which invoke immoral and unconstitutional restrictions upon the inalienable rights of U.S. Citizens and of so-called “U.S. Persons for Tax Purposes”.

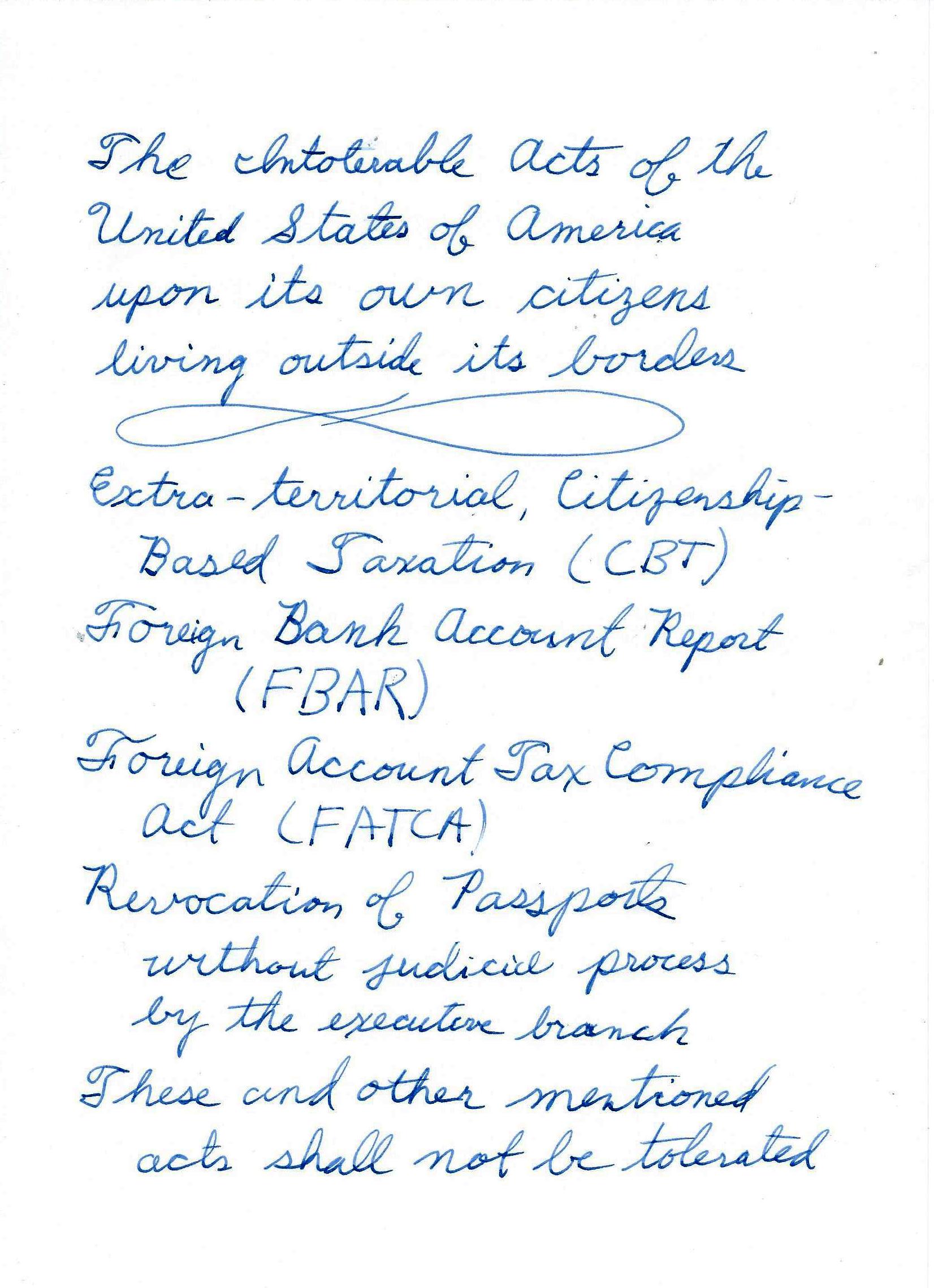

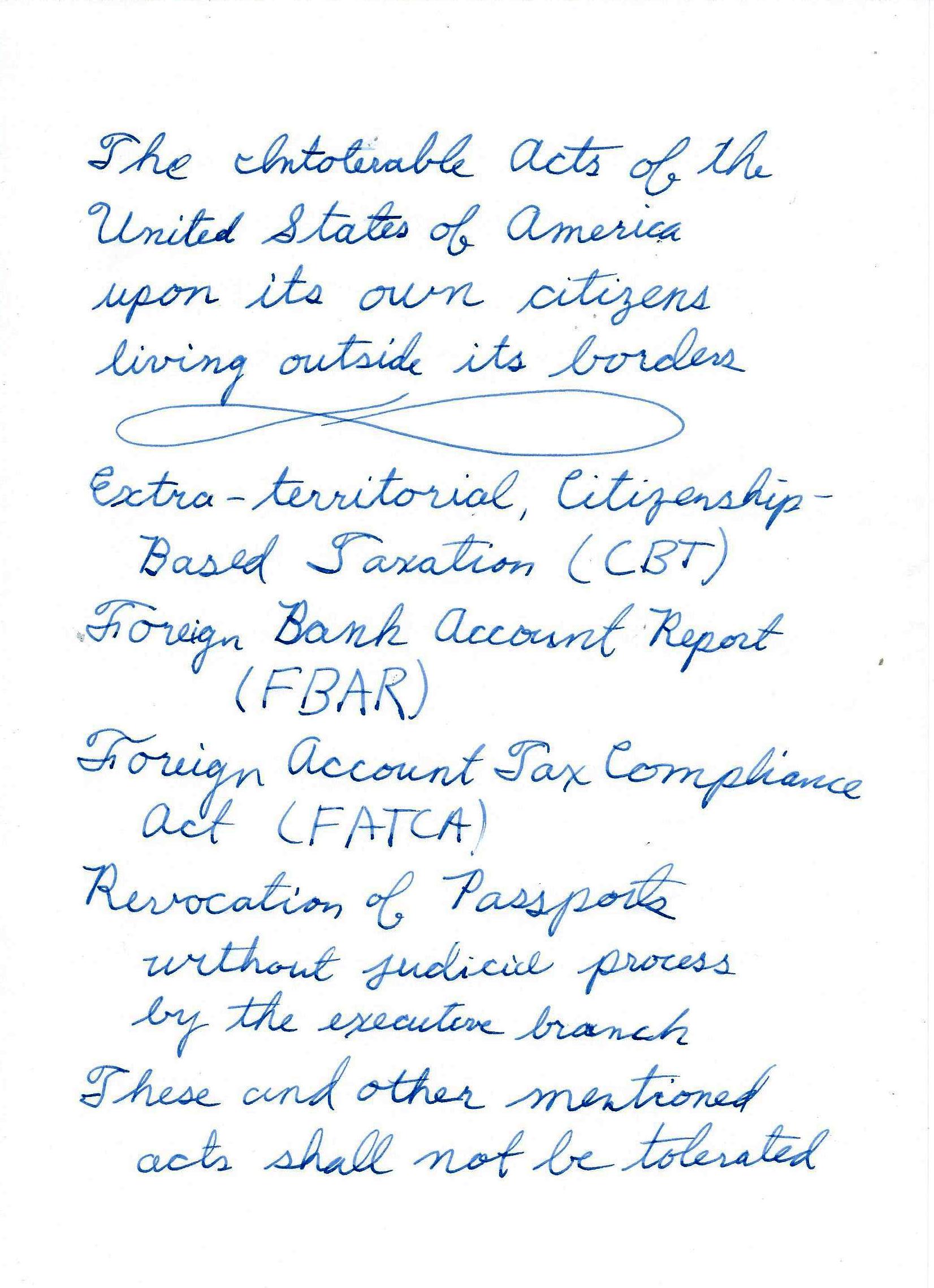

These actions, performed by the government of the United States of America, upon its own citizens living outside its borders, are heretofore listed as The Intolerable Actions:

Your violation of our inalienable rights simply because of our presence outside your borders,

your placement of your laws outside your borders and upon our persons,

your extra-territorial taxation,

your redundant taxation reporting requirement, after we have reported taxes where we live,

your evaluation of our tax if it is high enough, and your assessment of additional tax if you do not believe our local tax is high enough to your tastes, and which is evaluated on every category,

your excessive governmental usage of reverse-tax-loopholes against us,

your bizarre judicial and extra-judicial governmental determinations of willful versus non-willful conduct,

your required extra-territorial activity-reporting upon trusts and business activities,

your excessive taxation of mutual funds and labeling to “PFIC’s”,

your presumption of guilt of tax evasion until innocence is proven,

your concepts of forced FBAR personal asset reporting,

your management of our private affairs through forced FBAR reporting to the federal police agency FINCEN,

your assessments of unconstitutional fines (greater than the value of the assets!),

your “amnesty” programs such as OVDP which devastated the assets of the colonists who could not prove their innate innocence,

your waving of our bills of rights, including the 4th, 5th, 6th, and 8th amendments,

your absence of government services,

your global FATCA bounty-hunting of U.S. persons,

your FATCA IGA deputization of friendly and unfriendly governments to bounty hunt U.S. persons,

your FATCA sanction threats and your forceful over-ruling of our local government’s laws,

your even further over-reach of the above to our families, associates and “U.S. Persons for Tax Purposes”,

your for-profit consulate services,

your taxation-based citizenship and tax-based issuance of travel documents such as passports,

your threat of revocation of our passports if we do not fulfill your unconstitutional demands,

your restriction of our emigration rights,

your excessive payments for emigration ($2350),

your criminally lousy emigration consulate service, and long lines,

your non-optional servitude of your citizenship and your designation of “US person”, stealing our children for servitude to you,

your so-called “protection” of your Bank Securities Act of 1933, which disallows us from purchasing securities where we live,

your WEP discount of our earned Social Security solely because we have additional non-American supplemental pension programs,

your toleration and encouragement of global discrimination inside our colonies because of our American national origin,

your forced registration and potential draft of our youth in your army,

your dismissal of our legal arguments,

your barriers upon voting, and often disallowance of our children’s right to vote,

your lack of response to our correspondences,

your labeling of us all as criminals and tax evaders within the halls of buildings we are forced to pay for, and

your demonization of our colonies and our colonists in your government buildings and in your captive media.

Posted: These unconstitutional violations of our inalienable rights shall not be tolerated by those citizens of the United States of America who live outside America in the colonies.

This listing of Intolerable Acts may be updated periodically, based upon the democratic inputs of the United States Citizens and U.S. Persons for Tax Purposes.

Brilliant! Very comprehensive and very honest.

Bang on!

The list is long – thanks for compiling!

@Banc De L Asteroide

You nailed it.

More easy to comprehend than the post last week written in style of few hundred years ago.

This is what I tend to write lately:

The US has built a virtual Financial Berlin Wall to keep US persons in by punishing harshly those who have left – even those gone decades – all in the name of tackling US resident tax cheats with an account(s)/assets overseas. FATCA is part of this new Berlin Wall.

JFK famously said in Berlin ‘we don’t need to build walls to keep our people in.’ Fast forward to the present day, and the US has done precisely that with its compliance and tax laws assuming all US persons live in the US, with extra penalties restrictions and disincentives for money, accounts, and investments in countries other than the US, even if you live permanently overseas and this money, accounts, and investments, are local to you.

The US Constitution did not confine liberty and the pursuit of happiness only to those US persons resident in the US. In an increasingly global and mobile world the US should not punish US persons living, working overseas, and expanding US influence and trade overseas. This is in complete contrast to all other OECD nations, thus disadvantaging those with US Citizenship.

The situation of US persons tax resident abroad:

Double Taxation (county of residence + US tax via tax treaty gaps)

Without Representation (would never have agreed to it all)

Without US Government Services (that US resident US persons may receive)

Without a Care By The US Government For One’s Well Being (only about stick and compliance)

With Unfathomable Compliance (obligation to overlay the 74,000+ page US tax code on top of the tax code of one’s country of residence – with inevitable tax treaty gaps through which double taxation flows through).

With Excessive Compliance Cost (see above – it all requires highly specialized assistance and can’t be done with TurboTax, and you don’t use that because of the potentially bankrupting penalties (that US residents do not face for their everyday accounts in the US if not done right).

With Excessive Compliance Penalties (The U.S. tax rules punish accounts and investments that are foreign to the USA. The compliance penalties for not reporting accounts right could be bankrupting even if no US taxes are owed)

It is all UnAmerican, has nothing to do with ‘liberty and justice for all”, it is unfair and wrong!

Any US persons living overseas caught up in this must visit the message boards of The Isaac Brock Society and Facebook Citizenship Based Taxation and American Expatriates Groups; and consider supporting the Canadian FATCA IGA Lawsuit and contribute to citizenshiptaxation dot ca.

US citizenship should be about the greatest liberty in the world. Yet the truth is US persons living overseas are tremendously disadvantaged by the US government compared to nationals from all other OECD countries. The US should join the OECD and adopt Residence Based Taxation.

Nice handwritten part shows up on Twitter well:

https://twitter.com/spinweaveknit/status/735604553198931969

https://twitter.com/JCDoubleTaxed/status/735584755979190272

https://twitter.com/JCDoubleTaxed/status/735637012502323202

@JC The US Constitution did not confine liberty and the pursuit of happiness only to those US persons resident in the US.

Right, tell that to the Homelanders.

Also wish Americans would stop thinking they invented the concept of Liberty. Are any history classes, other than American history, taught in the schools there? Do homelanders not realize how extremely young their country is in terms of other world nations? Or do they think they invented the world? In their own image of course. The arrogance appalls me as it does many in Europe and elsewhere. Wielding that big stick in such a short time carries clout I imagine. The USA could have been the beacon of a new world but they failed. An incredible loss of potential. The statue of Liberty was a gift which they have tarnished.

“The US Constitution did not confine liberty and the pursuit of happiness only to those US persons resident in the US.”

The US Constitution is silent on that matter. The 5th Amendment prohibits depriving a person of life, liberty, or property without due process, but the 5th Amendment was written by dead white males and the 5th Amendment doesn’t even have an army to defend it. The 5th Amendment says nothing about pursuit of happiness.

Once upon a time US courts thought the US Constitution rules how the US is constituted, so the US government was only allowed to do what the Constitution allowed it to do, so no matter what extraterritorial place the US government wanted to act and no matter what maybe-or-maybe-not-foreigner the US government wanted to act against, the US government couldn’t do it without due process. Well that’s dead now of course. The 16th Amendment is the only one that applies outside of US borders now.

“The USA could have been the beacon of a new world but they failed.”

Actually once upon a time it was unless you were black or Irish or Jewish or atheist or Filipino or communist. It failed after that.

Once upon a time I had an argument with my father about democracy. He said that the US couldn’t have a democracy like ancient Greece.

Well of course. Greece gave us the word democracy but not the implementation. 90% of ancient Greeks were slaves.

Why couldn’t the US be a democracy like modern Switzerland.

Though of course have the same question about Canada.

Of course my list was incomplete, but how could I leave out the most important one. Let me try that again.

“The USA could have been the beacon of a new world but they failed.”

Actually once upon a time it was unless you were black or Irish or Jewish or atheist or Filipino or communist or an American race. It failed after that.

It’s not a popular opinion, I know, but 100 percent of the grievances in that list can be avoided in Canada by not filing US tax returns (or attempting to vote or register for the draft or obtain a US passport) and not admitting to US citizenship when asked by a bank.

The usual caveats: One, in other countries the FATCA-related problems can be more serious. Two, emigres with family and financial ties to the US may have difficulties, especially those without multiple citizenship.