Donna-Lane Nelson is a co-plaintiff with me in the Republicans Overseas U.S. FATCA/IGA/FBAR lawsuit.

The July 14, 2015 Complaint states that: “…Fearing that she would eventually not be able to bank in the country where she lived, she [Donna-Lane] decided to relinquish her U.S. citizenship. She did so on December 11, 2011 at the U.S. Consulate in Bern, Switzerland. The decision to relinquish her U.S. citizenship was not easy, but ultimately she felt that she had to choose between having the ability to access local financial services where she lived or be a U.S. citizen…”

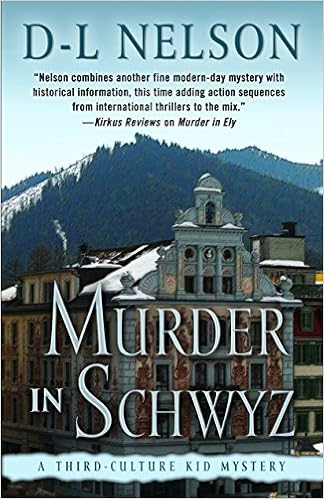

Donna-Lane, a novelist, has published a murder mystery (“Murder in Schwyz“) which includes a description of the harm caused by FATCA:

“…At home, Brett’s marriage is in deep trouble, but he doesn’t want a divorce. He wants the best for his two daughters and he is also trapped because Swiss banks are closing the accounts of Americans. He has put every asset in his Swiss wife’s name. A divorce will leave him with nothing.”

A novel that includes FATCA harm is, I think, a first.

Now — Eric in Switzerland (see complete response below in comments) tells us about the Switzerland FATCA Fact:

“It might be a novel but it sure isn’t fiction.

I could write a short book myself about lives turned upside down here in Switzerland. My elderly parents (American father/ Swiss mother) had their account shut down for a time by UBS. My American sister who only lived in the US until she was eight years old and her successful French husband went through FATCA hell in Geneva until she renounced out of desperation on their lawyer’s advice. FATCA wanted her French husband to cough up “back taxes” for the sin of sharing an account with his American wife…but you guys know all this.

I’ve had friends lose their house mortage, credit card accounts etc. I know an American couple who lived and prospered here since 1972 and were forced to sell everything and retire in the US although they had prepared for years to retire in Switzerland. FATCA made that Swiss retirement totally impossible. They spent a small fortune trying before just giving up…

“The US used the carrot and the stick to force the IGA signing but really, in the end, all there was was the stick. The Swiss know this and they are very bitter.

I had lunch with my half-brother about two months ago. He is a very honest, wealthy, clever and hard working businessman based in Geneva. He’s mainly into real estate. He owns a dozen apartment buildings, restaurants, a tourist hotel near the Cornavin train station and who knows what else. He has never lived or worked in the US. He just turned seventy last July. So we were having lunch and he told me that he deeply resented having to fill out a new form for his bank stating that he had no dealings with any Americans in the form of partners,investors, etc. He told me that he called up his bank and said “what is this bullshit”!?. They just told him (politely of course) to fill it out and sign it or we’ll have to suspend all your banking activities until you do. They also said, again very politely, don’t get pissed at us and change banks because there’s no escape. All Swiss banks are doing this.

You can multiply this outrage by every single business account holder in Switzerland.

Oh congratulations Chuck Schumer D/NY. Oh job well done Charlie Rangel D/NY. Sterling idea there Carl Levin (ret.) D/MI. And finally, bravo mister president Barack Hussein Obama, you thick c%ç*. You have successfully pissed off the entire international business world and have made them puke at the very idea of getting an American “person” even remotely involved with their enterprise in any way, shape or form. Brilliant, just f&%*ing brilliant!

I am a proud US Navy veteran. I volunteered in 1974. The Navy launched my career in aviation maintenance which eventually took me all the way to working for Swissair. It makes me so sad to say that I never thought I would harbor so much hatred for my own country. It makes me cry to think that short sighted and insatiable greed has replaced every noble principle that America was originally founded on.”

They should be putting out a kindle version. I see some used copies show up.

@ Barbara and Norman,

Sorry your comments went to moderation, which they should not have. In the past few days, the software has automatically blocked a few other comments. They came from different people and, as with yours, were blocked for no apparent reason (fortunately they were able to post other comments after that without problem). We’re not sure why this happened and we’re trying to find out and fix it. We appreciate your commenting and hope you don’t have any more problems doing so.

@Pacifica777: Norman and I have in common that we live in East Asia. Perhaps the software is trying to hold back the tide of Asian hordes. It’s happened to me countless times before: my e-mails blocked as spam, purely because they originated in Hong Kong at the time (the blocking agency–of course in the USA, where else?–actually cited this as the reason). Maybe now Trump is behind it: “Stop Asian electrons sneaking into our Internet!”

@Donna-Lane: I’m not an author, though I’ve designed some books for people. What kind of publisher in their right mind wouldn’t release paperbacks? Especially of thriller novels? Sounds like you need a new publisher, or to join the parade of self-publishers.

They have published 11 of my novels but I am looking for a new publisher. Getting published is much harder than writing a book.

@ Barbara,

No, Asian hordes (and all other continents’) are welcome here 🙂 The malfunction nabbed a comment from the UK and a few Canadian ones in addition to yours and Norman’s. Some good news, we have the glitch fixed now. Apologies to you and all who were inconvenienced by it.

@ Norman Diamond & Barbara

This has happened before to me. Glitches appear now and then but our super admins always manage to overcome ’em.

RE: Donna-Lane’s new novel — big Western YAHOO! The ongoing FATCA F-up saga will now reach a broader readership. This is really exciting because people sometimes just pass over articles without reading, no matter how worthy and well-written they are. Some people read (more likely skim) articles but obviously do not comprehend, as is evident by their comments. Even though I’ve spent thousands of hours reading about this, I”m always most drawn to the personal experiences … like when Donna-Lane became the woman who vomited after her renunciation. Now she is the woman who wrote the first novel to shine a light on FATCA. We’re so blessed to have talented people on our side.

PM of Trinidad and Tobago peddling FATCA for nearly a one hour news conference.

He’s desperately trying to get FATCA passed. He warns everyone on the islands will pay 30% more for everything if the US applies the withholding.

Thanks. I laughed when I read that I’ve become the woman who vomited. When I met my new landlady who is a dual, we were talking and all of a sudden she said,”Oh, you’re the woman who vomited.” Or maybe I’m the writer who vomited.

We are all in this fight together.

“I laughed when I read that I’ve become the woman who vomited.”

Have you met George Bush? He vomited on the prime minister when he visited Japan.

I remember. Maybe we can form a club.

What the US is doing to its citizens is beyond nauseating. Our heads should be spinning a la “The Exorcist”.

While FATCA can be difficult, keep in mind that other countries through the DAC (in the EU) and CRS (in the countries) are requiring many of the same things now for there citizens. All governments are looking for money and claiming that rich people are hiding it overseas in secret accounts is an easy win politically. Expats are just collateral damage in this

@Room 237 “…are requiring many of the same things now for there citizens.”

Do you mean “for their residents”? There’s a bit of a difference.

Room 237,

Collateral damage is to expats from the US who are resident in other countries but still tax resident in the US because the US taxes on citizenship, unlike other countries who tax according to citizenship and will be held to reciprocity with CRS. (Eritrea also has CBT rather than RBT, the other outlier as the USA). Are you a US expat living abroad and affected by FATCA?

Imagine…

You’ve lived almost your whole life in the country you live now. Your father was a Dutch citizen and worked temporarily in the USA for the Dutch government. You were born in the USA but moved as a baby or toddler to the Netherlands. Your father is Dutch and consequently you are too. Because you were born in the States you are also an American citizen.

You attended school in The Netherlands and you know everything about Dutch history and speak Dutch (hard wired). Later on you learn English although the skill level will never approach the Dutch control of the language.

For more than half a century (55 years) you are living in Holland. You left the USA when Kennedy was being elected.

You paid taxes during 41 years in Holland. A country known for having the highest tax rate in the world (almost 70% of all the money ends up in the Dutch tax office). This is not the case for Walmart or Starbucks in Holland, they pay 2 or 3 percent in taxes?

Therefore it has been difficult to save money for the elderly day. Meanwhile you are sixty one years old and close to retiring.

All of a sudden several bank accounts are refused or denied it is difficult to find a bank that accepts a so called US Persons, renewal of your mortgage seems impossible, investing in a capital management fund is also refused. You are supposed to fill in a so called TIN number?? And after some investigation you discover that you are supposed to file taxes in the USA. Absolutely a surprise! Especially since the American Consulate has had your home address for ages. Why were you never informed? More than eight million Europeans where surprised by this unknown tax law that only two countries in the world follow, which means that you are tax accountable even if you don’t live in the concerning country and have no possessions in that country and never used or will use any benefits. The USA is one of them it turned out. A complete shocker.

NOW you have to file taxes over a period of many years. The tax rules are completely different. Supposedly one is not obliged to pay double for the same tax sort. But some taxes are different and the risk is that you pass the threshold and have to pay again. For decades you have been saving for a house in order to sell it just before retiring. One of the few things that are tax-free in Holland. Not in the USA it seems where capital gain costs money.

Because America is far away the prices of US Accountants are sky high and because it now turns out that you must file taxes also in the USA this burden will repeat year after year until the day you die.

Although you are very fond of the USA it should be better to give up your American citizenship for practical and financial reasons. Almost impossible! All of a sudden the Renunciation form to apply cost a lot (minimal of $ 2.350,-). Social Security number and birth certificates are not available in Holland which you need to proceed. The enforced statement of an American lawyer is also expensive. All to gather it cost you many months and a lot of money (20.000 euro’s is not an exception). However; new surprise: you have to be up-to-date with filing your taxes – in the current situation this will take many years.

It seems all very unfair considering you have been seriously law-abiding your whole life. Dutch law because you have no choice and also the country and place you grew up, attended school, found your partner, worked for years. Even if you would decide to go live in the USA it will be difficult to bring a long your wife and children; they do not even have Green cards and have different rules to follow.

Please think about it: in between two countries, the danger of no bank account, mortgage, and losing life savings at risk. For what real reason?

I apologize for my bad English. Dutch would have been much easier.

Thanks,

A FATCA victim

@Francois

By not mentioning the possibility of being subject to the S. 877A Exit Tax on renunciation you are minimizing the effects of this. It is FAR WORSE than you are actually describing.

But, your comment is very good. What it really demonstrates is that U.S. citizenship is nothing more than a modern day form of slavery.

“it now turns out that you must file taxes also in the USA this burden will repeat year after year until the day you die.”

As you know, this particular thread discusses a novel, i.e. a work of fiction. So I am greatfully relieved to find, among your recitation of true and sad facts, this tiny bit of fiction: “until the day you die.”

(The burden of US taxable persons doesn’t end when they die.)

Hi François – I had a similar shock last year when I, too, learned for the first time that US citizens have to file tax returns even if they haven’t lived in the US for decades or have never lived in the US.

The good news is that so far there have been no reports of law-abiding dual citizens like you and (until I renounced) me actually being pursued by the US. It seems their powers of enforcement are limited, if a person has no US assets or income.

I renounced as fast as I could (in Amsterdam, actually 🙂 I found the IRS forms and the treaty so confusing and contfradictory that in the end I decided I probably didn’t need to file. I did file one form, confirming that I had renounced and didn’t owe any tax and hadn’t owed any tax for five years. I got my CLN, and now I am once again able to open bank accounts.

Everyone’s situation is different but I hope my experience is useful to you. Good luck!

@Francois

Welcome to Brock.

If you decide to renounce as a dual citizen from birth you should be exempt from the exit tax if you received citizenship of both the U.S. and some other country at birth, if you continue to hold the citizenship of that country, if you are taxed as a resident of that country, AND if you have been a resident of the U.S. for no more than 10 of the 15 years prior to renouncing U.S. citizenship, you’re exempted from the exit tax provision..

This would mean you having to submit 5 years of back returns plus a partial year for the year in which you renounce to avoid becoming a ‘covered expatriate’ along with an explanation that you had no knowledge of needing to file.

You could however chose to renounce to obtain a CLN for the banks and do nothing else as long as you do not have any US income or assets and never wish to take the risk of visiting the USA again.

Read carefully before making a decision.

http://www.renunciationguide.com/

@Francois, it might be useful to send your comments to MEP Sophie in’t Veld, who has taken an interest in FATCA and associated issues as imposed on the EU and ‘Accidental Americans’ who are Dutch and EU citizens, is well versed in the problems, and has been doggedly persistent in asking pointed questions in the EU Parliament over a number of years now. She also initiated a lawsuit against the US re data protection and privacy issues, and is concerned about US demands for EU data (ex. http://www.washingtonpost.com/wp-dyn/content/article/2008/06/30/AR2008063001895.html ), so is very concerned about US domination and encroachment on EU rights and laws.

Ex.

http://www.europarl.europa.eu/sides/getDoc.do?pubRef=-//EP//TEXT+WQ+E-2016-005680+0+DOC+XML+V0//EN

https://twitter.com/sophieintveld/status/777080742010650624

See also;

http://isaacbrocksociety.ca/?s=in%27t+veld

For more background, try this search;

“in’t veld” AND “united states”

Apologies, as I am only an anglophone, my links and searches are only in English.

Francois. Children born in the USA whose parent was a diplomat are not US citizens. This is the only exception. If your father was a diplomat , you are home free. If he wasn’t tell your bank he was. Think very long and very hard before entering the US tax system. None of their programs are meant for accidental Americans.

@Francois– I am a Canadian living in Canada where it is possible to hide my American place of birth from my bank and not get FATCAd. If I were in your shoes, I think I would find a new bank which does not demand production of an identity document with place of birth listed. I would also not voluntarily disclose my place of birth. Barring that option, I think I would (under duress only) buy a CLN from the Embassy to show to my bank. I would then skip the whole tax filing thing and show the IRS my middle finger. $2350USD is extortion enough. This would definitely be my second option– I would resent paying them the $2350.