Mr. Monte Silver is legally tackling in a U.S. Court the United States Transition Tax by arguing that he has suffered from a “procedural injury”.

The DC Court Judge generally explains the lawsuit: “Plaintiffs do not seek a refund or to impede revenue collection. Instead, they challenge the IRS’s adopting of regulations without conducting statutorily mandated reviews designed to lessen the regulatory burden on small businesses. As relief, they ask the court simply to compel the agencies to do what the law requires—Regulatory Flexibility Act and Paperwork Reduction Act analyses. Tax revenues and their collection are unaffected by such relief.”

From the Court ruling:

‘Plaintiffs complain that the regulations have “imposed significant burdens on Plaintiffs and other small businesses,” including “forc[ing] small businesses to spend enormous amounts of time in futile efforts just to try and understand what [the regulations] mean[],” and “forc[ing] small businesses to expend significant funds to try and comply” with the regulations. Id. ¶¶ 33–34.

Plaintiff Silver declares: “[I]n trying to comply with the statute and regulations . . . I have been forced to spend significant funds.

Worse still, I will be forced to expend money on Transition tax-related compliance for years to come, even though I did not report any Transition tax liability…”

“Plaintiffs allege that the agencies neglected to undertake procedural measures designed to protect small business from the burden of unwieldy and cost-intensive regulations—namely, the publishing of an initial and a final regulatory flexibility analysis, 5 U.S.C. §§ 601, 603(a), and a certification that the regulation has reduced compliance burdens on small businesses, 44 U.S.C. § 3506.”

Defendant IRS moved to dismiss the lawsuit claiming in part that Mr. Silver lacked “standing”.

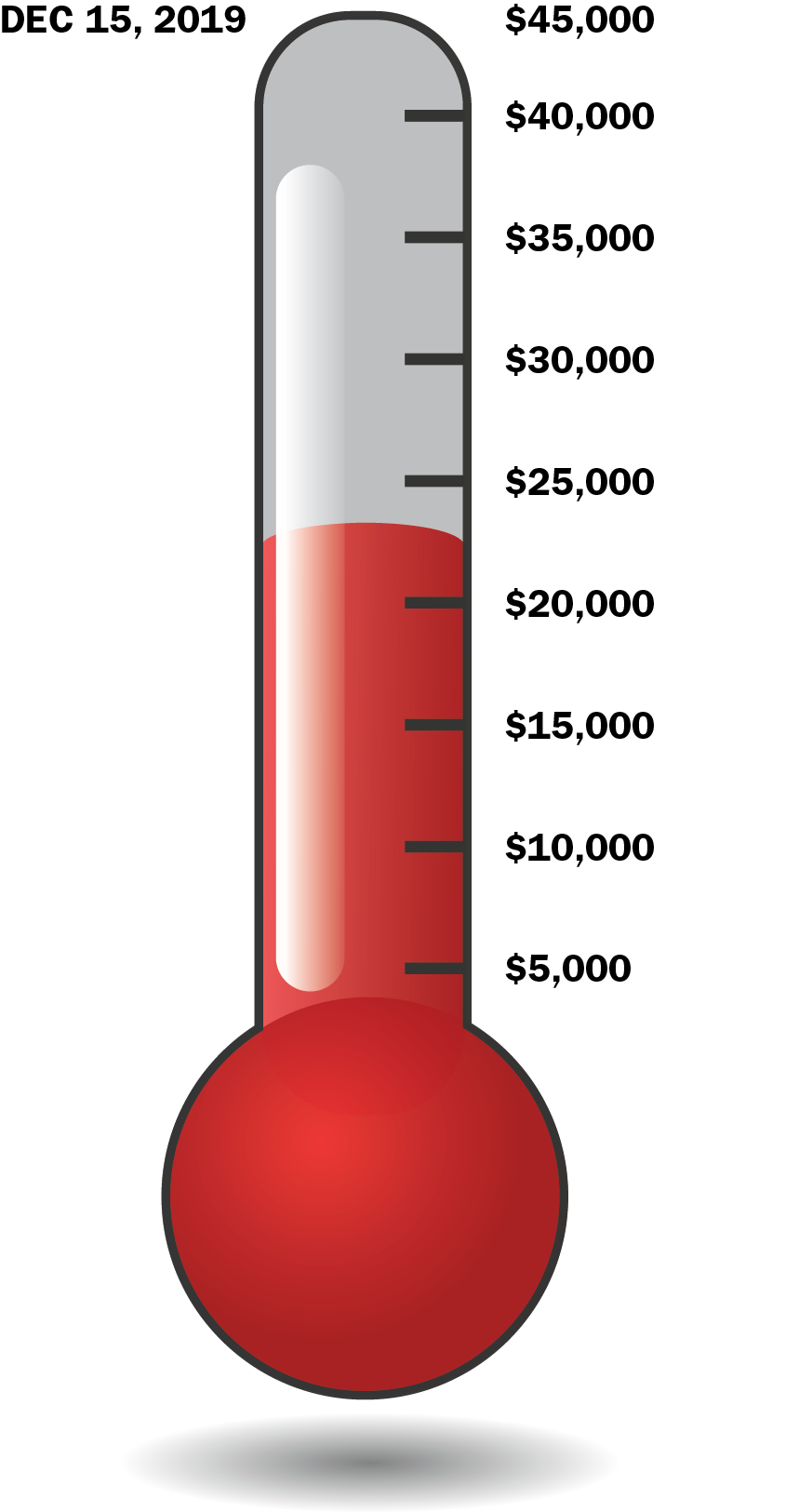

On Christmas eve, 2019 the U.S. DC District Court disagreed, rejected IRS motion to dismiss —- and the lawsuit continues.

JapanT says: “Yes there is a Santa Claus!”

See the DC Court ruling (some text above) and the article in the press on the ruling.