UPDATE – June 14, 2016

The following items were kindly provided by Allison Christians; sources for this paper:

Questions Submitted

NB: notice 3 different dates for when the house was aware of the IGA exemption to tabling policy

Reposted with permission of the author

WHILE PARLIAMENT SLEEPS: TAX TREATY PRACTICE IN CANADA

Allison Christians*

10 J. PARL. & POLITICAL L. 15 (2016).

ABSTRACT

ABSTRACT

Canada’s Parliament plays little but a perfunctory role in the adoption of tax treaties, even though these agreements have significant impact on Parliamentary autonomy over core national budgetary matters as well as core legal and administrative functions. This article argues that Canada’s tax treaty process reflects a studied and intentional preference against public engagement in international fiscal policy, and that this stance has a negative impact on the rule of law. The article demonstrates the governance issue posed by lack of meaningful Parliamentary oversight using a recent departure from stated treaty policy, namely, the passage of a controversial agreement to implement the Foreign Account Tax Compliance Act (FATCA), an aggressive and extra-territorial regulatory regime imposed on Canadian financial institutions by the United States. The article examines the implications of Canada’s approach to this and other tax-related agreements and concludes that a much more engaged and informed Parliament is vitally necessary to achieve integrity in Canada’s treaty process.

INTRODUCTION

Tax treaties are the means by which nations share the revenues generated by cross-border business and investment activities. By ceding jurisdiction to tax certain kinds of income according to international norms, tax treaties constrain legislators’ autonomy in setting national tax policy. Because Canada’s ratification process involves adopting tax treaties as domestic law, these agreements also create access to administrative and judicial procedures in Canada, and thereby introduce international legal processes and principles in the interpretation of domestic tax law provisions. We might therefore expect that Parliamentarians would pay close attention to the tax treaties that come before them. Yet, Parliament plays little but a perfunctory role, mechanically passing tax treaties with virtually no scrutiny even as these instruments have gradually expanded in scope and arguably shifted in purpose.

What explains Parliament’s minimal input on tax treaties despite the significant role they play in national tax policy? A plausible answer seems to be a settled history of foreign affairs being the sole prerogative of the Crown, coupled with a treaty policy that prioritizes procedural expediency in Parliament over the messy politics involved in greater deliberation. Applied to a technically complex area like taxation, the desire for expediency— and likely an unspoken but rational desire for those in power to conduct foreign affairs without impediment—may encourage successive governments to navigate tax treaties quickly through Parliament despite occasional pledges to align treaty-making processes with principles of democratic participation in lawmaking, and established processes that would facilitate such participation.

Taking the position that tax treaties have significant impact on Parliamentary autonomy over core national budgetary matters as well as core legal and administrative functions, this article argues that Canada’s tax treaty process reflects an unstated preference against public engagement in international fiscal policy, with a negative impact on the rule of law. It first documents recent tax treaty processes in the context of the broad precepts associated with the treaty power, drawing attention to deviations from established precedents and stated policies. It then demonstrates the governance issue posed by lack of Parliamentary participation using a recent and significant departure from stated treaty policy. Finally, it argues that following established treaty procedures could be a marginally more appropriate approach to tax treaty policy, at least to the extent it would reintroduce democratically legitimate legislative constraints on the executive even while preserving the Crown’s treaty-making prerogative. However, as the article concludes, a much more engaged and informed Parliament is vitally necessary to achieve integrity in Canada’s treaty process.

PARLIAMENTARY CONSIDERATION OF TAX TREATIES IN CANADA

Over the past fifteen years, Parliament has adopted legislation implementing 32 international tax agreements1 without a single standing vote occurring in the House of Commons at any point in the legislative process. These 32 agreements collectively form over 750 pages of binding law in Canada, none of which was considered for more than two sittings at any stage of consideration in either the House or Senate. 2 This is the reality of recent tax treaty practice in the Canadian Parliament.

These treaties, part of a larger network of tax agreements Canada has developed with 94 countries,3 constitute a significant body of law that commands a great deal of resources to develop, to administer, and to defend against misinterpretation by individuals, firms, and other governments. This is a body of law that impacts business and investment decisions, the Canadian economy, and individuals in their personal lives, even if largely invisible to the general public.4

Despite the importance and significance of Canada’s tax appear to view the process by which treaty-based tax law emerges as a tertiary issue of little or no practical consequence. For most, the relevant point for discussion is the content of the legislation as enacted, and not how the legislation came to be. The indifference of scholars and practitioners appears matched by a more generalized public indifference: after all, it is perhaps difficult to imagine tax treaty debates garnering much focused attention from non-tax experts, or that any would-be Parliamentarian dreams of participating in committee consideration of the finer points of determining the primary tax residence of a company organized in one place and managed in another. Yet the process by which policy and ideas become rules and standards bear directly on the substantive content of law.

Parliamentary interest in treaty-based tax lawmaking seems particularly warranted since tax treaties bind the nation and its future lawmakers not only with respect to past promises, but also with respect to future international legal processes.’ These include binding arbitration procedures and third-party involvement in the settling of disputes.6 They also include the consideration of foreign law and even “soft law” principles in the application of Canadian tax law to international business and investment activities carried out in Canada.’ Accordingly, lawmakers and law observers alike might appropriately concern themselves with the ‘routine proceeding’ of Parliamentary enactment of tax treaty implementing legislation.

A. THE TREATY PREROGATIVE

Lawmakers may view themselves as removed from the treaty power because treaty-making in Canada is one of a number of “royal prerogative powers” historically vested in the sovereign by the Queen.8 The sovereign, for these purposes, means the “crown in right” of Canada.9 The Queen has delegated this right to the Governor General as her representative in Canada,10 and the Governor General exercises this power on the advice of ministers.11 The Minister of Foreign Affairs assumes the primary responsibility in giving this advice, which in practice means that the Minister of Foreign Affairs is primarily responsible for concluding treaties on Canada’s behalf. 12 The succession of authorities and silence in constitutional law suggests that the Executive can act alone to bind Canada internationally, without any involvement of the Parliament.13

However, treaties are not generally considered to be self-executing in Canada, to the extent that they would require a change in the domestic law in order to be implemented.14 As a result, the Executive may negotiate, sign, and even ratify15 treaties without consulting Parliament, but the Parliament (or provincial legislatures) generally must act before a treaty can be implemented, depending on the authority to regulate conferred upon each under the Canadian constitution.16 This status quo appears to have resulted in a fairly uneasy sharing of power, as demonstrated by the adoption and abandonment of official procedures over the years, and confirmed by a growing volume of scholarly writing on the subject.

B. RECENT PRACTICE: 37TH PARLIAMENT TO THE PRESENT

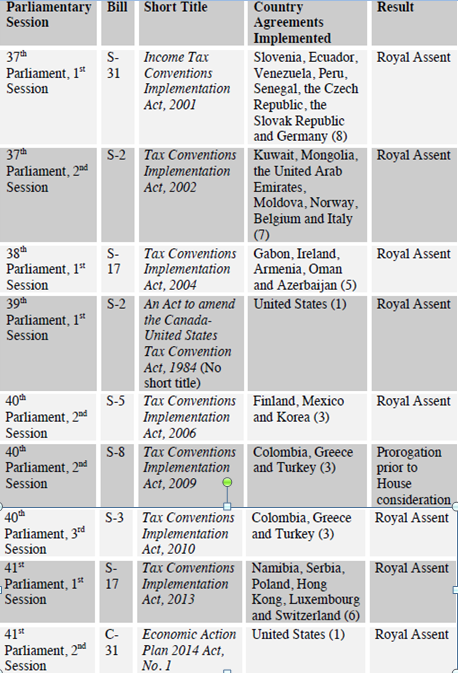

Since 2001, Parliament has debated nine pieces of government legislation implementing tax treaties and tax agreements with 33 countries as described in the following table.

Table 1: Tax Treaty Implementing Legislation (37th Parliament – Present)

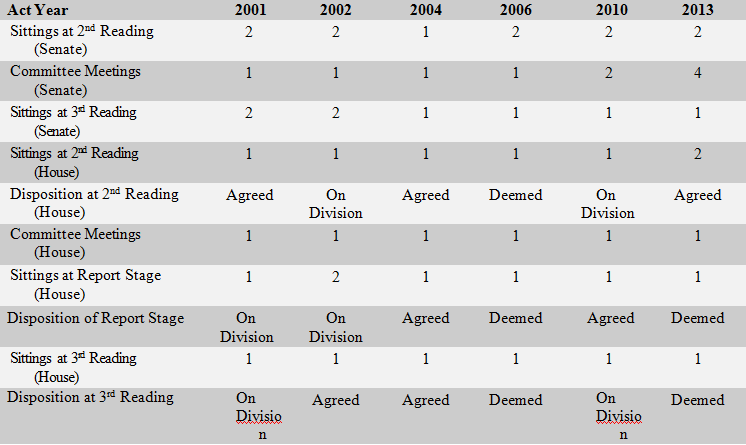

The general parliamentary practice with respect to tax treaty legislation is for a Government bill to be introduced in the Senate to implement tax conventions with several countries, and for a short title to be assigned reflecting the year in which the bill was introduced.17 The notable exceptions to this practice are the two legislative vehicles implementing tax agreements with the United States, which are discussed further in Part II. With respect to the six above-described Tax Conventions Implementation Acts to receive Royal Assent since 2001, another set of data illustrates Parliamentary practice:

Table 2: Parliamentary Consideration of Tax Convention Implementation Acts (sittings per stage)

The above chart yields a few observations about Canada’s tax treaty practice. For example, at no stage of House debate on any of these bills was there a recorded division – that is, where Members are called to stand in their places as votes are tallied.18 Moreover, in no case did House Committee consideration exceed one meeting, and only in recent years did the Senate Committee on Banking, Trade and Commerce hold more than one meeting on any of these bills.

Significantly, two of these bills were ‘deemed’ to have completed multiple steps in the legislative process, with the Tax Conventions Implementation Act, 2006 only debated once in the House before being “deemed read a second time, deemed referred to a Committee of the Whole, deemed considered in Committee of the Whole, deemed reported without amendment, deemed concurred in at report stage and deemed read a third time and passed.”19 The Tax Conventions Implementation Act, 2013 was deemed to have completed both Report Stage and 3rd Reading as part of a larger unanimous consent motion to adjourn the House for the summer recess.20

When Parliament deems procedures to have occurred, bills can speed through the legislative process, but Parliamentary and public input is minimized. There is no official policy regarding the government’s position with respect to such input, but the acceleration of process suggests that the views of Parliamentarians as well as the public (outside of those directly consulted in the negotiation stage by the relevant Minister) are unsolicited at least, and arguably unwanted.

Of course, the speeding through of legislation requires majority will, if not unanimous consent of the legislature. Yet, agreement to speed legislation may not always reflect perfect accord with its contents. Three of the convention acts described in the above table had at least one stage of debate terminate “on division”, which occurs when parliamentarians do not wish to conduct a traditional vote but at the same time do not wish unanimous passage. How can this seeming expression of discontent be reconciled with a lack of greater effort to alter these bills?

One answer is that parliamentarians are induced to acquiesce if they feel that their options to change the content of a bill are limited, either procedurally or politically. In some cases the concern may be even more practical. The mere timing of a tax treaty, for example if proposed right before summer recess, may serve as a deterrent to scrutiny. In the context of a majority government likely to succeed on virtually any legislation regardless of opposition, having an entire party remain in Ottawa longer would amount to an effort as quixotic as it would be unpopular, and likely undone by the invocation of time allocation.21

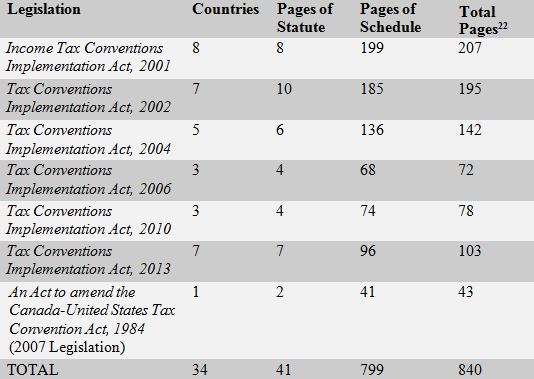

C. STRUCTURE OF LEGISLATION

In tax treaty implementing legislation, the bulk of the law is the agreement itself, which is normally contained in a schedule to the bill. The respective page counts demonstrate this phenomenon, as documented in the following table.

Table 3: Structure of Tax Conventions Implementation Acts (2001-present)

While generally Canada negotiates its tax treaties from a model convention promulgated by the Organisation for Economic Cooperation and

Development (OECD), each treaty contains some degree of variation owing to particulars negotiated by the Minister or delegated official.23 Thus not all the tax agreements described above seek the same sorts of changes. For instance, the 2013 legislation – which has fewer average pages of agreement per country yet received more committee study in the Senate than any of the other Tax Conventions bills – focused in large part on information sharing agreements rather than the elimination of double taxation.

The placement of the negotiated agreements in the schedule of the legislation implicates procedural limitations on amendment that restrict Parliament’s ability to modify a treaty short of rejecting it all together (an extreme position). As O’Brien and Bosc explain in House of Commons Procedure and Practice, schedules to legislation cannot be amended by Parliament when they contain agreements; only the text of the legislation itself may be amended.24 Parliament might amend the legislation in such a way as to render some part of a negotiated agreement ineffective, but the overall effect of including text in schedules is to restrict amendment.

Thus, beyond the potential for indifference as to the subject matter, procedural limitations might help explain why none of the Tax Conventions bills were reported from committee with amendment, nor had Report Stage amendments proposed in the House, even when referral to committee was on division.25 It is not clear to what extent procedural limitations on amending power are related to the amount of debate devoted to a bill at each stage, nor whether this impacts on the holding of recorded divisions at different stages in the legislative process. Certainly if something has quickly passed through the chamber and arrives in committee with one day for study, parliamentarians may have not had adequate time to consider the matter and prepare thoughtful amendments.

One study “estimate[s] that roughly 40 per cent of federal statutes implement international rules in whole or in part.”26 However, it is difficult to know what percentage of legislation implements bilateral agreements as opposed to other matters. In other words, while changes to domestic legislation can and do reflect obligations under international agreements, it is not always necessary to include the agreement in a schedule to the legislation. Indeed, these are cases where only certain articles of a convention are included in the schedule to implementing legislation.27 By nature, tax treaty implementing legislation require the full text of the associated agreement to be included as a schedule to the legislation.

D. COMPARISON TO SIMILAR AGREEMENTS

Parliament’s apparently minimal involvement in tax agreements might be compared with its relatively more active participation in bilateral agreements involving free trade. Free Trade Agreements (FTAs) also contain tax rules in the sense that they undertake reductions in border taxes on exchanged goods, but they go further in regulating terms of trade with partner jurisdictions (and typically carve out most other tax-related measures from their scope). Like tax agreements, FTAs are often technically complex and difficult for non-experts to analyze. Yet Parliament seems much less reluctant to spend time deliberating FTAs than it does tax conventions.

In the period observed (37th Parliament to the present), FTA bills implementing bilateral agreements contained more amendable provisions and shorter agreements (mostly tariff rates) than tax treaty implementation acts. When compared to the practice associated with Tax Convention Acts, FTA debates occur at more sittings per stage and see more amendment attempts. FTA legislation also differs procedurally from income tax implementing legislation in that FTA implementation acts are introduced in the House first, before moving to the Senate.

An example is illustrative. The House debated the Canada– Panama Economic Growth and Prosperity Act (41st Parliament, 1st Session) over a total of nine sittings at Second Reading alone. This is more debate than the House undertook with respect to all of the Tax Conventions Acts from 2001 to the present, combined. Members sought numerous committee amendments to the Canada-Panama deal over the course of four sessions.28

Similarly, the Canada-Colombia Free Trade Agreement Implementation Act (40th Parliament, 3rd Session) enjoyed four days of Second Reading in the House before being debated at nine committee meetings. Further, this agreement was the subject of three Report Stage votes (one recorded division, the other two recorded divisions applied the results of the first vote by unanimous consent).29 Both bills enjoyed no fewer than five recorded votes (excluding Report Stage amendments) in the House, though these included (in both cases) time allocation motions relative to further consideration of the bill.30

Various factors may account for the difference in Parliament’s approach to FTA legislation and Tax Conventions Acts. It may be that Parliamentarians feel they understand the concepts surrounding free trade better than they do international taxation and are therefore more eager to debate these pieces of legislation. Perhaps they perceive free trade to have more evident economic effect in Canada than a bilateral tax treaty and they apportion Parliamentary resources accordingly. The politics of trade may be more salient to the public than the politics of taxation (though this may be changing somewhat as a result of media coverage of international tax issues). Parliament may also be more cautious in scrutinizing trade deals because of an FTA with the United States that brought the Senate and House to an impasse and forced a snap election in 1988.31 Bilateral treaties may seem unlikely to create similar political turmoil and may therefore seem relatively benign by contrast, even if their economic, social, and political effects may be equally significant.

Whatever the reason, tax treaty implementation appears to take a fairly unique path in Parliament where, in recent years, little debate occurs in either house, few amendments are sought, and no recorded votes are held. While bill structure and perception likely contribute to this phenomenon, the process seems to enable quite a lot of rule-making by the executive with virtually no Parliamentary oversight.

E. COMMITTEE JURISDICTION AND SUBJECT MATTER OF DEBATE

Despite the inclination toward deeming procedural steps in tax treaty implementation legislation, it seems that Parliament views its role with respect to these acts as more than pro forma in nature. For example, the Senate has at least on occasion raised questions about who should study tax treaty implementation legislation, given that the subject matter involves both taxation (traditionally the purview of the Banking, Trade and Commerce Committee) and foreign relations (traditionally the purview of the Foreign Affairs Committee).32

During the period studied herein, namely from 2001 to the present, legislation introduced in the Senate was typically studied by the Banking Committee. On the House side, consideration occurred at the Finance Committee, with the notable of exceptions of the 2006 legislation (deemed referred to and reported without amendment by the Committee of the Whole) and the 2002 legislation, which was referred to the Standing Committee on Foreign Affairs for reasons not clear from the record.33

Whether the Banking or Foreign Affairs Committee is the proper Committee to study the legislation has been at issue in the past, where tax treaties have been seen to be potentially inconsistent with other policies. In 1998, the Standing Senate Committee on Foreign Affairs, in reporting legislation implementing a set of tax treaties without amendment, noted two concerns related to the legislative process.34 Both concerns focused on the use of tax treaties to share taxpayer information with other governments. First, the Committee proposed that the Department of Foreign Affairs and International Trade (now Global Affairs Canada) “assure” the Senate that it conducted “pre-screening” of partner countries’ capacity to implement the undertakings laid out in the tax agreements, before presenting implementing legislation.

Second, while praising the exchange of tax information provisions in these agreements as a “useful tool” for preventing tax evasion, the Committee expressed worry about the use of such information by treaty partners. The Committee suggested that the Senate be provided with “any information available to the Government about inappropriate use of tax information exchanged as a result of tax agreements and conventions entered into by Canada.” The Committee specifically noted privacy concerns, “encouraging” the Government “to attempt to ensure that an adequate level of privacy is accorded the tax information shared by Canada with the other signatory countries.”35

The following year, the Senate again raised the issue of the proper referral of the bill. This time, Senators linked the procedural issue to general human rights concerns as well as to the ongoing privacy and confidentiality concerns, which some felt had not been resolved previously. 36 In this case, the legislation sought to implement tax treaties with a number of countries, one of which was Uzbekistan.37 The Senators engaged in an extended Second Reading discussion about whether Canada ought to enter into any bilateral agreement with Uzbekistan, given a recent discussion by the Senate regarding ongoing human rights abuses in that country.38 In an unusual move, the Senate sought a “double referral”—agreeing “That the Bill be referred to the Standing Senate Committee on Banking, Trade and Commerce and, upon completion of their review, to the Standing Senate Committee on Foreign Affairs.”39

The bill was ultimately considered and reported without amendment by both committees, though not without points of order raised over the “unusual” process.40 The extended debate continued at 3rd Reading, during which Opposition Leader Sen. Lynch-Staunton noted that “it is highly unusual that a tax treaty bill would have taken so much time. I believe it is because we are now tending to go from the pure financial trade aspect of treaties to their human rights aspect. Hopefully, that is something which will be emphasized over the years”.41

Contrary to Sen. Lynch-Staunton’s stated hopes, the procedurally unusual Senate experience of 1999 has not been repeated since that time, though the main issues raised surrounding privacy and confidentiality have only increased in scope and importance. The event speaks to how the debate on tax treaty implementation may serve other Parliamentary purposes and engage in broader questions about Canada’s relationships with other states.

To achieve broader input without repeating the double referral process, Parliamentarians could encourage a committee seized with the bill, such as Finance, to seek subject-matter studies by other committees to inform its deliberations. For example, following the 1999 Senate’s concerns in matters involving the transfer of taxpayer information to foreign tax authorities, Finance might consult the House of Commons Subcommittee on International Human Rights and the House Standing Committee on Access to Information, Privacy and Ethics.42 This ‘subject matter study’ practice has been observed in recent years in the context of budget bills. For example, Finance has sought advice and amendment from committees more suited to address the subject matters of the bill that are not within the natural expertise and purview of the committee procedurally seized with the bill.43

Finally, the issues that led to the procedural anomaly of double referral seen in 1999 arose again but without similar Parliamentary reaction in the irregular events surrounding the adoption of Canada’s most recent tax-related implementation act. That act, entitled “An act to implement certain provisions of the budget tabled in Parliament on February 11, 2014 and other measures,” enacted several hundred legislative changes, including a new tax information sharing agreement with the United States. The agreement itself, as well as the act that implemented it, broke several established precedents respecting international tax agreements between Canada and its most important treaty partner, the United States. In so doing, it ushered in legislation that stands to impact hundreds of thousands of Canadian residents and citizens in ways that still appear to be ill-understood by lawmakers.

CASE STUDY: INTERGOVERNMENTAL AGREEMENT ON FATCA

In a recent article published by this journal, Charlie Feldman described in great detail the unusual circumstances surrounding Parliament’s adoption of Bill C-31,44 an omnibus bill that included amongst its provisions an act to implement a complex technical tax agreement with the United States.45 Styled as a tax information exchange agreement “under” the current Canada-US tax convention, the agreement is referred to as an “intergovernmental agreement” (IGA).46 This is because of the format given to this agreement by the US Treasury, together with more than one hundred virtually identical agreements Treasury is concluding with other countries. 47 The IGA requires Canada to undertake enforcement of an expansive financial record-keeping and cross-border reporting regime pursuant to a US law adopted in 2010, entitled the “Foreign Account Tax Compliance Act” or FATCA. 48 Though the US has since concluded IGAs with multiple countries, the arrangement is dissimilar to all other tax agreements both in form and scope. In form, the IGA is distinct both because it is a treaty for Canadian law purposes, but it is not a treaty under US law, 49 and because the treaty under which it purportedly exists should have been renegotiated in accordance with its terms, owing to unilateral override by the United States in enacting FATCA.50 In scope, the agreement is distinct in many respects, with two main features being its lack of reciprocity51 and its deference to US Treasury regulations.52

The approach of Parliament with respect to US-Canada tax agreements noted in the data tables above reflects the relationship between Canada and the United States. As the Government of Canada explained in 2007:

The Canada-United States tax treaty is, given the depth of Canada’s ties with the United States, particularly important. Like all of Canada’s [double taxation agreements], the Canada-U.S. treaty is based on a model developed by the OECD, but it has always included some special features that reflect the unique Canada-U.S. relationship. As cross-border business and investment practices evolve, the tax treaty has to change as well if it is to remain effective.53

The unique nature of the Canada-US tax relationship may explain why agreements with the United States are not typically bundled with those of other countries. However it does not explain the anomalous nature of C-31, the only tax agreement implementing legislation introduced in the House in the last 14 years, and the only tax agreement that was implemented through budget implementation legislation rather than through separate tax convention legislation.

While the peculiarities of the FATCA IGAs could fill the pages of a book, its adoption in Canada also brought to the fore an issue unique to Parliament’s oversight of tax treaties, namely, the procedural implications of urgency. Throughout the process, the Government’s position was that failure to implement the IGA quickly would have dire immediate consequences for Canadian banks and financial institutions, which faced US sanctions if they failed to comply with FATCA.54 The Government pointedly and strategically used this urgency to take a number of steps that intentionally discouraged and curtailed Parliamentary scrutiny. This is troubling because the only real urgency in adopting the IGA was political, and it appears mainly motivated by a desire to avoid public attention to a controversial issue that had already garnered media attention and political opposition.

A. MANUFACTURED TIME PRESSURE

Those responsible for negotiating and signing the IGA knew that it contained issues that would spark controversy if brought to the attention of the public. Long before the IGAs had even been envisioned, former Finance Minister Jim Flaherty had gone on the public record in 2011 to denounce the application of FATCA to Canada given the longstanding cooperative relationship between the two countries and the absurdity of applying draconian tax evasion rules to highly-taxed and compliant Canadians.55 Minister Flaherty especially noted that “[t]o rigidly impose FATCA on our citizens and financial institutions would not accomplish anything except waste resources on all sides.” Soon therafter, Canadians who might be affected by the law began organizing to express their concerns, including contacting lawmakers.56 But by 2014, the

government’s focus had apparently shifted away from any concerns about the legal and moral implications of the US intent to apply FATCA to Canadians, to accepting that task as its own mandate, and turning to public relations to manage Canadians’ reactions.

Correspondence among government officials at the time indicates a preoccupation with developing a communication strategy, which would involve posting the text of the IGA alongside “information that clearly addresses the main criticisms, concerns and questions”.57 In email correspondence dated a month before publicly releasing the text of the IGA, one official stated that “Finance is certainly aware of the controversial nature of this agreement.”58 The correspondence included a link to a story in the national media entitled “U.S. FATCA tax law catches unsuspecting Canadians in its crosshairs,” which outlined the widespread and dramatic impacts of FATCA on Canadians.59 Rather than meeting that controversy with a plan for careful review and consideration of the merits of making an agreement to ensure compliance with FATCA in Canada, the Government busied itself with “preparing a ‘robust communications plan.”60 Expressing urgency in the deed, the focus of the Government was entirely on “ensuring that the treaty process goes smoothly” over any other consideration.61

In the circumstances, a “smooth” Parliamentary process appears to have meant a process stripped of opportunities for Parliamentary input. In the IGA process, a smooth flow through Parliament ensured that the affected population would have virtually no knowledge about decisions taken that would directly impact them, let alone any opportunity to engage their members of Parliament and make informed inquiries about the issues at stake. Instead, only those few who were previously aware of the issues involved were able to provide any input, and even that input appears to have been ignored.

Even members who purported to have been approached by constituents seemed to misunderstand FATCA. For example, in answer to a question posed on 29 May 2014 regarding the broad application of the law to Canadian citizens and residents, MP Cheryl Gallant declared that “Mr. Speaker, the residents of Renfrew—Nipissing—Pembroke who pay their taxes, who are not hiding money, do not have to worry. They are in touch with my office and we are helping them through this.”62 It is not clear what sort of help her office could possibly provide constituents with respect to an international agreement, nor why, in her mind, the legislation only impacted tax cheats when this was clearly not the case.

During Committee consideration of the bill, I called the assumption of urgency into question because the United States had already deferred the date by which it intended to impose sanctions on anyone subject to FATCA by another year.63 I went further and suggested that imposing sanctions on Canada would be an extraordinary act, given the 1996 agreement between Canada and the United States, which was still in force. The fact that no such urgency existed appears to have had no impact on the implementation schedule, however. Indeed, comments in House debate continued to claim without merit that “[w]ithout an agreement in place, obligations to comply with FATCA would have been unilaterally and automatically imposed on Canadian financial institutions and their clients as of July 1, 2014”.64

That is obfuscation because the main relief of FATCA offered by the IGA was to reduce the scope of FATCA sanctions in the event of nonreporting.65 Yet at the time Parliament was being asked to pass Bill C-31, the US Treasury had already delayed both the possibility of higher FATCA withholding and the deadline by which reporting would need to occur, not least because the United States itself was unprepared for the event.66 There was plenty of time for Parliament to carefully study FATCA and understand exactly what Canada was promising by signing the IGA, as well as who would be impacted by it. The Government’s sense of urgency was simply not grounded in legal reality.

B. TABLING

While rushing the IGA through Parliament via an omnibus legislative vehicle is perhaps an error of substance, a related concern regarding form is present through the IGA’s exemption from the Government of Canada’s Policy on Tabling of Treaties in Parliament.67 The IGA was entered into on February 4, 2014. Its implementing legislation (Bill C-31) was introduced on March 28, 2014, but the agreement itself was only formally laid before the House of Commons with its required explanatory memorandum on September 15, 2014, more than two months after C-31 had come into force.

Correspondence among government officials indicates that those responsible for developing the IGA were fully aware of the Treaty Tabling Policy. The Policy and its exceptions were the subject of email correspondence between the Department of Foreign Trade and Affairs (now Global Affairs Canada) and the Department of Finance in August of 2013—fully six months before Finance released public notice regarding the existence of the IGA, and seven months before the IGA was packaged in Bill C-31 and tabled in Parliament.

C-31 included the IGA as a schedule to the legislation, consistent with other tax treaty practice. However, it was wrapped in budget legislation totaling 363 pages amending dozens of statutes. Procedurally, it was time allocated at most stages of debate – was the subject of various points of order, including on its inclusion of the tax treaty – went through lengthy Senate pre-study, and had 272 motions in amendment proposed at Report Stage. In short, the legislative vehicle was particularly unique for this agreement, which arguably itself was so different from the tax conventions otherwise herein described that it ought to be considered separately from them on that basis alone, if also not separately from everything else in C-31.

C. A TALE OF TWO PROCEDURES

The traditional route of Tax Convention Implementing Legislation seems relatively benign compared with the ad hoc process followed in enacting the FATCA IGA. Yet neither process provides for adequate scrutiny of tax treaty implementing legislation. A committee that meets briefly by choice is perhaps preferable to having meetings arbitrarily curtailed through a false sense of urgency. Either way, legislation is not scrutinized fully but the latter seems designed to ensure this result. Further, in terms of informing the electorate, having recorded votes on legislation is preferable to not knowing where parties stand, but a single vote that covers hundreds of items (of which a tax treaty is but one) conveys little.

While the legislative vehicle for implementing legislation is largely at the government’s discretion, it is not true that Parliament’s review of international instruments should be limited to a cursory glance. The problem, of course, is convincing parliamentarians that the topics are worthy of consideration given everything else before Parliament. Admittedly, explaining tax treaties is not the most straight-forward task. This is no excuse for parliamentarians to fail to inform themselves or use the resources and procedures at their disposal. More troublingly, however, it appears the executive purposely made efforts in the case of C-31 to circumvent robust parliamentary deliberation and instead sought to supplant it with a robust communications plan. While it is true that Parliament is the master of its proceedings, the procedural status quo as regards recent tax treaty practice bodes ill for lawmaking in Canada.

Canada’s tax treaties are evolving. While they will continue to eliminate double taxation while providing tools to fight tax evasion, information sharing is becoming more common. This new element adds an additional piece to the parliamentary puzzle. While reviewing tax treaties through committees with a focus on finance and banking may provide for a review from a fiscal perspective, these committees are perhaps not best placed to evaluate the mechanisms by which personal information is collected, stored, transferred, and used. In that regard, in addition to more comprehensive committee study, it may be opportune to involve The Privacy Commissioner of Canada, who is an Officer of Parliament reporting directly to the Senate and House of Commons.

CONCLUSION

We can expect Canada to continue negotiating and concluding tax treaties – and related agreements -and seeking their expeditious implementation through Parliament with little or no scrutiny despite the ever-increasing stakes for the rule of law. In the meantime, the IGA and possibly other agreements involving taxpayer information exchange are likely to yield controversies that will be decided by the Courts after great amounts of time and resources are expended. A more informed process before passing laws seems vitally necessary. Research into recent practice reveals a thin Parliamentary record on tax treaties: 750 pages of agreements with 33 countries enacted without a single House vote and no more than two days of debate at any stage of Chamber consideration in the House or Senate. From the outside, it is hard to view this as an appropriate apportionment of legislative resources given the importance and impact of these agreements.

It perhaps goes without saying that the risks with treaties are particularly high. Domestic legislation, relatively speaking, can be easily amended. A poorly concluded agreement may take years to modify – especially if one side finds tremendous benefit in taking advantage of an unintended consequence of the instrument as worded.

There is no question that tax treaty practice in Canada is complicated. The interaction of treaty implementation acts with the Income Tax Act and the Income Tax Conventions Interpretation Act has changed over the years as modifications are made to statutes and Courts make new determinations.68 While the subject matter might be technical, this does not absolve parliament and parliamentarians of their obligation to conduct due diligence on behalf of the Canadian people. It is especially troubling to this subject that merely declaring urgency provides a ready mechanism to bypass Parliament on controversial matters, forestalling the kind of discussion that might help clarify underlying policies and understanding their wisdom – or lack thereof.

*******************

* H. Heward Stikeman Chair in Taxation, McGill University Faculty of Law. Thanks are due to Scott Wilkie, Armand deMestral, and Charlie Feldman for helpful comments on an early draft and to Stephanie Blakely and Melanie Crestol for excellent research assistance.

1 Canada’s income tax treaties are typically referred to as agreements or conventions, though the term “agreement” was at one time reserved for international instruments entered into between Canada and other commonwealth countries. See John R. Owen, Ed., Canada’s Tax Treaties (2001) at 2.

2 The 41st Parliament alone passed implementation legislation relative to seven of these. In the 41st Parliament, 1st Session, S-17 “An Act to implement conventions, protocols, agreements and a supplementary convention, concluded between Canada and Namibia, Serbia, Poland, Hong Kong, Luxembourg and Switzerland, for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes” contained legislation relative to six countries, and C-31 of the 41st Parliament, Second Session, implemented the Agreement Between the Government of Canada and the Government of the United States of America to Improve International Tax Compliance through Enhanced Exchange of Information under the Convention Between the United States of America and Canada with Respect to Taxes on Income and on Capital.

3 For a list and links to all of Canada’s tax agreements currently in force, see Department of Finance Canada, Tax Treaties: In Force, at http://www.fin.gc.ca/treaties-conventions/in_force–eng.asp.

4 Lara Friedlander & Scott Wilkie, Policy Forum: The History of Tax Treaty Provisions-And Why It Is Important To Know About It, (2006) Canadian Tax J. 54: 907, 910 (“There is only a limited body of readily available precedent or history that can help to inform interpretive decisions on the intent and application of tax treaties, to ensure that they reflect the legal and economic decisions taken to outline and define countries’ reciprocal tax accommodations.”).

5 Joanna Harrington, “Redressing the Democratic Deficit in Treaty Law Making: (Re-)Establishing a Role for Parliament” (2005) 50 McGill L.J. 465 – 509 (stating that “a parliamentary role in treaty making is necessary to avoid engaging the nation in long standing legal commitments without public scrutiny and debate”).

6 For a discussion of the interaction between domestic and treaty-based rules

for international tax dispute resolution, see Allison Christians, “How Nations Share,” (2012) 87 Indiana L. J. 1407.

7 See, e.g., The Queen v. Crown Forest Industries Limited et al., 95 DTC 5389

(SCC) (referring to OECD commentaries to the OECD Model Tax Convention as a valid interpretive source). There has been some scholarly debate on this subject over the years in international circles. For a discussion, see Allison Christians, “Networks, Norms, and National Tax Policy” (2010) 9 Wash. U. Glob. Stud. L. Rev 1.

8 A prerogative right is one “that remains in the Sovereign as one of the bundle of discretionary common law rights which were, at and by the common law, exercisable by the Sovereign in person.” W.F. O’Connor, Report pursuant to resolution of the Senate to the Honourable the Speaker by the parliamentary counsel: relating to the enactment of the British North America Act, 1867, any lack of consonance between its terms and judicial construction of them and cognate matters. (Ottawa, 1939), at 146. Prerogative powers include “the power to do all acts of an international character, such as the declaration of war and neutrality, the conclusion of peace, the making or renouncing of treaties, and the establishment or termination of diplomatic relations.” A.E. Gotlieb, CANADIAN TREATY MAKING 4 (1968).

9 Maurice Copithorne traces the chain of delegation and some of its implications in National Treaty Law and Practice: Canada in Monroe Leigh, Merritt R. Blakeslee & L. Benjamin Ederington, eds., NATIONAL TREATY LAW AND PRACTICE: CANADA, EGYPT, ISRAEL, MEXICO, RUSSIA, SOUTH AFRICA (2003). The “Crown” refers to “the monarch acting in a public capacity—over which Parliament has no authority.” Armand de Mestral and Evan Fox-Decent, “Rethinking the Relationship between International and Domestic Law” 53 McGill L.J. 573, 596 (2008). deMestral and Fox-Decent explain that “today the domestic prerogative powers of the Crown are very limited (e.g., the bestowal of honours), but the federal government’s basic claim to a near-monopoly on foreign affairs continues to rest on its claim to prerogative power in this field.” Id.

10 This delegation is accomplished by letters patent, the most recent of which was signed in 1947 and is reproduced at R.S.C. 1985 App II, No. 31. See Copithorne, supra at 91.

11 Prior to 2013, the Minister of Foreign Affairs was assigned the primary responsibility to provide this advice by the Foreign Affairs and International Trade Act, section 10 (“The powers, duties and functions of the Minister extend to and include all matters over which Parliament has jurisdiction, not by law assigned to any other department, board or agency of the Government of Canada, relating to the conduct of the external affairs of Canada, including international trade and commerce and international development.”) This Act was repealed in 2013, and replaced by the Department of Foreign Affairs, Trade, and Development Act (DFATD), which contains an identical provision. Department of Foreign Affairs, Trade and Development Act, S.C. 2013, c. 33, s. 174, s. 10. DFATD “continues” the prior department “under the new Department of Foreign Affairs, Trade and Development”, which replaced the Department of Foreign Affairs and International Trade, or DFAIT. Id at s. 2; see also Legislative Summary of Bill C-60: An Act to implement certain provisions of the budget tabled in Parliament on March 21, 2013 and other measures, at section 2.4.12. Upon the swearing-in of Justin Trudeau as the 23d Prime Minister of Canada on 4 November 2015, the government renamed several departments, including the DFATD, which is now called “Global Affairs Canada.” Privy Council Office, “Machinery of Government Changes,” 5 November 2015, at http://www.pco-bcp.gc.ca/.

12 See De Mestral and Evan Fox-Decent, supra; Copithorne supra at 94.

13 See, e.g., Copithorne supra at 91.

14 Copithorne, supra at 91-92.

15 Ratification is generally defined as the formal confirmation by each treaty signatory that it consents to be bound by a treaty. Vienna Convention on the Law of Treaties (VCLT) Art. 11.

16 The Constitution is silent on the treaty power, save a provision that is now defunct. Constitution Act, 1867, section 132 (giving authority to the federal government to implement “British Empire Treaties”); Part I of the Constitution Act, 1982, being Schedule B to the Canada Act 1982 (U.K.), 1982, c. 11, s. 11(g). The authority to regulate is shared between the federal and provincial legislatures. Charter s. 91, 92. A 1937 decision of the Judicial Committee of the Privy Council declared that forming and performing obligations of treaties were separate acts, and that forming belongs to the Executive but performing to the Legislature. Attorney-General for Canada v. Attorney-General for Ontario, CTS 1985/19, CTS 1964/4, CTS 1963/13, CTS 1975/11 (known colloquially as the Labour Conventions case). For a discussion, see DeMestral and Fox Decent, supra at 581 (“A key aspect of the separation of international and domestic legal orders often stressed by Canadian courts is that treaties are made by the executive arm of government without parliamentary direction or participation. It is then argued that international law has scant legitimacy in the Canadian legal order unless it is formally implemented by a legislative act.”).

17 The specific terms assigned to the instrument (i.e. convention, treaty, agreement, or similar) are irrelevant. For example, the full title of S-17 (41st Parliament, 1st Session) is: An Act to implement conventions, protocols, agreements and a supplementary convention, concluded between Canada and Namibia, Serbia, Poland, Hong Kong, Luxembourg and Switzerland, for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes.

18 When a question is put on a motion at any stage of debate, the House may agree or disagree unanimously, or it can be “on division.” On division means that it is recorded that there is some dissent but a recorded tally is not taken. For discussion of House voting practice, see O’Brien and Bosc, “House of Commons Procedure and Practice” (Second Edition, 2009) at “Putting the Question” in Chapter 12 “The Process of Debate”.

19 House of Commons Journals, No. 93. 7 December 2006.

20 House of Commons Journals, No. 272. 18 June 2013.

21 Time allocation was invoked with respect to Second Reading consideration of S-17 (Tax Conventions Implementation Act, 2013). While a vote was held on the time allocation motion, the House did not hold a second vote when time expired. As indicated in the Journals, the question ending Second Reading was called at 11:04pm, perhaps explaining the lack of desire for a recorded division. See Journals of the House of Commons, 10 June 2013 No. 266.

22 The page counts in this table come from the PDF of the Royal Assent version of each bill from LEGISinfo and exclude cover pages and tables of contents. “Pages of Statute” reflect only those portions enacting new legislation, while “Pages of Schedule” reflect the total pages of annexes and schedules forming part of the legislation. These contain the agreements being implemented along with any other diplomatic notes or exchanges that form part of the instrument included in the bill as assented to.

23 The OECD Model serves as the general template for most of the world’s 3,000 treaties, though the United States has its own model as does the United Nations. For a discussion, see Michael Lennard, “The UN Model Tax Convention as Compared with the OECD Model Tax Convention – Current Points of Difference and Recent Developments” (2009) 49:8 Asia-Pacific Tax Bulletin 4-11.

24 Supra note 18 at “Stages in the Legislative Process” in Chapter 16 “The Legislative Process’ (stating that “An amendment may generally be moved to a schedule, and it is also possible to propose new schedules except in the case of a bill giving effect to an agreement (a treaty or convention) that is within the prerogatives of the Crown. If the schedule to such a bill contains the Agreement itself, the schedule may not be amended. Notwithstanding this, amendments may be proposed to the clauses of the bill, as long as they do not affect the wording of the Agreement in the schedule, even if the consequence of the amendments is to withhold legislative effect from all or part of the Agreement.”).

25 It is not clear whether there is a correlation between “on division” expressions of disagreement and subsequent attempts to amend. It may be that votes “on division” represent a commentary on form rather than substance.

26 Evan Fox-Decent and Armand de Mestral supra note 9.

27 See, for example, Schedule I to the Safeguarding Canada’s Seas and Skies Act (S.C. 2014, c. 29) entitled “Text of Articles 1 to 5, 7 to 23, 37 to 41, 45, 48 and 52 of the International Convention on Liability and Compensation for Damage in Connection with the Carriage of Hazardous and Noxious Substances by Sea, 2010”.

28 See, in particular, Minutes, Standing Committee on International Trade, 4 October 2012.

29 House of Commons Journals, 9 June 2010.

30 Arguably, the most procedurally similar treatment to the Tax Conventions Act was the Canada-EFTA Free Trade Agreement Implementation Act of the 40th Parliament, 2nd Session. The act sought to implement an FTA among Canada and the States of the European Free Trade Association (Iceland, Liechtenstein, Norway, Switzerland), as well as the Agreement on Agriculture between Canada and the Republic of Iceland, the Agreement on Agriculture between Canada and the Kingdom of Norway, and the Agreement on Agriculture between Canada and the Swiss Confederation. The implementing legislation was debated at Second Reading in the House during three sittings before five days of committee meetings. Report Stage occurred at three sittings (one amendment), and an additional three sittings occurred at Third Reading. It was then sent to the Senate, which considered the matter at fewer sittings and meetings than the House at all stages prior to receiving Royal Assent. However, this point of comparison to tax treaty practice is somewhat inapt given that the legislation had previously been introduced in Parliament on two occasions. The first time was in the 39th Parliament, 2nd Session, during which C-55 (Canada-EFTA Free Trade Agreement Implementation Act) had three days of Second Reading debate in the House and one committee meeting in May and June of 2008 before Parliament dissolved. The bill was re-introduced as bill C-2 to the 40th Parliament, 1st Session, on December 1st, 2008. However, as a result of the 2008 Canadian Parliamentary “crisis,” then Prime Minister Stephen Harper sought to suspend Parliament days later in order to avoid a confidence vote, and the Governor General agreed to prorogue. The events are recounted in “Parliamentary Democracy in Crisis” Peter H. Russell, Lorne Sossin eds. University of Toronto Press. (2009).

31 The 1988 General Election as discussed in Sen. John Lynch-Staunton, “The Role of the Senate in the Legislative Process” (2000) 23:2 Canadian Parliamentary Review.

32 A bill may not be referred simultaneously to more than one Committee, but it may be sequentially referred to more than one Committee, as was the case with a 1999 tax treaty implementation bill, discussed infra.

33 During Senate debate over a 1999 implementation bill, Senator Dan Hays stated that an earlier tax treaty implementation bill had been referred to the Committee on Foreign Affairs “because of the heavy workload of the Banking Committee.” Debates of the Senate (Hansard) 36th Parliament, 2nd Session, Volume 138, Issue 11. 24 November 1999. In noting that the Senate had flexibility in referring a Senate bill as opposed to one received from the House of Commons, Senator Hays went on to state that his view that “the traditional reference of tax treaties to the Banking Committee [is] useful in that taxation is an important aspect” of tax treaty implementation bills. Id.

34 Standing Senate Committee on Foreign Affairs, Sixth Report, Journals of the Senate, V. 65, May 28, 1998, (Discussing Bill S-16, “An Act to implement an agreement between Canada and the Socialist Republic of Vietnam, an agreement between Canada and the Republic of Croatia and a convention between Canada and the Republic of Chile, for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income”).

35 Id

36Debates of the Senate (Hansard) 36th Parliament, 2nd Session, Volume 138, Issue 11. 24 November 1999 (Hon. Consiglio Di Nino sought to refer proposed tax treaty implementing legislation to the Foreign Affairs Committee rather than the Banking Committee because, inter alia, in his opinion privacy and confidentiality issues “were not properly responded to the last time we dealt with this matter.”).

37 Bill S-3, to implement an agreement, conventions and protocols between Canada and Kyrgyzstan, Lebanon, Algeria, Bulgaria, Portugal, Uzbekistan, Jordan, Japan and Luxembourg for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

38 In advocating for the consideration of respect for human rights as a pre-requisite for entering into bilateral treaties with other nations, Senator Kinsella stated that “I would look at the domestic human rights record of each country as a matter of course, and I would make a judgment in terms of whether I want to do business of this nature with them or whether, indeed, as a foreign policy instrument, I would want to use these kinds of measures to get their attention.” Debates of the Senate (Hansard) 36th Parliament, 2nd Session, Volume 138, Issue 11. 24 November 1999. In discussing how the Senate ought to proceed with the issue, Hon. Consiglio Di Nino noted an ongoing procedural question regarding whether the Banking Committee or the Foreign Affairs Committee would be the proper destination for the legislation.

39 Debates of the Senate (Hansard) 36th Parliament, 2nd Session, Volume 138, Issue 11. 24 November 1999.

40 Debates of the Senate (Hansard) 36th Parliament, 2nd Session, Volume 138, Issue 17. 7 December 1999.

41 Debates of the Senate (Hansard) 36th Parliament, 2nd Session, Volume 138, Issue 23. 16 December 1999.

42 If the idea of multiple committees in each Chamber reviewing the same legislation seems undesirable from a legislative resources perspective, a joint solution might be found. For example, a Joint Committee on the Scrutiny of Tax Instruments might be struck, modeled after the Standing Joint Committee for the Scrutiny of Regulations.

43 See, for example, Minutes of The Standing Committee on Industry, Science and Technology. 30 April 2014. “It was agreed, — That the Committee undertake a study, as suggested by the Standing Committee on Finance in their motion adopted on Tuesday, April 29, 2014 of the subject matter of clauses 175 to 192 (Atlantic Canada Opportunities Agency and Enterprise Cape Breton Corporation), clauses 239 to 241 (Telecommunications Act) and 317 to 368 (Amendments Relating to International Treaties on Trademarks) 369-370 (Reduction of Governor in Council Appointments) of Bill C-31, An act to implement certain provisions of the budget tabled in Parliament on February 11, 2014 and other measures.”

44 Charlie Feldman, “Parliamentary Practice and Treaties” (2015) 9 J. Parliamentary & Pol. L. 585.

45 “Agreement Between the Government of the United States of America and the Government of Canada to Improve International Tax Compliance through Enhanced Exchange of Information under the Convention Between the United States of America and Canada with Respect to Taxes on Income and on Capital,” as implemented by Implementation Act Schedule 3.

46 The title of the IGA indicates that it is an “Agreement … under the Convention.” It is not clear what this means as a matter of law, nor its implications for interpretation of the underlying treaty, in either the United States or Canada. For a discussion, see Allison Christians, Interpretation or Override? Introducing the Hybrid Tax Agreement, 80 Tax Notes Int’l 51 (Oct. 5, 2015).

47 The US Treasury adopted the term IGA in connection with certain model agreements it developed for global use in the implementation of FATCA, after it became clear that FATCA posed insurmountable implementation problems owing to its fundamental incompatibility with the domestic laws of other countries.

48 26 USC 1471 et seq. Prior to the passage of FATCA, Canada and the United States had long had a reciprocal information exchange relationship pursuant to an agreement reached in 1996, and Canada has a network of more than 90 other tax agreements that also have information exchange provisions. See discussion in Christians and Cockfield supra. As Government of Canada memos indicate, “automatic exchange of information is either not part of these arrangements or is less comprehensive than the FATCA model” ATIP Response of Dec 3, 2015 (on file with the author) (ATIP page 000032).

49 See discussion in Allison Christians and Arthur Cockfield, Submission to Finance Department on Implementation of FATCA in Canada, 10 March 2014, available at http://ssrn.com/abstract=2407264; Allison Christians, The Dubious Legal Pedigree of Intergovernmental FATCA Agreements (And Why It Matters), 69 Tax Notes Int’l 565 (11 February 2013); Tax Cooperation, Past, Present & Future, IFC Econ. Rep., Winter 2014, pp 12-16.

50 FATCA overrides the tax treaty because it unilaterally imposed a new condition, namely FATCA compliance, on the eligibility of Canadian residents for the reduced tax rates enumerated in the treaty (while having no impact on US persons’ eligibility for reduced Canadian tax rates. Some make the technical argument that there is no override because FATCA is “merely” a withholding regime, and that taxpayers may be ultimately eligible in certain cases to a final rate of tax consistent with the treaty, albeit on the basis of a delay without interest (which was simultaneously extended by Congress). No court has yet had the opportunity to rule on the merits of this argument. Article XXIX (7) of the tax treaty lays out a regime for the countries to deal with tax treaty overrides caused when one country enacts a domestic law that conflicts with the treaty in effect. That provision states: “Where domestic legislation enacted by a Contracting State unilaterally removes or significantly limits any material benefit otherwise provided by the Convention, the appropriate authorities shall promptly consult for the purpose of considering an appropriate change to the Convention.” Canada-United States Convention with Respect to Taxes on Income and on Capital signed at Washington on September 26, 1980, as amended by the Protocols signed on June 14, 1983, March 28, 1984, March 17, 1995 and July 29, 1997. The IGA expressly does not change the convention; it cannot do so because it is not a treaty under US law. See Christians (2013) supra note 49.

51 The agreement requires extensive undertakings by Canada while requiring no new undertakings by the United States, since all the undertakings stated on behalf of the United States were already in place since 1996. See 26 CFR 1.6049-4(b)(5) and 1.6049-8, T.D. 8664, 61 FR 17574, Apr. 22, 1996, as amended by T.D. 8734, 62 FR 53491, Oct. 14, 1997; T.D. 9584, 77 FR 23395, Apr. 19, 2012 (regulations describing information to be exchanged with Canada, extended in 2012 to other specified IGA partner countries). Moreover, the United States reserves the unilateral right to withhold information under the sole discretion of the IRS, notwithstanding the undertaking stated in the IGA. See T.D. 9584 (Revising the information exchange regulation, and stating that “even if an information exchange agreement is in effect, the IRS will not exchange information … if the IRS determines that the country is not complying with its obligations under the agreement …. This is not a hypothetical claim; the Mexican tax authority recently complained of noncompliance by the United States under the Mexico-US IGA. See EU incumple entrega de información:

SAT, El Universal, 3 December 2015, at

http://www.eluniversal.com.mx/articulo/cartera/finanzas/2015/12/3/eu-

incumple-entrega-de-informacion-sat. The agreement expressly acknowledges the imbalance in the terms of exchange and states: “The Government of the United States acknowledges the need to achieve equivalent levels of reciprocal automatic information exchange with Canada. The Government of the United States is committed to further improve transparency and enhance the exchange relationship with Canada by pursuing the adoption of regulations and advocating and supporting relevant legislation to achieve such equivalent levels of reciprocal automatic information exchange.” IGA Article 6. To date, there has been no indication that this commitment is being carried out. For a discussion, see Bruce Zagaris, Raising Revenue on the Backs of Caribbean Jurisdictions, 80 Tax Notes Int’l 607 (Nov. 16, 2015) (“In the IGAs the U.S. acknowledges its inability to fully reciprocate and promises to do so by January 1, 2017. However, 14 months before the deadline, Treasury is nowhere close to reciprocating and … the U.S. has failed to sign the OECD standard for automatic exchange of information.”).

52 See, e.g., IGA Article 1(1)(q), (r), (ii); Article 4(5) and (6); and Article 4(7) (coordination of definition swith US Treasury Regulations).

53 Department of Finance. Backgrounder: The Fifth Protocol to the Canada-United States Income Tax Convention. 21 September 2007.

54 See Finance Canada “What would be the consequences for Canadians and financial institutions had the intergovernmental agreement (IGA) not been signed?” Frequently Asked Questions: Foreign Account Tax Compliance Act (FATCA) and the Intergovernmental Agreement for the Enhanced Exchange of Tax Information under the Canada-U.S. Tax Convention. Online: http://www.fin.gc.ca/afc/faq/fatca-eng.asp. Compliance with FATCA in the absence of an IGA was considered by some a virtual impossibility given the incompatibility of Canadian rules respecting the safeguarding of personal information held by institutions with the furnishing information to a foreign government required by FATCA. However, the manner in which FATCA is written would override such safeguards by having banks either force individuals with US indicia to waive their privacy rights or suffer the loss of their bank accounts. See 26 USC 1471 et seq and regulations thereto. It is not clear whether a bank’s action to force an individual to make that choice would withstand Constitutional scrutiny, but it is clear that Canadian banks sought to relieve themselves of the litigation and other risks attending to that action. For a discussion, see Christians and Cockfield supra.

55 Jim Flaherty, Letter on Americans in Canada, Financial Post, 16 Sept. 2011, at http://business.financialpost.com/news/read-jim-flahertys-letter-on-americans-in-canada.

56 See, e.g. Isaac Brock Society, “Getting the Message Out,” 19 December 2011, at http://isaacbrocksociety.ca/2011/12/19/getting-the-message-out/; Maple Sandbox: A gathering place for people fighting FATCA, FBAR and US

citizenship-based taxation, About Maple Sandbox,

http://maplesandbox.ca/about-maple-sandbox/ (We … connected through another website after we both were stunned and dismayed to discover that, after almost 40 years as Canadian citizens, the United States might still consider us US citizens or “US persons” for tax purposes.”).

57 ATIP (page 000032)

58 Email of Gerard Lim to Margaret Dritsas, 14 January 2014, ATIP page 000170.

59 Email of Margaret Dritsas to Gerard Lim, 14 Jan 2014, ATIP page 000171, including a link to Amber Hildebrandt, U.S. FATCA tax law catches unsuspecting Canadians in its crosshairs, CBC News, 13 January 2014, at http://www.cbc.ca/news/canada/u-s-fatca-tax-law-catches-unsuspecting-canadians-in-its-crosshairs-1.2493864.

60 Email of Margaret Dritsas to Gerard Lim, 14 Jan 2014 (stating that Finance needed “policy cover” and “a strong communications plan for this item”.).

61 Email of Gerard Lim to Robert Chapman, 31 July 2013 (“Due to time constraints, JLI’s input at this point is focused on ensuring that the treaty process goes smoothly”).

Even members who purported to have been approached by constituents seemed to misunderstand FATCA. For example, in answer to a question posed on 29 May 2014 regarding the broad application of the law to Canadian citizens and residents, MP Cheryl Gallant declared that “Mr. Speaker, the residents of Renfrew—Nipissing—Pembroke who pay their taxes, who are not hiding money, do not have to worry. They are in touch with my office and we are helping them through this.”62 It is not clear what sort of help her office could possibly provide constituents with respect to an international agreement, nor why, in her mind, the legislation only impacted tax cheats when this was clearly not the case.

During Committee consideration of the bill, I called the assumption of urgency into question because the United States had already deferred the date by which it intended to impose sanctions on anyone subject to FATCA by another year.63 I went further and suggested that imposing sanctions on Canada would be an extraordinary act, given the 1996 agreement between Canada and the United States, which was still in force. The fact that no such urgency existed appears to have had no impact on the implementation schedule, however. Indeed, comments in House debate continued to claim without merit that “[w]ithout an agreement in place, obligations to comply with FATCA would have been unilaterally and automatically imposed on Canadian financial institutions and their clients as of July 1, 2014”.64

62Debates 4 June, 2014, at https://openparliament.ca/debates/2014/6/4/cheryl-gallant-5/. The question was posed by Elizabeth May, who stated, “This is a list of the people, and I am sure there are many in her riding, who would be affected by FATCA. It is far more than U.S. citizens. According to a legal expert, it would apply to Canadian citizens who are also U.S. citizens; Canadian citizens born in the U.S. who thought they lost their citizenship; Canadian citizens born in the U.S. who have lived their whole lives in Canada, having come here at maybe six months old; Canadian citizens with green cards; Canadian citizens who physically spend a certain amount of time in the U.S.; or, Canadian citizens sharing financial accounts with U.S. persons, for example one who is married to or shares a business venture with a U.S. person. This is why it is estimated that approximately one million Canadians will be affected by FATCA. Does the hon. member for Renfrew—Nipissing—Pembroke have some concerns for those constituents within her riding?”

63 See testimony of Allison Christians before the House Standing Committee on Finance, “There also appears to be a false impression that there is urgency in this matter, yet the U.S. has a list of countries it will “deem” to have an agreement like this in place, and Canada was the very first country on that list and it was there before we signed an agreement. Even if we weren’t on the list, the U.S. Treasury recently announced another 18-month grace period, so we have the time to get this right. Let us not act in haste and repent at leisure.” Standing Committee on Finance. 13 May 2014.

64Debates May 29th, 2014.

65Even in the absence of an IGA, these sanctions would only have applied to financial institutions that chose not to enter into agreements with the IRS to gather and furnish specified information. See 26 USC 1471(a). The purpose of the IGA was to enlist Canada in forcing all Canadian financial institutions (as defined in US Treasury regulations) to enter into such agreements, and to bypass any Canadian laws that might otherwise prevent information from being gathered and furnished to the United States in the manner provided. It is not clear whether those laws would prevent such transactions whether under FATCA or as provided in the IGA; Parliament was never given the opportunity to study this matter so the issue has been left to the Courts. The IGA provides a second relief, which is to exclude reporting of certain registered savings accounts. This might marginally ease the compliance burden on financial institutions but has no impact on the US law regarding the taxation and reporting obligations of the individuals to whom such accounts belong, a fact that does not seem to be well-understood.

66 See Treasury Inspector General for Tax Administration, Foreign Account Tax Compliance Act: Improvements Are Needed to Strengthen Systems Development Controls for the Foreign Financial Institution Registration System,

September 27, 2013, at

https://www.treasury.gov/tigta/auditreports/2013reports/201320118fr.pdf

(stating that “the IRS did not sufficiently develop requirements for the initial Foreign Financial Institution Registration System as needed for new system development”); Taxpayer Advocate Service 2013 Annual Report to Congress at 244 (“The technology necessary for the IRS to utilize the information being gathered under FATCA is still in the early stages of development… The compliance application, which would match and compare the information reported by the various parties, is not scheduled for release until 2016 at the earliest.”).

67 This is a government policy that the government is free to change at will. Members of the government proclaimed to Parliament that the policy had been followed in the case of the IGA. Debates, 28 April 2014, Peter Van Loan on Points of Order, at https://openparliament.ca/debates/2014/4/28/peter-van-loan-3/only/ (“In this case, the fact is that the government, the cabinet, actually did grant such an exemption to the tabling policy. As such, the very words of the policy, the requirements of the policy, have been followed. The processes for obtaining the exemption were obtained. As a result, the requirement that it be tabled in the House 21 days in advance of the legislation being introduced is not necessary and the policy is fully complied with.”). However, subsequent requests for documentation evidencing adherence to the policy demonstrate that this was not the case. For example, in response to a Question on the Order Paper tabled on 24 November 2014, Tom Lukiwsky, Mr. Saxton, John Baird and Paul Calandra confirmed that no “joint letter that clearly articulates that rationale to proceed with the ratification, without tabling in the House of Commons” was created pursuant to section 6.3(a) for exceptions to the Policy.

68 See, for example, “Section 4.3 of the Income Tax Conventions Interpretation Act” as discussed in tony Schweitzer and Jesse Brodlieb, “Canadian Taxation of Income Earned and Distributed by a Subsection 94(3) Trust” (2013) 6:12 Canadian Tax Journal at 464.

I also posted a response to iota which appears to be missing entirely.

I’ll try again.

@iota

There is no obligation for the CRA to automatically provide this information, even through Privacy Commission Therrien said there should be. Also, the banks are only obligated to inform you if you ask them.

I asked my bank and they told me I had to ask the CRA. The CRA in turn told me I had to ask the Revenue Minister. After months of asking my MP and she supposedly failing to get a response, I asked the RM directly. I got a call from the CRA a month ago, letting me know that they had heard from the RM’s office and that the information I sought is forthcoming from them, but needed to be channeled back through the RM’s office because it was the RM’s office that was making the request. Maybe the RM needs to run it by the legal team first, who knows. I called the CRA back yesterday, and they said to call them back if I haven’t heard anything in two weeks.

Can’t find anything to identify the problem, Bubblebustin.

@Bubblebustin – my mistake, I thought I had seen in the UK Guidance that there was an obligation for the bank (not the tax agency) to inform customers whose information was going to be sent by the bank to the tax agency. But I’ve had a look, and can’t find it, so evidently I was mistaken.

So basically – there’s no requirement for taxpayers to be told anything, whether their information is being sent as part of a FATCA sweep, or in response to a specific request from the IRS (possibly as a result of the information obtained by the IRS from the FATCA harvest).

Thanks, Calgary411.

Maybe it’s gremlins.

It looks like the emoji doesn’t show up so looks like it cut off before the emoji.

Test

@iota @Trish

Do I understand from the above posts that the IRS or other tax agencies don’t want the taxpayer to be informed because it might hamper or impede their investigation ?

@Calgary

WK also remarked that she meant to put the smiley face after her comment. Maybe she had, and it didn’t show up. Iota’s did though.

@Calgary,

In case you’re curious because there is now a smiley face in WK’s comment. I saw her comment a while ago that the smiley face wasn’t appearing at the end of her previous comment. I couldn’t see it on my screen either, so I stuck the smiley face in and deleted her comment requesting it be put in.

@Bubblebustin – that’s how it looks to me.

It would be interesting to know what standard of evidence the

IRSforeign jurisdiction has to meet to get agreement that the taxpayer should not be informed.@iota

Everyone including the IRS knows that we are more predisposed to those kinds of things because we keep all of our money in foreign banks where the IRS can’t see it.

@Bubblebustin – it certainly seems to be a rights-free zone. Wish I could find a similar Q&A for HMRC.

“Do I understand from the above posts that the IRS or other tax agencies don’t want the taxpayer to be informed because it might hamper or impede their investigation ?”

The IRS doesn’t want the taxpayer to be informed because it might hamper or impede identity thefts and embezzlements by IRS employees.

But sure, you probably do understand something different from the above posts.

@All

I will remind everyone I once called for Brian Ernewein’s termination of employment from the government of Canada and the stripping of his civil service employment protections. For this I was roundly criticized by many Brockers for encouraging the “politicization” of the civil service and by doing so would encourage future right wing government to start messing around with departments they don’t like such as Health Canada and Environment Canada.

BTW, what happened to Miss Career Civil Service herself Isabella Brock. I am curious what she thinks of these newly disclosed emails Allison Christians found.

For old times sake and to remind Isabella Brock again I will post my favorite “Fourth” branch of government video.

Iota and BB

It is clear the govt doesn’t give a damn about the rights of taxpayers.Something that may eventually come round and kick them in the behind…..

BTW, I am STILL waiting for Isabella Brock to come back here and defend here valiant civil service colleagues.

I found the 1936 treaty:

Rates of Income Tax on Nonresident Corporations and Individuals

https://www.loc.gov/law/help/us-treaties/bevans/b-ca-ust000006-0086.pdf