Thanks to Calgary411 for posting this on the Media thread. There’s been a lot of discussion on this, so I’ve created a separate post for it and moved the comments here.

Thanks to Calgary411 for posting this on the Media thread. There’s been a lot of discussion on this, so I’ve created a separate post for it and moved the comments here.

Greg Swanson has written a three-part series, “Americans abroad: a case study in the dumbing down of American policymakers,” providing a concise synopsis of the situation faced by US persons outside the US as a result of CBT and the history behind it.

Greg Swanson has written a three-part series, “Americans abroad: a case study in the dumbing down of American policymakers,” providing a concise synopsis of the situation faced by US persons outside the US as a result of CBT and the history behind it.

Part I and Part II are online at Medium.com now. Part III to follow soon. I’ll post the link when it does.

Greg is the coordinator of PurpleExpat.org, which is focused on the elimination of citizenship-based taxation.

Further to my post about commenting in general entitled Announcement March 31st, some specific points on repetitious commenting:

Going back and forth on a point doesn’t advance discussions and, after enough rejoinders, other readers tend to tune it out. Repetitious comments made by a person or persons in a short period of time can be particularly problematic when a person replies, saying basically the same thing again, to every comment made in reply to their initial comment.

Such comments provide only redundant information and redundant thoughts/ideas while making a thread difficult to read efficiently. Some people suddenly learn of a problem with their real or alleged US citizenship and are in distress and need information f-a-s-t. As well, exchange of thoughts and ideas is hampered by repetitious and circular discussion. Please bear this in mind when commenting.

Karen Alpert (Australia), John Richardson (Canada), Larry Stern (Israel) and Leonard Tuber (Israel) will discuss “territorial vs. citizenship-based taxation, their many advantages and disadvantages, and the myriad of challenges and questions posed by the US’s use of this type of tax system,” Monday 3 June 12:00 BST (11:00 UTC / 07:00 EDT).

You can submit questions at the TaxLinked site. For more information and/or to submit a question, click here.

A debate/discussion on Citizenship And Worldwide Taxation: Is It Morally Justified Or Unjustified? between John Richardson and Edward Zelinsky will take place Friday May 17, 2019, 14:00 EDT (18:00 UTC), hosted by TaxConnections, live on YouTube. It will run for an hour-and-a-half.

CBT is morally unjustified: John Richardson (Lawyer, Citizenship Solutions, Toronto, Canada)

CBT is morally justified: Edward Zelinsky (Law Professor, Cardozo School of Law, New York, USA)

Click here for full information, to see the questions which have been submitted, to pre-register, and/or to submit questions (P.S.: Note at the bottom of this page videos of people who we know.)

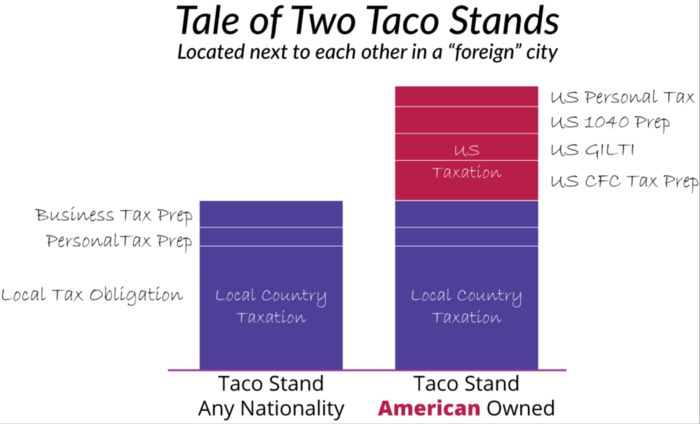

The United States Imposes A Separate And Much More Punitive Tax On U.S. Citizens Who Are Residents Of Other Countries, John Richardson, TaxConnections.

TaxConnections and CitizenshipSolutions Posts by John Richardson, Laura Snyder and Edward Zelinski written after this event was announced: Continue reading →

The US Government Accountability Office has released an 83 page Report to Congressional Committees, “Foreign Asset Reporting: Actions Needed to Enhance Compliance Efforts, Eliminate Overlapping Requirements, and Mitigate Burdens on U.S. Persons Abroad”. Thanks to JC for posting this link on the Media page.

Related Brock post: April 2019 Report From GAO is evidence of how #FATCA and Foreign Asset Reporting is viewed in the Homeland by USCitizenAbroad.

Republicans Overseas is hosting an event, with House bill co-sponsor Congressman George Holding, Solomon Yue and John Richardson on the Taxation Fairness for Americans Abroad Act bill, London, England, 24 April 2019.

“There is a bill to fix citizenship-based taxation for Americans! Come learn all about it from its sponsor, Representative George Holding!

Representative George Holding (R-NC) will be walking us through his bi-partisan bill that introduces residence-based taxation for all American expatriates, titled Tax Fairness for Americans Abroad Act. This could mean the end of filing income taxes for non-US residents. He will discuss the ins and outs of his legislation, and how together we can get it across the finishline!

Solomon Yue, Global CEO of Republicans Overseas, will be here again to discuss the global grassroots efforts and necessary action items for the expatriate community.

John Richardson, Canadian tax lawyer of Citizenship Solutions, will be joining us again to explain why he endorses this legislative solution from a professional perspective.

. . . . “

Full details and registration at the EventBrite site.

There has been a lot of dissatisfaction expressed in recent months, on the site and in e-mails to the moderators, regarding irrelevant/off-topic comments. It’s also important that Brock provides a place for people to express their thoughts. To strike a balance, we have installed a “move comment” function, with which we can move a comment to a different thread.

This should help keep things more focused while, at the same time, the person’s comment still appears on the site and discussion can ensue without overwhelming the original, unrelated, thread.

Moving a comment from one thread to another keeps both threads more useful to persons seeking help or information or simply having a coherent discussion on a topic.

We do not intend to eliminate thread drift from the site, just to keep certain threads focused, such as a post that deals with a project or a post focused on a specific type of information but someone posts a comment way off-topic; say, consulate problems on the FATCA thread.

Many topics overlap a lot, so don’t expect perfection — and every one of us undoubtedly has a different sense of just where “on-topic” ends and “off-topic” begins (can’t please everyone all of the time), so you may still see some comments you feel are out of place but to a lesser degree.

Thread drift is inevitable on a site that values sharing of ideas and opinions. It can be pesky and annoying, but sometimes it’s a good thing which expands discussion; and exchanging thoughts is important part of the Brock community. We don’t want to quench that! But this should keep parts of the site on target.

We’ll be getting together for lunch Saturday, 9 February, at 1:00 pm at Montana’s BBQ Restaurant, 1750 Ogilvie Road. Plenty of free parking on site, also accessible by city bus.

We’re currently expecting 9 people — hope you can come, too! Please rsvp by posting a comment here or e-mail me at pacifica at isaacbrocksociety dot ca

Further to Patricia Moon’s comment here yesterday about having been contacted by Stephanie Soong Johnston of TaxAnalysts regarding the European Union’s resolution to open negotiations on FATCA with the US, Ms. Johnston’s article appeared today: EU Lawmakers Vote to Kick Start FATCA Talks With United States. It contains several quotes and observations by John Richardson along with mention of the Isaac Brock Society and ADCS.

” . . . . John Richardson, a lawyer speaking on behalf of advocacy groups the Isaac Brock Society and the Alliance for the Defence of Canadian Sovereignty, noted that only a few countries confer citizenship based only on birth in their countries and that only two countries impose worldwide taxation based only on citizenship: the United States and Eritrea. The United States, however, is the only country to do both, according to Richardson.

Richardson welcomed the EU resolution because it recognizes that the United States is imposing worldwide taxation on people who are tax residents of Europe and have no connection with the United States, adding that the combination of FATCA and U.S. citizenship-based taxation has rendered the citizens and residents of other countries as second-class citizens in their home countries.

“’On a broader level, the EU resolution will be welcomed by Canada and other countries who are suffering the effects of U.S. extraterritorial laws — FATCA and citizenship-based taxation,’ Richardson said. ‘All countries should support the EU resolution and all countries should work together to ensure that U.S. tax laws cannot extend to the tax residents of other countries.’”