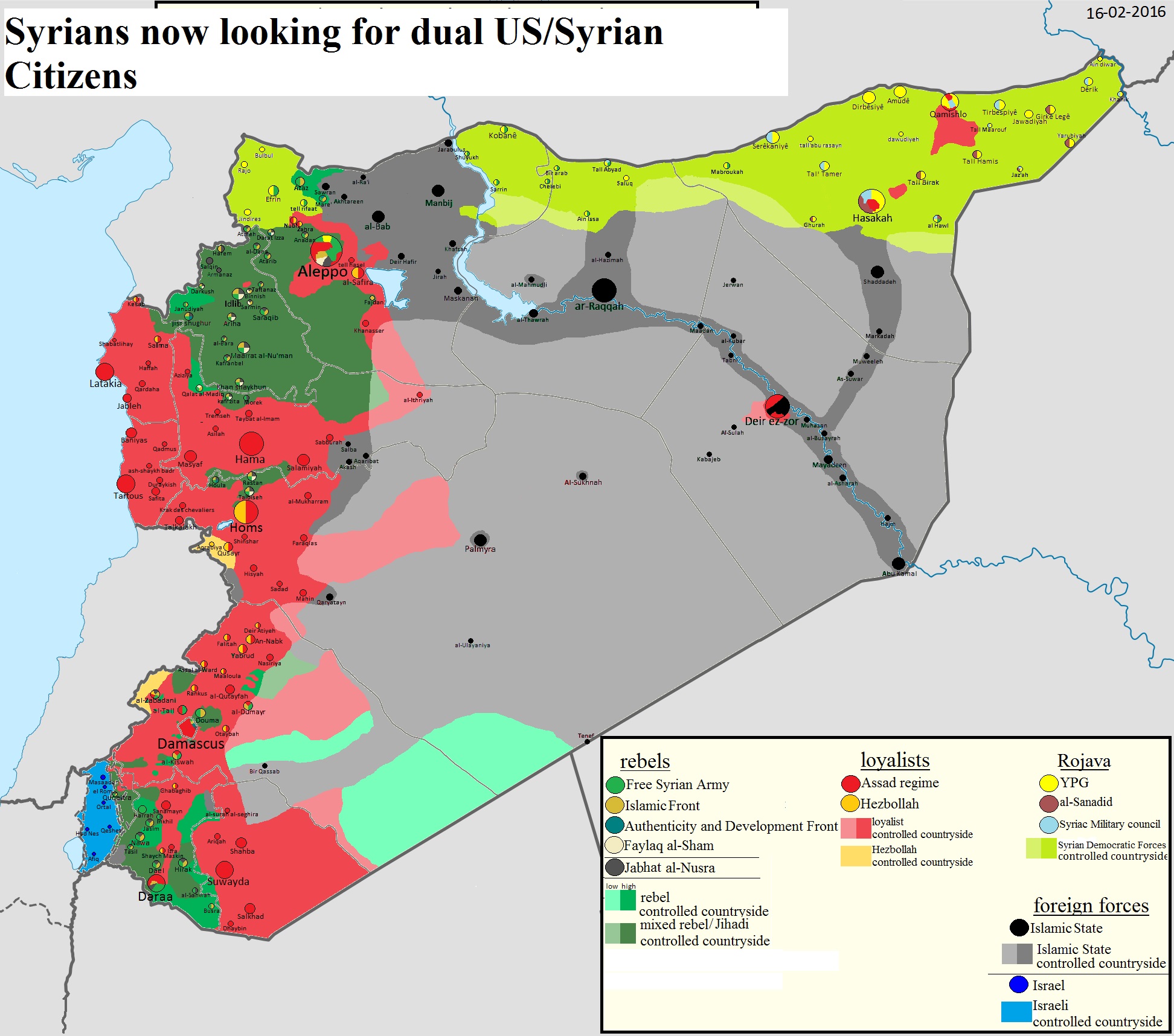

A Syrian Institution has registered in the program to search for indicia of persons born in U.S.A. The searches are to be performed in branches located within Syrian-government territory and also disputed territory in Aleppo.

The Bank of Jordan in Syria will be searching for indicia of persons with “unambiguous indication of U.S. place of birth” . If such persons shall be located, their names shall be stored within the branches permanently and sent yearly to the United States.

The bank has branches in Damascus, Homs, Latakia, Tartous, and the disputed city Aleppo. Aleppo is disputed between a number of freedom fighters including the Islamic Front.

The bank has been registered as an FFI (Foreign Financial Institution) which has been approved to search after U.S. citizens in whichever country they are located. The bank has received the authority from the Obama administration to have foreign governments and foreign institutions ferret out U.S. citizens living in tax havens such as Finland, Syria, or Canada— using newly-developed own government and bank tools. Americans not living in America have negative presumptions of innocence as these Americans have not been living in America.

The effort is expected to ferret out a large portion of the 8.7 million U.S. expat population.

The perfect gift to ISIS!

…from a very evil USA government.

Who of any US Presidential candidates will address this or do they really not care?

Thanks for the write-up, Banc De L Asteroide.

A phishing email might be enough to get the Fatca data from an FFI. Recently W-2 data was stolen from 2,500 employees of GCI, a telecom company in Alaska. It looks rather easy to do:

“Tax forms for more than 2,500 GCI employees stolen in email scam

Alaska Dispatch News

Annie Zak

March 4, 2016

GCI employees received an email Friday evening telling them their W-2 information had been disclosed to a third party last week through an email phishing attack.

In the email, GCI Executive Vice President Greg Chapados said the company believes the 2015 W-2s of all employees who worked for the Alaska telecom company and its subsidiaries Denali Media, UUI and Unicom at any time during 2015 have been disclosed.

That information includes Social Security numbers, names, addresses, income and tax withholding information. No customer information was affected, and the attack didn’t compromise GCI’s IT systems or networks, the email said.

David Morris, a company spokesman, said over 2,500 people were affected by the attack.

In February, a third party impersonated GCI’s Chief Financial Officer Pete Pounds via email to the company’s payroll department. That third party requested employee payroll information and specifically W-2s for everyone who worked at GCI in 2015.

“The employee who received the sham email correctly questioned the request as unusual,” Chapados wrote. “The third party impersonating Pete persisted with the request, however, and ultimately the requested information was emailed to the third party on Feb. 24.”

GCI became aware of the attack on Thursday, notified the FBI, and is continuing to investigate the attack. It’s too early to know who’s responsible for the scam, Morris said.”

https://www.adn.com/article/20160304/tax-forms-more-2500-gci-employees-stolen-email-scam

If USA really thinks it will solve the debt by going after US expats they’re making a storm in a tea cup.

What it will do is kill export opprtunities for US companies in the States as banks no longer accept US transactions anymore.

Now, thanks to CBT and FATCA America is toxic to the rest of the world.

Bravo president Obama for destroying the USA even more.

Thanks for this post @Banc De L Asteroide. Great graphic reminder of how FATCA puts those identified (or suspected to be) as Americans at risk.

The US hubris is such that it would for ideologic reasons endanger those it claims as citizens and US persons, and expose them to the very same forces that it is opposing politically and militarily.

The US government is betraying its citizens via FATCA, – for NO PROVEN BENEFIT (no cost benefit analysis ever done by the US Treasury/IRS) which is very ironic since when we renounce, the State Dept. tries to test our resolve by warning us that we will lose US protection as the price we pay for expatriating.

And when terrorists steal lists of those revealed as USpersons under FATCA, they won’t care whether the data is faulty or over inclusive, or includes non-US citizens with other ‘US indicia’. Or whether an accountholder included in error by the FFI because of US indicia like a birthplace has expatriated.

Any cost benefit analysis of FATCA should include the threat to the security of the person for individuals abroad identified as US citizens or USpersons.

@Steven TRACY

“What it will do is kill export opportunities for US companies in the States as banks no longer accept US transactions anymore.”

Exactly. And why do American high schools and universities teach foreign languages if a so-called “U.S. Person” is forcibly noncompetitive in the global marketplace? I simply cannot understand this…

The real tragedy is Homeland don’t see it. The 15 August 1961 and 1 July 2014 both have walls invoed.

The first date was when the Berlin Wall went up, the second is when the Financial Wall for ‘US persons’ went up. Many never saw it coming with virtually all Homelanders blind. East Germans saw the Wall everyday which ‘US persons’ find out when a FFI hands them a W9 form.

This Wall will be breached eventually for resident citizens in their respective countries around the world.

Really does highlight the absurdity of FATCA and the US born jihad against US persons in the world.

This is an example of the ‘benefit’ of being a US citizen ‘abroad’ right?

: )

Some US tax law academics refer to the ‘benefits’ of US citizenship in order to justify birthplace and parentage based taxation. Supposedly we’re part of the US ‘community’ and therefore must pay for the privilege of membership in the US country club by acceding to being treated as ‘tax residents’ of the US no matter how much and in how many of the range of ways this causes harm http://www.cbc.ca/player/play/2473959702 . Prof. Kirsch, where is the ‘comfort’ to be found for those deemed US persons and identified as such by financial institutions in places like Syria? (sees comments about making US extraterritorial CBT, and FATCA more ‘comfort'[able], in ‘Citizenship-based taxation’

interview; CBC, All in a Day, July 15, 2014, Season 2014, Episode 300178525 09:03 ).

The US Ambassador to Canada was unavailable to address US extraterritorial CBT in the CBC interview with Prof. Kirsch. You know, that ‘heavy travel schedule’ wouldn’t allow the Ambassador to speak to Canadians (and those claimed as Americans) residing in Canada, the country that the Ambassador was sent to.

Is this how you treat someone you obdurately claim as a member of your US community or family? Have commercial interests look for and identify them, compile handy databases of their name, address, account #s, balances, etc. The US approach is to demand that expat USpersons in Syria just trust to luck that no malevolent anti-US forces will steal that valuable data and track down USpersons.

Perhaps the Ambassador to Canada was unavailable that day because Harper had shunned him and frozen him out from any relationship or ability to do his job in Canada.

with this police-state “attitude”, there will be many, many more millions exiting the USSA, joinin the 8.7 million who got smart earlier ! ! ! ! !

On the FATCA letter from Syrian banks (one imagines):

“Pay America your fair share or we hand over your name and address to IS.”

The ultimate tool to enforce CBT.

According to the list (below) updated 2/2/2016 neither Syria nor Jordan have signed a FATCA IGA and yet the Bank of Jordan in Syria appears to be FATCA compliant. Puzzling.

https://www.treasury.gov/resource-center/tax-policy/treaties/Pages/FATCA.aspx

@EmBee

I think that if a bank wants to continue to do business in the US it will become Fatca compliant regardless of an IGA.

I heard that all the banks in Monaco are compliant and Monaco has not signed an IGA.

@Badger – The US Ambassador is using the silence strategy and hopes FATCA will go away with time as with politicians around the world.

Somehow we need to raise this issue so it remains on the radar screen everyday.

How many ATMs are there in Canada? Imagine if there was an anti FATCA stick on each one, the US Embassy at night with an anti FATCA message projected on to it?

This US Ambassador to Canada doesn’t want to look a BUFFOON like the last one did when he addressed the problems of *US expats* in Canada. Though his website said he was there to converse and answer questions, I don’t believe he ever responded to one US-deemed USC Canadian.

http://www.international-adviser.com/news/1002316/american-expats-canada-reprieve

I like these suggestions showing up once again, Don!

Yes, Calgray411, the current ambassador learned to keep his mouth shut, knowing that US persons are now in for a sh!t storm, NOT relief from the US government and its Canadian accomplices.

@Don and @Ginny, re the silence from US Ambassador to Canada; Heyman. The US and now the current Liberals have chosen the tactic of pretending that our issues don’t exist – and they hope to limit public scrutiny and criticism by remaining silent ( ex. http://www.cbc.ca/allinaday/2016/01/25/opposition-critics-weigh-in-on-fatca/ ).

The US Ambassador didn’t respond to the CBC ) http://www.cbc.ca/player/play/2473959702/ ) because nothing he could say would be able to successfully spin the obvious extraterritorial threat and burden to Canadians that FATCA and US extraterritorial CBT represents. He knows that our local legal Canadian accounts are considered ‘offshore’ ‘foreign’ accts by FINCEN. He could only repeat what the IRS and US Treasury have to say about how those deemed to be UStaxablepersons/citizens anywhere in the world have a duty to demonstrate lifelong fealty in the form of bowing to US life control and the US extraterritorial tax system, but of course that wouldn’t fly. There is no way to make that US position palatable. He also knows that for the administration that appointed him, reportedly, FATCA is one of Obama’s pet initiatives.

Heyman’s job is to get concessions out of Canada on a number of issues, as he made clear from the beginning. Nothing about his mission includes doing anything to address our issues. Under his watch, the lines of Canadians queuing up to formally sever ties with the US has never been longer.

He’ll never acknowledge the extortion and abuse that FATCA represents. He’s got to be aware by now of the lawsuit, and any briefing from the previous ambassador Jacobson had to have included the increasingly shaky state of relations with Canadians deemed US persons in Canada.

And as a Goldman Sachs investment banker ( http://www.macleans.ca/news/canada/chicago-investment-banker-bruce-heyman-will-be-next-u-s-ambassador-to-canada/ ) who better to know perfectly well that treating Canadian accounts and assets as if they were in the Caymans like the Pritzker trusts of the US Commerce Secretary ) http://www.bloomberg.com/news/articles/2013-05-21/pritzker-s-54-million-family-trust-fee-seen-as-unique ) or Treasury Secretary Jacob Lew’s investments ( http://www.cnbc.com/id/100454907 ) results in maltreatment of ordinary Canadian citizens and taxpayers – and that US banks don’t bear an equivalent burden of threatened economic sanction ( 30% witholding and potential lack of access to US market) and thus have a significant economic advantage which may very well be a NAFTA issue ( https://openparliament.ca/committees/finance/41-2/34/prof-arthur-cockfield-1/ ). Not to mention the burden of being effectively barred by US extraterritorial tax policy to use our own local legal investment and savings opportunities (registered savings RESPs, TFSAs, RDSPs treated as ‘foreign taxable trusts’ and Canadian mutual funds as PFICs).

It may well be that the relationship between Harper and the US wasn’t warm, but I doubt that US demands to impose FATCA on Canada (resulting in Harper government about face and final capitulation) made it any warmer.

@calgary411

“This US Ambassador to Canada doesn’t want to look a BUFFOON like the last one did when he addressed the problems of *US expats* in Canada.”

How is a Canadian citizen in Canada a *US expat* …? The Canadian is in his homeland, one would have thought; it is pretty clear and simple. And the US Ambassador sounds like an arrogant prat…

Another story involving the theft of W-2s, this time at a US high-tech company. It’s beginning to look like a epidemic:

An excerpt:

“As I noted in last month’s warning about W-2 phishing, fraudsters who perpetrate tax refund fraud prize W-2 information because it contains virtually all of the data one would need to fraudulently file someone’s taxes and request a large refund in their name. Indeed, scam artists involved in refund fraud stole W-2 information on more than 330,000 people last year directly from the Web site of the Internal Revenue Service (IRS). Scammers last year also massively phished online payroll management account credentials used by corporate HR professionals.”

http://krebsonsecurity.com/2016/03/seagate-phish-exposes-all-employee-w-2s/

It somehow seems fitting at this time to reference the Wiki page on Fatca and its inherent security risks:

“Security. As piracy, kidnapping, and global terrorism dominate the political and media climate, some thinkers have questioned the entire FATCA mentality, where non-U.S. banks and non-U.S. governments are entrusted with the private data of U.S. citizens. The following countries have been entrusted with FATCA’s private data of U.S. persons: Brazil, Croatia, Israel, Kosovo, Mexico, Qatar, Uzbekistan, Algeria, Azerbaijan, Bahrain, China, Columbia, Georgia, Serbia, Thailand, Turkey, Ukraine, UAE, Angola, Cambodia, Kazakhstan, Tunisia. FFI’s are required via FATCA to identify U.S. persons and store their asset values and U.S. Social Security numbers. There are many countries which have been, could be, or are at war or cold war, where FFI’s have implemented FATCA. There is no control over which government or which individuals at these locations have control of the identity of U.S. persons. Here are some examples of the quantity of FFI’s registered in troubled areas: Afghanistan: 15, Chad: 5. China: 1,021. North Korea: 1, Nigeria: 92. Iraq: 16. Russia: 1,117. Ukraine: 217. Venezuela; 179. Yemen: 13 “

Here you see President Obama’s “negative presumptions” and reversing the burden of proof

https://www.whitehouse.gov/the-press-office/leveling-playing-field-curbing-tax-havens-and-removing-tax-incentives-shifting-jobs

“The following countries have been entrusted with FATCA’s private data of U.S. persons: Brazil, Croatia, Israel, Kosovo, Mexico, Qatar, Uzbekistan, Algeria, Azerbaijan, Bahrain, China, Columbia, Georgia, Serbia, Thailand, Turkey, Ukraine, UAE, Angola, Cambodia, Kazakhstan, Tunisia.”

They forgot one:

United States, where IRS employees participate in identity theft.