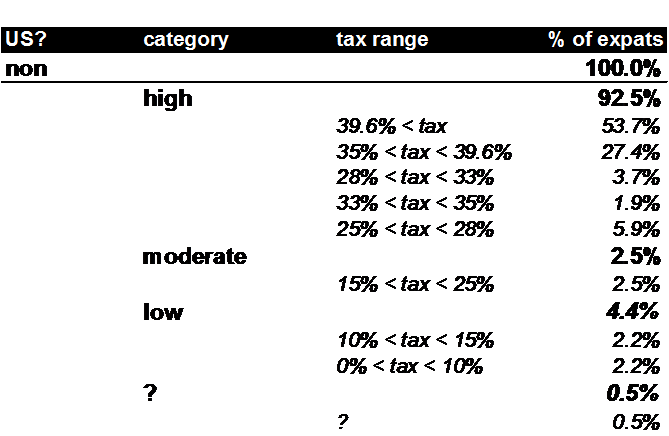

Washington will punish the masses to meet the needs of media propoganda—media which often says “rich expats are leaving America to avoid taxation”—But reality shows that 91.5% 92.5% (updated) of U.S. expats live in regions taxed higher than any typical U.S. tax rate (higher than 25%). And another 2.4% 2.5% live in countries moderately taxed (15%-25%)!

The punishment is meant for those terrible few — “the 1%-ers” , but the effect of the media and Washington is to punish the masses. 8.7 million US citizens live outside America as expats or immigrants. The media has branded them all as rich jet-setters out to escape taxation.

But U.S. expats largely live in high tax regions. This data shows that their reasons are totally NOT for tax avoidance.

The data is assembled from US citizens in each country, as shown by local census and UN data.

A small portion (1.7% 0.5%) of the US expat population lives in “?” countries whose tax rate cannot be identified yet by the author.

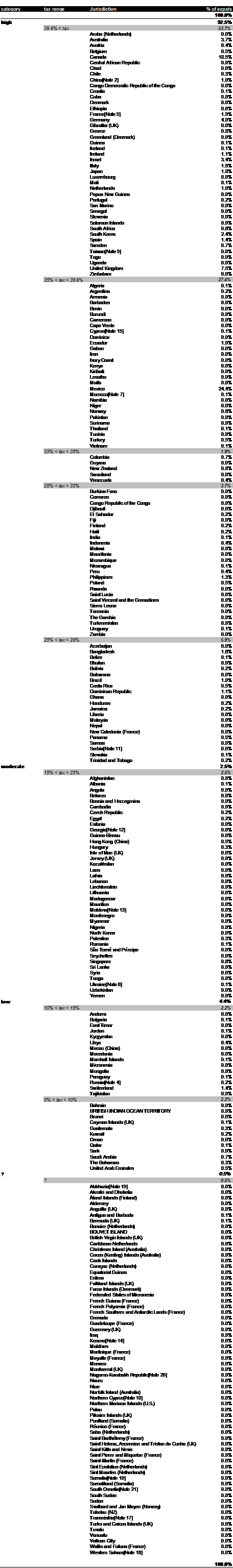

A very small portion of the US expat population lives in jurisdictions known to have personal income tax rates which are less than 10%. This includes Saudi Arabia, Bahrain, Brunei, Kuwait, Oman, Qatar, and United Arab Emirates—far from a luxurious place one might dream to live in luxury.

The only “luxurious” places where US expats are identified to live are The Bahamas (0.3%), Cayman Islands (0.1%), and Guatemala (0.3% ), with the percentage of total U.S. expats in parentheses. Note that Guatemala is tied with Bahamas as being the most luxurious “tax haven” where Americans might move to evade taxation.

(By the way, Guatemala is known to be attractive to U.S. retirees who are trying to minimize their costs in a low-cost-of-living jurisdiction so as to make best use of their limited retirement funds. Many retired servicepersons have discovered Guatemala for this.)

So the entire U.S. extra-territorial personal income tax code is based upon screwing 98% of U.S. expats, simply because media propoganda wants to chase after a tiny proportion of Americans living in Bahamas or the Cayman Islands–who are assumed to be guilty of tax evasion until proven innocent. And the media is also villifying the entire expat population because 1.7% 0.5% of the expat population lives in a place like Ukraine, Vanuatu, Wallis and Futuna, Western Sahara, Zimbabwe — where authors simply cannot find information about the country’s tax rates.

Here are where U.S. expats and emigrants live, sorted by the tax rate of their country.

Washington (and the Washington media): Liars, Liars. Pants on Fire.

(updated 10 March with tax rates from

http://www.economywatch.com/economic-statistics/economic-indicators/Income_Tax_Rate/ )

This information is interesting and proves, yet again, that FATCA as applied to those deemed U.S. persons living outside the U.S., has absolutely nothing to do with collecting taxes and everything to do with imposing fascist and totalitarian policies of control and surveillance on its victims.

I’m sorry to say this, but I seriously doubt that any relief will ever come, at least in the U.S. itself, as they don’t give a damn and the “elected officials”, who are supposed to look out for the interests and well-being of the citizens that they supposedly represent, are totally unresponsive and dysfunctional. The U.S. system is based solely on lobbying and “pay to play”. Justice there only comes at a cost, not because a wrong needs to be made right or that an injustice is being perpetrated that needs urgent attention, but rather that somebody pays to change a law or correct an injustice. Had the Isaac Brock Society paid the over $500,000 instead of to a law firm in Canada, but rather to a few “lawmakers” in Washington, FATCA would have been quickly taken care of and we might not be in this situation today.

The fact that thousands are renouncing their U.S. citizenship should, one would think, attract the attention of elected representatives, who would investigate what is behind this. In the U.S. that is highly unlikely, as there is no longer any semblance of a representative government, and certainly not for expats, who have no representation to start with, yet they are considered fair game to be taxed and have laws applied to them, without having any right to redress or challenge this laws through the democratic process. Yet, the naive Americans still believe that they are dealing with a democratic system. Does a democratic system tax people who, at the same time, they refuse to give even one representative? Does a democratic system hold its diaspora in such malicious contempt and tries, in any way possible to ruin their lives financially? Does a democratic system ignore, and simply not answer, any inquiries about FATCA sent to official “representatives” of the people?

When Americans accept that they are not dealing with a democracy, perhaps then this matter will be handled in the right way. Until then, the ever obedient, law abiding and fearful American will grumble and obey. More and more will renounce, but few will ever stand up to this outrage and collectively refuse, as would be the case in true democracies. It hurt me greatly to hear a German friend, when commenting about FATCA and the problems it has caused to U.S. persons living outside the U.S., say that the Americans actually deserve this, for being such a cowardly and subservient people, unable to rise up against injustice and put an end to such vicious abuse and extortion.

Your data give a good snapshot of where US citizens are living outside the USA. Has anyone come across statistics of the ages of the non-residents and their employment status? This would be useful to determine how many are under 18 and likely dependants of an adult; how many are employees and dependants of the US Government in military or diplomatic missions (I’ve seen numbers in the 500,000 to 1 million for this alone); how many are students studying or traveling abroad; how many are volunteers with humanitarian organizations; and so on. These data would be quite telling as to how many principal earners and heads of household there actually are. My suspicion is that the number of income earners abroad is less than 3 million. I also wonder how many are retirees living off pensions and savings.

Furthermore, more to the point: the number of renunciants and those abandoning permanent residency is less than 0.3% of the approximately 1.7 million net gain in citizens each year (births, deaths, and immigration considered). Is it any wonder that policy-makers and law-makers aren’t concerned about 3 out of every 1,000 immigrants?

My advice to those who are impacted is to work feverishly on obtaining a second ‘escape’ citizenship, become as compliant as possible in the meantime, and pull the ripcord as soon as possible. This is not going to get better with time in my humble opinion.

BTW, I renounced naturalized citizenship in 2012 after 15.5 years.

How about somebody like me? I am from Poland originally currently in the U.S. on green card. I have lived here for 15 years, part of my family is here too.

I am thinking about doing the opposite than most of the people here. I am thinking about applying for US citizenship with knowing that I will continue to live in the U.S. However, I do have some plans spending retirement in Poland. What should I do?

If I move to Poland back can I be non-compliant simply because no FATCA can get me? (based on my non-US birthplace)

Jonasz,

Perhaps until you have to open bank accounts in Poland — will you have retirement savings, etc. to transfer to Poland for your retirement expenses? Perhaps lots to research here at this site even before you take the step to become a US citizen. It should be a well-thought-out decision as there are many consequences for those with US citizenship or permanent (green card) status in the US. No one can give you a specific answer on how to make your decision as it varies for everyone’s situation and level of risk tolerance. It does appear that if you make an unwise decision for yourself, it may be deemed *willful*.

Great, valuable research here. Maybe we should have a #Mythbusted link on the side bar, where we can collect others and for easy reference when dispelling the many fallacies against us?

Good idea, Bubblebustin! Fantastic and informative post, Mark Twain!

Great post @ Mark Twain.

The facts are there for the US to see, but the FATCAnatics are not interested in FACTS, and never were.

And in the meantime, the US hypocrisy continues as it refuses to participate in the OECD CRS while demanding FATCA data via the threat of economic sanctions – coercion and extortion of the rest of the world – while continuing to solidify its position as the biggest tax haven in the world.

http://www.internationalinvestment.net/regions/us-and-oecd-showdown-seen-looming-over-crs/

@Badger

Fool me once…shame on the OECD!

http://taxpol.blogspot.ca/2014/02/oecds-plan-for-global-tax-info-exchange.html

A great idea, Bubblebustin.

I put a link in the Take Action! sidebar box. I’ll go through the archives tomorrow and find some other links for it.

Also, if anyone has links to data elsewhere on the internet, I encourage you to post them on the Mythbusters! page.

And thanks for this post, Mark Twain. It’s what I vaguely suspected, but so useful to see it as data.

Thanks Pacifica.

What this shows is that the secretary should have used his powers under the BSA to exempt all these countries from fbar

Dear all:

First of all I have to say that I have no words to describe what I feel when I start unveiling this issue. I start knowing about it by the end of February 2016 here in Argentina where I´m reseding for almost my complete life (49).

It is is completely unbelievable what is this about, I am disgusted and angry, don´t know whom to ask for advise, and with a feeling of civil violence over me.

I will appreciate your comments or help on this issue. I have a form to complete and sign and give back to the bank and I don´t know what to do.

I cannot beleave that we are almost 9 million people leaving abroad, with all the social network available nowadays and we cannot connect massively to sign up for revocation of these unfair rules.

Metro: You have come to the right place! Welcome! I have copied your question to another thread where it may receive more visibility and someone with greater expertise than I will be able to give you the help you need.

You are amongst friends here who either have gone through what you are experiencing or are afraid they will in the future. My own bank has not asked me to sign anything … yet. I have decided, in my own situation, that I will sign nothing. But every one of us has a unique situation with consequences that may differ greatly depending on your own life’s circumstances.

While you are waiting for a reply I would suggest reading a lot. For starters go to the Sidebar, scroll down to “Important Information” and click on “Your Experiences: Banking”. There may be something there that will help you.

My heartfelt good wishes to you.

Very interesting Mark Twain. Real facts in the end may too the balance. Thank you.

Metro,

Welcome to Isaac Brock Society. Yes, we are so glad you found this site. I can’t advise you whether or not to sign the form your bank has asked you to sign — different countries and their US-deemed *foreign financial institutions* (your local Argentinian bank) may have different policies from other countries regarding reporting your accounts to the US if you refuse to sign (by saying you are recalcitrant). In your country, they may be able to just close your accounts. I don’t know (at this moment) what is set out in the IGA that Argentina signed with the US to implement this US extra-territorality in your country.

As you can see, we have just funded for litigation of the IGA that implements FATCA law in Canada. You can also read of planned litigation in the US against CBT that others of the *almost 9 million of us* can support as it is, in my view and the view of many, US citizenship-based taxation (CBT) that is the main (but for some not only) problem. A or the way forward is for those in these other countries to support the CBT lawsuit — read about it here: http://isaacbrocksociety.ca/2015/11/20/alliance-for-the-defeat-of-citizenship-taxation-adct-announces-cbt-lawsuit/. Argentina, as well as Canada and all other countries of the world except the US and Eritrea tax on residence (RBT) and that is the only way it should be with the dire consequences for many of FATCA.

In the meantime, follow MuzzledNoMore’s advice to read much of the resources here. In the end, we all must make our own decisions, but you will find support from the people who comment at this site. Others can likely give you much better advice and information than I can. One step at a time, Metro. I am so sorry that you too find yourself up against this injustice.

Thank you Calgary. I´m almost sure that Argentina is a non IGA country but signed.

Could you please explain this part for me (from Miranda…):

“Third, it threatens with fines that are way out of proportion to the damage done to government, in violation of the Eighth Amendment: e.g., a $10,000 account earns in a year interest of $100, for which $25 tax is owed–damage to the government, $25; potential non-wilful fine, $10,000; potential willful fine, up to $100,000 or 50% of the contents of the account per annum.”

Those $10.000 is an annual accumulation ? a monthly maximum line ? how should be considerated or calculated ? Thank you in advance.

You may already have this information, but here is a site of Tom Alciere, who is a commenter here at Brock. I hope it is information helpful to you, Metro. I had never seen this before. It is of interest to me (Thanks to Tom A!):

U.N. Member Countries and their FATCA IGA status

Non-FATCA Banks in Argentina

Re: your question:

This is in reference to Foreign Bank Account Reports (FBAR / FINCEN114) yearly reporting is the aggregate (total) of all your highest balance anytime in the year of accounts equals US$10,000 or over, you must file and this is from the IRS site a link on those requirements: https://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Report-of-Foreign-Bank-and-Financial-Accounts-FBAR. So it is the total of each account’s highest balance anytime over the year. (Hope that makes sense.)

I can only say that I agree with you regarding *way out of proportion to the damage done to government, in violation of the Eighth Amendment*.

Metro you haven’t given us enough information for us to help. What form from the bank. ? If in Spaniish, can you translate it please.

@Jonasz

One thing to keep in mind is that once you are in the United States for more than seven years as a greencard holder, you have to go through a lot of the same hassles that citizens have to leave the U.S. tax system. It is impossible to tell how the situation will change, but greencard holders have very little political power, so I can’t see any way that they will change the policy in their favor.

@Publius: yes, I have been GC holder for 13 year out of my 15 years here, so in a case I leave the U.S. it won’t make a difference if I leave as GC holder vs US citizen?

@Jonasz

It is surprisingly tricky for a greencard holder to end their obligations for U.S. tax, particularly if they have lived in the U.S. as long as you have. See:

Virginia LaTorre Jeker has done an article on this: http://blogs.angloinfo.com/us-tax/2012/12/31/giving-up-your-us-green-card-make-sure-it-is-done-correctly-or-pay-the-price/

Hello Duke

I am us citizen by born, and I´ve been living in Argentina for almost 50 years.

It ask regular data as: address, birthplace, date of birth, name, last name, etc.

and then it goes deeper:

Country of residency for tax purposes.

Indicate all countries where you have residence for tax purposes according to their laws of those jurisdiction or maintain US citizenship. And there are 4 lines to be completed (with the SSN).-

After this point, there is another one where eventually you must tick a reasonable explanation (is a statement) why you are not a US resident for tax purposes.

The last tick would be: presentation of US renouncing certifcate.

And blablabla bunch of BS and final signature.

I am sure I am below all the thresholds but this is intimidating, it’s like going fishing sharks with a network for hakes. I feel very alone with only my true with me.

Thank you for your help.

Metro,

Is it possible that you have done something during your 50 years in Argentina that might be considered a “relinquishing act”?

Did you become a citizen of Argentina after age 18 with the intention of giving up your US citizenship?

Have you worked for the Argentine government?

Have you served in the Argentine military?

See this page for more detail: http://isaacbrocksociety.ca/2011/12/12/relinquish-dont-renounce-if-you-can/

(but note that it was written before they raised the cost of a CLN to US$2,350 for everyone).

Also – do you have a US passport?

Karen

not at all from my pint of view, I am not Argentinian citizen but I am planning to do it very soon, without renouncing the US citizen at least for now. I am collecting some documents to do so. It would be another umbrella, I think.

No to all your answers, except the last one. Yes I have a US passport.