Something I think we need to better understand (or at least I do),

Roy Berg, director of U.S. Tax Law at Moodys Gartner Tax Law LLP, discusses concerns that Canada’s approach to FATCA may spark a dispute with the U.S. over personal trusts:

Advisor.ca, Dean DiSpalatro, March 31, 2014: “Feds bury FATCA law in Budget bill”

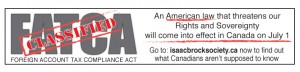

On Friday the Conservative government tabled legislation to implement key elements of this year’s Budget. But it contains more than tax credits.

Buried within is a revised version of draft legislation implementing the Intergovernmental Agreement (IGA) with the U.S. on FATCA. A Department of Finance press release makes no mention of this part of the bill.

…

If the trust has a Global Intermediary Identification Number (GIIN), the firm will consider it a fully compliant Foreign Financial Institution (FFI). As a result, the trust will receive the dividends in full.

If the trust doesn’t have a GIIN, the U.S. firm withholds 30% and passes it to the IRS. Berg says the same will happen with securities accounts based in the U.K., Ireland and other countries that have IGAs with the U.S. Their IGAs and guidance notes label trusts as FFIs.

How did our lives become so complicated?