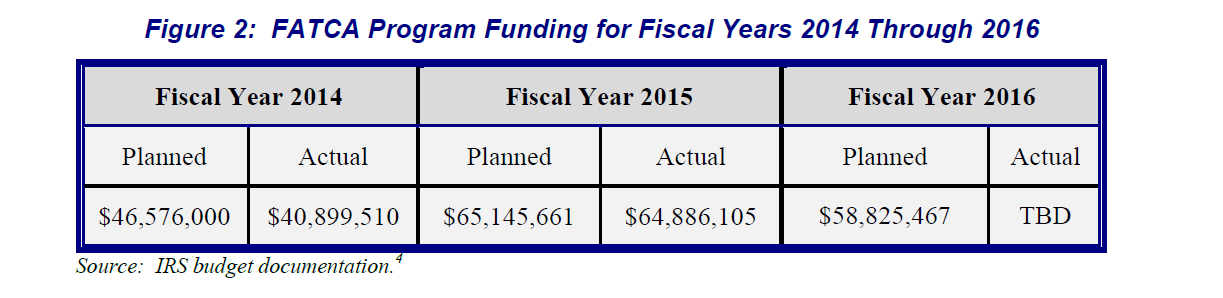

The United States Government uses, on average, $54 million per year to locate its expat U.S. citizens and their assets in the bizarre government expat-locator program called FATCA.

FATCA, the Foreign Account Tax Compliance Act, was designed to locate 9 million U.S. citizens residing overseas and their assets.

Indeed, there is also a quantity of U.S. citizens who have savings and investments overseas, and also a U.S. immigrant population whose assets might remain in their country of origin. However, the greatest population of persons sought in the FATCA program are the 9 million U.S. expats. With respect to the 9 million, those quantities are nearly negligible, and it is quite accurate to say that the population that FATCA seeks to locate is approximately the 9 million U.S. expats. And the Obama rollout of FATCA pointed out that it was Americans overseas that were the object of FATCA.

$54 million / 9 million = $6 of costs to locate each of the U.S. citizens overseas.

Q: What value does America put on its expats? A: 6 bucks a piece. #FATCA

Is it true that “they” are looking for former U.S. citizens, i.e. ex-pats? How are they doing it, and what happens if they find a person who didn’t do all the legal and financial acrobatics required?

(expatriates. Rather than ex-“Patriots”)

@Banc de l’Asteroide:

$6 per head for the USG. I wonder how much more it costs US “partners” (eg– the Canadian government, CRA, and Canadian banks as an example) per head to feed it to the US?

And the cost per ex-pat targetted in renunciation fees, accounting fees, consulate travel costs, extortion charges (US taxes), missed days at work to travel to the consulate, etc?

too easy

https://en.wikipedia.org/wiki/Foreign_Account_Tax_Compliance_Act#Implementation_cost

@Arlene Hansen

“Is it true that “they” are looking for former U.S. citizens, i.e. ex-pats?”

If you are new here, welcome to Isaac Brock. The US government and IRS are looking for anyone with lingering US citizenship or US taint even though these expats no longer live in the US. This was even happening somewhat before FATCA. Now the hunt is intensified. Many countries have intergovernmental agreements with the USA regarding FATCA. Under these IGAs, foreign banks report to their home country`s tax authority which in turn report to the IRS. Financial information is thus handed over to the IRS on “US Persons“ abroad.

As to “what happens if they find a person who didn’t do all the legal and financial acrobatics required?“ we shall see. I suspect threatening letters from the IRS may eventually be sent to expats.

You can find tons of additional information at this site. I hope others will come in with more info for you.

And when you get such letter?

http://www.birdtricks.com/blog/the-best-liner-to-use-in-your-parrots-cage/

These letters are also useful for cat lovers as litter pan liners.

Yet we are charged thousands of dollars to renounce and get a CLN. They put an excessive value on that!

Here is an example I read just last night: “One Man’s Painful Journey to Renouncing Citizenship”. A dual citizen had attended an American university, then taught English in Asia for 7 years, and returned to the land where his family had lived for generations, only to find out he could not open a bank account. He wonders what to do. Ultimately he shells out the $2350 for a CLN which he is supposed to receive in 3-5 months time, only to wait and wait while they delay and delay. He asks if the excessive delay could be “a final, spiteful, parting middle finger in your face from the US government?”

Exactly.

This man’s story was posted last night on zerohedge. Be aware that the comments below zerohedge articles tend to show more profanity and stupidity than civility and intelligence. It is what it is.

http://www.zerohedge.com/news/2016-09-22/un-becoming-american-one-mans-painful-journey-renouncing-citizenship

The Aussies would joke about the English being £10 POMs because that was the cost to get to Australia on the passenger liners.

$6 Yanks ? $6 USSs (US Slaves) ?

This doesn’t tell the whole story of what US expats are “worth”.

What’s the latest scientific figure pulled out of Robert Stack’s sphincter…$100 billion in “lost tax revenues abroad”? Divide that by 9 million, and we’re each accountable for $11,111 in unpaid taxes. To be liable for $11,111 in taxes, assuming a median tax rate of 25%, one needs to earn roughly (allowing for the $108,800 FEIE and the standard deduction of $6300): $160,000 gross income. That means every last man, woman and child outside the benighted Homeland, and tainted with the American retrovirus, is hiding $160,000 in ill-begotten income in shady foreign dealings (all foreign dealings being by definition shady).

So, cost to catch us cunning thieves: 6 bucks. Income received: $11,111.

That’s a 185,000 percent return on investment. Wow, the US government is smart! No wonder they do such a good job keeping their financial house in order!

Nothing coss the government only 6 bucks. If a politicians sees anything that cheap he or she puts another relative on the payroll to study why the cost is so low.

http://www.accountingtoday.com/news/tax-practice/irs-spent-15-million-on-flawed-fatca-system-rollout-79339-1.html

IRS Spent $15 Million on Flawed FATCA System Rollout

Washington, D.C. (September 22, 2016)

By Michael Cohn

“……….The Internal Revenue Service spent $15 million on a delayed implementation of an upgraded system for handling an aspect of the Foreign Account Tax and Compliance Act, but the software did not deliver the expected business results, according to a new report.”……….

Report here;

https://www.treasury.gov/tigta/auditreports/2016reports/201620077fr.pdf

#FATCA The Loser: Costs the World $100 billion: Transparent Calculations

http://isaacbrocksociety.ca/2016/02/12/fatca-the-loser-costs-the-world-100-billion-transparent-calculations/

“also a U.S. immigrant population whose assets might remain in their country of origin”

I bet they outnumber the US’s diaspora. Canada isn’t the only non-US country; there are quite a lot, and a lot of them are worse than the US, so I bet there are more than 9 million such people.

But still what does it matter. The US makes other countries pay the expenses of tracking down people with US taint, including immigrants to the US.

While there is some tax that Uncle Sam gets from Americans abroad, the elephant in the room is the taxed owed by appreciation of the principle residence, which is taxable in USA but not Canada. For example of what might be owed to the USA, say one million expats in the big cities (mainly Vancouver and Toronto) own their houses, and that their residences appreciated by one million dollars since 2000. If we subtract off the $500,000 gains exemption, the remaining $500,000 taxed at about 25%, about $100,000 per residence. For all one million expats, that is about $10 billion. This is money that is lost from Canada forever with no benefit to Canadians. This loss though assumes that tainted Americans actually declare that they sold their house to Uncle Sam — a related issue is that FATCA allows large financial transactions, such as selling a house, to be detected, making the prospect of the enforcement of this rule easier and scarier.

@Barbara

That figure comes from the IRS assuming that Americans who don’t file are similar to those who do, but lots of people don’t file because they think that the FEIE exempts them. The people who file are disproportionately the high earners in my experience.

“The people who file are disproportionately the high earners in my experience.”

Low earners file if they’re idiots (like me) or if they have US withholding that should be refunded (like me).

Form 1040’s instructions even say that if a US payer deducted non resident tax due to the Form 1040 filer’s address, the withholding can be declared on Form 1040. The IRS refunded my withholding in most years. The exceptions were years when IRS employees, likely including Monica Hernandez, embezzled my withholding.