Error For those considering their US vote, @NoGo suggests this tweet on candidates as a post for Brock…

https://twitter.com/bracing/status/693567510856220672

Dear @BernieSanders Please–inform yourself of #FATCA‘s harmful effects on ALL US expats. It’s major for us.

Mrs W

Mrs W

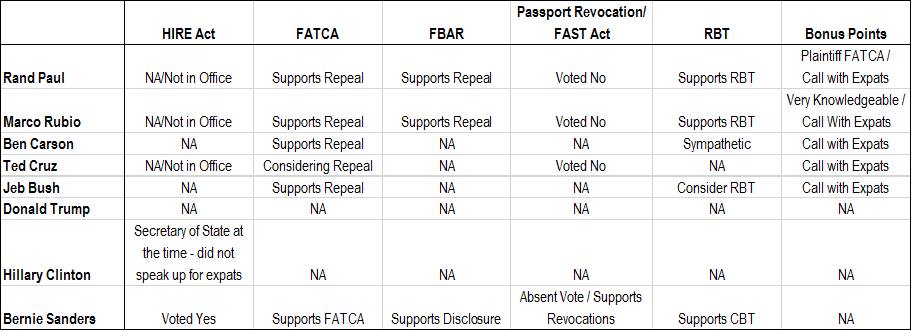

Very revealing chart and a great tweet!

The only candidate running who probably doesn’t have a chance, but who wants to stop all this nonsense and dump the entire tax code is Mike Huckabee. All the others want the same tax code but to add a few hundred pages to a tax code that is larger than the Christian Bible and much harder to understand.

Mike wants the FairTax which is more in line with our founders and no attempt will be made to collect taxes beyond our borders, but within our borders everyone except the Low income earner, who gets a subsidy every month of more than they would spend in FairTaxes.

Sad to say the other members of the Republican and Democrat herd want increased the cut of our pay for those who are already paying through the nose.

Also,

Republicans Overseas now has posted an entry of the Mrs. W tweet and the chart here: https://www.facebook.com/republicansoverseas/posts/461607380689729

@Wilton, While it is true that none of the Democrats would repeal the IRS tax code, it is NOT true that on the Republican side, besides Mike Huckabee, “all the others want the same tax code.” Ted Cruz promotes getting rid of the IRS tax code and having a 16% business Flat Tax that will allow us to eliminate the corporate income tax, Obamacare tax, the death tax, etc. and a 10% Flat Tax for Americans. When the S. Carolina debate was broadcast, I remember my husband getting so angry at Marco Rubio for misrepresenting Ted Cruz’s tax plan – that he stomped out of the living room. Rubio claimed Ted Cruz is proposing is a VAT or value added tax (which it is NOT) and even after Ted Cruz tried to educate him and explain why his tax plan is NOT a VAT, Rubio was so busy thinking up a nasty retort that he paid no attention to what Cruz actually said. Rubio was able to get the last word in, which is all he cared about. The exchange is here:

http://www.slate.com/blogs/moneybox/2016/01/14/marco_rubio_makes_ted_cruz_look_silly_for_promising_to_abolish_the_irs.html

Rand Paul (who, like Mike Huckabee, is a long shot for the presidency) would repeal the existing tax code and replace it with a “low, broad-based tax of 14.5% on individuals and businesses.” He calls his plan “The Fair and Flat Tax.” Read the full article here:

http://www.forbes.com/sites/kellyphillipserb/2015/09/17/rand-paul-takes-aim-at-the-tax-code-literally-with-an-ar-15/#2374ea4d301c

If Bernie is at all sensitive to the plight of non-resident Americans, he would not refer to corporate inversions as “renouncing US citizenship”. This is an insult to every US citizen who’s had to renounce for love of family, or the ability to thrive as well as their compatriots do in the US or where they live.

https://berniesanders.com/press-release/sanders-blasts-corporate-deserters/

BB. Wishful thinking I’m afraid. NONE of the candidates got either party are at all sensitive to the plight of non resident Americans. The candidates don’t know or care. The only possible exception is Rand Paul and he doesn’t have a chance- too honest for his own good.

We should try to get Trumph onside

That comment usually works very well at getting the Berners out.

Not true, Duke. Just go to th Republicans Overseas Facebook page for recent interviews with several of the GOP candidates.

At least Paul, Rubio and Bush have spoken directly and in opposition to FATCA and CBT.

All any Democrat has done is voiced their support of FATCA and associated renouncing US citizenship with tax avoidance by corporations.

After last night we need to work on getting “Supports Repeal of FBAR” and “Supports RBT” into Ted Cruz’s columns. How do we get his ear?

Of course, don’t forget about registering for the primaries! https://www.fvap.gov/ . States can require registration up to a month before a primary. If you want an anti-CBT bet, Rubio would seem to have made the firmest commitment.

From Daniel Kuettel

Rand Paul, Rubio, Bush and maybe Cruz. Paul has a track record of supporting expats, Rubio has a balanced platform and supports RBT and Bush pledged to make changes for expats. Cruz needs to clarify his platform better.

Good to see we are now pushing re voting and getting issue heard. Hopefully ABC Nightline piece on renunciation will air soon.

Hopefully ABC Nightline piece on renunciation will air soon.

Talked to Geoff HOPEFULLY within a month no promises

https://www.change.org/p/bernie-sanders-bernie-sanders-citizenship-based-taxation-and-fatca/c

I don’t know if petitions help or not but Bernie Sanders needs to read the comments coming his way. Like this one:

A. S., Germany

Gutted that Rand Paul is now out of the race. He may not have had a chance but as long as he remained a candidate I had hope for change on FATCA…

Came on this accidentally through Cheryl’s link here: http://isaacbrocksociety.ca/2015/09/20/we-need-69521-by-january-1-2016-to-pay-the-canadian-fatca-lawsuit-legal-bills-and-keep-our-litigation-moving-forward-il-nous-reste-69-521-a-ramasser-pour-notre-poursuite-judiciaire/comment-page-64/#comment-7161954 – of interest to me. Just how would this work for FATCA, FBAR, IGAs and any *US Person* in this *new union*. And, no more illegal alien / US citizenship problems.

https://www.youtube.com/watch?v=V9K9Xedk5eM&feature=youtu.be

Sovereignty for who? (President) Cruz?

OUR CANDIDATES

Democrats Abroad recently reached out to the Democratic Presidential candidates on issues important to overseas US citizens. We asked for their responses to these issues. Three of the candidates on the Democrats Abroad primary ballot (Hillary Clinton, Bernie Sanders, and Rocky de la Fuente) replied with the following answers. Martin O’Malley did not reply and has suspended his campaign.

Hillary Clinton | Rocky De La Fuente | Bernie Sanders

HILLARY CLINTON

FATCA: Would you support the FATCA “Same Country Safe Harbor” for Americans abroad, the regulatory reform that Democrats Abroad recommends for fixing FATCA’s problems but retaining its strength?

I’ve heard loudly and clearly about the burdens that FATCA and other reporting places on Americans living abroad. I understand that this is an extremely important issue – and is creating disruptions in the basic, day-to-day lives of everyday Americans living abroad. I’ve heard that it can be harder to open a bank account, harder to save for retirement, and harder to get a mortgage. I share these concerns – Americans living abroad shouldn’t face excessive burdens in their lives. I know that the vast majority of Americans living abroad are paying their fair share, and we should ease burdens on law abiding Americans living abroad while focusing on the real, true offenders. This is a complex area, and we need to make sure we don’t weaken enforcements against true tax cheats, while making sure we don’t create additional unnecessary burdens. I am committed to working with Americans living abroad and members of Congress to find the right solutions.

RBT: Would you support the replacement of the current system of taxing overseas Americans, known as citizenship-based taxation, with a system of residence-based taxation?

I know that most Americans living abroad are just trying to make a living and provide for their families. I believe that we need a broad discussion about reforming our tax code to cut taxes for hard-working, middle class American families living both here and abroad, and to ask the wealthiest Americans to pay their fair share. That means, among other things, closing loopholes that allow many hedge fund managers to pay a lower tax rate than nurses or teachers and supporting proposals like the Buffet Rule. But it also means closing loopholes that create incentives for corporations to ship jobs and profits overseas, and making sure that the wealthiest Americans can’t move overseas to avoid paying taxes. Americans, regardless of where they live, often benefit from American education, infrastructure, legal protections, and trade policies. This is a complicated issue and I will work with Americans living abroad and members of Congress to cut taxes for hardworking, middle class Americans, but also avoid creating any adverse incentives for those looking to avoid contributing their fair share.

FBAR: Would you support reforms to FBAR regulations to address these concerns and inequities?

As president, I will work with Americans living abroad and members of Congress to examine filing requirements with the aim of avoiding redundancies and minimizing unnecessary paperwork and confusion. Any reforms would also need to be scrutinized to avoid weakening government capacity for monitoring illegal activity or tax avoidance facilitated by holding foreign bank accounts.

Medicare portability: Would you support an amendment to the Medicare law permitting American citizens to use Medicare benefits to pay for health care in approved medical facilities located outside the USA?

I’ve fought to protect and strengthen Medicare throughout my career and have continued to press the importance of this lifeline in this campaign. I support further examination of how Americans over 65 living abroad and eligible for Medicare could apply their benefits to care at approved medical facilities located outside the U.S. 5.

HR-3078: Would you support the establishment of a Commission on Americans Abroad to study and propose remedies to U.S. policies that harm or unfairly burden Americans living outside the U.S. (as provided for in House bill HR-3078)?

As president I would support a bipartisan effort to examine how the U.S. government’s laws and executive actions impact U.S. citizens living abroad, like the Commission on Americans Abroad proposed in House bill HR-3078, which is sponsored by Representative Carolyn Maloney, whose endorsement I am honored to have in this campaign.

Windfall Eliminations Provision “WEP”: Would you support the examination of the WEP and its impact on U.S. citizens abroad to establish a remedy that preserves the social security benefits fairly earned by Americans abroad through their U.S. working life?

Americans living abroad, like all hardworking Americans, have a right to the Social Security benefits they have earned when they retire, and I am concerned that the WEP as now designed is not fair to many Americans who have paid into Social Security but see their benefits reduced due to the WEP. That’s why I support further examination of how the WEP impacts American citizens abroad to ensure that they are treated fairly in the Social Security system.

Further, I will fight to expand Social Security for those who need it most and who are treated unfairly today. This includes giving Social Security credit for caregiving and expanding benefits for widows who can now see their benefits fall by as much as 50 percent when a spouse dies. And I will oppose Republican efforts to reduce annual cost-of-living adjustments or raise the retirement age. Finally, to ensure these critical benefits for decades to come, I will ask the highest-income Americans to pay more, including options to tax some of their income above the current Social Security cap, and taxing some of their income not currently taken into account by the Social Security system.

FAST Act passport revocation: Would you support, as part of the implementation of the 2015 FAST Act, these requests aimed at preserving the security of Americans abroad and their families?

Every American should pay what they owe under our tax laws. In enforcing those laws, it is also essential to preserve the safety and security of Americans living abroad. Ensuring the security of Americans living abroad was a central part of my job when I served as Secretary of State and, as president, will continue to be of great importance to me. The State Department and any other U.S. government agency must strive to ensure Americans living abroad are provided with timely information and open lines of communication with their government. As public servants, it is our job to look out for the safety of all Americans, including those residing overseas. That is why as president I would make sure that the 2015 FAST Act is implemented fairly and in such a way as to ensure we protect Americans. I will ensure that Americans receive timely and accurate information about their tax responsibilities and are given ample opportunity to remedy or resolve any related issues, within a reasonable timeframe, before a passport is revoked due to a tax delinquency.

Hillary Clinton | Rocky De La Fuente | Bernie Sanders

ROCKY DE LA FUENTE

1. FATCA: Would you support the FATCA “Same Country Safe Harbor” for Americans abroad, the regulatory reform that Democrats Abroad recommends for fixing FATCA’s problems but retaining its strength?

YES

Having traveled extensively and having lived abroad, I am very familiar with the banking challenges that FACTA presents. While its intent is worthy, its approach is flawed. It casts a broad accusatory net that almost treats U.S. citizens living abroad as if they were presumed to be guilty of tax evasion. While the issue of tax evasion is a legitimate concern of our federal government, the method of identifying evidence of such action should be efficient as well as effective. It should not be structured upon regulations that are singularly designed to facilitate an agency’s convenience at the expense of creating an unconscionable burden to citizens living abroad. That being said, FACTA serves a legitimate purpose and should not be repealed. However, its untenable provisions should be reviewed and replaced with regulatory requirements that do not destroy our citizens’ banking relationships overseas.

2. RBT: Would you support the replacement of the current system of taxing overseas Americans, known as citizenship-based taxation, with a system of residence-based taxation?

YES

Citizenship-based taxation places an undue burden on U.S. citizens living abroad. In effect, it imposes dual-tax exposure upon individuals who, other than on a limited basis, do not represent an economic burden on the programs and services that our federal government provides. Residence-based taxation reflects one’s rationale contribution to the programs and services that affect the lives of those who reside in any given country and city. As Democrats Abroad so cleverly implies, unless the United States aspires to become the next Eritrea, it is time to join the rest of the world in recognizing the nexus between taxation and the programs and services such monies are meant to fund.

3. FBAR: Would you support reforms to FBAR regulations to address these concerns and inequities?

YES

In our federal government’s zeal to create agencies and promulgate regulations, it often fails to do due diligence with regard to redundant and conflicting regulations. The overlap between FACTA and FBAR is an example of such failure. Both address aspects of tax evasion, and while FBAR’s reach may be more comprehensive, a single regulatory approach would be more effective and efficient and far less burdensome with respect to law-abiding citizens living abroad. I would suggest thinking beyond implementing reforms to FBAR and FACTA and explore how a more focused, consolidated approach might be enacted to concentrate on the actual activities that are intended to be policed while eliminating redundant reporting requirements and facilitating alternative forms of filing so as not to unduly burden law-abiding citizens abroad.

4. Medicare portability: Would you support an amendment to the Medicare law permitting American citizens to use Medicare benefits to pay for health care in approved medical facilities located outside the USA.

YES

While I understand the countervailing argument that the United States has an interest having Medicare disbursements “recirculate” within its economy and that there may be legitimate concern about monitoring fraud in foreign countries, the reality is that Medicare is truly an entitlement since its funding comes from those who have made forced contributions to it. Individuals who have contributed to the Medicare systems should be able to deploy any disbursements where and as they choose to secure the medical treatment they need. Imposing limitations that are for the convenience of our government as opposed to the best interests of its citizens does not reflect the values upon which our Nation was founded. It is not only an unsound economic approach, it is morally wrong.

5. HR-3078: Would you support the establishment of a Commission on Americans Abroad to study and propose remedies to U.S. policies that harm or unfairly burden Americans living outside the U.S. (as provided for in House bill HR-3078)?

YES

As evidenced by the other issues discussed in this forum, the federal government’s regulatory environment is often myopic. It crafts solutions that are executable at home but nearly impossible to implement overseas other than at an enormous cost to our citizens living abroad. The Constitution begins with the words “We the People of the United States” It does not begin with the words “We the People of the United States except for those citizens living abroad.” HR-3078 is reflective of that truth. To suggest that we differentiate between U.S. citizens because of their geographic location is to lose sight of the rights that are granted under the Constitution.

6. Windfall Eliminations Provision “WEP”: Would you support the examination of the WEP and its impact on U.S. citizens abroad to establish a remedy that preserves the social security benefits fairly earned by Americans abroad through their U.S. working life?

YES

This issue parallels the arguments made with respect to Medicare. Again, Social Security is an entitlement due to the way Congress has chosen to fund it. The arbitrary nature of the factor that WEP applies to address “windfall” retirement distributions can be unfair and capricious as it related to citizens living abroad. It needs to be examined and reformed to address its original intent in a fair and equitable manner rather than a one-size-fits-all approach that can be unduly burdensome to our citizens overseas.

7. FAST Act passport revocation: Would you support, as part of the implementation of the 2015 FAST Act, these requests aimed at preserving the security of Americans abroad and their families?

YES

Our federal government has continued to expand the authority of the IRS well beyond its original purpose. It has become a quasi- militaristic agency because of the enforcement power it has been given. Unfortunately, it has too often demonstrated an inability to perform its enforcement responsibilities in a way that is congruent with the mandates of our Fifth Amendment. U.S. citizens, regardless of their place of residence, are entitled to Due Process. The guidelines suggested by Democrats Abroad are in direct alignment with rationale thought and a preservation of Due Process for everyone involved. It is somewhat embarrassing that we live in a time when Congress must be reminded of its responsibility to protect our fundamental rights.

Hillary Clinton | Rocky De La Fuente | Bernie Sanders

BERNIE SANDERS

Question: Would you support the FATCA Same Country Safe Harbor for Americans abroad, the regulatory reform that Democrats Abroad recommends for fixing FATCA’s problems but retaining its strength?

Yes. I support the “Same Country Safe Harbor” proposal and I commend Democrats Abroad for its leadership in working on this important initiative. In my view, banking and other financial services provided to overseas Americans should be treated as a local activity.

We need to make it easier for law-abiding Americans living overseas to manage their personal finances and buy a house, while making it harder for tax cheats to hide their money in offshore tax havens to avoid paying their fair share in taxes. I look forward to working with you to turn these goals into action.

The same country exception would ease the burden on overseas Americans – teachers, IT workers, researchers, small business owners, academics, aid workers and stay-at-home parents – and permit the U.S. Treasury to focus on curbing tax avoidance by Americans living inside the United States who move their money to offshore tax havens to avoid paying taxes.

Question: Would you support the replacement of the current system of taxing overseas Americans, known as citizenship-based taxation, with a system of residence-based taxation?

This is something that deserves serious consideration. Other than Eritrea, the U.S. is the only country that I am aware of that requires the filing of two annual tax returns to reconcile complex tax codes of different countries.

In my view, we can provide tax relief to middle-class families living overseas, while prohibiting large corporations and the wealthy from avoiding over $100 billion a year in taxes by stashing their cash in the Cayman Islands and other offshore tax havens.

Question: Would you support reforms to FBAR regulations to address these concerns and inequities?

Yes, I look forward to working with Democrats abroad to address these concerns and make this system more equitable. As you know the FBAR reporting threshold has not been adjusted for inflation since it was first initiated in the early 1970s. We need to look at that. We also need to look at removing the unnecessary duplication in the reporting requirements between FBAR and FATCA.

I am also sympathetic to the concerns raised by older Americans living abroad with the mandatory online reporting requirements that are now in place.

At a time when this country has an $18.4 trillion national debt and so many unmet needs, I do believe that we need to do everything we can to eliminate tax evasion. I also believe that we should be rewarding, not punishing, middle-class citizens living abroad who are following the rules. In my view, we can and we must accomplish both of those goals.

Question: Would you support an amendment to the Medicare law permitting American citizens to use Medicare benefits to pay for health care in approved medical facilities located outside the United States?

I support a Medicare-for-all single-payer health care plan to make health care a right, not a privilege, for all Americans, including Americans living and working abroad. Instead of spending federal health care dollars on the multi-million dollar salaries of insurance company CEOs, it is time to use this money to guarantee health care to every American citizen.

As you know, retired U.S. military personnel and their dependents living overseas are reimbursed by the U.S. government for most of their medical bills through the TriCare For Life system. In my view, there is no reason why we cannot use the Tricare program as a model for a Medicare delivery program for all Americans living overseas.

Question: Would you support the establishment of a Commission on Americans Abroad to study and propose remedies to U.S. policies that harm or unfairly burden Americans living outside the U.S. (as provided for in HR-3078)?

U.S. citizens living abroad deserve to feel that their country and the officials elected to represent them consider their interests just as they consider the interests of Americans living in the United States. I support the establishment of a Commission on Americans Abroad to examine the impact of federal financial reporting requirements, the ability to vote in U.S. elections, and access to federal programs like Social Security and Medicare for Americans living abroad.

Question: Would you support the examination of the WEP and its impact on Americans abroad to establish a remedy that preserves the social security benefits fairly earned by Americans abroad through their U.S. working life?

Yes. I have been a strong supporter of repealing the WEP to provide fair and equitable treatment to all workers on Social Security, including our teachers, firefighters, police and other public servants who have contributed into Social Security.

Further, at a time when senior poverty is going up, our job must be to expand benefits, not cut them. I have introduced a plan to increase Social Security benefits by over $1,300 a year for seniors who have income of less than $16,000 a year. My plan also extends the solvency of Social Security for more than 50 years by lifting the cap on taxable income so that the wealthiest 1.5 percent of Americans pays the same percentage of their income into Social Security as everyone else.

Question: Would you support, as part of the implementation of the 2015 FAST Act, these requests aimed at preserving the security of Americans abroad and their families?

I support efforts to ensure that Americans living and working abroad have access to information on tax debts and proper notice before the IRS requests that the State Department revoke or deny the renewal of the passports of U.S. citizens. Proper due process provides procedural and legal safeguards that permits an American abroad an opportunity to satisfy tax debts prior to the denial or revocation of a citizen’s passport. I also believe that safeguards should be put in place to protect and preserve the security of Americans living abroad and their families.

Hillary Clinton | Rocky De La Fuente | Bernie Sanders

JakDac has asked me to post this reply he received from US Senator Kaine:

Date: 3 Feb 2016 2:24 am

Subject: Reply from Senator Kaine

To: Jak Dac

Mr. Jak Dac

Aussie

Brissy, null 4000

Dear Mr. Dac:

Thank you for contacting me with your concerns about the Foreign Account Tax Compliance Act. I appreciate hearing from you.

The Foreign Account Tax Compliance Act (FATCA) was enacted by Congress in 2010 to address non-compliance by U.S. taxpayers who use foreign accounts to engage in tax evasion. Major provisions of this law went into effect on July 1st, 2014; it requires foreign financial entities or institutions to report information about accounts held by American taxpayers to the Internal Revenue Service (IRS). Foreign banks can face a 30 percent withholding tax on payments from U.S. accounts if they do not report this information.

Tax avoidance and evasion cost the federal government tens of billions of dollars in lost tax revenue. Shifting corporate profits and individual income into low-tax countries is one tactic used to evade taxes and has led to several banks receiving large fines and penalties from the U.S. government because of their role in tax evasion.

The law’s implementation has been complicated, requiring new forms and regulations from the IRS and bilateral agreements between the United States and dozens of countries and territories to address legal issues. Critics of this law have acknowledged the efforts of the IRS and the Treasury Department to address their concerns and provide additional guidance and extensions to comply with it.

I understand criticisms of the tax code and the FATCA, and I support a comprehensive overhaul of the federal tax code to make it simpler, more predictable, and more progressive. The code should be fair and pro-growth; it should also make us globally competitive. Tax compliance should not be a burden for honest taxpayers or unduly limit their access to financial services.

On March 4th, 2015, Senator Rand Paul introduced S. 663, legislation that would repeal the FATCA’s reporting for banks and individuals and withholding penalties for foreign financial institutions. This bill has been referred to the Senate Finance Committee.

President Obama and leaders in Congress have made tax reform a priority for the 114th Congress. I’m hopeful there will be a serious debate about tax reform this year, with comprehensive proposals, committee consideration, House and Senate floor action, votes on alternative proposals, and bipartisan action in Congress. We can resolve the difficult problems our nation faces, including tax reform, in a bipartisan manner.

I will be sure to keep your concerns in mind should the Senate consider legislation affecting tax compliance. Thank you again for contacting me.

Sincerely,

Tim Kaine

Big-Bucks Bernie doesn’t give a shit. He’s all for taxing all us “tax-cheats” as he calls us. He and his buddy Chucky Schumer and Carl (Show me the money) Levin. All three of them are money-grubbing scumbags.

And anything he says in the course of an election campaign is just a scheme to “buy votes”. PERIOD.

Either REPEAL FATCA or we REVOLT!

If anyone’s still reading this thread: this chart left out an apparently important name: John Kasich! He came in second to Trump in yesterday’s Primary. Anyone know where Mr. Kasich stands on our issues?

How about some retweets ??

JakDac

@DemsAbroad Does he support RBT did he state this ?

0 retweets 0 likes

Reply Retweet

Like View Tweet activity

More

Democrats Abroad @DemsAbroad

Yep. He did.

0 retweets 1 like

Reply Retweet

Like 1

More

February 21, 2016 at 8:29 pm

Please comfirm did Bernies state he supports RBT and where and when can we see playback of Town Hall event ? Cheers JD

Julia Bryan

Hi JD, we will have the recording up shortly and then I can confirm.

Best, Julia

Sent from my iPhone

mailed-by: demsabroad.eu

Julia Bryan

Hi Jak,

I don’t know the exact question formation but our moderators will definitely be asking the candidates their views on taxation issues that affect Americans abroad as this is a concern for everyone of our members. Thank you for your note! Also, if you’d like to send in your question via Twitter by using #GlobalTownHall and it hasn’t been already asked, it may be chosen during the call as we are hoping to feature at least one twitter question per candidate.

Best, Julia

Democrats Abroad (@DemsAbroad)

Hi. If you were on the call, we did specifically ask him that and he is in favor of quickly repealing CBT and getting RBT.

(https://twitter.com/DemsAbroad/status/701507138548535300?s=03)

Democrats Abroad (@DemsAbroad) tweeted

Senator Sanders states that he supports the Safe Country Safe Harbor proposal to reform #FATCA. #GlobalTownHall

(https://twitter.com/DemsAbroad/status/701485828925734912?s=03)

Democrats Abroad (@DemsAbroad) tweeted

Hi. If you were on the call, we did specifically ask him that and he is in favor of quickly repealing CBT and getting RBT.

(https://twitter.com/DemsAbroad/status/701507138548535300?s=03)

Alexander Reuvekamp (@AlexReuvekamp) tweeted

#GlobalTownHall I wonder how important the fatca problem is for Clinton. I would like to see a promise to change to RBT instead of CBT

(https://twitter.com/AlexReuvekamp/status/701461258931929088?s=03)

Martha McDevitt-Pugh (@McDevittPugh) tweeted

Overall tax reform required to address taxation of US citizens abroad. You should not be punished for living abroad #GlobalTownHall

(https://twitter.com/McDevittPugh/status/701462525586628609?s=03)

Hillary interesting / bankable ?????

http://www.democratsabroad.org/our_candidates

2. RBT: Would you support the replacement of the current system of taxing overseas Americans, known as citizenship-based taxation, with a system of residence-based taxation?

YES

Citizenship-based taxation places an undue burden on U.S. citizens living abroad. In effect, it imposes dual-tax exposure upon individuals who, other than on a limited basis, do not represent an economic burden on the programs and services that our federal government provides. Residence-based taxation reflects one’s rationale contribution to the programs and services that affect the lives of those who reside in any given country and city. As Democrats Abroad so cleverly implies, unless the United States aspires to become the next Eritrea, it is time to join the rest of the world in recognizing the nexus between taxation and the programs and services such monies are meant to fund.

The candidates know what this unfair “law” is causing to honest people Americans abroad.

It s horrible, a tremendous burden hurting them in many ways.

If the candidates don’t speak up to repeal FATCA and protect all Americans when they win (if they do) there is no reason to vote for them.

Keeping unfairness is not a good sign.

Americans -abroad- should vote for the candidate with higher votes who is repealing FATCA. This will bring the candidate forward to win. 7M plus is a very good number plus the vote of americans inside.

Honest American people living abroad do not deserve this.