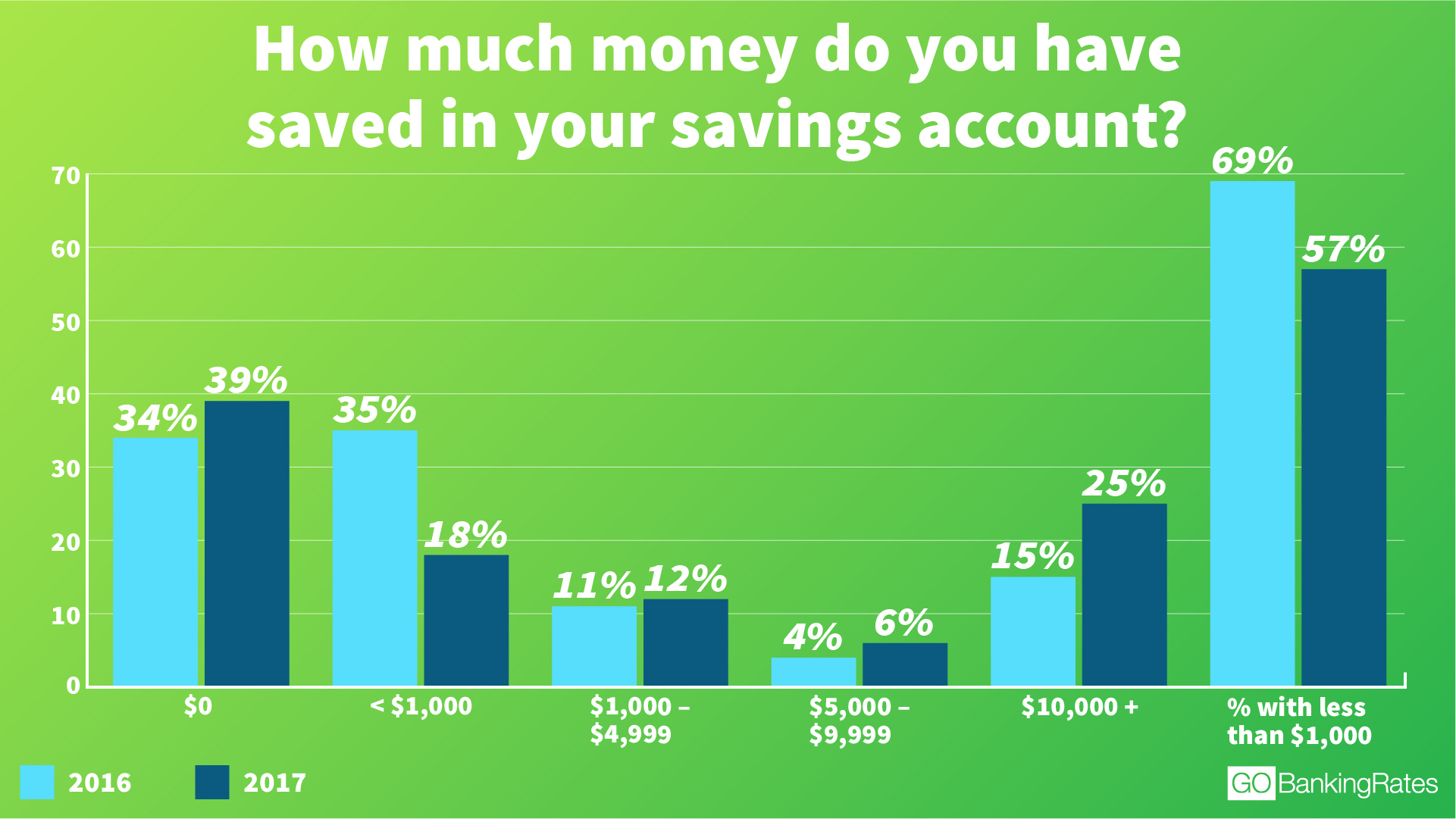

But American Homelanders have little savings. Only 25% of them have more than $10,000 saved. Perhaps that’s why the fraudulent aggregate FBAR limit remains $10,000–it’s more money than 75% of Americans have in savings.

What is more, their Social Security System is a Ponzi scheme that has not invested in anything except worthless government debt — i.e., there is no money in it–just the obligation of the Federal government to collect even more taxes to pay the recipients of Social Security.

So you’ve saved your money, but neither the people nor the politicians in the USA have saved theirs.

What effect will this have on Citizenship Based Taxation and FATCA? The majority of Homelanders have not one bit of sympathy for you and how the US government is persecuting you. As Roger Conklin said, “The tail wags the cow.”

THERE IS AT LEAST ONE HOMELANDER WHO CARES WHAT HAPPENS TO EVERY CITIZEN.

You quoted Roger Conklin.. roger was a 60 year friend of mine and he passed away about 2 yrs ago. A wise man who is sorely missed by all who knew him.

He and I were always friends of the expats.

“American Homelanders have little savings.”

Aren’t they all hiding their savings in foreign accounts?

Roger Conklin passed away a couple of years ago but his wisdom is with us in his writings. He lived a big part of his life abroad and had to come home and close a good business because of double taxation where up to 88% of his intake went to the Government of Brazil and the Government of the U.S.A.

The Income tax is the culprit. The constitution prohibited it until the Marxists took over the U.S and got it amended to let them take our income and ruin the U.S. economy.

Our congress must act to pass the FairTax and disband the IRS so we can again have a good life here and abroad.

Agreed but it never going to happen. Control over that nassive ampunt of money and debt is the source of power of all in the government. They would prefer being skinned alive that giving up that power.

I was listening to a financial podcast a while back (can’t find it anymore) and they were interviewing a Wharton Business School professor whose research interest is payday lending. She referenced an annual Federal Reserve survey the most recent of which says that “Forty-six percent of adults say they either could not cover an emergency expense costing $400, or would cover it by selling something or borrowing money” (p. 9 – https://www.federalreserve.gov/2015-report-economic-well-being-us-households-201605.pdf). According to this same Fed survey (p. 10) “Thirty-one percent of non-retired respondents report that they have no retirement savings or pension at all, including 27 percent of non-retired respondents age 60 or older.”

She also said that the number of payday lenders exceeds the combined total of McDonalds and Starbucks in the US. This factoid is all the more staggering when you consider, she said, that payday lenders are banned in 30% of states. A large subsection of US residents are forced to pay the proportionally very high charges because they can’t afford to wait the 3 business days for the check to clear.

It’s hard to believe, but, the world’s most prosperous country has nearly 50% of adults with less than $400 instant access savings and nearly a third with ZERO retirement savings or pension. These individual facts don’t seem to reconcile with the overall picture that (p. 9) “sixty-nine percent of adults report that they are either “living comfortably” or “doing okay””.

Only hard to believe for those who have not lived there for a very, very long time. Those of us who are more recent ‘evacuees’ are not at all surprised,

USA appears to be all but bankrupt, both financially and morally. These survey findings are not news to me at all. The USA is now grasping for cash from around the globe, a sign of it’s own financial and moral status.

The argument for the repeal of FATCA and the adoption of RBT are absolutely sound, both should be done as soon as possible.

The trouble is, it’s like having a sound argument for their being no god at a bible bashers prayer meeting.

I know many are hanging on hoping this monstrosity gets thrown in a bin marked “really stupid ideas” but I do hope they have a plan B, because it’s going to be a brave Politician who is going to defend exempting wealthy expats from taxes to the US public.

The only difference between the US and Greece is that Greece, being a member of the EU can not print money to cover it’s debts.

The major difference between the US and Greece is that the US is the only country in the world that can print the world reserve currency to cover its debts. If or when the US dollar ceases to be the world reserve currency the US will turn into a super-sized Greece very quickly. The Chinese (and others) are working hard toward that end.

The other point that is lost in all of this, of course, is the fact that it is pretty difficult to survive, let alone save, if you happen to be working on the minimum wage. Maslow’s hierarchy of needs comes into play for a significant portion of the US population.

Well, Maslow’s heirarchy of needs doesn’t just affect the US population only. There are expats who are struggling to make ends meet and are still expected to foot the bill for US indigents.

Sorry but my cup of “give a shit” ran out a long time ago. The US can choke on its own exceptionalism.

I know where you are coming from, Animal. I understand your anger. I think all of us here do.

8 years after getting involved in this I frankly hold ill will toward the USA and it’s residents. I tried hard not to feel that way, but I just do. If they go down the toilet then CBT and FATCA will almost certainly be a big part of it, and I’m afraid I will take pleasure in the suffering of that incredibly stupid bully known as the USA.

Oh I know, many residents would not support CBT and the hounding of US persons all over the globe, but most DO.

Just as they only have themselves to blame for their pathetic export performance in a global market place, they only have themselves to blame as the world moves slowly but surely to minimise US exposure and exposure to the dollar.

Heck, I have even played my small part in that, I have no US investments any more, I won’t buy any US products, goods or services and I certainly will not be going there and spending money again.

The only fly in that ointment is my wife just got a job with a US company, but here’s the thing – They wanted an American over here to do it, but they decided that it was too expensive and the tax issues were a problem. Well, yea! It was cheaper to hire my wife, and fly her out to the USA for three weeks training, then send her back here.

One six figure salary less for an American, one more Brit happy to take it.

Way to go USA, you dumb asses.

@ Mike

Isn’t that what’s called “cutting off your nose to spite your face”? THIS is the sort of story that would make the American exceptionals pause for thought … I think.

Well, on one hand, this would make Americans less sympathetic to the plight of rich expat “thousandaires.” On the other hand, it makes the renunciation fee look even more ridiculous. (It would be nice to know what percentage have more than USD 2,350. Going by all this,maybe 20 percent?)

@ maz57

“The major difference between the US and Greece is that the US is the only country in the world that can print the world reserve currency to cover its debts. If or when the US dollar ceases to be the world reserve currency the US will turn into a super-sized Greece very quickly. The Chinese (and others) are working hard toward that end.”

Great point. Politicians in the US know this. Which is why they will continue to do everything to shift the blame upon us for the mess they created.

@ EmBee

“@ Mike

Isn’t that what’s called “cutting off your nose to spite your face”? THIS is the sort of story that would make the American exceptionals pause for thought … I think.”

Doubt it will, so very few Homelanders have such jobs and if they went overseas to take one, they become “the other” just as we are.

@ Zla’od

“Well, on one hand, this would make Americans less sympathetic to the plight of rich expat “thousandaires.” On the other hand, it makes the renunciation fee look even more ridiculous. (It would be nice to know what percentage have more than USD 2,350. Going by all this,maybe 20 percent?)”

Ridiculous it has always been, but to the homelander mind set, the fact the we are ‘avoiding our responsibility’ to the himeland is more rediculous.

Mike took the words right out of my mouth. I won’t even attend a professional conference in the USA, because I don’t want a penny of mine to be spent there.

And to think: I used to be that American at expat gatherings who would shut up other nationalities (mostly Brits, Aussies, and French) who would sneer out loud at the USA. Now they sneer at me for bad-mouthing Saint Barack, whom they all worship.

Way to go, USA. Rah rah rah.

Can someone tell me why I am suddenly no longer getting email notifications of my comments? I’ve checked all the right boxes and filled in all the right fields.

I’m not getting notices either.

My wife’s new company have sent her a present from the USA. I bristled when I saw where it had come from. I know, silly, but I hate that place with a vengeance.

I think the most important thing that everyone is forgetting that their is only one real reason why people would expatriate. It is too avoid taxes obviously. Why else on earth would anyone leave the greatest nation that currently exists, has ever existed and will ever exist. It is only rich people who are trying their best to avoid paying their fair share. Bunch of nogoodnicks.

Just incase anyone is reading this I am being 100% sarcastic with the above statement. There are plenty reason why one might leave.

Cheers,

krackerjack121

Another example why snitch laws like #FATCA #CRS are evil

Check out @DanielJHannan’s Tweet: https://twitter.com/DanielJHannan/status/884033739310981120?s=09

During 1970s and 1980s people had to get black market US $ to import material like Baking flour and other necessities into Jamaica to keep people alive. Such activity would now be reported under #FATCA and #CRS. These are unjust and evil extra territorial laws. These are Tools for Tyrants.

Here is more saber rattling as posted by the attorney Virginia who posted this as a new update on her blog. https://www.angloinfo.com/blogs/global/us-tax/irs-cid-chief-significant-international-tax-investigations-under-way/

While you are all getting excited about FATCA being repealed and CBT going away I doubt they would let go of anything that is making a penny for them. The best advice given as per the person who started this blog is to renounce and rejoice yoir freedom. The sooner the better. Even people who went into OVDP and streamlined programs are now regretting.