UPDATE, post-August 4 and 5 summary trial dates (again through cross-post from @ADCSovereignty, John Richardson): https://adcsovereignty.wordpress.com/2015/08/07/morning-after-hangover-dont-think-about-law-and-drive-more-on-adcsoverignty-fatca-summary-trial/

*********************

UPDATE AFTER DAY 2 (through cross-post of link from @ADCSovereignty, John Richardson): @ADCSovereignty reaches “milestone” – End of #FATCA summary trial means the “End of the beginning”

*********************

Here is a cross-post from https://adcsovereignty.wordpress.com/2015/08/05/the-adscovereignty-fatca-lawsuit-is-underway-thoughts-on-day-1/

The @ADCSovereignty #FATCA lawsuit is underway – thoughts on day 1 and more

Posted on August 5, 2015 by adcsovereignty

Hello from Vancouver – thought I would share my thoughts (after having slept on them) about Day 1

We can learn a great deal from John Le. Carre and from Warren Buffet. Read on.

Nevertheless, most of the wisdom in the world comes from reading bumper stickers.

Wisdom does not come from “Elevator Rumors”. Specifically, I saw the following comment on the Isaac Brock Society site:

Reason to have more donors involved and to dig deep:

Stephen’s latest update…

RUMOUR FROM COURT ELEVATOR: JUDGE’S RULING NOT COMING UNTIL LAWSUIT FULLY FUNDED. DONATE NOW!

(Sleep well everyone — tomorrow will likely be another emotional roller coaster day.)

Well, I suppose this is true. The Judge will almost certainly “reserve judgment”. This means that the decision won’t come down for a few weeks. So, yes it’s true that (as a practical and factual matter) the “Judge’s ruling not coming until lawsuit actually funded”. It will probably be a few weeks until the ruling comes down. During that few weeks I am sure that the final $100,000 funding goal will be reached.

But, the Judge will rule WHETHER the lawsuit is funded or not. As another commenter on Brock said:

RE: “Can the elevator ruling be correct ? I don’t understand how it is of any concern of the Judge whether we have paid the last 4.x% of the fee BEFORE he issues his ruling. That surely is a matter between our Attorneys and ourselves.”

No worries. I’m sure that comment was a humourous poke from one Brocker to others (particularly those who haven’t contributed yet) to send a contribution to ADCS. The Judge has no idea of how or to what extent a party to the litigation before him was funded. That’s definitely a private matter in Canada.

Thanks for sharing your prayers this morning too.

Either way, it’s time to meet our $100,000 goal. So, come on … Really, this whole thing has been funded on the backs of repeat donors and many (but not all) people of modest means. Yet, the comments from Brock make it clear that there is WORLD INTEREST what’s happening on August 4 and 5 in Vancouver. It’s pretty clear that many of those who “have the most to lose” are doing the “least to support this lawsuit”. So, come on. It’s time to step up up to the plate. You get my point …

Speaking of the Judge’s Ruling …

The Judge (Justice Martineau) appears to be very sensitive to the date your banking information may be transferred to the IRS. He has given (in various contexts) indications that he realizes that his decision needs to be rendered prior to the “CRA to IRS Turnover Date”. This realization has influenced the proceedings in various ways (including denying the government’s motion for an adjournment).

What happened? On the flow of the day …

The comments at the Isaac Brock Society beginning (approximately) here provide a reasonable narrative.

My thoughts in a broader and more general sense …

First – the Judge

My subject impressions …

I have always felt that both “listening to” and “deciding” this case would be a nightmare for a single judge. That said, I am very pleased with the Justice Martineau. I say this for the following reasons:

1. He is working hard (and I thing gets it) to understand that FATCA affects Canadians who happen to also be U.S. citizens. He understands (I think) that the primary impact of FATCA is Canadian citizens and residents.

2. He is working hard (and I think he gets it) that the effect of U.S. “Extra-Territorial Taxation” is to subject Canadians to U.S. taxation which could result in double taxation (a point that is flatly denied by the Government lawyers).

3. He is (I think) a Judge who is experienced in a number of areas of law and understands that this is NOT JUST an issue of taxation (the Government lawyers are trying to paint a picture of FATCA being just one more treaty in the sea of “information exchange”).

4. My impression of him (rightly or wrongly) is that he is an intelligent man who attempts to be fair.

5. He clearly has spend considerable time learning about the broad issue AND he is seeking to learn more!

Some objective facts …

The lesson from John L. LeCarre’s “Russia House” – You can learn a lot by the questions that are asked …

For me, the most interesting part of the day was actually at the beginning. Justice Martineau began by asking the lawyers to explain where, in the Constitution of Canada, the Government of Canada received the authority to enter into the IGA. In others words what precise section of S. 91 of Canada’s Constitution allowed the Government to do this at all.

This was interesting to me for two reasons:

A. It demonstrated that he recognizes that there are constitutional limits on what the Government of Canada can do; and

B. It recognized the issue of whether the FATCA IGA could bind provincial credit unions (at least this is what I think he was getting at).

In any case, it’s very encouraging that Justice Martineau addressed the question of:

What allows the Government of Canada to enter into the IGA at all?

Second, Team Arvay …

Joe Arvay and David Gruber did a superb job. The issue in this “Summary Trial” is whether the FATCA IGA can be authorized/justified under the existing Canada U.S. Tax Treaty. To this end, Team Arvy had to explain:

A. That the FATCA IGA was subject to and limited by the terms of the Canada U.S. Tax Treaty (the Government is arguing that the FATCA IGA should be used to interpret the tax treaty); and

B. That the terms of the Canada U.S. Tax Treaty do NOT extend to authorizing the kind of information exchange required by the FATCA IGA.

I believe that they made the argument about as well as it could be made (this does NOT mean that the Judge will agree). But, the argument was well made. What impressed me most about Mr. Arvay’s discussion of the FATCA IGA, was that his description “hit the sweet spot” of:

• explaining just enough so that the issue could be understood; but

• NOT explaining so much that the issue could NOT be understood.

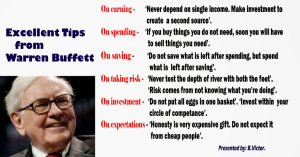

Lessons from Warren Buffett – You may recall Warren Buffett’s saying that:

Joe Arvay and Warren Buffett both understand the “just enough, but not too much principle”.

Third, The Government lawyers …

Although our cause is just, the case is legally complex and the legal arguments are difficult. We all know that we begin with a presumption that the FATCA IGA will be upheld. Sorry, but that’s just reality. Anybody with a U.S. place of birth who lives outside the United States is now subject to oppression and persecution. It is incumbent on those who are oppressed and persecuted to reclaim their dignity, reclaim their rights and reclaim their freedom. That’s just the way it is.

The Government could have selected a better legal team. My impression is that the Government lawyers do NOT understand the broader implications of FATCA, that FATCA is an issue that affects ALL Canadians, that FATCA burden’s Canada’s sovereignty and most importantly that:

FATCA is simply wrong!

Remember:

“It’s not a sprint. It’s a marathon.”

This will be appealed. It will continue for a long time. That said, this group of “government lawyers” has the capacity to “snatch defeat out the jaws of victory.”

We will see.

Fourth, the observers …

It’s significant that there are people there. There are people watching. It’s shows that people care. It makes it clear to Justice Martineau that his decision will affect the real lives, of real people in real ways.

This can never be a bad thing!

Conclusion, so far so good …

Today is August 5, 2015. Four years ago – on August 5, 2011 – the compliance industry was “herding people” into the IRS OVDI program. The “push back” is beginning. Today is day two of the hearing. I will keep you “posted” (okay, bad pun intended).

P.S. Speaking of bumper stickers, how about these:

or if you don’t agree then:

Yes the system is corrupt. Yes we have to hope that the Canadian system this time will not be so corrupt.

There will still be cause for worry. An off-topic digression will explain why.

Japan’s present constitution was written by the US during the occupation after World War II. Article 9 prohibits the use of military force. Shortly after the occupation ended and Japan-except-for-Okinawa regained some amount of sovereignty, Japan and the US signed a treaty which was considered by some people to violate Article 9. When the case reached Japan’s Supreme Court, the US told Japan to make sure the Supreme Court would rule that the treaty didn’t violate Japan’s constitution. The Supreme Court obeyed. Now more than 50 years later, the current prime minister, Dishonest Abe, wanted to amend Article 9. Abe figured out he wouldn’t get enough votes, so he bypassed the amendment procedure and “reinterpreted” Article 9 instead, to allow vastly increased use of Japan’s military. He used his “reinterpretation” to write “security” bills, and the “Liberal Democratic Party” (neither liberal nor democratic) railroaded the bills through the lower house. It is expected that the upper house will not vote on them, so after 60 days the bills will return to the lower house and the two-thirds majority held by the LDP and allied party will railroad the enactment of the bills. (Royal assent is not needed in Japan.) Now, in case anyone has any constitutional objection, Dishonest Abe further stated his reliance on the aforementioned Supreme Court ruling that approved a far weaker military treaty.

We have to hope that Canada’s Supreme Court will not rubber stamp the US government’s demands the way Canada’s Con artists do, and the way Japan’s Supreme Court and con artists do.

Polly –

If an injunction is evoked — it will be like throwing a wrench in the machine. What would happen THEN?

(1) The US would defer on whatever it has to defer on? Already five years or so into implementation. Those perps see FATCA as forever country. Not just tomorrowland.

(2) The US would start to levy 30% on passthrough $$$ for Canada? Unlikely. The FATCA bomb is so like the nuclear bomb. Poisons everything for everybody. So cannot be used. Ever. Especially on largest trading partner with longest contiguous border. Useful only as threat. But threat must be maintained.

Hypothesis: FATCA is far more about (a) preemptive control of non-extraterritorial US citizen departure and (b) monitoring financial flows in the post 9/11 era than it is about trying to shake down existing extraterritorials for revenue. Swiss bank history is real, but it is also diversionary peanuts. Do the math.

Wasn’t that just some goofy pipsqueak who tried to masquerade as Wizard of Oz? Quintessential American myth. Shred the veil.

Open your eyes. Fire up your wetware. Sauve qui peut.

Here’s a “blast from the past” regarding CRA non-collection of US “penalties”.

Don Cayo at Vancouver Sun was one of the first – and best – reporters following this issue. He wrote a series of articles in July – Sept 2011 about US harassment of dual Canada-US citizens.

In the campaign of fear that was being ramped up by the compliance industry and “press-release” reporting, Don Cayo was the first to widely report that CRA will not collect US taxes from Canadian citizens under the Canada-Tax Treaty. This was a real SCOOP at the time!

http://blogs.vancouversun.com/2011/08/24/verbatim-what-canada-says-about-collecting-irs-non-filing-penalties/

“Several correspondents and callers have asked me to post a link to the Canadian Department of Finance statement spelling out that the Canada Revenue Agency will not collect non-filing and non-disclosure penalties on behalf of the IRS.

If the department has posted a link to this statement, I am not aware where it is. I quoted from a statement in an email to me from an employee who asked that it be attributed to the department itself, not to any individual.

The full text of the statement, unedited, is:

• As outlined in detail below, penalties imposed under FBAR would not be collected by the Canada Revenue Agency (CRA).

• CRA does not collect taxes and penalties imposed under a foreign tax law, unless it has been agreed to do so pursuant to a reciprocal provision to that effect contained in a double taxation agreement in force between Canada and another country.

• The Canada-United States Income Tax Convention contains such a reciprocal provision, which allows for the collection by a country of taxes imposed by the other country, including civil penalties. The provision applies to all categories of taxes collected, and to contributions to social security and employment insurance premiums levied, by or on behalf of the governments of the respective parties. This means that the provision does not apply to penalties imposed pursuant to laws that impose only a reporting requirement (as opposed to those that impose taxation along with reporting requirements).

• Thus, penalties imposed under the U.S. Bank Secrecy Act for failure to file Form TD F 90-22.1 (Report of Foreign Bank and Financial Accounts, commonly known as “Foreign Bank Account Report”, or “FBAR”) are not covered by the above provision of the Canada-U.S. Income Tax Convention and would not be collected by the CRA.

• Moreover, the obligation to collect taxes imposed by the other country does not apply in cases where the individual was a citizen of the requested state at the time the tax liability arose in that other country. This means that the CRA would not collect the U.S. tax liability of a Canadian citizen if the individual was a Canadian citizen at the time the liability arose (whether or not the individual was also a U.S. citizen at that time).

You can link to my previous posts and columns on this issue here (my original story), here (a column on how a range of people from senior global bankers to ordinary citizens will be affected) and here (a column on the finance department ruling and on the possibility that some American-born residents of Canada may have lost their US citizenship).”

@ wondering

I was “wondering” if you knew about other countries and if they will collect fbar and taxes for the US from their citizens. It would be interesting and helpful to have a list of the countries that would and would not collect these taxes and fbar penalties.

Don Cayo has since changed his stripes and become a shrill for the complance industry

in an e mail exhcange between he and i, i was pretty much told by him ” it serves me right for not knowing my obligations and i had better fess up and file” and “to bad even though i am a canadian citizen”

i used to read and respect his opinion and column.

it now serves a better purpose. at the bottom of my bird cage

@2terrified2sleep

I am NO kind of expert in these tax treaty matters … but it would likely depend upon whether a country had a tax treaty with the US that included “mutual assistance in collection” and the term and conditions of that. Tax treaties are widely available on the Internet.

Outside of a country’s own tax authority agreeing to collect on the US behalf, the US cannot collect taxes in foreign states, and generally courts will not enforce foreign tax revenue claims

Because the US generally will not assist in the collection of any other country’s taxes from its own citizens, some countries may not reciprocate in collecting US taxes for their own citizens (this is Canada’s position).

For those waiting for more information:

UPDATE, post-August 4 and 5 summary trial dates (again through cross-post from @ADCSovereignty, John Richardson): https://adcsovereignty.wordpress.com/2015/08/07/morning-after-hangover-dont-think-about-law-and-drive-more-on-adcsoverignty-fatca-summary-trial/

But the Charter is law too, right?

@2terrified2sleep, go to this publication from the US Congress.

https://www.jct.gov/publications.html?func=startdown&id=4550

The USA signed the OECD mutual collection treaty but then reserved/opted out the collection part of the treaty/

The USA has bilateral collection with five countries.

Anyways most so called US Persons are beyond collection

From Allison Christians

https://twitter.com/taxpolblog/status/629741188933750787

@Polly

“But the Charter is law too, right?”

I believe that the Charter as part of the Constitution of Canada is FUNDAMENTAL law upon which all other law must exist.

Thanks, JC, for the link above which gets to to Allison Christians’ comments on the summary trial. She gives a clear summary of where things are at this stage.

http://taxpol.blogspot.ca/2015/08/update-on-canadian-fatca-litigation.html?utm_source=twitterfeed&utm_medium=twitter

“In broad strokes the suit seeks to prevent the Canadian Revenue Agency from furnishing to the US Internal Revenue Service the personal and financial account information of Canadian citizens pursuant to the FATCA IGA signed by Canada and enacted into law last year. This is not a charter-based (constitutional) challenge, rather it is a challenge that certain provisions of the IGA are unlawful based on the Canada-US Tax Treaty Act (which in effect ratifies the US Canada Tax Treaty) and the Income Tax Act. Thus it is not about fundamental rights and freedoms at this stage, but about an interpretation of relevant laws, including the existing tax treaty.”

Thank you again, John, for your 3rd update, after the 2 days in court — “Don’t think about law and drive”.

Thanks John,

You really nailed the underlying “natural law” argument and the fundamental morality of the matter. In the end, morality and natural law must prevail.

Here’s an inspiring quote from MLK:

“One may well ask ‘How can you advocate breaking some laws and obeying others?’

The answer is found in the fact that there are two types of laws: there are just and there are unjust laws.

I would agree with Saint Augustine that ‘An unjust law is no law at all.’

A just law is a man-made code that squares with the moral law or the law of God. An unjust law is a code that is out of harmony with the moral law. To put it in the terms of Saint Thomas Aquinas, an unjust law is a human law that is not rooted in eternal and natural law.”

Martin Luther King “Letter From a Birmingham Jail”

@The Mom. By all means file a FOI request if you feel motivated. In my experience, Justice invokes client-solicitor privacy when it comes to sharing information. In any case, it seems entirely plausible that the Government of Canada might pay non-governmental lawyers for advice, just as they might do for consulting engineers, accountants, and other professionals, even when they have such professionals in the public service.

The Government of Canada no longer publishes departmental annual reports; these have been replaced functionally by Treasury Board Estimates Part III, Reports on Plans and Priorities, available at http://www.tbs-sct.gc.ca/rpp/2015-2016/index-eng.asp. If you go through the list, you will see that there is nothing listed under “Justice”. Justice Canada in fact is viewed as lawyer to a single client, the Government of Canada. It has always been such, so far as I know.

@NorthernShrike, re;

“…..Justice Canada in fact is viewed as lawyer to a single client, the Government of Canada. It has always been such, so far as I know.”

I would add to that “Justice Canada in fact is viewed as lawyer to a single client, the Government of Canada. It has always been such, so far as I know.”

The Harper government is mis/using Justice Canada in this and other instances as a way of turning our own taxpayer revenues and federal institutions to achieve his own and the Cons objectives AGAINST the civil, constitutional and human rights and wellbeing of CANADIAN CITIZENS and LEGAL RESIDENTS – who are ALL CANADIAN TAXPAYERS AND ACCOUNTHOLDERS. It as if Harper and the Cons are the sole client of the Justice Dept. – a whole federal department set to doing their personal ideological bidding in abusing the very Canadians they have a sworn duty to protect and to serve.

We will never know what the Justice Dept. said about FATCA because the Feds redacted most tof their response to the FOI filed by Blaze http://maplesandbox.ca/2014/finance-canada-244-pages-access-to-information/ as well as issuing mostly non-answers to the Parliamentary questions filed by MP Mai, and filed by MP Hsu ( http://taxpol.blogspot.ca/2014/11/questions-on-canada-us-fatca-agreement.html http://taxpol.blogspot.ca/2015/01/responses-to-questions-on-canadas.html ). The documents that Blaze eventually received (Thank you, thank you Lynne!!) was just a mess of redacted documents – some of which even had the TITLES blacked out. In one of the Harper government responses to either the MP’s questions, or Lynne’s FOI was an answer that even IF the Justice Dept. had been consulted re FATCA, the mere fact of a question or consultation having taken place was covered by attorney client privilege.

So, the Cons refused to even confirm IF they had consulted Justice, much less what Justice said.

Further to my point above about the Cons misusing the Justice Dept as if it was their own personal lawyer. They also issued non-answers to the information request filed by MP Brison but the link to the dropbox file posted by Allison Christians no longer works.

http://taxpol.blogspot.ca/2014/01/canadian-government-responds-to-fatca.html

Anyone else saved a copy of the Cons response to MP Brison?

Just to add to what Badger said.

In addition to the FOI request to Finance, I also did an FOI to Justice.

They gave me print copies of laws and regulations. Virtually everything else they gave me was totally redacted.

@ badger

I’ve got the government response to Scott Brison (Ted Hsu also) in pdf format but I don’t know how to post it. I could relay it to Calgary411 if you want.

Yes, send it to me, EmBee, and I will reply with it to badger’s comments.

I did find this, the Government’s typical dragging of feet: http://maplesandbox.ca/2013/order-paper-questions-from-liberal-scott-brison/comment-page-1/#comment-11466

@ calgary411

Sorry. It turns out the pdf files are too big to transmit by e-mail. We’ll try to figure something out later.

@EmBee You could probably use a drop box like We Transfer.

On the topic of FOI, things are even worse in the U.S. I have had an FOI request at the Department of State for some personal information since September 2012–almost three years ago.

I call every few months and get the same answer. They are looking for it. Then, they point out the information I am seeking is from over 40 years ago. I tell them I requested information from that time from the Canadian government and I had it in less than three weeks.

In a parallel universe, where the Government of Canada is representative of the people of Canada, communications between the Department of Justice and the representative of the people of Canada are privileged communications — they are shared between the Department of Justice and the people of Canada, but kept secret from everyone else.

“On the topic of FOI, things are even worse in the U.S.”

They sure are. In 2005 I gave an FBI agent some documents that were created during the period 2003 to 2005 about my 2002 US tax return, when I didn’t know about Monica Hernandez but suspicious things were happening. The FBI doesn’t issue police reports so they said the closest thing would be to submit an FOIA request to show that my documents were on file. The US Department of Justice replied that my documents had been DESTROYED IN 1990.

How did I forget, FOIA in the IRS too.

In 2011 the IRS accidentally revealed a page containing what I thought was one document (but later guessed it might be copies of two documents, but the IRS isn’t saying) regarding my 2006 US return. When the IRS noticed their mistake, they replaced their exhibit by something not including that page. I submitted an FOIA request for copies of the same kind of documents for several tax years including 2006. The IRS replied that a diligent search failed to find such documents. Even though the IRS had revealed in court a page that had the name of the IRS employee who had possessed that page in order to file it in court, the IRS’s diligent search failed to find even that page.