"Residence should be a “necessary condition” for US taxation for ALL people!"https://t.co/4fCxD7DmiJ Jackie Bugnion on importance of RBT

— Patricia Moon (@nobledreamer16) May 3, 2016

This is the first in what I expect will be a series of posts on an issue we have yet to really focus on. Yes we all know what RBT is and so on but what we may not be so aware of, is how the US, while claiming we are “residents” of the U.S., doesn’t even give us equal (if not better) considerations than aliens/immigrants. And if this information doesn’t make you hopping mad, read it until it does.

*******

cross-posted from citizenshipsolutions dot ca

Introduction

Every country in the world with the exceptions of Eritrea and the United States claim tax jurisdiction based on “residence”. Although the tests for “residence” may differ, “residence based taxation” means that it is possible to sever your tax connection to a country by severing residence.

The nations of Eritrea and the United States impose taxation based on citizenship. U.S. citizens (primarily those “Born In The USA”) can NEVER sever their tax connection to the United States as long as they remain citizens. When it comes to U.S. citizenship-based taxation it is possible to NEVER have lived in the United States and still be subject to taxation!

Citizenship-based AKA “Place of Birth” Taxation is NOT based on any kind of physical presence or actual residence …

Q. Why is it that:

(from an email message I received)

“The British are called “subjects” but they are citizens; and the Americans are called “citizens” but they are “subjects”?

A. How about, as a proposed answer? (from an email message I received), because (CBT = “citizenship-based taxation”):

“CBT is a servitude (apparently some minds still can’t accept the abolition of slavery and racial segregation, so they have to reintroduce servitude). You, like any American “citizen” are in truth property of the IRS, and you will remain so unless you give up your citizenship (which means, like all serfs that you wold have to buy back your freedom from your master). If you don’t like the word “serf”, you may say that you are indentured. But that’s basically the same idea; you’re not free.

CBT is a problem of the rest of the world, because it is vile and

despicable: “No one shall be held in slavery or servitude; slavery and the slave trade shall be prohibited in all their forms.Why? CBT means that an American is bound by birth to pay taxes to the US, even if they have never lived there. The truth is, all Americans (including you, including all people in Congress) live in serfdom. Those considering that CBT (i.e. being a serf) is a problem only for expats, are not really concerned by their liberty. They are cattle in a pen, they don’t know what freedom means. CBT has made the word “freedom”

meaningless.”

Strong language indeed! Offensive to some? Yes. But what about the concept itself? Is “citizenship-taxation” morally offensive? It depends on who you ask. Is it better to call U.S. citizens “prisoners”? There have been many references to the “prison of citizenship-based taxation“.

The simple fact of the matter is that:

1. The United States claims the right to impose world-wide taxation on people who do NOT live in the United States and on income earned outside the United States.

2. The United States requires all those who it defines as its citizens to comply with expensive, penalty laden reporting requirements that enforce the principle that: “U.S. citizens abroad are required to live as a U.S. resident lives”. This is the “When In Rome, Live as a Homelander” principle.

What this post is about

This post is NOT about “U.S. citizenship-based taxation” per se. This post is about the connection between “presence” in a country and taxation. U.S. citizens are ALWAYS U.S. tax subjects as long as they are citizens WHETHER THEY HAVE ANY PHYSICAL PRESENCE IN THE UNITED STATES OR NOT!

That said, CBT is a problem ONLY for those U.S. citizens who decide to live outside the United States. From the perspective of U.S. citizens living in the United States (“Homelanders”), the U.S. tax system is based on residence. Let them try to leave the United States of America!

The ONLY advantages to being a U.S. citizen are that you have the right to live, work and carry on business in the United States.

For U.S. citizens, “residence” is not a necessary condition for U.S. taxation.

Rather for those born in the United States, “citizenship” is a “sufficient condition” for U.S. taxation.

But, I have digressed …

This post is about “non-resident aliens” and the circumstances that may cause them to be converted from “non-resident aliens” to “resident aliens”. Once they have been converted from “non-resident aliens” to “resident aliens”, they are subject to the full force of the Internal Revenue Code.

Until they are converted to “residents”, non-resident aliens are subject to their specific and far narrower rules. These rules are found primarily in Internal Revenue Code S. 871. The mode of “taxation of non-resident aliens” combined with FATCA and the refusal of the United States to embrace the OECD Common Reporting Standard, reinforces the role of the United States as a Tax Haven.

Different kinds of visas = Different kinds of “physical presence” to the United States

From a U.S. perspective, if you are NOT a U.S. citizen, you are an alien. Aliens will enter the United States under different kinds of Visas or (in some cases) with NO visa.

The “Green Card” (permanent residence Visa) vs. Other Kinds of Visas (not for permanent residence)

How are “non-U.S. citizens” AKA “aliens” taxed under the Internal Revenue Code? At what point does an “alien” become a “resident” of the United States?

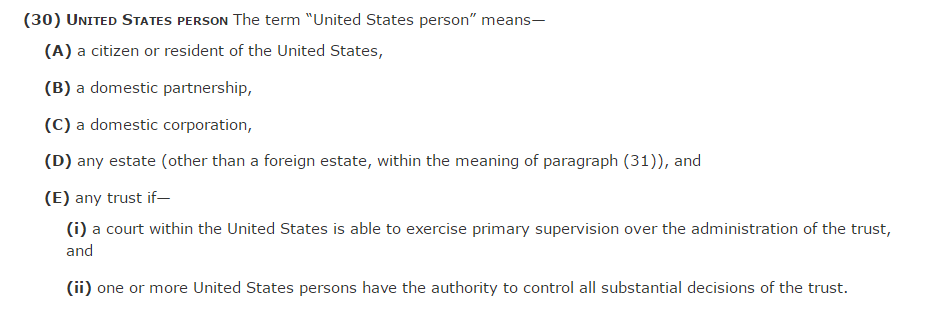

S. 7701(a)(30) tells us that “U.S. Person” includes a “resident”. When does an “alien” become a “resident”?

S. 7701(b)(1)(A) defines when and ONLY when an “alien” becomes a “resident”.

The circumstances INCLUDE:

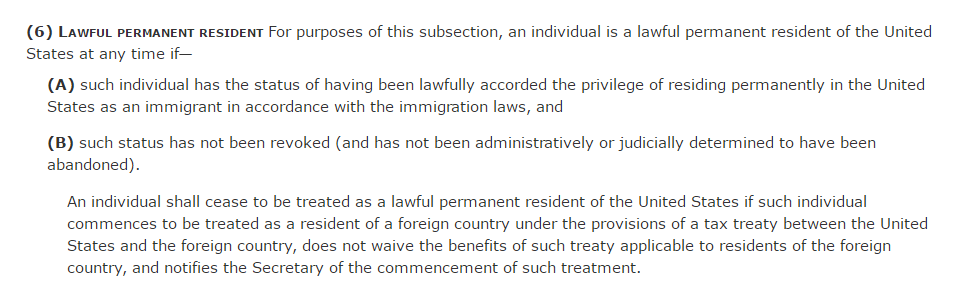

The Green Card Test – lawfully admitted as a “permanent resident”

Note that a Green Card gives the right of “permanent residence”. Therefore the (rebuttable) presumption is that Green Card Holders have an actual physical presence in the United States.

Q. Is it possible for a Green Card Holder to rebutt the presumption that he is a U.S. “resident”?

A. Yes, the Green Card Holder may be able to make use of a “Treaty Election” (normally Article IV) of a Tax Treaty. Does the availability of the Treaty Election presume that one should NOT be at tax resident of more than one country? Does the presume that a person should be subject ONLY to taxation where he actually resides? Does this assume a presumption of “residency based taxation”? It’s interesting to read the criteria to determine “tax residency” under the “Canada U.S. Tax Treaty“.

Article IV of the Canada U.S. Tax Treaty reads:

Article IV

Residence

2. Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States, then his status shall be determined as follows:

(a) he shall be deemed to be a resident of the Contracting State in which he has a permanent home available to him; if he has a permanent home available to him in both States or in neither State, he shall be deemed to be a resident of the Contracting State with which his personal and economic relations are closer (centre of vital interests);

(b) if the Contracting State in which he has his centre of vital interests cannot be determined, he shall be deemed to be a resident of the Contracting State in which he has an habitual abode;

(c) if he has an habitual abode in both States or in neither State, he shall be deemed to be a resident of the Contracting State of which he is a citizen; and

(d) if he is a citizen of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement

The “tie breaker” provision of the treaty seems to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

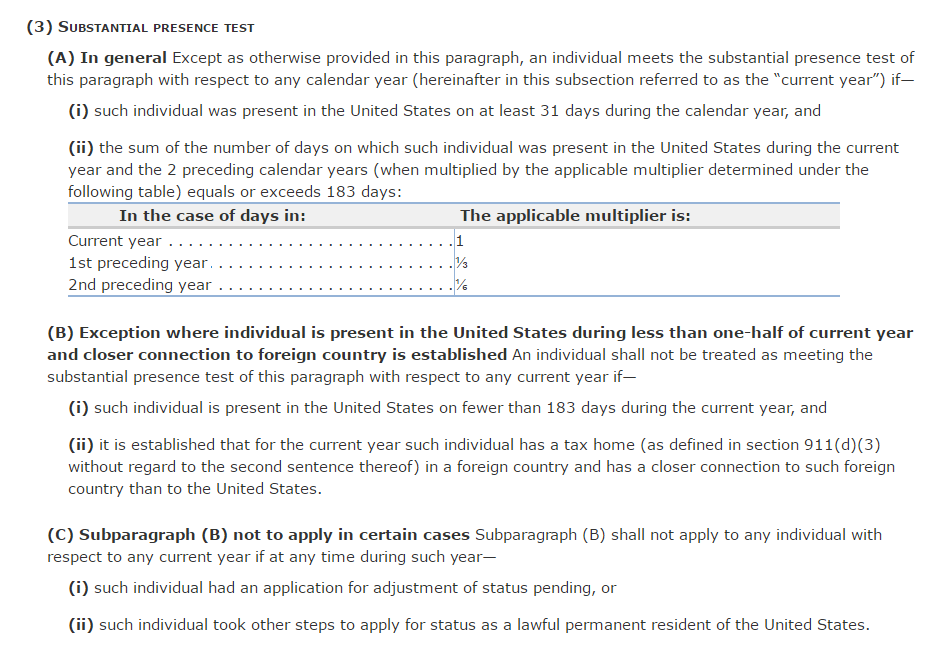

Meets the “substantial presence” test

Note that “substantial presence test” is found in S. 7701(b)(3) and needs to be read very carefully.

A. Defending yourself against having actually met the “substantial presence test”

Note that S. 7701(b)(3)(B) provides a “defense” to meeting the “substantial presence” test. This defense is generally referred to as the “closer connection” exemption. It is NOT available to U.S. citizens (they are not aliens) or to Green Card Holders (they are already “residents”).

It is generally claimed by filing IRS Form 8840.

If you meet the substantial presence test file Form 8840, "Closer Connection Exception Statement for Aliens" https://t.co/rAZCjywXQb

— Citizenship Lawyer (@ExpatriationLaw) May 1, 2016

By filing Form 8840, one is taking the position that:

Yes, I have met the “substantial presence test”. But, I have a closer connection to another country.

The “defense” is based on S. 7701(b)(3)(B) of the Internal Revenue Code. This “defense” is NOT based on Article IV of the Tax Treaty. Notice that the defense is based on being a tax resident of being another nation. Can one infer that the Internal Revenue Code assumes that people should NOT be considered to be “tax residents” of two countries?

The “closer connection test” seems to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

B. Defending the allegation that you have met the “substantial presence test” in the first place

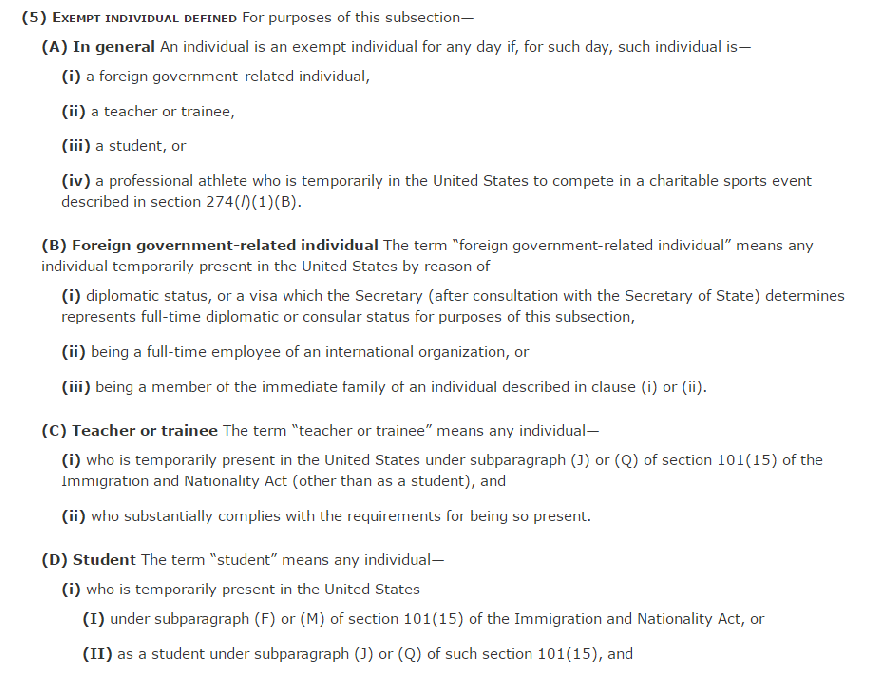

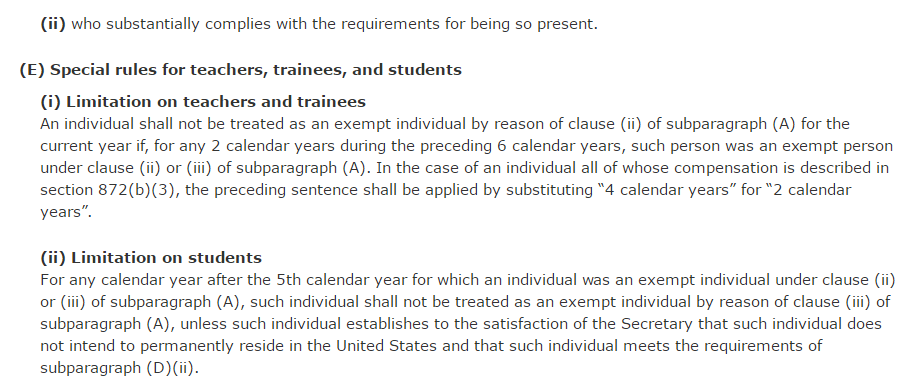

To meet the “substantial presence test” you are required to have spent a certain number of days in the United States. S. 7701(b)(5) specifies days of ACTUAL physical presence in the United States that are NOT to be counted as “physical presence”.

continued

Significantly, this section of the Internal Revenue Code specifically references S. 101(15) of the Immigration and Nationality Act to clarify exactly which kind of visa holder is entitled to this exemption. In other words, the focus is on the specific kind of visa that the person used to enter the United States.

The “exemption” is generally claimed by filing IRS From 8843.

IRS Form 8843: Explaining why you don't meet the substantial presence test – what days are excludable? https://t.co/kd9vwXWO8Z

— Citizenship Lawyer (@ExpatriationLaw) May 1, 2016

By filing Form 8843, one is taking the position that certain days that you were actually present in the United States should NOT be counted as a day toward meeting the “substantial presence” requirement. Notice how the basis for the “exemption” is tied to very specific kinds of visas and specific reasons for actually being present in the United States. A practical description of

- who must file Form 8843

- why Form 8843 must be filed

- how Form 8843 defends one against meeting the “substantial presence” test may be found here.

The “exemption from days toward the “substantial presence test” seems to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

One might think that the United States has a system of “residence based taxation” …

Notice that the obvious purpose of the S. 7701(b) and Article IV of the Tax Treaty are to ensure that, for non-citizens”, a “physical presence” in the United States is met before one is treated as a “tax resident”?

In the case of “aliens” it appears that “residence” is a necessary but NOT a sufficient condition for U.S. taxation.

What is it about a “U.S. place of birth” that makes U.S. citizens exceptional?

Why should this be different for citizens? Why shouldn’t citizens also be required to have a “physical presence” in the United States before becoming a “resident” for tax purposes? Why should ONLY U.S. citizens be “tax residents” of the United States even if they reside outside the United States?

The usual answer to this question is:

It’s Cook v. Tait! By God in 1924, the Supreme Court of the United States (per Justice McKenna) ruled that the United States could impose taxation on its citizens abroad.

I am not certain that Cook v. Tait can be interpreted to mean that the United States can impose taxation on ALL of its citizens abroad. As I noted in a previous post about “Cook v. Tait”:

“Citizenship taxation” is a relic of the post that probably was NOT justifiable in 1921. If it was justifiable as a general principle, note that even in 1921, the definition of “citizen” in Article 4 of Regulation 62:

4. A citizen is defined as follows: “An individual born in the United States subject to its jurisdiction, of either citizen or alien parents, who has long since moved to a different country and established a domicile there, but who has neither been naturalized in or taken an oath of allegiance to that or any other foreign country, is still a citizen of the United States.”

This appears to mean that if Cook HAD become a naturalized citizen of Mexico OR taken an oath of allegiance to Mexico, that he would NOT have been considered to be a U.S. “citizen” for tax purposes. It also means that all those “so called Americans abroad” who emigrated to other countries and became citizens of those countries would NOT have been considered U.S. citizens for tax purposes! This suggests that “citizenship taxation” does NOT have the rich history that it’s advocates claim. It also means that the new U.S. concept of the “Tax Citizen” which began in 2004 is NOT the entrenchment of an old principle but the establishment of a new principle.

Interesting, assuming that Cook had become a citizen of Mexico and was residing in Mexico, perhaps Justice McKenna should have ruled that:

The definition of “U.S. citizen” for tax purposes seemed to assume that:

1. People should NOT be tax residents of more than one nation; and

2. They should be treated as “tax residents” of the country where they actually reside.

Conclusion …

Those born in the United States are NOT exceptional. In order for the United States to participate in the global world:

As Jackie Bugnion so persuasively argues, Residence should be a “necessary condition” for U.S. taxation for ALL people!

John Richardson

All of the analogies being mentioned here today are spot on. The USA maintains the illusion that you can “leave the plantation” but when you do the banks and tax agencies are cued up to hunt you down to make sure you are a forever US tax and form slave. What a deal for the USA! It doesn’t have to pay the hunters or provide any services to the hunted. Here’s another potential “US person” trap …

ALERT for “US persons” RE: CANADIAN 2016 CENSUS

A) Access the long form of the census here:

https://www12.statcan.gc.ca/nhs-enm/2016/ref/questionnaires/questions-eng.cfm

B) Be aware of your risk when you answer the citizenship related questions on the long form.

C) Consider the information and suggestions provided at this website:

http://countmeout.ca/

D) Definitely DO NOT make it easier for them by submitting the long form online.

I’m not a number, I’m a free man.

Therefore I shall never comply…

@ calgary411

Thanks! You can’t see the fingers on the fellow’s left hand but if you could you would see that the middle finger is extended.

@ calgary411

What you can see is that fellow’s nose is as long as Pinochio’s.

“That said, CBT is a problem ONLY for those U.S. citizens who decide to live outside the United States.”

Hey Baby Elle, you brought it on yourself. Change your decision now.

Hey, Calgary411’s son, you brought it on yourself. Change your decision now.

“From a U.S. perspective, if you are NOT a U.S. citizen, you are an alien.”

No, the US knows that US non-citizen nationals are neither US citizens nor aliens, even though US regulations contradict each other on how to deal with these.

Meanwhile, CBT is still CBT. Even when a tie-breaking treaty validates the US non-resident status of a non-resident US person, the non-resident person is still a US person.

“Those things [shock collars] belong on CBT supporters’ private parts.”

Dear shovel,

What are private parts?

Yours truly,

FBAR

@Norman,

FBAR replies;

UStaxablecitizenserfs’ asse(t)s, wherever located in a foreign (non-US) country.

@ Steven Tracy

You and I for sure and Gwen as well as others. We are not budging, not giving up. I am autonomous. No country, not even my own owns me.

I am a Free Woman. If I do/did nothing else, my statement of claim in our law suit sets that out.

And no tax condor or anyone else in any position will ever convince me otherwise. Nor do I feel like a victim. Systems hold no weight or providence over me. I know who I am.

I am the only person who is entitled to define me.

@All

The 2016 Canadian Census topic now has its own post.

@CanadianGinny re: “And no tax condor or anyone else in any position will ever convince me otherwise. Nor do I feel like a victim. Systems hold no weight or providence over me. I know who I am. I am the only person who is entitled to define me. ”

Ginny, I love your tenacity and non-defeatism. Was thinking of that ‘last great act of defiance’ poster you may have seen where an eagle is about to grab a small field mouse who stands facing the eagle with his tiny middle finger up in the air. But it doesn’t quite fit you Ginny. You are no average mouse. This is more fitting:

http://i3.cpcache.com/product_zoom/1343840827/the_nexttothelast_great_act_of_defiance_stainle.jpg?height=250&width=250&padToSquare=true

@brockers… when I stop crying with laughter at the mouse with the gun I am gonna print it off, superimpose an American Bald Eagle and post it on my cubicle wall. brilliant!!

@Crystal London, Crying with laughter beats just crying eh!? I’ve seen the original ‘great act of defiance’ with a bald eagle, but not the ‘next to last’ version.

Is Article 4 of Regulation 62 still in effect? Or was it “repealed” by the legislation of 1986 (?) that said you were still a US citizen if you had not “intended” to relinquish your US citizenship when you naturalized?

“@brockers… when I stop crying with laughter at the mouse with the gun I am gonna print it off, superimpose an American Bald Eagle and post it on my cubicle wall. brilliant!!”

Hey! crystallondon Canadian bald eagles residing in British Columbia object vociferously to that implication that they are American. You owe them an abject apology! They say that they were born and bred in Canada and owe no allegiance to the state who has absconded with their likeness.

Better yet, call them North American bald eagles.

Coastal Bald Eagles living in the Fraser Valley winter year- round in Canada.

The others are migratory and could be subject to designation as US birds due to spending more than 80 days in the US thus inviting being FATCA’d out of the proceeds of any prey they catch.

However the year round diaspora of Coastal Bald Eagles in BC and in the southern regions of Ontario and coastal regions of Newfoundland highly object to being termed as “American Bald Eagles” since they never set foot in the USA and object to being lumped in with those bald eagles who migrate and take advantage of the prey in the UNITED STATES.

As I have heard them mutter in their branches. “Why the hell should we be charged for American fish when all we’ve ever caught are Canadian salmon. We don’t fish from American streams!”