SWeden pays 73,700 USD per each resident adult US-citizen immigrant to be located with the #FATCA ethnic-identification system. Is Sweden offshore? (I had always thought that Sweden was on the continent of Europe). (Total FATCA implementation costs in Sweden are estimated to be greater than 7.61 billion SEK.)

Would it be at all possible to dispel any myth that residents in USA are sending their money to SWeden to avoid taxation? Has no one in Washington or Stockholm yet realized that SWeden has the highest personal tax rate in the world?

FATCA, the Foreign Account Tax Compliance Act, is an enforcement tool of the requirements of Americans to report their “foreign” bank accounts. Since US has extraterritorial taxation based upon citizenship, these reports are required of all US citizens and all US persons living throughout the world or in Sweden. “Foreign” and “offshore” are defined as anything that is not in American. Canada is “offshore’ and, Mexico is “offshore”, and the Swedish accounts of a dual citizen living in Sweden are also considered both “offshore” and “foreign” according to the IRS and its captive media. US persons are required to fill out the Foreign Bank Account Report FBAR at the U.S. Financial Crimes Enforcement Network (FinCen). Those that have not filed FBARs are eligible for jail terms, or fines reaching 300% of a persons asset value. A child is responsible for filing its own FBAR and is not exempted from the penalties. FBARs are required to be filed electronically at the FinCen website. Additionally, qualified “rich” US persons (those with over $200,000) are required to have also filed IRS form 8938, with an additional penalty structure.

The Swedish government administration stated that the costs of implementation should be considered versus the threatened 30% sanctioned tax which could be applied for non-compliance.

Sweden could not estimate the business effect of FATCA, despite that Swedish law requires that the business impact must be evaluated for legislations. In following discussions, it was estimated that each small financial institute (comprising 95% of the FFI’s) would incur 1 million SEK yearly FATCA administration costs. (Documentation of the costs to larger institutions has not been located.) IRS lists 744 FFI’s to date, yielding a minimum estimated yearly cost of 744 million SEK (excludes the cost of the 5% larger institutions), or 7.44 billion SEK over 10 years. The costs to the Swedish government were estimated to be above 15 million SEK for implementation and 15 million SEK per year thereafter, for a 10 year public cost of 165 million SEK. Total FATCA implementation costs in Sweden are estimated to be greater than 7.61 billion SEK.

As Sweden approaches a cashless society, nearly every resident has a bank account, yet only the 82.9% over 15 yrs old are considered further in this analysis.

With 9,784,445 inhabitants and 17,000 resident U.S. citizens, the Swedish government cost is 777 SEK per capita, 447,700 SEK per resident US-citizen resident and 937 SEK per adult Swedish account, or an astounding 539,984 SEK per adult resident U.S.-person account.

Using the 6-yr average of IRS exchange rates (7.33 SEK/USD), this yields the cost of 73,700 USD to locate each adult resident US-person account.

Would it not have been better for Sweden to just hand over 761 million SEK to USA each year—as a tax for having allowed immigration and emigration with USA?

But, FATCA is about finding rich offshore tax evaders! They are sending their money to Sweden—in order to avoid taxation! Believe it! Believe it! You should be believing all of the FATCA “offshore” media propoganda for Sweden. They are not paying their fair share! We need to get every last PESO out of them!

Who are they actually going to find? The objective is to find all suspected U.S. persons living in Sweden and any suspected Swedes living in USA.

They will find many “real Swedes” have had no control over their Swedish parent’s sexual lust to procreate in America. Thousands of “real Swedes” have studied or worked temporarily in USA, and begat children upon U.S. soil.

They may also find about 51,000 SWedish-citizen schmucks living in The Land of the Free as expats. I suppose that Obama wants to find them, too. There ought to be a few of those pesky buggers with checking accounts back in Du gamla du Fria, due to their devious history of once having lived someplace other than America. They might have inherited something from grandma, have a summer house, or might even be renting out their Swedish family home in their absence. Somehow, these terrible immigrants in America need to be located and punished for their sins.

FATCA looks for “indicia” of these pesky U.S. persons.

Let’s remember that Swedish law prohibits discrimination based upon national ethnic place of birth. “…. Lagen är tvingande 3 § Ett avtal som inskränker någons rättigheter eller skyldigheter enligt denna lag är utan verkan i den delen……..3. etnisk tillhörighet: nationellt eller etniskt ursprung, hudfärg eller annat liknande förhållande,”

Swedish law also forbids FATCA discriminating against business managers and accounts payable clerks (those US persons who might require signature authority upon Swedish business accounts) and whose employers accounts would be reported to the U.S. IRS.”10 § Diskriminering är förbjuden i fråga om… 2. behörighet, legitimation, auktorisation, registrering, godkännande eller liknande som behövs eller kan ha betydelse för att någon ska kunna utöva ett visst yrke.”

Sweden law forbids discrimination of any company offering services to the public or to dual citizens, including banks “12 § Diskriminering är förbjuden för den som 1. utanför privat- och familjelivet tillhandahåller varor, tjänster eller bostäder till allmänheten…. ”

Some of the “Real Swedes” who have no dual citizenship believe (even though they are paying out the whazoo) that this doesn’t affect them. But, if those “Real Swedes” try to open a new bank account, they have a choice of filling out a checkbox on a form that states either “I am a U.S. Person for tax purposes” or “I am not a U.S. person”. If said “Real Swede” refuses to answer, said Swede is not allowed to open a bank account in Sweden.

It’s possible that some of the costs had been pooh-poohed as having synergies with the coming OECD program Common Reporting Standard, where ALL minorities in Sweden will be required to declare their country of birth, city of birth, and other passports to their banks. As this program comes on line in Sweden, ALL minorities will be mapped out for selective treatment.

Sweden also believes that it is going to get reciprocal information from USA, which ought to be worth a few kronor? Yeah, right, Sweden already started delivering up its data last year, and it is still waiting for that reciprocal data, as described in its IGA (FATCA Intergovernmental Agreement) “The Government of the United States acknowledges the need to achieve equivalent levels of reciprocal automatic information exchange with Sweden. The Government of the United States is committed to further improve transparency and enhance the exchange relationship with Sweden by pursuing the adoption of regulations and advocating and supporting relevant legislation to achieve such equivalent levels of reciprocal automatic information exchange.” Dear Sweden, other than the “r”, what part of “total bullshirt” don’t you understand?

Every year that Sweden performs its discrimination and waits for reciprocity, Sweden pays 744 million SEK in compliance costs .

So, what is it that America is after? Tax money? That’s ridiculous. Even with America’s ludicrous double-tax-filing requirement in extraterritorial Citizenship-Based-Taxation, USA cannot squeeze tax money out of any US-person Swedish citizens residing in Sweden. America’s taxation concept is to “tax-up” its citizens to the higher of the local (Swedish) tax rate or the Homeland tax rate. In all cases, the Swedish tax rate is highest—even unemployment and parental and other social payments, and pensions are already taxed highest by Sweden.

The only potential gain for US is to claim tax-treaty superiority of passive income (interest & dividends), forcing such Swedish-resident dual citizens is to first pay passive income tax to USA and to attempt to credit those tax payments to their own tax authority skatteverket. In other times, this might have succeeded to draw tax revenue away from the Swedish Skatteverket and over to the IRS. However, today’s interest rates are near or below zero. Another potential gain for US might be to collect additional tax from dual citizens who might have won one of the pre-taxed government lotteries. In this case, Sweden will pre-tax the dual-citizen winner, and USA will collect additional taxation afterwards.

The Sweden Parliament (Riksdagen) passed the FATCA implementation with a resounding margin. Ironically, the only hope for dual citizens in Sweden came from the anti-immigration nationalist party Sweden Democrats, (SD) who voted “no” in mass to FATCA. However, the Sweden Democrats were not worried about any dual citizens nor any “real Swede” accidental dual citizens—the Swedish Democrats were simply against the astounding costs of FATCA — the costs that would especially hit the smaller Swedish institutions. The Sweden Democrats are widely criticized for their extreme views — how ironic that the anti-immigrant Sweden Democrats were the only party that considered the ridiculousness of the FATCA costs upon Swedish society and the discrimination of Sweden’s immigrant population.

Is there now a new meaning for “alla människors lika värde”? —- men visa personer är värd 539,984 SEK per stuck

So the entire American government is bullying up on you, and the entire Swedish government is bullying up on you. So, turn to the leader of the bullies, the European Union? The leader of the EU bullies answers “it’s ok to discriminate, as long as the discrimination is for commercial reasons”. Do you think the media will help? The media will tell you to go back and do what the bullies want. Should you ask for help from your ambassador? The ambassador will bully you some more. Well, the best way to handle a racist bully is to run –to get away from the bully and to renounce citizenship. Some of the victims of this bullying are CHILDREN. Children cannot run or lose their US citizenhp. Others have other family reasons that disallow them from running. So, what do you do if you’ve tried everything but you just don’t know how to get rid of that bully?

What does a person do when the bullies have put a $73,700 price on his head? Well, FATCA racial discrimination has hit its target. In Sweden, we lost one of our best Swedish Americans. We lost him to FATCA. FATCA took his life. He had no other route to get away from the Swedish government and the US government. The Swedish media and the US media chastized him. He was surrounded by organized racist, government mobs. Because of FATCA, one of the best dual citizens decided to take his own life.

Meanwhile, the FATCA “tax evaders” “1%’ers” , “Ex-Patriot“, and all other government-sponsored and media-implemented propoganda continues, in the name of more money for the deficit governments of the world. Discrimination has been justified in the name of taxation propoganda.

We are standing up to these bullies. The bullies are sitting behind the glass. When will the world realize that these banks and these governments and their captive media are just a bunch of bullies? Does the each person in the world need to become the next object of bullying before they realize the problem?

There is a very very small chance that Swedish media and the Swedish government and the Swedish people will reverse this discrimination and eliminate FATCA and CRS organized discrimination from their lawbooks. Perhaps there are a few non-racist Swedes that are willing to stand with us. Perhaps the King will stand up for his grandchildren and their dual-citizen playmates. Perhaps that small group of concerned people will grow and Sweden might show itself as a leader against ethnic discrimination.

alla människors lika värde

Excellent entry into what FATCA really costs, both in human terms (literally) and in the outrageous sums of money that this is costing every citizen of every country that has signed up to, or rather been bullied into signing up to the FATCA monstrosity. Surely the figures that you give, of the cost to the banks, the suicide of an innocent victim of FATCA, along with the clearly discriminatory letter from Nordea Bank, should be enough to get a good story in the Swedish press. May I suggest getting in direct contact with the Editor of Dagens Nyheter, the main Swedish news source, print and online, and let them have the raw facts, especially the figures and how every Swedish citizen ends up paying for it, as well as the clear discrimination as outlined in the letter from Nordea Bank. Under law, there is no difference if a bank would deny services and products to a person due to their place of birth or affiliation, wanted or not and if a restaurant would refuse to serve food to all nationals of Japan and a nearby shop would refuse to offer sales to all black people. That would be seen as outrageous and a clear and flagrant violation of the law against discrimination. You should really press the Editor of Dagens Nyheter on this. You may also want to contact a leading Swedish member of parliament. Swedish people have by nature a very egalitarian attitude to life and anything that has even the slightest hint of discrimination is condemned in very clear terms. This is a perfect example of that, clear and unambiguous discrimination. That is the story here, much more than FATCA is ruining the finances of those tainted with the American stench. Everybody in Sweden will understand and react to the discrimination in all of this. Please get this story and the figures beyond this website and into the ears of the Swedish media and key politicians. I think the result there will be more understanding and democratic than in Canada, which is now clearly the lapdog of the big bully to the south.

Bullied? What easier way for the Swedish (and Canadian, and UK, etc) tax authorities to get a closer look at the bank accounts of a subset of its citizens, their joint account-holder spouses, and business accounts than under the cover of “FATCA”?

I have been told that several people in France are mounting a legal challenge there, charging that by obeying with the demands of FATCA, the banks themselves and the French government itself are in serious violation of the very First Article of the French Constitution, that states, very clearly, that all citizens are equal before the law, without distinction of origin….

First, French banks, following orders and obeying new French laws related to FATCA have, by searching through their data bases to find any indicia showing US origin, violated the First Article of the French Constitution.

Second, the French Government itself, by initially demanding and then accepting this information based on criteria of “origin” have also violated the First Article of the French Constitution.

According to a French lawyer that spoke to a friend of mine, this is quite serious, as there is no argument here. The sole criteria for segregating the accounts was based on origin or affiliation (which is the same in a legal context). It would be exactly the same if the government were to ask the banks to send them all account information of Jews, for example. That was, chillingly, exactly what the Nazi occupiers demanded of French banks during the occupation of France. What is the difference? The only difference today is that there is now a Constitution to protect against such totalitarian abuses. Here, it is not some minor article of the Constitution that has been violated, but the very First Article itself, which is, as the lawyer said, the very pillar of French law and national identity.

ARTICLE 1.

France shall be an indivisible, secular, democratic and social Republic. It shall ensure the equality of all citizens before the law, without distinction of origin, race or religion.

COMPLETE FRENCH CONSTITUTION (SEE ARTICLE ONE)

In English:

http://www.conseil-constitutionnel.fr/conseil-constitutionnel/root/bank_mm/anglais/constiution_anglais_oct2009.pdf

In French:

http://www.conseil-constitutionnel.fr/conseil-constitutionnel/root/bank_mm/constitution/constitution.pdf

Beware that in the UK banks try to portray an image of non-discrimination on their webpages for setting up accounts.

For example when enquiring about citizenship, it asks this information from everyone with a box that scrolls every country under the sun.

UK banks very much engage in ‘backroom data discrimination/’

There’s no difference if the Nazis asked for everyone’s religion up front, offering every religion possible in the scroll box while only really being interested in the Jews as with the example above.

If it’s true I’m glad there’s a proper challenge in France.

Just had a thought – a good source to track down affected ‘US expats’ abroad could be using American University alumni directories.

I was just reading the background of an American working in EU media and their Ivy League alumni status.

It may be a good way to contact these people and start the networking. It’s not perfect, but when you come across someone who is a ‘US person’ it provides another avenue for contact.

@Daniel

Well hope springs eternal I suppose but most elected representatives, whether MP’s, members of congress or parliaments, et al, have one unified answer when confronted with the constitutionality of a particular law, and here it is; “constitution?…consti–TUTION! we doan need to obey no steeenkin’ constitution”.

I’m not trying to be a comedian here. I am sixty-two years old and have lived in three different countries and eighteen different towns, cities and villages. All tolled I’ve been an expat for forty years. All that to say that I’ve been around enough to see with my own eyes that not matter which country, few, if any in the elected political class give a damn about their respective oath of office, or the fundamental document that is there to rein in their various personal ambitions.

America is in a post constitutional period and one doesn’t know whether to laugh or cry when some politician even mentions that once nearly sacred document. But this Fatca issue isn’t about America. It’s about our respective adopted countries.

I think it’s important to understand that whether it was Sweden, France, Switzerland, the UK and all the rest; once the Fatca IGA’s were signed it clearly demonstrated that the respective national constitution(s) were to be dismissed as a contemptible inconvenience of little consequence.

I suppose I could have left the UK off the above list as they have no written constitution but you get the point I am sure.

FATCA was written for the big banks and by the big banks by unscrupulous politicians doing their bidding, and FATCA will last as long as the big banks can buy politicians, and constitutions be damned.

FATCA and CBT will only be defeated by:

1. The unlikely event of a bloody revolution. Ha ha, can you see fat, sated, iPhone addicted Americans loading their muskets to defend us? Taking to the streets because some poor, hapless accidental American or two was financially ruined in Canada…?

2. An actual true, constitutional fearing man is elected POTUS and does away with the entire US tax code (and thus the IRS as it exists today) to replace it with a RBT system; either fair tax or flat tax.

3. The devils who designed FATCA, i.e., the banks, start to lose money, big money. and push for its dissolution world wide. This would actually go fast.

4. …and last. There was a collective, organized, nearly grassroots revolt by the international political community against the IGA’s implementing Fatca. All it would take, in this example, would be for one county to say to America; “This is costing us big money. We get nothing in return and, incidentally, we checked and it violates our constitution. We are therefore stopping today.”

With one country pulling out it could cause a domino effect. The big bully in the playground would suddenly be facing not just one brave boy but two, then three, then four etc. I pray that I live to see that day.

Reading this my eyes glazed over and I had a daydream.

Millions of US expats were sending in returns to the IRS claiming refunds.

The system was exploding, it was impossible to check everything.

Boom!

And then I woke up. Jeez I didn’t think it would come to this. I may have to get that renunciation going after all.

Mark Twain: I agree with Martin. If you haven’t already done so please be sure that somehow your calculations and your assessment of the situation get to the Swedish media and into the hands of average Swedes.

Daniel: That is certainly good news about rumblings of a legal challenge in France. Are there any links to online news about this?

Eric in Switzerland: I hope I live to see that day too.

@Mark Twain

One of the things that the banks haven’t gotten clear is that there are two conflicting definitions of U.S. person. A non-resident U.S. citizen is not a U.S. person under the Securities Act of 1933, but they are one for tax purposes. Something is going on with questions about citizenship in the U.K. apart from FATCA. Even the local credit union has citizenship and visa questions on its application from, but it is not on the list of FATCA reporting FFIs.

In the process of checking that the local credit unions were not FATCA reporting and therefore possible boltholes if things get really bad, I noticed something really strange. Some of the FATCA reporting FFIs are organizations set up by local British public sector bodies to do such highly questionable things as renovate local social housing and manage local NHS health and social care properties. I can’t see what good making these organizations FATCA reportable does, but it does highlight the absurdity of the legislation. I was wondering if this also happened in Sweden.

@Mark Twain

One of the things that the banks haven’t made clear is that there are two conflicting definitions of U.S. person. A non-resident U.S. citizen is not a U.S. person under the Securities Act of 1933, but they are one for tax purposes.

Something is going on with questions about citizenship in the U.K., too, apart from FATCA. Maybe it is CRS. Even the local credit union has citizenship and visa questions on its application from, but it is not on the list of FATCA reporting FFIs and only allow people to be members if they live or work in that city.

In the process of checking that the local credit unions were not FATCA reporting and therefore possible boltholes if things get really bad, I noticed something really strange. Some of the FATCA reporting FFIs are organizations set up by local British public sector bodies to do such highly questionable things as renovate local social housing and manage local NHS health and social care properties. I can’t see what good making these organizations FATCA reportable does, but it does highlight the absurdity of the legislation. I was wondering if this also happens in Sweden.

Correct, some banks have done their homework upon definition of US person according to bank securities act.

https://www.swedbank.com/investor-relations/swedbank-shares/Disclaimer/

3. Important information for US and UK persons

The information on this web site is not directed at and is not intended for persons, whatever their citizenship, who currently are in the territory of the United States, nor is it intended for U.S. residents, partnerships or corporations organized or incorporated under U.S. law or other U.S. persons ( as defined in Regulation S under the U.S. Securities Act of 1933, as amended),

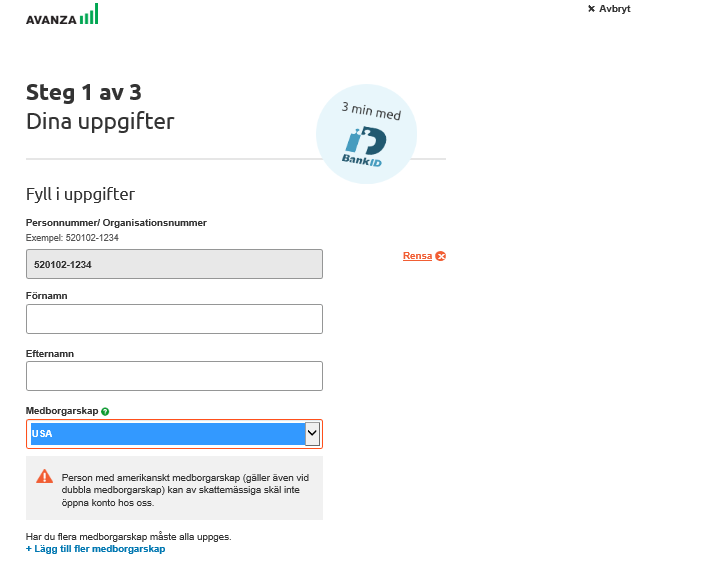

Some banks have kicked out all US persons, such as Avanza, so as not to deal with any of the distinctions.

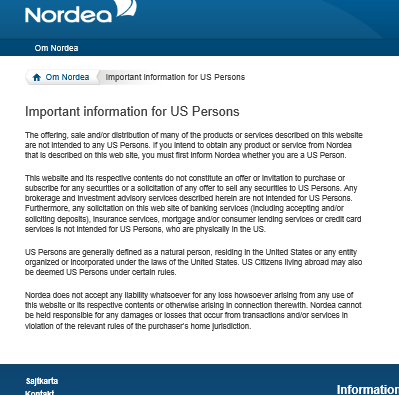

The Nordea issue uses “may” or “some” so as to allow them the ability to kick out who they want.

as far as the media goes, I’ve been trying for years. The issue won’t sell newspapers. “poor Americans” doesn’t raise any eyebrows. Still trying. Tweet frequency can help.

“ARTICLE 1.

France shall be an indivisible, secular, democratic and social Republic. It shall ensure the equality of all citizens before the law, without distinction of origin, race or religion.”

One cannot get much clearer than that. FATCA clearly violates the French constitution.

“According to a French lawyer that spoke to a friend of mine, this is quite serious, as there is no argument here. The sole criteria for segregating the accounts was based on origin or affiliation (which is the same in a legal context). It would be exactly the same if the government were to ask the banks to send them all account information of Jews, for example. ”

Do you have any names? I would be willing to join. I think there is an argument to the extent that the French government can say that the segregation of accounts is based on citizenship and not origin. I on the other hand have renounced and am still facing segregation because I am refusing to sign American documents, so I think I would be one of the better candidates.

Citizenship is a form of origin. Segregating dual-citizens based on one of their citizenships, in order to treat them differently than others who also hold one of the same citizenships, is discriminatory and illegal under many Constitutions and under individual laws in different countries. The question is, if you are able to make distinctions at these levels, then there is no end to the abuses that would inevitably follow. Think Nazi Germany in 1938: religion, ethnicity, skin colour, eye colour, size of the head, height, political beliefs, sexual orientation, etc.

The legal battle being fought against FATCA really should be about putting a stop to all discriminatory laws and focus on that. Those observing or caught up in this nightmare really should not put any hope in seeing the law changed within the US itself, but rather in individual countries fighting for and demanding equal treatment for all their citizens under THEIR laws. The efforts made to fight FATCA in the US itself, would be comical if they weren’t so tragic. There is no real interest to resolve the issue there, as it can be milked for financial and political gain for all its worth. Think of the State Department increasing renunciation fees by 422%, as they see a “business” here. Think of the US compliance industry “journalists” writing endless and repetitive articles on the subject, for which they are paid per view (Forbes), yet not once do they interview or challenge those politically responsible. They only regurgitate the same story over and over, but do nothing to change a thing, as that would cut off a big source of revenue for them. Think of the silly and totally useless American associations, such as ACA, Republicans Overseas, Democrats Abroad, who pay lip service at best, but not one has accomplished anything significant and are all too politically correct to take a firm and aggressive stand against those responsible for codifying discrimination into law and then spreading it throughout the world via threats and penalties. Fight your battles against discrimination, but don’t be naive.

The above says:

Under law, there is no difference if a bank would deny services and products to a person due to their place of birth or affiliation, wanted or not and if a restaurant would refuse to serve food to all nationals of Japan and a nearby shop would refuse to offer sales to all black people.

And this is Sweden. Isn’t Sweden at the bleeding-edge front lines in eliminating cash from their society?

Instead of eating at a restaurant, this could actually become true at the grocery store, and actually prevent certain dual nationals from being able to buy food!

How so?

If you have no bank accounts, you have no way to receive your pay and therefore lose the ability to obtain food legally by paying for it…because remember, they have mostly eliminated the use of cash from their society.

So how does one pay for food without a debit or credit card attached to a bank account if you cannot bank because your account is closed down due to being subject to FATCA and being rejected by all banks who no longer want to deal with those who are US persons???

This goes far beyond just bullying, which in and of itself is bad enough.

THIS HAS THE POTENTIAL TO MAKE SOME PEOPLE BECOME HOMELESS AND HUNGRY! And all of this at the hands of a foreign (to Sweden) government and because of an outside government’s demands.

And one more crucial thing I forgot when it comes to obtaining food in the absence of foldable paper spending money:

There has been a recent heightened call from several so-called economic experts that there is a need to eliminate cash from societies around the Western world to stop the problem(s) of drug-dealing and terrorism. But those who are not sheep understand that it’s actually to trap people into accepting bigger losses in the negative interest rate scheme that central banks around the world are claiming is the latest solution to fixing their banker mess.

Unfortunately, the situation of a few dual nationals who “don’t want to pay their taxes” takes a back seat to the interests of the Swedish financial and export industries. This is made very clear in the parliamentary “debate” held at the Riksdag before the FATCA agreement was passed.

I have seen the situation of both accidental Americans and US immigrants presented on Swedish Television (SVT). The subjects of both reports were shown to be in great distress and treated with sympathy. When questioned about the situation, however, government representatives expressed none, after all: citizenship is not just about rights, but about duty and responsibility, and citizens have the responsibility to pay their taxes. The United States is a democracy and the people have collectively decided the best way for their nation to collect the funds necessary to pay for public services. Sweden respects the right of the American people to decide for themselves how to collect taxes (spin, spin, spin).

The Swedish establishment protects the interests of Swedish industry which is dependent on a workable FATCA agreement. Dagens Nyheter is an establishment paper and is not going to jeopardize the situation for Swedish industry by shedding light on FATCA until its days are already numbered, after all: taxes collected from a strong export industry and vibrant Swedish economy, dependent on trade with the United States, help to sustain welfare and public services for the benefit of all Swedish citizens.

Swedish dual nationals can renounce their US citizenship if they “don’t want to pay their taxes” to the US, so there is already a perceived solution for those who have a problem with the law.

It’s not surprising that the Sweden Democrats, known for completely ignoring the rights of immigrants, was the only party to vote against the FATCA agreement. As stated in the article, they did this over concern for implementation costs and not the human rights of US persons. Because they aren’t (yet) part of the establishment, they can still get away with using common sense (even if their form of common sense is often questionable).

Two interesting Swedish language audio/video links:

from a program on state owned Swedish Radio where the host accuses politicians of silently betraying the privacy rights of the Swedish people by passing FATCA without any public debate.

with a video of the so called debate.

None of this has anything to do with “paying your taxes” and all concerned are well aware of that, so please let’s stop that way of describing FATCA and its toxic effects.

This has to do with serious, law-breaking discrimination and exclusion due to place of birth or origin, both illegal and easily challenged. That the Swedish Government and other governments see such basic non-discrimination articles as not worthy of any attention, respect, nor protection speaks more to the disappearance of our supposed democracies, with equality before the law once a cherished and respected cornerstone. Let’s please stop referring to FATCA as a tax collection system. First of all, it isn’t that at all. It s a reporting system based on using criteria of place of birth or origin, both completely illegal.

Sven,

You have absolutely no argument from me on the so-called “paying your taxes” issue!

The question is not about how some choose to describe FATCA and its effects. The issue at hand that we must focus on and adopt solutions for is, how to make those who think FATCA

Sven,

You have absolutely no argument from me on the so-called “paying your taxes” issue!

The question is not about how some choose to describe FATCA and its effects. The issue at hand that we must focus on and adopt solutions for is, how to make those who think FATCA is about taxes see that the damage being caused is unjust, is stealing from the tax base of the countries who have agreed to give the US taxing authorities what they are asking for at great expense and yet gives those nations nothing worthwhile in return.

We need to come up with a strategy that forces them to reconsider their position based on something that is near and dear to even those who currently take the position that those harmed the most by FATCA should just “shut up and pay already”. Until this begins to hit home with that group it will remain an uphill battle to get those in Sweden and other nations around the world to examine the injustice.

Subscribing.

Sven and Mikey…..the issues?

Deemed Expats per capita essentially owe zero tax to the homeland. Its a money losing proposition to the US.

Large numbers of deemed Expats are Nationals of other countries and deserve/demand that they be treated in their home Nation as EQUAL NATIONALS. Case in point there would be outrage in USA if a US Citizen who was a Cuban Pedro Pan immigrant was referred to as owing any allegience to Cuba!!

The cost in time and money for a deemed Expat to follow the US Rules is absured. It just can not be done. A Demmed Expat in Canada, the EU and most places should be able to simply send in a copy of their host nation tax return showing payment was made locally and you are paying your fair share somewhere.

@George

Not so simple. The sale of a principal residence isn’t reported on a Canadian tax return.

US expats are a declining revenue source, as the only reason why many end up owing tax is because they didn’t know about CBT when making those US taxed investments.

As far as increasing the renunciation fee goes, the State Department has really kind of screwed themselves there by saying it now covers their costs.

Thank you @Toby for posting those links. Would you be willing to post that and other primary source materials or reporting related to the situation of FATCA in Sweden to this IBS thread as well? http://isaacbrocksociety.ca/fatca-and-sweden/

Since many of us are unilingual English speakers, it is harder for us to find and post useful information that could be found by internet searching in other languages.