from The Nation

Interesting that FATCA, which predates CRS is not mentioned here.If the U.S. were interested in reciprocity, wouldn’t this be the focus? In fact, this is not FATCA or CRS. It is plain and simple discrimination. If the U.S. continues making the U.S.an unwelcome place for immigrants, we may no longer have to listen to the nonsense that our leaving is irrelevant due to the much larger numbers of people clamoring to get into the United States of America.

Excerpts:

Bank of America sent a customer a notice demanding details about their citizenship—and if they refused to answer, their accounts were promptly frozen.

Outside the United States, this is a normal practice. Dozens of countries have agreed to the Common Reporting Standard aimed at combating tax evasion, and began collecting citizenship information as part of that effort in 2017.

In the UK the banking industry has already been charged with collecting information on foreigners as part of a bigger plan to create a “hostile environment” for undocumented immigrants. Immigrants and advocates worry the United States could be next.

Under a separate law, foreign banks must collect citizenship information from Americans, ostensibly in order to track down potential tax-dodgers.

But domestically, they are not required to collect customer citizenship information.

Writing in The Hill, Gonzalez speculates that “some banks are more than willing to carry out Trump’s agenda of creating a system where immigrants have fewer economic rights than others.”

The American Bankers Association declined to comment on specific institutions’ policies, but said that “strict regulatory requirements” aimed at deterring illicit activities justify requests for personal information. “Banks of all sizes are required to collect a range of information about their customers to comply with the Bank Secrecy Act of 1970 and ‘Know Your Customer’ standards,” says spokesperson Blair Bernstein. “Since 9/11, these strict regulatory requirements have steadily expanded.”

A pending class-action lawsuit filed with the US District Court of Northern California against Wells Fargo claims that the bank refused to accept applications for student loans and credit cards from DACA recipients, which plaintiffs claim is a form of illegal discrimination under California consumer-protection law, as well as a federal civil-rights law originally drafted to protect emancipated slave “aliens.”

This policy is far more subtle than a stark red line on a map, but could result in the same outcome, with a segment of Americans’ being systemically relegated to an underclass. Whether intentionally or not, citizenship questions may well push more immigrants further into the margins.

Illegal immigrants and legal immigrants are not the same.

Wish these and other “confused” terms would not be used interchangably.

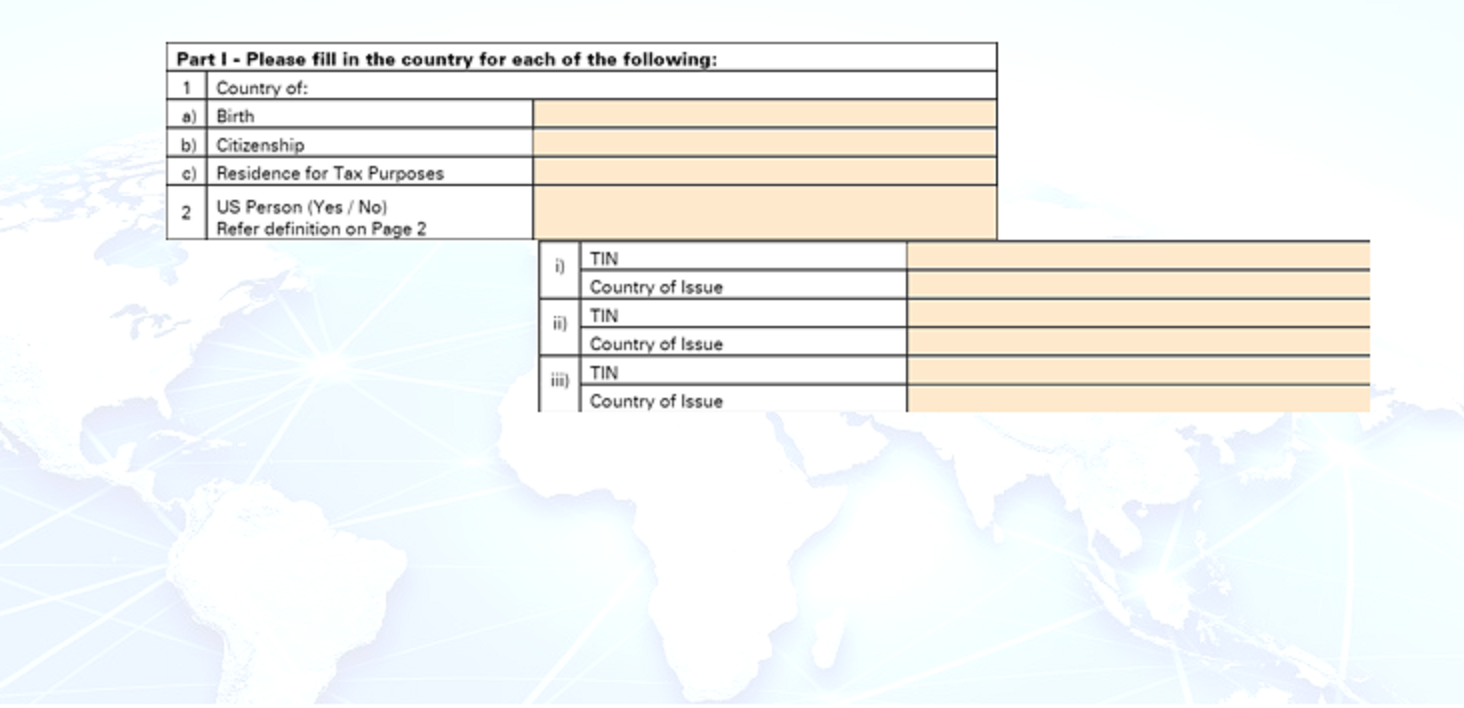

Part I question 1 a) is country of birth. A legitimate use for this is that if the country of birth is US then they’ll ask for a CLN. John McCain’s answer would have to be Panama because the Canal Zone now is part of Panama. An American Samoan’s answer would have to be none, as far as I can tell.

Question 1 b) is citizenship, for which an answer would be zero or more citizenships.

Question 1 c) is residence for tax purposes. An answer could be one or more. I’m not sure if an answer could be zero. A residence for tax purposes doesn’t have to be a country; for example it could be American Samoa or Puerto Rico or Hong Kong.

Question 2 is US person, yes or no. A person born in Puerto Rico wasn’t born in any country, they do have US citizenship unless they renounced, and if they still live in Puerto Rico then the US isn’t their residence for tax purposes, but they are a US person. Does Bank of America know to tax this US person differently from most other US persons?

Next come TINs and countries of issue. Until recently Japan didn’t have TINs. Should I have answered TIN “none”, country of issue “Japan”? Does American Samoa have TINs, so should someone answer TIN whatever, country of issue “none”? If the US issued an ITIN but the ITIN has expired, should it be included in the list?

Does anyone know what laws the BoA is trying to comply with? Does anyone know if compliance is even possible? Does anyone know if the US will penalize BoA for trying to comply?

It’s Bank of America. THey’re complying with laws of China and Saudi, who hold all their shares through shadow companies.

I’ve seen this brought up on a couple of forums and one thing makes me laugh, the complete and utter outrage from the very same people that would absolutely support FATCA. In the case of one poster expressing his absolute disgust, I’ve seen him support both FATCA and citizenship based taxation!

But then again, we know that the whole FATCA/CBT debacle is riddled with hypocrisy from top to bottom on an absolutely epic scale.

Now, let’s see those banks reporting those accounts back to the nation of citizenship, including US duals and watch the outrage explode.

Good.

“Outside the United States, this [collection of citizenship information] is a normal practice. Dozens of countries have agreed to the Common Reporting Standard aimed at combating tax evasion, and began collecting citizenship information as part of that effort in 2017.”

And it was all modeled after **FATCA**, created and dumped on the rest of the world by the **USA.** Pity the author of this article didn’t do a little research on the background of the CRS. The Bank of America is not foisting some evil foreign concept on the good people of the United States; rather, Bank of America customers, particularly those who are immigrants, are reaping the seeds the **US government** itself has sown.

In short: “normal practice”? My eye.

@Muzzled

This is not being perpetrated against all Americans but only immigrants. Nothing to do with tax policy that’s for sure. I don’t see any reference to the info being reported to any tax agency. (IRS)

As sad as it is and as much as we hate it, it is normal practice nowadays. CRS is in full swing and Sept 30 will mark the 4th time FATCA info will be transmitted. (2015, 20016, 20017 + this year).

When I saw this, I was thinking more along the lines of it being discrimination. Similar to the discrimination produced in Canada by the IGA- some Canadians in Canada are still protected by PIPEDA buf not those with US ties/indicia.

Patricia: Absolutely, it’s discrimination. And it is a particular type of discrimination that would not be in existence today if not for FATCA having started the ball rolling in this direction.

And yes, I will grant you that it has *become* “normal practice” but only since the advent of FATCA which has been in force now for a mere four years. I’m not ready to believe that any FATCA-style system with its inherent discrimination is in any way a “normal” way for the banking industry to behave toward its clients.

Same news picked up here

https://www.huffingtonpost.com/entry/bank-of-america-citizenship-question_us_5b88470ae4b0cf7b00339747