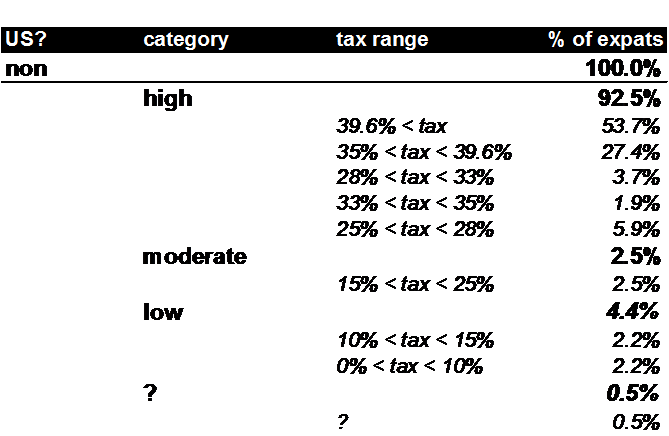

Washington will punish the masses to meet the needs of media propoganda—media which often says “rich expats are leaving America to avoid taxation”—But reality shows that 91.5% 92.5% (updated) of U.S. expats live in regions taxed higher than any typical U.S. tax rate (higher than 25%). And another 2.4% 2.5% live in countries moderately taxed (15%-25%)!

The punishment is meant for those terrible few — “the 1%-ers” , but the effect of the media and Washington is to punish the masses. 8.7 million US citizens live outside America as expats or immigrants. The media has branded them all as rich jet-setters out to escape taxation.

But U.S. expats largely live in high tax regions. This data shows that their reasons are totally NOT for tax avoidance.

The data is assembled from US citizens in each country, as shown by local census and UN data.

A small portion (1.7% 0.5%) of the US expat population lives in “?” countries whose tax rate cannot be identified yet by the author.

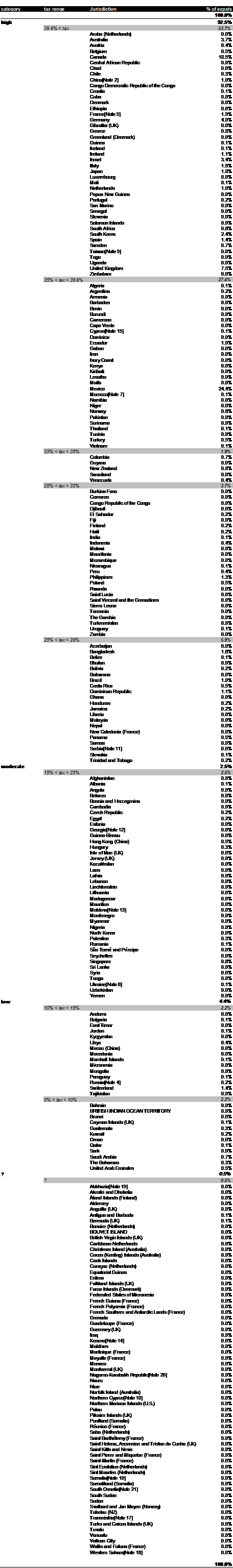

A very small portion of the US expat population lives in jurisdictions known to have personal income tax rates which are less than 10%. This includes Saudi Arabia, Bahrain, Brunei, Kuwait, Oman, Qatar, and United Arab Emirates—far from a luxurious place one might dream to live in luxury.

The only “luxurious” places where US expats are identified to live are The Bahamas (0.3%), Cayman Islands (0.1%), and Guatemala (0.3% ), with the percentage of total U.S. expats in parentheses. Note that Guatemala is tied with Bahamas as being the most luxurious “tax haven” where Americans might move to evade taxation.

(By the way, Guatemala is known to be attractive to U.S. retirees who are trying to minimize their costs in a low-cost-of-living jurisdiction so as to make best use of their limited retirement funds. Many retired servicepersons have discovered Guatemala for this.)

So the entire U.S. extra-territorial personal income tax code is based upon screwing 98% of U.S. expats, simply because media propoganda wants to chase after a tiny proportion of Americans living in Bahamas or the Cayman Islands–who are assumed to be guilty of tax evasion until proven innocent. And the media is also villifying the entire expat population because 1.7% 0.5% of the expat population lives in a place like Ukraine, Vanuatu, Wallis and Futuna, Western Sahara, Zimbabwe — where authors simply cannot find information about the country’s tax rates.

Here are where U.S. expats and emigrants live, sorted by the tax rate of their country.

Washington (and the Washington media): Liars, Liars. Pants on Fire.

(updated 10 March with tax rates from

http://www.economywatch.com/economic-statistics/economic-indicators/Income_Tax_Rate/ )

I can also consider your advice and relinquish.

How it must be done ? by presenting a note at the US consular servces emain entrance ?

Bottom line is that I need a stamp on my copy is that right ? or sending it by regular mail ?

but I can consider relinquishing option.

How it should be performed ? leaving a note at the US consular services main entrance ? for sure I will need a stamped copy. Or sending the note by mail ?

If you’re not an Argentine citizen yet, then you probably want to catch up with your US taxes (or at least figure out whether you owe anything ). To see if you need to file, complete the questions here: https://www.irs.gov/uac/Do-I-Need-to-File-a-Tax-Return%3F remember to enter all amounts in US dollars.

If you do need to file, there’s a streamlined program that removes the penalties as long as the IRS decides you are ‘non-wilful ‘. If you had no idea that you had to pay tax to the US, that’s likely to be non-wilful (but I’m not a tax professional ). Most likely, the tax owed to the US will be pretty small, because you get a credit for taxes paid to Argentina (or the Foreign Earned Income Exclusion). And, I think many of the basic IRS instructions are available in Spanish, which you may find helpful.

If your bank accounts have more than US $10,000, you’ll need to file FBARs too.

But be sure to look at all of your alternatives before you do anything. If you have no US assets and don’t plan to move to the US, surrendering yourself to the IRS may not be your best choice.

Oh, and to relinquish currently you need to make an appointment with the consulate after you’ve performed your relinquishing act (such as becoming an Argentine citizen with the intention of losing your US citizenship ). The consulate will charge you US $2,350 for a Certificate of Loss of Nationality. You’ll need to decide whether you want to avoid being a Covered Expatriate by coming into compliance with your US taxes.

You might like to read through this thread http://isaacbrocksociety.ca/renunciation/

It’s probably a better place to ask these questions to get a variety of points of view.

I thought you already read this article from the link you sent to me early today:

It has become clear that there are several advantages to relinquishing over renouncing:

(1) Relinquishment takes the act of losing your citizenship out of the hands of the US government. This has two benefits. (a) There should be no fee because it doesn’t require a US government official–it doesn’t take place in a US Consulate–you only go to the consulate to inform them of a fait accompli, and it only takes one visit, unlike renunciation which usually take two visits. (b) This saves you $450, or it should, because you are not requiring the services of the Consulate–you are there only to inform them of your intention when you committed a potentially expatriating act such as making a pledge to a foreign power.

(2) Relinquishment is usually a positive act which cannot be confused with an expatriation to avoid taxes. You do it so that you can take part in foreign government or to vote in the country you live in, not so that you can avoid US taxes.

(3) Relinquishment is not a renunciation of your citizenship, so much as a positive act vis-a-vis your new home and country. It is not a repudiation of your country but an acknowledgement that dual citizenship is an unworkable absurdity. Thus, relinquishment comes with less stigma, potentially.

An individual who has performed any of the acts made potentially expatriating by statute who wishes to lose U.S. citizenship may do so by affirming in writing to a U.S. consular officer that the act was performed with an intent to relinquish U.S. citizenship. Of course, a person always has the option of seeking to formally renounce U.S. citizenship abroad in accordance with Section 349 (a) (5) INA.

Metro. Unfortunately the paper you are quoting is outdated. It no longer the case. Also unfortunate that you didn’t gain Argentinian citizenship earlier.

Your bank will consider you American until you show them a CLN issued by the US embassy. Until you do, the bank will either close your account or report it to the US.

A CLN will cost $2350 whether you obtain it by relinquishing or renouncing. If you obtain Argentine citizenship with the intention of losing American, that is a relinquishing act but you still need to go to the embassy to document it and get a CLN. That is unless your bank accepts the idea that you relinquished but can’t afford a CLN.

Whether or not you decide to file 5 years of taxes is a completely separate issue. It’s unlikely they will chase you down in Argentina and unlikely they could do anything if they did. This shit is all because we are collateral damage in US politics.

Duke do you see positive to apply for the Argentinian citizenship now ? I see it as another tool or umbrella.