Given the trend of governments requiring their citizens and residents to report nearly everything (even Russia has now begun to require duals to register their 2nd citizenship), it’s amazing no one has come forth with a requirement to file a SpouseBar. Think of the normal approach the U.S. takes to anything foreign. “Alien.” Most countries have more benign terms in use for their non-citizen residents. “Permanent resident.” “Landed immigrant.” “Alien”- as if there were no similarities between an American and a human being that just happens to be from another country. “Foreigners” – being seen as some form of animal, wild, untamable, unworthy of freely mixing with the Homelanders but somehow, needing to be contained. And what are the three aspects the US always takes toward something foreign?

- First, the US hates anything FOREIGN.

- Second, the US hates anything regarding DEFERRAL.(Remember, “if you see the word foreign, the word penalty, is sure to follow”

- Third, the US hates LEAKAGE (for anything to get outside the US tax system)

After all, without a reporting requirement, that door undoubtedly opens far and wide to tax evasion. And certainly, the richer a couple is, the greater the risk of not meeting that noble goal of “paying ones fair share.”

The citizens of no other country have that privilege. Understand these disclosures are necessary to preserve freedoms of #Americansabroad https://t.co/7DLeRGqFov

— U.S. Citizen Abroad (@USCitizenAbroad) November 24, 2016

Keeping this in mind, President-Elect Trump has finalized the main appointments that will make up his cabinet. We looked at how many FBAR marriages there are currently (and still examining earlier unions). After all, some of these people are among the richest in the world. While there is a disturbing amount of physical abuse (allegedly in some cases) committed on the part of the males, so far we have found two couples that include an “alien spouse.” First of course, is President-Elect Donald J Trump. And then, of course, just as we had TurboTaxTimmy, our new Treasury Secretary may have some

Most expats have come across the issues of the gift and estate taxes, if for no other reason when trying to figure out what the value of an asset is (gift tax) vs how it is to be taxed (estate tax). Then there is the issue of an expat trying to get under the 2 million asset-test by gifting.

Just to remind, the relevant issue here is:

- an annual exclusion amount per donee per year There is no limit on the number of people that can be gifted to. There is no gift tax involved and no need to report

- US citizens and domiciliaries can also “gift split,” allowing married donors to exclude up to twice the annual exclusion amount per donee per year. Gift splitting is not permitted if either spouse is a non-US domiciliary and of course, there is IRS Form 709 to file. After all, we’re still talking about Form Crime

- An unlimited amount can be gifted to a spouse who is a US citizen

- There is an annual exclusion for gifts to non-US citizen spouses

So how will these rules affect our incoming members of the executive branch?

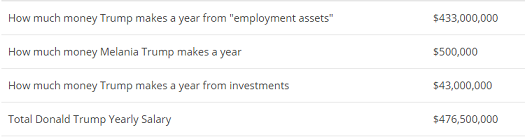

Mr Trump was born on June 14, 1946 making him 70 years old. His annual income is estimated to be $476,000,000.00.

Melania Trump (Melanija Knavs) was born on April 26, 1970 making her 46 years old. A difference of 24 years. Time wise, it is exactly the same gap as if I had married my father. It was impossible to ignore the body language of Mrs. Trump during the Republican Convention in Cleveland last July.

While I like Melania, it is hard not to think that this is a marriage based upon money. Nasty word = “golddigger.”

OTHER BIG TIME GOLD DIGGERS MALE & FEMALE

- Melania Trump came to the United States in 1996

- Met and began dating Donald Trump in 1998

- Received a green card in 2001

- Married DJT in 2005 (but was still an alien spouse)

- Became a U.S. citizen in 2006

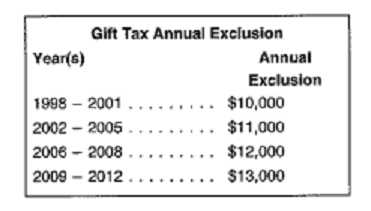

- Years x unmarried; gift to alien 1998-2001 – $10,000 x 4=$40,000

- Years x unmarried; gift to alien 2002-2005 -$11,000 x 4 = $44,000

- Years married to alien presumably, $100,000 =$100,000

- Years x married to US citizen 2006 onwards- unlimited

This means from 1998-2005, DJT could give Melania a total of $184,000 tax-free. Somehow, I seriously doubt she received such a small amount.

So, in addition to not revealing anything about his tax situation (to date) it is not difficult to imagine that he very likely has violations involving the gift tax. How convenient that the appropriate Secretary, Treasury, is also extremely likely to be in this boat and unlikely to do a damn thing about this likely violation.

.@realDonaldTrump wants to hand Steve Mnuchin the keys to @USTreasury – where he can make big banks even richer at the expense of families.

— Elizabeth Warren (@SenWarren) December 16, 2016

The new Treasury Secretary, Steven Terner Mnuchin was born December 21, 1962 and is a former investment banker and hedge fund investor. Mnuchin worked for the investment bank Goldman Sachs for 17 years. After he left the bank in 2002, he worked for and founded a number of hedge funds some of which were connected to George Soros. During the financial crisis, Mnuchin bought failed house lender IndyMac. He rebuilt the bank as chairman and CEO in the subsequent years under the name OneWest Bank.

Mnuchin made money out of the financial crisis by “aggressively [foreclosing] on tens of thousands of families” – according to a Take on Wall Street spokesman – as the CEO of OneWest.

While I read many horror stories of the aggressiveness of OneWest’s foreclosures,

this one boiled my blood:

Two years ago, OneWest filed foreclosure papers on the Lakeland, Florida, home of Ossie Lofton, who had taken a reverse mortgage, a loan that supplies cash to elderly homeowners and doesn’t require monthly payments.

After confusion over insuance coverage, a OneWest subsidiary sent Loften a bil for $423.30. She sent a check for $423. The bank sent another bill, for 30 cents. Lofton, 90 years old, sent a check for 3 cents. In November 2014, the bank foreclosed.

Of course, before becoming Secretary of the Treasury, Mnuchin must appear before the Senate Committee on Finance.Ranking member Ron Wyden (D-OR) said this:

“Given Mr. Mnuchin’s history of profiting off the victims of predatory lending, I look forward to asking him how his Treasury Department would work for Americans who are still waiting for the economic recovery to show up in their communities”

In 2004, he founded RatPac-Dune Entertainment as a side business, which financed a number of notable films, including the X-Men film franchise and Avatar. His business partners were Australian billionaire James Packer (whose gifts to the Netanyahu family are being probed by the Israel Police) and Brett Ratner. A second company, Relativity Media went bankrupt in July 2015; Mnuchin left just beforehand.

Donald Trump named Mnuchin the national finance chairman of his presidential campaign on May 5, 2016. Mnuchin, who later said in an interview he had known Trump “for over fifteen years,” accepted the offer. Prior to this, Mnuchin’s only involvement in politics was donating some $120,000 over a period of 20 years, primarily to Democrats.

Mnuchin will be the 3rd Goldman Sachs alumnus to serve as Treasury Secretary after Robert E. Rubin (Clinton) and Henry M Paulson (George W Bush). In this regard, an amusing caption appeared at zerohedge “Meet The New SwampMaster ~ Same As The Old SwampMaster “

Mr. Mnuchin believes Dodd-Frank to be too complicated; that it prevents banks from lending and considers“stripping it back as the number one priority on the regulatory side.”

Mnuchin has been married twice before and since November 2015, has been engaged to the Scottish actress Louise Linton. Ms Linton was born December 31, 1980, in Edinburgh. She had a privileged upbringing, studying at high-level arts institutions in the UK. In her “in-between year” she went to Zambia, writing

a much-maligned novel “In Congo’s Shadow: One girl’s perilous journey to the heart of Africa”

Karen Attiah, the Washington Post’s Global Opinions Editor, had this to say:

The erasure of the voices and experiences of Africans in stories about Africa, and the constant positioning in media narratives of Africans as background props for do-gooder Westerners, creates fertile ground for lazy thinking, writing and policymaking about Africa. It is dehumanizing, racist — and plain boring.

The only thing missing from the @LouiseLinton story is Tarzan and Mowgli. #Zambia is calling her out! #LintonLies

— Muchemwa Sichone (@WriteRevolt) July 4, 2016

Ms. Linton came to the U.S. in 2000. She graduated with a Bachelor of Arts in journalism from Pepperdine University, followed by a law degree (J.D.). While waiting to obtain her greencard, she graduated from law school in 2012.

She is a founding partner of stormchaserfilms ; Mr. Mnuchin is listed as an executive producer on one of the productions in progress. Which lends the idea that given the age difference of nearly 19 years, Ms. Linton might well find Mr. Mnuchin’s ability to fund her productions a primary reason for the relationship. I cannot help but look at her, then him and wonder…….

During a magazine interview, Linton said that “if she was invisible, she would, “sit with my boyfriend or follow him around and see what his day is like when I’m not with him and see if he talks about me.” One of the primary attributes is said to be having fantasies or a fixation on oneself; rather than be interested in some characteristic about their partner. If I were Mr Mnuchin, I might consider running like hell.

At any rate, even though Mnuchin and Linton have only been together about a year, it is evident that on Ms. Linton’s salary, she certainly has quite a wardrobe, lives with him in his $23-million dollar home in Bel Air. I’d be willing to bet he has spent more than $14,000 on her since they met.

OTOH, for those of us who simply don’t have that kind of money to throw around, there are ways to get rid of some of this tax burden (particularly if one is trying to become “uncovered” before renouncing.

Read up on some of them here

Why not give your non-U.S. spouse as much as you can each year (my understanding is that this is about $148,000).

What if you don’t have a spouse? Why not just go out and get one? Run an ad:

“U.S. person requires spouse of convenience to give $148,000 per year to.”

(Even a U.S. person could find a spouse with this promise.)And finally, although you might have to advertise for the spouse who will accept the $148,000 a year, you won’t have to advertise for the “Gold Digger/Hostile Spouse”. They just happen.

And hey, what about those FBARS?

Yes, the time has clearly come for U.S. citizens to register their “foreign spouses” directly with the IRS. The registration form should also require the person to give a reason for having married an alien in the first place when there are so many “perfectly good” U.S. persons to choose as spouses. The “alien spouse” is simply UnAmerican.

Gold diggers!!! Patricia Moon, I’m shocked! Shocked! Truly great reporting. Drain the swamp and fill it with crocodiles and alligators. ( Generals and Goldman Sachs Billionaires. Shocking!

DoD

You’re scaring me!

Important correction: Mowgli lives in India, not Africa.

Wasn’t part of the plot of that Swiss FATCA murder mystery, that an American character was basically forced to entrust all his money to his wife? I assume she leaves him and then dies, making him the suspect, or something like that.

A number of countries (often with Napoleonic-inspired legal traditions) maintain family registries and therefore DO record spouses. Fun choice-of-laws issues that might come up would be whether to require the US registration of foreign civil partnerships (and registered at what level?), or what to do about polygamous marriages.

@Zla’od

Re: Mowgli – true but that statement is not mine and unless I misunderstand the Tweep, he is pointing out how easy it is for (white) people to not be able to make distinctions regarding people of color (such as India vs Africa). Not unlike what Ms. Linton did in her book……..really gross/erroneous perceptions displayed in her story………..

I did not read the book so don’t know…..

So you mean governments in some countries maintain family registries that would include foreign spouses? I think that in general, most Western/1st world countries would most definitely find that unacceptable. Ja, would be fun to observe the mumbo-jumbo form wrangling they would come up with. LOL

So what about simply changing title on jointly-owned real estate? It seems to be an invisible (to IRS) transaction here in Canada (no tax consequence, so no reporting) to get under the $2M net worth bar?

“Yes, the time has clearly come for U.S. citizens to register their “foreign spouses” directly with the IRS.” – Nope…ain’t gonna happen. This “foreign spouse is pretty much raising both hands, middle fingers in the air saying “No…I’m not registering. End of discussion.”

@theAnimal

The intended tone of “yes it’s time” is snide, snarky, sarcastic. You better believe it is NIT time for folks to continue to let governments stomp all over privacy rights under exaggerated claims of tax evasion and terrorism. The Donald should pay gift tax if he is in violation. Would Milenia have accepted a mere $148k in those early years? Don’t think so…

@aardvark

Actually it is not that simple-imagine that the US person lives in Canada. He/she cannot just take name off the title because that portion represents a gift. If one does not want to pay gift tax/rates, the only option is to gift the $14,000 per year, reduce the % of ownership over time. At Toronto values, that is not enough to take care of a big chunk……It also can, put the other partner at more financial risk if he/she is not the principal earner………

aardvark. That is precisely what a close friend did. Good thing too as house valuations here just went up another 50%.

Patricia Moon. My friend opted to ignore the gift tax . (In part because of the 5 million lifetime exemption.). Apparently the lawyers winked and nodded.

@Patricia Moon. Even if I win the Lotto Max (fat chance of that happening), the only thing that is going to happen is my donating a large chunk of change to the lawsuit, and the rest is going into my personal bank-account which has no connection with my wife where my family will live off the interest. The USG won’t get a single dime out of it. And I will personally fund my wife’s compliance so that she can renounce. I haven’t even recognized my kids as American. They’re as Canadian as poutine and that’s the way they’re staying. ~smirk~ Obama can kiss my ass.

We could stop all the litigation, speculation and hand wringing if we would go back to the constitution as it existed before 1913 when the Marxist’s among us, sent by the would be revolutionary’s in Russia to destroy the Capitalist system. Repeal the 16th amendment to the constitution by doing exactly what the Marxist’s did to get it past”LYE” about your intent, as they did to get the greedy proletariat, haters of the rich, to push for the passage in order to stop Capitalists from raising the middle class to the rich class by sucking a larger and larger portion of their money and using it for their enrichment.

The FairTax would stop all the nonsense that the Marxist’s, who actually run the U.S. Government, have wrought and guarantee prosperity to a population the politicians use to get and keep power. When FairTax proponent Mike Huckabee refused a cabinet spot, I knew TRUMP would not embrace the only fair taxing system proposed since the Marxist’s took over here in the U.S.A.

The EXPATS can look in the mirror if they want to know who is to blame for their tax mess. Not once have I seen in the Isaac Brock blog, a reference to the FairTax which is the real answer to their prayers. Perhaps the founders and those who keep this blog going are also Marxist and want to destroy the middle class and keep them from getting rich. Keep on not mentioning the real solution and verify my thoughts that you don’t want a real lasting solution.

Set up and automatic mail system whereby a letter is sent to every member of congress every day seven days a week asking them to pass the FairTax. Do it in the name of several thousand expats. The cost would be real but expats would get relief when the congressmen and women got tired of all the mail. They only react, they never just act.

@Wilton J Tidwell

Your comment is completely unacceptable, rude and surprising, given how long you have participated in this blog. You are a Homelander. How dare you suggest that this situation is our fault. You sir, never respect the request that comments stick to the subject. You use our blog to endlessly promote your own agenda about the Fair Tax. We are not Americans and don’t care one bit about which tax system the U.S. uses. None of them work for us.

I am tired of you coming on my posts with this nonsense. If you cannot respect the topic of a post at least keep it to yourself. Otherwise your behaviour as a troll will be dealt with as such.

@Wilton J Tidwell, “the EXPATS can look in the mirror if they want to know who is to blame for their tax mess.”

I had given ALL to my former country when I left the United States a decade ago and I left in peace asking solely to never be bothered again. Instead the USA has become the “psychotic former girlfriend for decades ago” that decides to pop back into not only your life but that of your family.

I left asking nothing other than LEAVE ME ALONE.

I owe NOTHING to the people of the United States, my children owe the United States nothing.

On these very boards I give a great deal of slack to the Republican Party and President Elect Trump, I do this because of the real harm caused me and my family by the Democrats and at least for the moment the Republicans have promised in writing to help.

The problem is clearly visible when expats look into the REAR View mirror.

@Wilton J Tidwell, I told you before when you first came on this forum, that the internal tax affairs of the United States does not interest expats in the slightest. Expatriates do not use US infrastructure, nor do they receive ANY benefits for the taxes that they receive. FairTax does not resolve a damned thing about the filing requirements or paying penalties that the US has instituted with regards to IRS taxation of expatriates.

As Patricia Moon said, YOU are a HOMELANDER and you should be tooting your FAIRTAX to people who give a damn about internal tax affairs which is your FELLOW HOMELANDERS! The only tax solution that will solve expatriate problems (just so you know…IBS is an EXPAT site) is complete and total repeal of FATCA and the complete dissolution of Citizenship Based Taxation. FairTax in combination with Citizenship Based Taxation (which is currently the state of your IRS regulations) does NOTHING to solve EXPATRIATE tax problems and seeks to siphon just as much if not more out of the expatriate community. The only way FairTax will work for any expatriate is if Citizenship Based Taxation was repealed and Residence Based Taxation imposed.

As a foreign-citizen spouse of a US expatriate, I do not want MY account information in the hands of the IRS, and I steadfastly refuse to cooperate with the IRS in any way shape or form. My children were born in THIS country; not the United States and have never received ANY support whatsoever from the United States or its government, yet the US seeks to claim them as their own to siphon taxes out of them. It is a solid plus on my wife’s decision to not sign them up for US citizenship to keep those venomous leeches of the US Government from claiming them as tax-paying US citizens. And I refuse to allow the United States to claim them. We will live our lives the way we choose; expecting nothing and wanting nothing from the United States.

And frankly any Homelander who feels that “expat problems are their own making” is nothing but a THIEF! You benefit from expatriate taxation through the benefits that you receive and the infrastructure that you use derived from expatriate taxation of money earned abroad by expatriates who live abroad. To take money from expatriates and blame the victim for the injustices heaped upon them is the ultimate mark of a HOMELANDER THIEF.

As many have said, BEGONE!

@ The_Animal

Too harsh. William J Tidwell means well. I think the Fair Tax would solve expat problems, providing the USA in the transition to this system releases expats from all previous unfiled and/or incorrect tax and FBAR filings. IOW, sets them free, completely and retroactively. Unfortunately I don’t think they would do this. They are too anal-retentive and vindictive.

As long as the United States does Citizenship Based Taxation; any form of FairTax will STILL include taxation of expatriates. It doesn’t free expats or solve ANY expat problems. You are still on the hook for State Taxes which can determine whether or not they intend to continue levying income taxes. FairTax only eliminates federal income taxes. Then you are on the hook still for state taxes especially if you were formerly living in SC or California who are absolute sticklers about finding you if they feel you owe State taxes. So no, FairTax implementation on the federal level doesn’t help in any case.

@EmBee

Too harsh. I wonder! The real problem is the broad scope of what is defined as a expat in today’s world. It may run from a temp contract in Dubai to a Quebecker from Stanstead passing just one day in Vermont hospital maternity and doesn’ t speak one word of english.

There are those of us , past residents of the US ,of one stripe or another,who don’t care about the internal workings south of

us,be it FairTax or ShmareTax , who long ago disengaged themselves from their citzenship.WE ARE NOT US CITZENS ABROAD.

The animal speaks with a bitter heart and doesn’t need to be patted on the head.

@Mr Tidwell

I don’t how you define a Marxist.but the Democrats are very far from being Marxist. Be they Republican or be they Democrat they ALL work for the same boss,WALL STREET.

My simple understanding of the Fair Tax was that the federal income tax would be replaced by a federal sales tax. If you aren’t living in the USA then you have nothing to file with the IRS and nothing to pay the US Treasury … until you visit the USA and then you pay the sales tax on any goods (perhaps services too?) you buy while you are there. For anyone who doesn’t visit the USA it sounds like it would work out about the same as switching to RBT. US residents however might find aspects of this tax scheme quite problematic. I’m not saying what the USA should or should not do about this. I just don’t mind (as others do) that WJT brings this possibility up now and then. I found this article which lays out the pros and cons of the Fair Tax.

http://www.moneycrashers.com/fair-tax-act-explained-pros-cons/

Anyway my focus still remains on my government’s idiotic decision to allow a US law to become a law of Canada. No nation should cede it’s sovereignty to another nation like we did with FATCA.

“Anyway my focus still remains on my government’s idiotic decision to allow a US law to become a law of Canada. No nation should cede it’s sovereignty to another nation like we did with FATCA.”

In my bitterness (as Robert Ross has said), I haven’t lost sight of the fact that my country (Canada) has ceded sovereignty to a foreign nation with FATCA. But it has also ceded sovereignty on many occasions with other self-defeating legislation. We have a weak government and had voted out an even WEAKER government. We elect career politicians who know nothing other than to pander to big business interests who couldn’t care about the state of this country.

But in that regards, even though the canaries in the coal mine have cried out, it has fallen on deaf ears. There are smarter choices however people aren’t willing to take a chance on other political parties. Even though we say that we are a country of many political parties, we, like the United States, still only elect between the two political parties that hold any weight. Like the United States it is one or the other. IF you don’t elect the Liberals, it is a win for the Progressive Conservatives and vice versa, ad infinitum, ad nauseum. And each has shown its stripes as far as national sovereignty is concerned. Both are willing to sell out the country in terms of political gain. And yet, we as sheep voters elect to vote for them.

So what does that say about the voters?

My understanding is that Chrystia Freeland’s husband Graham Bowley(Freeland is a Liberal MP and cabinet minister) commutes to New York City during the week from Toronto to his job at the New York Times. This of course creates all sorts of weird tax and immigration consequences that I would be interested to see what the Canadian and American governments think of. Freeland’s husband notably is British not US or Canadian.

https://twitter.com/graham_bowley?lang=en

Even better from Trish’s point of view it looks like he flies PORTER Airlines from Toronto to NYC out of the Island Airport.

Not that I support harassing your MP but they seem to be regulars at Rose & Sons in Toronto.

http://www.roseandsons.ca/

@ The_Animal

I can’t disagree with what you’ve just said. You know I completely empathize with you and your family and I hope you realize that I’m still in their system. I self-exited but because I didn’t exit according to their rules I’m still a “catch” — if they can. It always comes back to there’s no way I’m going to feed their system information or pay penalties. I’m the limp body on the pavement at a protest … I won’t move a muscle to help them drag me away … and I’ve got lead bars in my pockets. I’ve also got an ace up my sleeve … old age. By the time they make their move on me, I’ll probably be outta here. I hope.

At least with FairTax that would be a de facto switch (but not retroactively for taxes already owed) to RBT; or more accurately “PPBT” – “Physical Presence Based Taxation” (since even visitors in the US who consume taxable goods/services would have to pay).

It’s very nice to be educated about the benefits of a FairTax for the expats but it seems that this ,as always, is beholden to the whims of the US. There seems to be more US sourced material here and therefore more hope that they will ,in their “devine wisdom”, fix the problems for non-HLers.

What about here (Canada),and not the US. Where are the politicians,the entrepreneurs, especially those with personal or business ties to the US. Are they sleeping or in hiding ? Why don’t we hear their suggestions,complaints. Of course,I forget,after all,they are rich and can write all of it off,on the taxpayer’s dime.

We do have a spineless government and you can bet that Mr Trump will chew Justin up before he can puff on his next joint.