“Republicans Overseas Action releases White Paper on Territorial Tax Reform for Individuals.

Consistent with the proposals being considered for corporate tax reform, worldwide taxation for individuals should be replaced with a territorial system. A territorial system for individuals would:

· Promote the exports of U. S. goods and services;

· Increase the soft power and reach of the U.S.

· Encourage skilled immigration to the U.S.

· Discourage expatriation of U.S. Citizens and encourage repatriation of wealth from overseas

· Eliminate unfair double taxation of U.S. Citizens

· Enhance U.S. national security by removing the sharing of sensitive personal information with unfriendly countries

· Substantially reduce the size and cost of the IRS

We welcome your comments and suggestions. Please email them to Ms. XXX at xxxx for our consideration and addition. We will ask Congress to consider our Territorial Tax Reform proposal for individuals. Happy New Year to all 9 million overseas Americans.”

// // // //

https://www.facebook.com/republicansoverseas/posts/606042006246265

|

www.facebook.com

Republicans Overseas Action releases White Paper on Territorial Tax Reform for Individuals. Consistent with the proposals being considered for corporate…

|

@ Mark Twain

Thanks for posting the entire white paper. This is more readable than what I found at RO FB earlier.

This would still have problems.

First a background comment. For wages and salaries, to determine which country is the source and gets first rights at taxation, and which country is second and must provide a foreign tax credit for taxes accrued or paid to the source country, the source country is the one where the person performs the labour. So for example when a US company paid half my salary and a Canadian company paid half my salary but I worked 3 weeks in the US and 1 week in Canada, the US was the source country for 3 weeks and Canada was the source country for 1 week, for salary from both payers.

Now, Republicans Overseas wants to make wages and salaries from US companies taxable when paid to workers serving outside the US. If Chang is a Chinese in China, a US company could tell Chang “We offer 2,000 euro for this work” and a French company could say “we offer 1,800 euro for the same work” and Chang would do her work for the French company.

Similarly, since Republicans Overseas wants to remove treaty reductions on dividends and interest, they want all non resident aliens to dispose of their US treasury bonds immediately. Neither China nor any other country will be America’s banker any more. Boom — oops no. Bust!

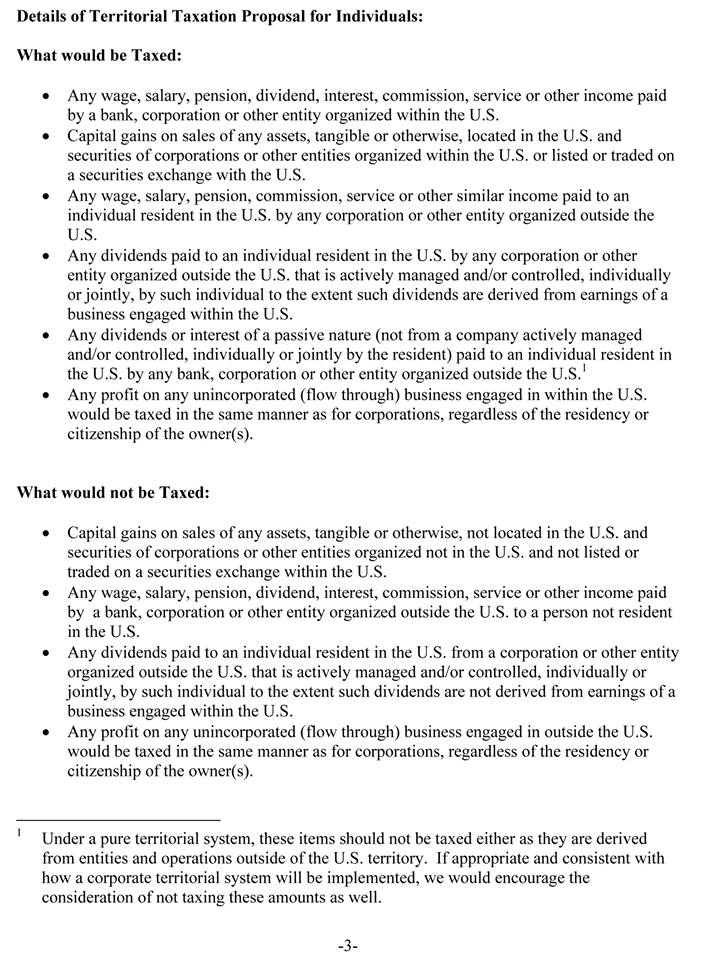

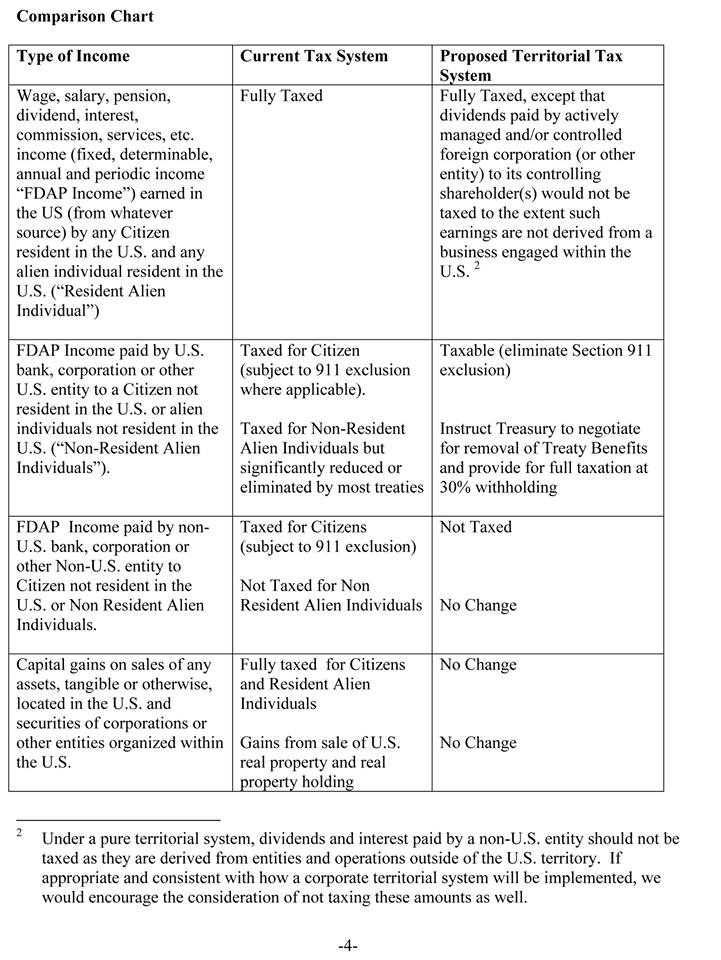

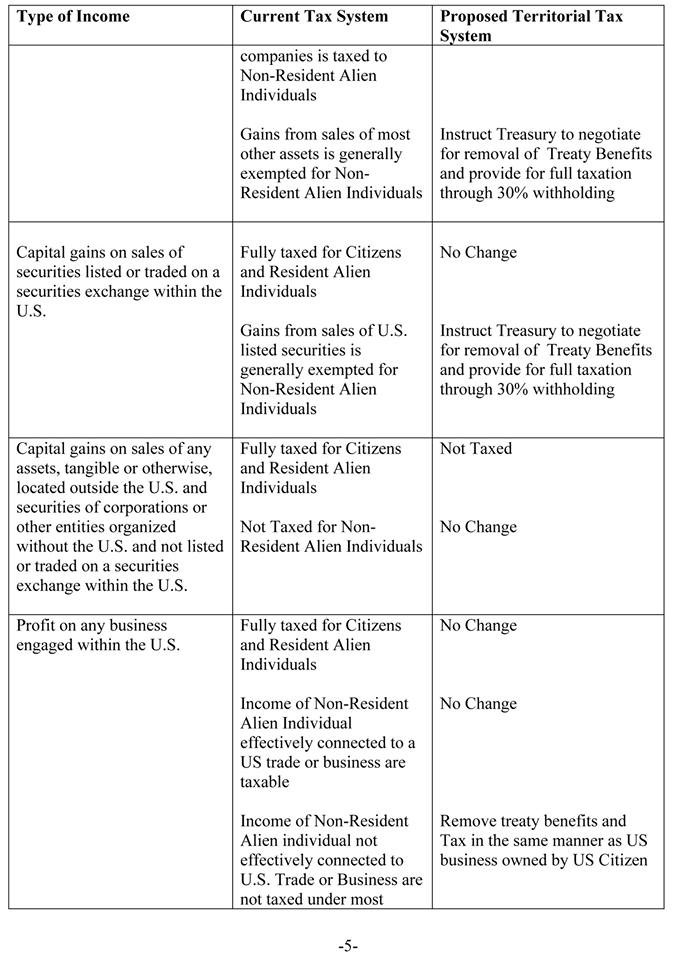

This proposes a new tax of 30% on interest and another new tax of 30% on capital gains for non-resident aliens who make inward investments into the US. Also a lot of trampling of existing tax treaties to remove any last vestige of benefit for dividends.

The US had better hope that it has absolutely no need for foreign investors in its markets and can survive purely on domestic investment, then. Because if enacted as written this would drive every last drop of foreign investment out of the US.

You really have to marvel at the lack of logic that went into parts of this “thinking”.

@Watcher those provisions are a major concern. Enforcing the capital gain tax in particular will be difficult. Presumably gains will be computed in USD, which will not correspond to the economic gain computed in the investor’s home currency. Plus, many international fund managers will hedge the currency risk inherent in USD denominated investment, leading to the potential of having a taxable capital and not being able to offset it with an economically related hedging loss.

Besides the obvious effect you’ve pointed out (that it will make US capital markets very unattractive), it saddles non-resident US investors with all of the unjust and illogical problems that nonresident US citizens are trying to rid themselves of.

To top it all off, the 30% tax rate exceeds the long term capital gains tax rate in the US and many other countries.

@Karen, just bonkers, isn’t it?

I noted with wry amusement that whoever wrote this proposal felt it necessary to state explicitly that no US tax would be levied on US non-resident aliens who receive non-US interest from non-US banks or non-US capital gains on non-US assets.

The mindset here seems to be that the 95% of so of the world’s population that has no connection whatsoever to the US is merely inhabiting some US tax “loophole”, granted to them entirely out of congressional largesse and withdrawable at any time.

I had an accountant that adamately claimed that U.S. had first dibs on interest payments of non-resident US citizens. First dibs on non-US interest payments and first dibs on US interest payments. He claimed that I should be demanding tax credits to my country of residence for all interest paid to the local government.

@MarkT

Proof positive of the KoolAid plus incompetence….Yikes!

I hope that with tweaking this proposal can provide a basis for something we can present to Tax Reform Committee members.

I understand the problem for anyone outside the US who wants to invest in that country but the US does create that interest and those gains so if it was something more reasonable than a whoppin’ 30% withholding would that help? I’m not an investor. If I were I would invest only in Canada. For me, the whole CBT/FATCA/FBAR thing was primarily about not wanting to support the US with made-in-Canada income or provide it with private information that even Canada does not demand from me (yet). I realize though that perhaps most Brockers have stronger ties to the USA than me. This white paper still looks good to me but I’m open to all observations as to wherein lies its problems. The intricacies of investments is something I have to leave to those who get it but I don’t think this can be made perfect for everyone’s situation. Right now I’ll just say TTR is way better than SCE (Same Country Exemption).

@EmBee

The current rules already tax interest and dividends paid by US companies to nonresident aliens. If there’s no tax treaty, then the payer withholds 30%. If there is a tax treaty, then the tax withheld is less as specified in the treaty, often 10% on interest and 15% on dividends. The US must amend the treaties to achieve 30% across the board, which will increase the tax paid by US residents on foreign interest and dividends to 30% as well.

The real problem with this proposal, though, is asserting the right to tax capital gains on US security transactions. As Watcher said, bonkers!

@EmBee

“The real problem with this proposal, though, is asserting the right to tax capital gains on US security transactions. As Watcher said, bonkers!”

To amplify a little why this is bonkers, suppose the US did unilaterally decide to levy a 30% capital gains tax on share disposals by non-resident aliens. Aside from all the logistical problems — measuring the actual gains, allowing offsetting losses, enforcement issues, and so on — the first thing to happen would be that other countries would have to allow tax credits for US tax paid, leading them to levy capital gains taxes of their own on US (and other) investors who make a capital gain in these non-US markets. And the US would now have to allow its own residents a credit for this against their US taxes.

Where investment flows are roughly matched and/or tax rates approximately equivalent this is simply a zero-sum game; what the US gains in tax on capital gains realised in US stocks by foreigners, it loses on the US tax credit it has to allow US taxpayers for non-US capital gains taxes levied by other countries.

And where not, it can be a losing situation for the US. A credit against US capital gains tax is of no use to an investor living in one of the many countries that does not have a capital gains tax at all (and the number is greater than you think; besides the obvious such as the middle east, quite a few OECD countries have no capital gains tax — some use a small wealth tax as a surrogate). These investors will simply avoid US stocks, and take their money elsewhere. US stock values fall to compensate.

@ Karen

Thanks. Ah, it’s US securities then. Nothing about the US makes me feel secure.

@ Watcher

Thanks. So it’s US securities AND the ever-present complexity of filing in two countries. I’ll try but it will be hard to shed too many tears if US stocks “fall to compensate”. Would these problems be enough to chuck RO’s proposed TTR in the trash can or can tweaking save it from that fate?

@EmBee

Although schadenfreude can be a very satisfying emotion, in practice if US stocks fall then so does much else. As the saying goes, “When the US sneezes the world catches a cold.” In any case, the US isn’t likely to adopt this policy precisely because its effects would benefit nobody and only make everyone’s lives worse. It’s a lose-lose outcome. A sort of financial ‘mutually assured destruction’.

Can tweaking save this proposal? My best guess is that these tax-the-evil-foreigners clauses were added as a naive attempt to ‘pay for’ the other stuff that congress might see as giveaways. It is well known that congress is always keen to levy taxes on non-voters, so who better than the eternal ATM that is non-resident aliens? The problem is that these non-resident aliens can, in this case, very readily pick up their ball and leave the field. In which case these taxes would entirely destroy the revenue stream they intended to tap.

And then, who knows what other countries might demand of the US when a whole heap of treaties are all “renegotiated” to apply them wholesale? I doubt they would simply swallow new terms without a decent compensation elsewhere. Treaty negotiations take years, and most are negotiated at the rate of around once per generation. Of course, the US could simply renege on all of them, but that seems unlikely given that it clearly has similar amounts of disdain for both foreigners and its own citizens living abroad.

On further reflection I guess the point can be made more succinctly: If there was any money to be had out of taxing foreigners on their US capital gains, the US would already be doing it.

@ Wathcer

Okay, maybe a shade of schadenfreude but truthfully I’d rather it was honest commerce which made the world go around rather than the stock market which looks like a gambling casino to me. I can accept the reality of it but I don’t have to like it. At least with TTR people CAN pick up their ball and leave. They are not entrapped by a citizenship which is difficult and costly to shake loose. If they choose to play by the new rules the field is still theirs. If they choose not to, they can play elsewhere. There seems to be less coercion involved with TTR than there is with CBT. However, I imagine as soon as it’s realized that the US won’t get its usual and expected “we score all the points, you get none” the TTR will be toast.

“This proposes a new tax of 30% on interest and another new tax of 30% on capital gains for non-resident aliens who make inward investments into the US.”

The 30% tax on interest is old, but usually reduced by tax treaties. The 30% tax on capital gains might be new but I’m not sure.

“if enacted as written this would drive every last drop of foreign investment out of the US”

Yes, what did you think I meant by ‘Neither China nor any other country will be America’s banker any more. Boom — oops no. Bust!’

“Presumably gains will be computed in USD, which will not correspond to the economic gain computed in the investor’s home currency.”

Yes but that’s not a new problem (except that it will be new for some non resident aliens of the US). Those of us idiots who used to try to be compliant had to convert US gains and losses to Canadian for our Canadian returns, convert Canadian gains and losses to the US for our US returns, and do impossible calculations on Form 1116.

“I understand the problem for anyone outside the US who wants to invest in that country but the US does create that interest and those gains so if it was something more reasonable than a whoppin’ 30% withholding would that help?”

If they would let tax treaties remain in place then they’d still be able to attract investment from residents of treaty countries.

Though now I wonder. The US doesn’t have a tax treaty with China. Why in the world is China willing to hold so much US treasury debt?

[Tax treaties]

“Of course, the US could simply renege on all of them, but that seems unlikely given that it clearly has similar amounts of disdain for both foreigners and its own citizens living abroad.”

http://isaacbrocksociety.ca/2012/06/12/the-last-in-time-rule-makes-tax-treaties-with-the-united-states-essentially-worthless/

@NormanDiamond

“The 30% tax on interest is old, but usually reduced by tax treaties. The 30% tax on capital gains might be new but I’m not sure.”

The US currently does not tax most types of interest on any non-resident aliens, treaty or not, so this would be entirely new. (It also explains why China is currently happy to hold US treasury bonds, any why it could be… um… less happy if this goes through — in which case I’d expect a carve-out for treasury bonds and sovereign wealth funds as the only way to save face.)

Capital gains on most things, including shares, are also not taxed currently. Capital gains on a few things are taxed though, the most notable being real estate gains which, for non-resident aliens, is treated as ordinary income and so taxed far more heavily than it would be for a US citizen.

“Yes, what did you think I meant by ‘Neither China nor any other country will be America’s banker any more. Boom — oops no. Bust!’

Exactly. You said it first. More pithily, too.

In 2016 withholding was taken from interest from some US payers but not from others. In 2015 it was none. Some time previously it had been all. I didn’t know the reason for the fluctuations. The reason wasn’t visible in treaties.

Yes the proposal to do it to capital gains is new.

@Norman Diamond, The US does have a tax treaty with China. And as Watcher wrote, the exemption on most types of interest is available to nonresident aliens of any country, with or without a treaty.

“The US does have a tax treaty with China.”

Yes I see it there. I can’t find the page that I looked at a few days ago.

On the question of taxing capital gains of NRA’s India is renegoting it’s tax treaties right now to permit as such.