New Zealand’s financial industry invested 100 million NZD, whilst its government invest 20 million NZD to prevent Americans from sending their money to New Zealand to avoid taxation. Also, eligible Kiwis can be identified to pay tax to USA–to help USA tax Kiwis whom USA declares “United States Persons for Tax Purposes“. Such identified Kiwis can be forced to pay U.S. taxes while living in Kiwiland.

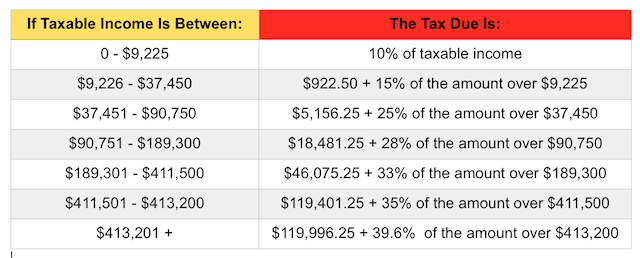

So far, by investigating the highest two US tax categories, we’ve seen that the only 0.274% of the first 81.1% of the expat population’s tax returns yield tax revenue to USA. Now, we investigate expats who may be exposed to USA’s 33% to 35% tax bracket—which comprises 1.9% of the US expat population. If a United States person lives in a country in this range, he could be exposed to USA taxation ranging from 0% all the way up to 6.9% (average 3.45%). These countries are identified to have taxes in this range (with percentages of the US expat population).

Total 1.9%

Colombia 0.7%

Guyana 0.0%

New Zealand 0.8%

Swaziland 0.0%

Venezuela 0.4%

New Zealand is the most significant in this group, and has a top marginal tax rate of 33%. Let’s compare that to America’s tax tables.

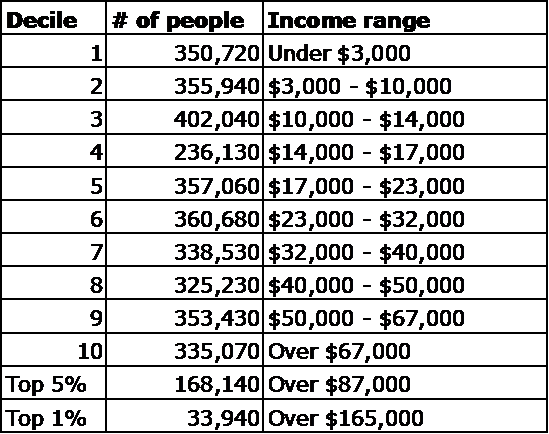

U.S. tax rates for single filers

America has a policy to require its citizens to pay additional tax to U.S.A. if the residence country of a U.S. citizen is not as high as the U.S. tax rate. It has about a $100,000 income exemption. Hence, a US person in New Zealand making 511,501 USD to 513,200 USD per year will be taxed by USA an additional 2% (a very narrow band worth considering insignificant). For any income above $513,201 USD, USA will tax that person 6.9%. This means, that USA can only tax dual citizen Kiwis with incomes over $513,201 (763,000 NZD).

So, how many Kiwis have incomes over 763,000NZD? A: Far less than 1% of the Kiwi population, or less than 1% of the dual-citizen population.

New Zealand has 0.7658% of the US expat population. And therefore, less than 0.07658% of the U.S. expat population can be taxed 6.9% of their marginal income above $513,200. This is beginning to sound ridiculous–Just BEGINNING to sound ridiculous. The story can be no better than U.S. citizens living in Colombia (0.7%), Guyana (0.0%), Swaziland (0.0%), or Venezuela (0.4%). Less than 0.019% of the US expat population can be taxed maximum 6.9% for their incomes above $513,200.

In New Zealand—how many people is this really? Various estimates yield the quantity of U.S. citizens in New Zealand to be between 21,462 Kiwis BORN in USA, to 38,207 to 66,600 Kiwis with known and unknown US citizenship. USA could tax less than 1% of them.

USA could potentially tax less than 666 Kiwis 6.9% of their marginal income above $513,200.

The ridiculousness of America’s extra-territorial taxation glares in New Zealand.

New Zealand has self-paid more than 120 million NZD to help America collect taxes from less than 666 rich dual-citizen Kiwis.

@Mark Twain, this is very valuable work.

I would do the following myself but you likely can do a calc swiftly.

Could you do an estimate based on the known information you have, as to what the USA could possibly collect from NZ Citizens with US taint.

I think this is a project we need to do country by country to pair up with the actual country by country cost.

sure. Provide me with the income of those 666 rich dual citizens. The calculation is simple.

Don’t forget the net investment income tax. For anyone in the income range you’re talking about, NIIT could be significant. Those earning above the NIIT threshold will owe the IRS 3.8% of their investment income on top of the amount you’ve computed. I suspect this could materially increase the US tax owed/collected in New Zealand and elsewhere (including high tax countries).

Mark, could you create a formula so anyone could plug in the variables and get their own ridiculous outcomes for their own countries?

It’s not just about taxation, but tracking people. If your a ‘US person,’ authorities around the world will simply go to the US for FATCA information.

Yet again ‘US persons’ are being disadvantaged vis-à-vis their fellow citizens.

Why should one resident Canadian citizen have their data viewable to any government in the world while another one doesn’t?

The US is going to become a clearing house of data of sorts for other countries. Where it’s illegal for the local government to collect and maintain different data, not so for the US. Once it’s in the US’ hands that transfer of data government to government supersedes any national protections.

For the EU (or anywhere else for that matter), the following must be pursued:

1. Alter the KYC (Know Your Customer) procedures at FFIs to include a new classification (EU resident citizen) that by default is FATCA exempt / only local tax authority reporting or EU saving directive.

2. FFIs should be liable to errors resulting in the customer facing financial loss, penalties or even criminal charges by releasing the data to the wrong tax authority.

3. EU banks should have a section on the banking websites that clearly shows their tax reporting status online / in real time along with listing any changes over the calendar year. When a change of status is made, the customer should be notified and given 30-60 days to dispute the proposed tax reporting change along with a huge message flashing on the homepage of their banking website.

The way to challenge FATCA outside of the courts is to make it real to people force transparency on the FFIs is one way to do that.

Of course FFIs will resist these changes after wasting millions on FATCA implementation, however, the customer needs a pathway to be in the driving seat with this issue.

By allowing FFIs to run a backroom operation out of the public spotlight light is wrong. The financial industry is up to their necks in FATCA by lobbying governments around the world to pass these laws. However, the free pass they’ve paid for should come without consequences. Currently we run a post FATCA world where FFIs face no consequences for errors or responsibility to their customers what has been reported to whom. That has to change.

That’s what’s really going on in the world today.

If 666 people earning an average of USD 2M a year pay 7% if that to the US it amounts to USD 93M a year in taxes to the US.

If you think people who earn $2M a year pay taxes like people who earn $100K then I have a bridge for sale I’d like to show you.

Very valuable analysis, thanks so much @MarkTwain for all your work.

So very useful to have some way of quantifying what it will cost NZ (and every other country in the world) to pay for the FATCA lunch the US Treasury is demanding at the world’s expense – via extortionate threats of unwarranted and unjustified economic sanctions.

No wonder NO COST/BENEFIT analysis was ever done (or published) by the US for FATCA. All the cost is borne by the world – for no benefit to anyone – even the US. The numbers would be damning. We already know that the BS ‘tax gap’ numbers they throw around were pulled out of someone’s aaah ….. hat, and have no robust basis.

So the globe bears the cost of implementing foreign US FATCA law – sucking money out of every other country’s tax revenues and taxpayer and accountholder assets – to implement a US ego project – based on some US political fools’ convenient political and rhetorical claims – without any basis in fact.

https://www.youtube.com/watch?v=yLfxrPnfR_8

Here’s an example of the Trump mentality. Some nutcase decide to make a go at the stage and The Donald wants him in jail because his internet people found some pro ISIS videos on the internet from him. Trump didn’t have kind worlds for the judge who let him walk free.

If President Trump ever is allowed to go abroad, what is he going to say or do to FATCA protestors in the crowd? Rant get him out, US expats are un-American because they don’t want to pay US taxes outside of the US?

My EU ID card beckons in my pocket to go back abroad and that day is getting closer and closer. (Also I’d love to get involved with a FATCA legal challenge in the EU as well).

@Gwen, regarding Canadia, their top marginal rate is above America. USA cannot legitimately taxup Canoodians any higher. It is only the various tax treaty loopholes that USA can take advantage of to illegitimately tax Canadian citizens. Examples of illegitimate taxing up are PFICs and the Canoodian pension plan.

Otherwise, you have to try to replicate the calculations. I plan to address the next lower tax rate next…….Time permitting.

@Don said:It’s not just about taxation, but tracking people. If your a ‘US person,’ authorities around the world will simply go to the US for FATCA information.

Bingo and precisely. It’s about information collection less about tax.

@ Mark Twain: thanks.

http://www.tipalti.com/

To defeat FATCA, I think it’s important developments in the compliance industry.

The above company is a sort of PayPal that collects W9s W8s forms etc gelling together a payment system with IRS BS tax compliance forms.

It’s obvious they’re trying to weed out ‘US persons’ so US companies sending payments abroad don’t have to deal with that issue.

The US is becoming more and more cumbersome to do business in. The US is in the process of isolating itself on several levels. First the Berlin Financial Wall, all money leaving the US must now be put under scrutiny for tax evaders, terrorism, and any other thing the USG cooks up. Another is if Donald Trump is elected president will be pulling out of TPP. What Trump doesn’t tell people is TPP is less to do about trade and more to do about boxing in China for the next 20 years economically to slow the US’ decline in world power.

Trump’s election would do American ex-pats a favour. If the US walks away from TPP, that will leave a vacuum of leadership for China to exploit.

The US exiting TPP will equal the Chinese RMB gathering further acceptance and more decline for the US dollar. FATCA will be weakened in future as long as China doesn’t demand the same. Having said that even if China instituted their version of FATCA, they wouldn’t be demanding tax returns or tax from American ex-pats would they?

Interesting times are ahead.

http://www.bbc.co.uk/news/business-35799404

Another FATCA outrage coming in the UK? The Government is planning to create a top up savings account for low paid workers who set aside 50 pounds per month.

Will this be restricted for UK ‘US persons’ as well in the same way OAP savings accounts were that offered higher interest rates last year?

Is the Government going to get the NS&I to do this or offer this through any UK bank?

The money isn’t big, however, it’ll be the FATCA compliance BS that’ll probably make FFIs put in the ‘US person’ clause.

Sorry, but you have a misrepresentation of the tax due. Since 2006 the foreign earned income exemption is actually taken out of the bottom brackets. So for a single filer the first dollar over the exemption is actually taxed at 28% and not 10%. Thus reaching the higher brackets faster. So this makes it that much more lucrative for the IRS.

This caused a lot of frustration since it pushed people out of the 0% tax brackets for long term capital gains and qualified dividends.

Yaacov. Oops. I will have to update this in the future.

Yaacov But then, no. The exemption is scheduled that way. The tax credit is not. One can choose to exempt and/or credit. Exempt the first 100k, then credit the rest.

Yaacov and others: please continue to check and critique

I still think that Kiwi’s with lower income than USD413k will still owe some US tax. Here’s a hypothetical case:

Let’s assume a Kiwi with NZD200k taxable income in 2015. Using the tax calculator from NZ Inland Revenue, this individual would pay NZD56,920 of income tax. Married Kiwis file separate returns, no joint returns and only a single tax table.

Let’s assume that 5% of the income is interest and dividends (looking at aggregate statistics from the Australian Tax Office, interest and dividends are about 6% of aggregate taxable income in Australia — I’m assuming the distribution is similar in New Zealand as I’m not as familiar with the statistics available there). So, 5% is not unreasonable for someone with this level of income. Assume the remainder of taxable income is earned income. Note that I am not very familiar with the NZ tax system, so I’ve just assumed that the US taxable income is the same as the NZ taxable income after currency conversion. I have not allowed for exemptions or standard deduction on the US side, as I don’t know how they differ from the Kiwi rules.

Converting these numbers into USD using the Annual exchange rate provided by the IRS of 1.492 for 2015, these income numbers convert to USD134,048 total income with USD6,702 of investment income and USD127,346 of earned income. The NZD tax converts to USD38,150 of available Foreign Tax Credit. Using the Married Filing Separate tax table for US tax, I get tax of $32,000, which is completely offset by FTC. (Note that, as the top Kiwi tax rate of 33% kicks in at only NZD70k or about USD47k, tax paid in NZ is greater than US tax even though the marginal rate is the same).

However, as income is above USD125,000, this individual is also subject to the Net Investment Income Tax (the threshold is $200k for singles and $250k for married filing jointly, and $125k for MFS). Therefore she will owe 3.8% of the USD6,702 in investment income or USD255 in tax. No FTC is allowed to offset this tax. (if you’re going cross-eyed with the numbers in paragraph form, a rough spreadsheet is available here)

Yes, choosing Married Filing Separate is a worst case scenario, tax-wise. However, I would expect that a large percentage of expats are married to NRAs.

Another small note — your income distribution numbers are from 2008. I haven’t looked for NZ inflation numbers, but if you adjust to 2015 dollars, the top 1% could be pretty close to NZD200,000.

Bottom line — more people owe US tax than you would think based on raw tax rates. It doesn’t even take PFIC taxes to get there.

Having said that, it’s still a pretty small number of people that will owe anything. The bigger problem is the loss of privacy and the potential for identity theft due to having your local tax authority share your financial data with the IRS (and whoever else in the US government might want to look at it).

I think this investment tax is what is known as the Obama care tax on the rich?

Karen’s good comments came before I was able to write the next piece upon clarifications. See the next piece I wrote.

Yes, NIIT is the Obamacare tax. But the thresholds are not indexed, so over time it will hit more middle class taxpayers.

The big problem with NIIT for expats (other being part of CBT, of course) is that it cannot be offset by the foreign tax credit. So, every expat with income over the threshold will be double taxed on their investment income, even in high tax countries.

For your project of estimating the number of expats actually paying tax to the IRS, just estimate the number of individuals over the NIIT threshold.

BTW, Australia has detailed de-identified tax data on a random sample of 100k taxpayers available for “legitimate research”. Is anyone aware of similar data being available in other countries?

@Mark Twain

Great analysis. The NZ government was warned about this before they passed the legislation, but paid no attention. The real losers in New Zealand are duals who are self employed. There is no social security agreement between the US and New Zealand so all self employed US Persons are subject to the self-employment tax (around 15% of gross income) on top of their kiwi taxes.

To rub salt in the wounds, even if a US/Kiwi paid enough into self employment tax to qualify for US Social Security on retirement the NZ government would confiscate it when drawn as they deduct any overseas pension payments from the local aged pension requirement. What a rort.

There is also a strong possibility that folks would have to pay capital gains tax on property sales or any other asset as NZ does not have a capital gains tax. Plus, of course, FBAR, PFIC on qualified retirement plans (Kiwisaver) and all the other nonsense.

Kiwis that are US tainted are going to be royally screwed – assisted by the NZ government and paid for by the NZ taxpayer.

“One can choose to exempt and/or credit. Exempt the first 100k, then credit the rest.”

For the 90% of us who make less than the exclusion limit it doesn’t matter, but for those who make more, here is good news.

The IRS’s lawyer in Tax Court, and Departmnt of Justice in Court of Federal Claims, both alleged that I was frivolous by obeying the IRS’s published instructions to exclude the amount of excluded income from Form 1116 line 1. They want people to “double dip” both benefits on the same portion of the income. In Tax Court I presented four IRS publications and the IRS’s lawyer stopped discussing the issue, but in Court of Federal Claims I did not respond to the DOJ’s allegation on the issue. So I think the Court of Federal Claims ruling means you have to “double dip” now. Affirmed by Court of Appeals for the Federal Circuit, cert. denied.

“The big problem with NIIT for expats (other being part of CBT, of course) is that it cannot be offset by the foreign tax credit.”

That sounds like yet another treaty violation by the US.

Of course the US isn’t the only country that violates treaties (which is the reason some of my returns depended on US Supreme Court rulings US v. Sullivan and Garner v. US).

So how come countries uphold the US exceptional CBT clauses of tax treaties?

“So how come countries uphold the US exceptional CBT clauses of tax treaties?”

Most likely because they don’t understand the real-world implications. In high tax countries, they all think that FTC will mean that no tax goes to the US.

When the US passes something like NIIT there are so many other moving parts in the equation that the implications are hidden, until someone actually tries to fill in their US tax forms.

I wonder how many renunciations (especially those by covered expatriates) are a response to NIIT.

Mark, exempting and then taking the foreign credit might actually result in a worse outcome for the taxpayer. If you look closely at the FTC form (form 1116 – line 12), you need to adjust your total foreign tax by the relative part of your exemption vs your gross income. So it might actually be more beneficial to forego the exemption and just use all your foreign tax (depends on how the interim brackets pan out in each country).

Obviously, the IRS did this by design to minimize the impact the FEIE has on the tax outcome.