family born in the United States; all my grandparents, aunts, uncles and cousins were born and living in Canada. In fact my family connections in Canada go back to well before confederation, and I am related to two Fathers of Confederation.

As a child I had deep connections to Canada, spending 3 months every summer, from the age of one visiting family and spending time at the family wilderness cabin in Ontario.

I decided when I was 17 that I wanted to move to Canada, live in Canada for the rest of my life, and become a Canadian citizen if possible.

I moved to Canada at the age of 18 on a student VISA and then became a landed immigrant on my way to becoming a citizen of Canada. I subsequently found out that my parents were Canadian citizens at my birth and that I might become a Canadian Citizen by applying as an adult to be registered as a Canadian Citizen Born Abroad. Being a Canadian by birth was particularly appealing to me. The Canadian Government allowed my registration retroactively.

New York Times: Law Lets I.R.S. Seize Accounts on Suspicion, No Crime Required

The Internal Revenue Service agents did not accuse Ms. Hinders of money laundering or cheating on her taxes — in fact, she has not been charged with any crime. Instead, the money was seized solely because she had deposited less than $10,000 at a time, which they viewed as an attempt to avoid triggering a required government report.

“How can this happen?” Ms. Hinders said in a recent interview. “Who takes your money before they prove that you’ve done anything wrong with it?”

The federal government does.

Law Lets I.R.S. Seize Accounts on Suspicion, No Crime Required

Does anyone except Jack Townsend still doubt that the IRS is a criminal organization?

Hat Tip: Zero Hedge

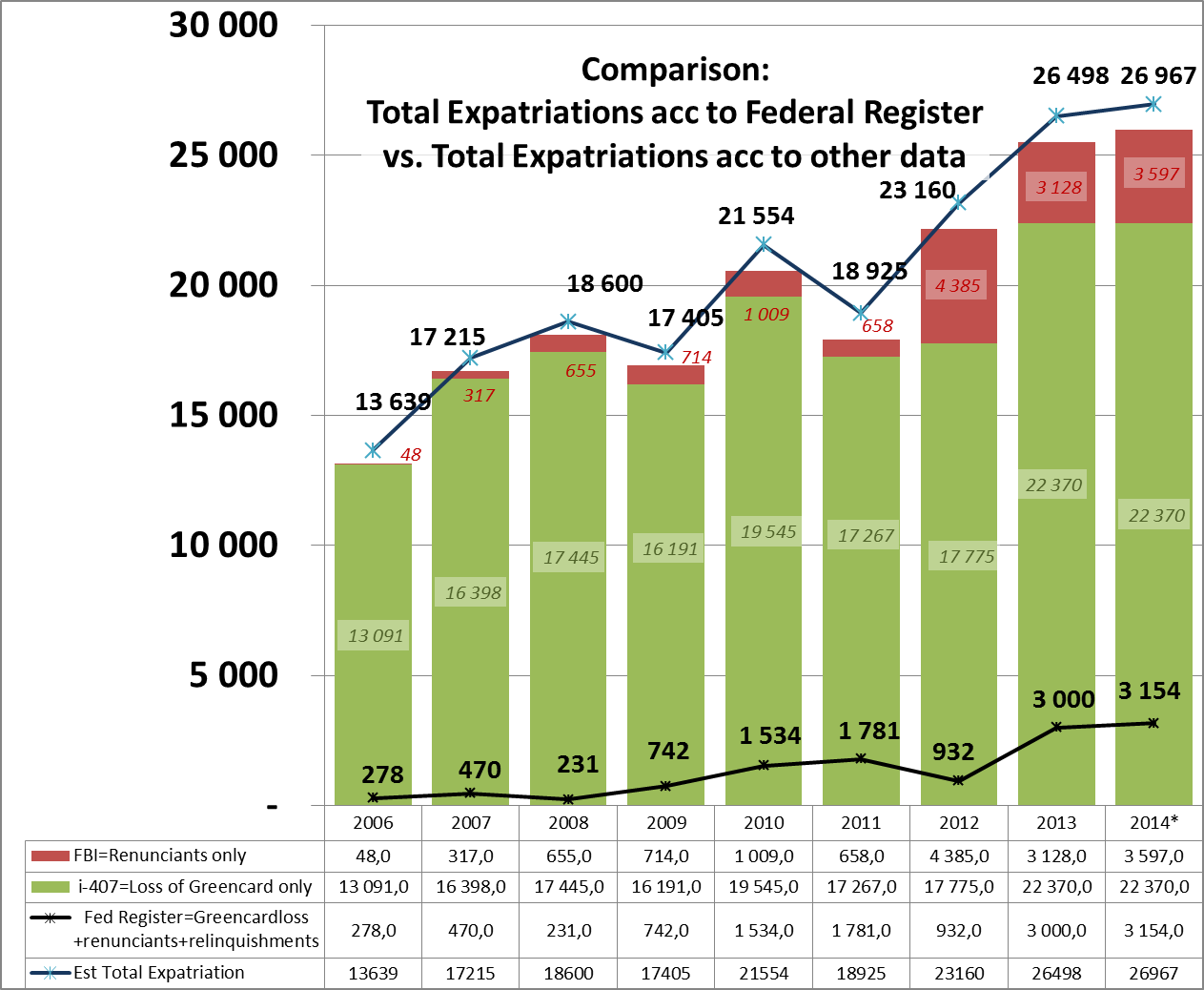

Cooking the Books at the Federal Register: What Has the Executive Branch Been Feeding You?

Are US Refugee statistics correct?

Hmmm. What’s up here? Does 2+2 = 32? Why are the US Federal Register published statistics off by a factor of 8? Is this “truth”? Is this “competence”? Is this “leadership”? Is this “‘information’ for ‘formulating an opinion’?” What kind of opinion is meant to be formulated with this kind of “information”?

The President turns to his staff mathematician and asks: “Quick, what’s 2 = 2 ?” The mathematician answers, “The answer is straightforward: 2 + 2 is exactly 4.” The President turns to his staff statistician, and asks the same question. The statistician replies: ” The probability that 2 + 2 lies within the region 3.5 and 4.5 is 98% “. The President turns to his appointed first report at the Federal Register, and asks the same question. The administrator responds “What would you like it to be, Mr. President?”

Federal Register Statistics (the ones published all the time, shown as the black line in the graph):

Let’s look at what the Federal Register has reported, as acquired from Wikipedia’s “The Federal Register Quarterly Publication of Individuals Who Have Chosen to Expatriate” (source referenced “A” below). This is a list which supposedly reports the quantity of Expatriating individuals from USA–the number is supposed to include 1) renunciants, 2) relinquishers, and 3) those long-term residents who have terminated their visa’s (“this listing, long-term residents, as defined in section 877(e)(2), are treated as if they were citizens of the United States who lost citizenship.” (“A” & “B“))

FBI statistics of renunciants only (red bar on the graph)

Any Developments from Credit Unions in Canada?

Has anyone heard anything new on Alterna being exempt from FATCA reporting?

#fatcainfo : Twitterers–tweet to Swedish radio whatever you think that SWeden (that tax haven) could use for FATCA reciprocity

SwedishPublic Radio (SR) has sense of humor!

They created tag #FATCAINFO to list the reciprocal data you think USA should xchange for Swedish FATCA data.

What US data would Sweden really be interested in?

Use your imagination—what could that tax haven Sweden use for FATCA reciprocity that they could possibly use?

You can’t understand it, but the Swedish national radio satire program requested it here:

http://sverigesradio.se/topsy/ljudfil/5116840.mp3

(No blocks, you can send serious sh_t, too)

Tweet away—humor is more powerful than seriousness!

From @WSJperfinance and @SaundersWSJ report renunciations continue at record pace

More Americans renounce citizenship—2014 is on on pace for a record http://t.co/uSD4yqLKzs via @WSJpersfinance – and 2015 will be higher!

— U.S. Citizen Abroad (@USCitizenAbroad) October 24, 2014

The article includes:

Unlike other developed nations, the U.S. taxes citizens on income they earn anywhere in the world. The rule dates to the Civil War. U.S. tax liabilities can also cover children born to Americans abroad, extending the reach of the Internal Revenue Service across generations as well as oceans. There are only partial offsets for double taxation for people who owe taxes both to the U.S. and a foreign country, and the reporting rules are onerous, experts say.

For decades these laws were rarely enforced. Now, scrutiny of Americans abroad is intensifying because of the Foreign Account Tax Compliance Act, or Fatca, which Congress passed in 2010. The law’s main provisions, which took effect in July, will require foreign financial institutions to report income of their U.S. customers to the IRS.

Comments are open, at least for now.

#Sweden one-up’s USA’s #FATCA & #FBAR: Assumes all of its #Expatriates to be Corrupt

Whereas US FATCA program assumes all of USA’s expats are tax cheats, Sweden does one better and considers all of its expats as being corrupt. In both systems, the accused must prove himself innocent because otherwise he is assumed guilty.

Crosspost from this article: http://bit.ly/ZL5GSb

The US FATCA system requires the world’s banks to police expatriate US citizens, by demanding their bank account balances, Social Security numbers, and addresses and personal information. The Swedish system requires Swedish banks to inquire and store data upon the political status of its expatriates. It doesn’t stop there-it requires the same status upon the relatives of the account holder. And, same as FATCA, if the account holder doesn’t comply the account is to be frozen by the bank.

Although this documentation is demanded by the Swedish government, the bank association “assures” the bank customers that the bank holds the information confidential. Right–why does a bank perform police investigations—is the bank then going to prosecute those that can’t prove they aren’t corrupt?—Well, maybe not, but it will freeze the account and stop the usage of most of the functions in the bank account. Freezing bank account functions as a threat to force private-information disclosure is as close as one could get to deputizing a financial institution with unconstitutional police powers. I wonder if that old grundlag is really worth anything at all?

Sweden has followed the US’ lead, in deputizing the world’s banks to police over the citizenry.

The worst possible combination for a Swedish citizen could be that the Swedish citizen is an expatriate located in USA. In this case, the person is assumed both a tax evader and corrupt. This became evident in a recent story upon Swedish TV, where a man received a series of questions asking the origin of the money in his account, if he was a US person, and the whole series of questions about the political activities of himself and his relatives.

Apparently, the bank (Nordea) had combined a form which assumes that anyone suspected of a US person must prove himself as not being a tax evader, together with the assumption that any Swede living outside Sweden is corrupt.

With a population of only 9 million—Sweden could be on its way to have a more intrusive government than its big brother USA.

.

ALL RIGHTS RESERVED

ALL RESPECT DESERVED

http://www.penningtvatt.se/fragor/bo-utomlands

Rought translation: If you live abroad

If you live abroad, special rules apply. Your bank needs to know if you have a high political post or high post in the state, a so-called politically exposed persons, or if you are a close relative or a known associate of such a person. These stringent regulations are aimed primarily at combating corruption.

With a high political post or high post in the State referred

• Heads of State or government, ministers and deputy or assistant ministers;

• Members of Parliament,

• Judges of the Supreme Court, judges of constitutional courts or other similar judicial bodies at the high level,

• senior audit of the boards of central banks;

• ambassadors, diplomatic envoys and high-ranking officers in the armed husband, and

• persons who are included in the state-owned company’s management bodies

With close relative meaning

• wife / husband,

• partners who by law is equated with wife / husband,

• children and their spouses or partners, and parents

The information the Bank receives about you is treated as confidential and subject to banking secrecy and the Personal Data Act

SVT story upon FATCA arriving in Sweden

http://isaacbrocksociety.ca/2014/10/21/fatca-has-no-maximum-only-minimums-fatca-comes-to-sweden/

This post is a cross post from: http://bancdelasteroideb612.wordpress.com/2014/10/23/sweden-one-ups-usas-fatca-fbar-assumes-all-of-its-expatriates-to-be-corrupt/

Canada AM: US tax backlash

Canada AM: US tax backlash