CANADIAN FATCA LITIGATION UPDATE December 7, 2019:

You are contributing to raising the money needed to pay the legal costs to litigate with the Government of Canada — to prevent Canada from imposing the U.S. FATCA law directly on Canada and Canadians.

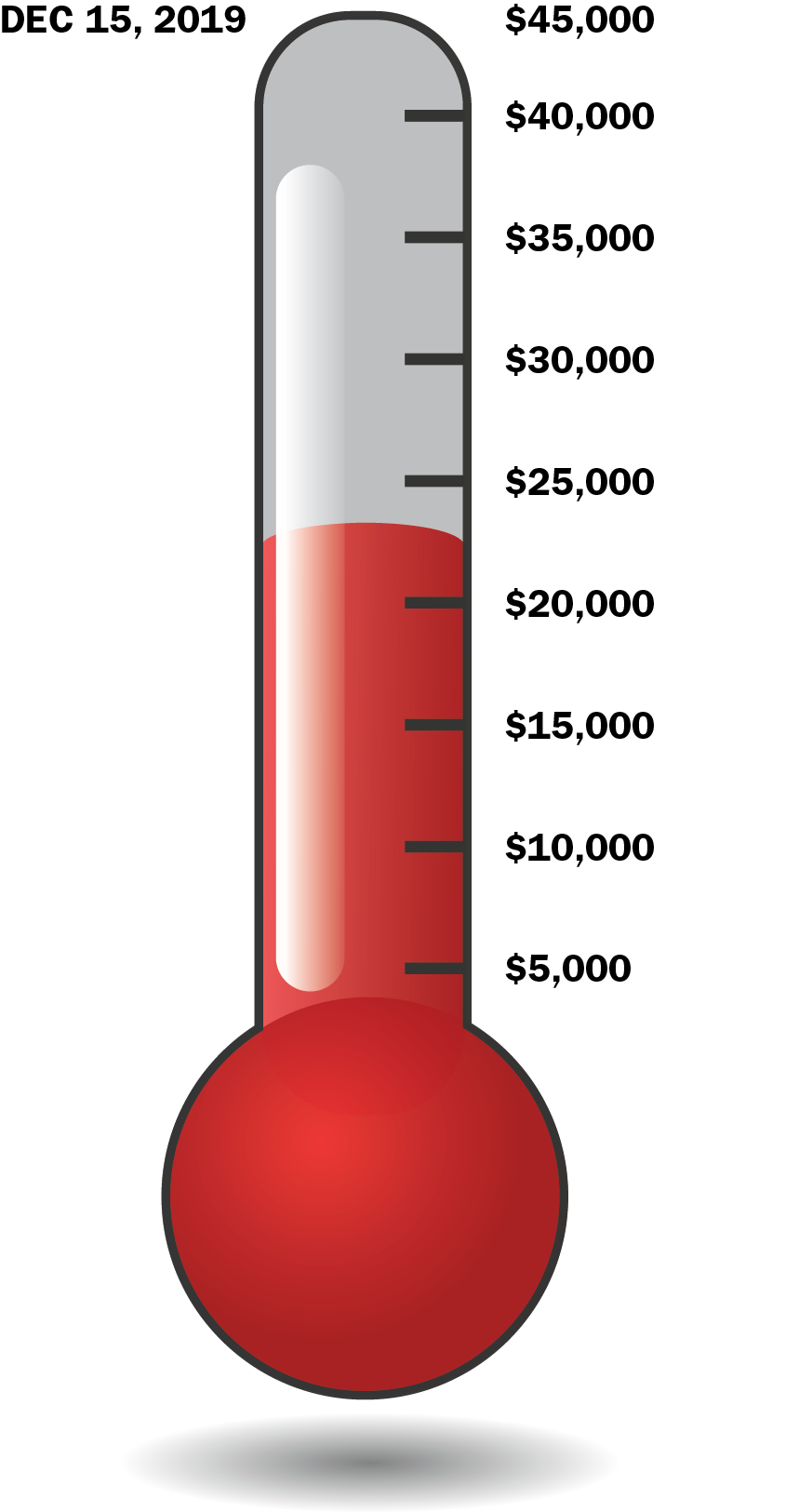

The Alliance for the Defence of Canadian Sovereignty and Gwen and Kazia have raised $24,612 in this funding round. We ask you for $20,388 in EIGHT DAYS to make $45,000 December 15 payment for appeal of FATCA Federal Court decisions.

You can DONATE by cheque, cash, PayPal (easiest) and transfers.

Gwen and Kazia, two brave Canadian citizens having no meaningful relationship with the U.S., are appealing on your behalf two Federal Court decisions to the Canadian Court of Appeal.

The grounds for appeal will include violations against their autonomy (Charter section 7), privacy (8) and equality (15) as well as arguments that the ruling was improperly based on the finding that the Income Tax Act is primarily regulatory in nature, and that factors such as the relationship between Canada and United States were not properly dealt with. Fleshed out details of appeal grounds will be provided in the Factum, likely early next year.

Gwen and Kazia ask for your help in paying for the legal costs of the appeal. If you feel that FATCA IGA laws harm you or someone that you know, PLEASE DONATE.

Appellants need to raise three installments of $45,000 on December 15, February 15, and April 15, and will apply for approximately $50,000 funding from the Canadian Court Challenges Program. Appellants and the Alliance for the Defence of Canadian Sovereignty — SEE OUR WEBSITE FOR MORE DETAILS (ADCS-ADSC).

Justice Mactavish in ruling against us said that it is “important” to avoid consequences threatened by the U.S. But we say not at the expense of our Charter rights.Canadians and International supporters: Please help end one of the FATCA compliance laws that impact on all of our countries.

You can SEND DONATIONS by cheque, cash, PayPal (easiest), and transfers.

For more details see: Alliance for the Defence of Canadian Sovereignty

Our four Board members are John Richardson (co-chair and legal counsel), Patricia Moon (Treasurer), Carol Tapanila, and Stephen Kish (Chair).

To clarify, I support the principles behind suing the Canadian government, just not convinced it will help anyone, and worried it might make things worse for many.

@Jack

From what I gather you are looking for a possible way to get more expats on border vis a vis the lawsuit by finding a way to show there would be little or no financial risk and maybe even somehow some financial gain in participating and seeing the case won.

The lawsuit cant be seen in terms of financial risk but in terms of sovereignty . How do you like

the CRA being a courier of your personal financial information to IRS ?

Or possibly fining you for not having a ITIN/SS, which hasn’t happened yet but may ?

Robert, How would you like to lose at the Supreme court level, thus have it cemented in law that you definitely are a second-class citizen, such that the Canadian government and banks no longer feel the need to play the “Are you a US citizen? Wink, wink just say no if you aren’t US tax compliant” game?

Jack , as a canadian , where would you drawn the line for our southern neighbor’ s demands ? If there is a loss ,at least there was an effort. According too you, if the case is lost, we are branded as second class citzens and the banks show us no pity ,but in reality , the country becomes second class bcause it has given into financial threats at the price of its citzens.

The wink wink approach is good for now but has a short expiry date.

” How would you like to lose at the Supreme court level, thus have it cemented in law that you definitely are a second-class citizen……”

Its already cemented in law. (i.e. the IGA.) The lawsuit is an attempt to “uncement” it. So a loss at any level only means that the present deplorable situation continues to be unchanged and unchecked. Other than the wasted effort and expense, there is no downside to a loss. The damage is already done.

Maybe one should add that if this lawsuit is won, Canada has the greatest concentration of US citizens abroad- and it would send a message as a precedent to all other countries. If Canada falls out of FATCA by telling America basically that it will not be bullied by USA – then basically America can let FATCA go. When the law was implemented, those in charge in America were surprised themselves how countries agreed to comply. They used the dollar and the banking system to push through their objectives. WIthout Canada – the biggest foreign tax base for USA, other countries could follow. It could mean the end of FATCA.