UPDATE, post-August 4 and 5 summary trial dates (again through cross-post from @ADCSovereignty, John Richardson): https://adcsovereignty.wordpress.com/2015/08/07/morning-after-hangover-dont-think-about-law-and-drive-more-on-adcsoverignty-fatca-summary-trial/

*********************

UPDATE AFTER DAY 2 (through cross-post of link from @ADCSovereignty, John Richardson): @ADCSovereignty reaches “milestone” – End of #FATCA summary trial means the “End of the beginning”

*********************

Here is a cross-post from https://adcsovereignty.wordpress.com/2015/08/05/the-adscovereignty-fatca-lawsuit-is-underway-thoughts-on-day-1/

The @ADCSovereignty #FATCA lawsuit is underway – thoughts on day 1 and more

Posted on August 5, 2015 by adcsovereignty

Hello from Vancouver – thought I would share my thoughts (after having slept on them) about Day 1

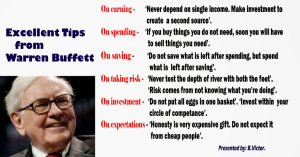

We can learn a great deal from John Le. Carre and from Warren Buffet. Read on.

Nevertheless, most of the wisdom in the world comes from reading bumper stickers.

Wisdom does not come from “Elevator Rumors”. Specifically, I saw the following comment on the Isaac Brock Society site:

Reason to have more donors involved and to dig deep:

Stephen’s latest update…

RUMOUR FROM COURT ELEVATOR: JUDGE’S RULING NOT COMING UNTIL LAWSUIT FULLY FUNDED. DONATE NOW!

(Sleep well everyone — tomorrow will likely be another emotional roller coaster day.)

Well, I suppose this is true. The Judge will almost certainly “reserve judgment”. This means that the decision won’t come down for a few weeks. So, yes it’s true that (as a practical and factual matter) the “Judge’s ruling not coming until lawsuit actually funded”. It will probably be a few weeks until the ruling comes down. During that few weeks I am sure that the final $100,000 funding goal will be reached.

But, the Judge will rule WHETHER the lawsuit is funded or not. As another commenter on Brock said:

RE: “Can the elevator ruling be correct ? I don’t understand how it is of any concern of the Judge whether we have paid the last 4.x% of the fee BEFORE he issues his ruling. That surely is a matter between our Attorneys and ourselves.”

No worries. I’m sure that comment was a humourous poke from one Brocker to others (particularly those who haven’t contributed yet) to send a contribution to ADCS. The Judge has no idea of how or to what extent a party to the litigation before him was funded. That’s definitely a private matter in Canada.

Thanks for sharing your prayers this morning too.

Either way, it’s time to meet our $100,000 goal. So, come on … Really, this whole thing has been funded on the backs of repeat donors and many (but not all) people of modest means. Yet, the comments from Brock make it clear that there is WORLD INTEREST what’s happening on August 4 and 5 in Vancouver. It’s pretty clear that many of those who “have the most to lose” are doing the “least to support this lawsuit”. So, come on. It’s time to step up up to the plate. You get my point …

Speaking of the Judge’s Ruling …

The Judge (Justice Martineau) appears to be very sensitive to the date your banking information may be transferred to the IRS. He has given (in various contexts) indications that he realizes that his decision needs to be rendered prior to the “CRA to IRS Turnover Date”. This realization has influenced the proceedings in various ways (including denying the government’s motion for an adjournment).

What happened? On the flow of the day …

The comments at the Isaac Brock Society beginning (approximately) here provide a reasonable narrative.

My thoughts in a broader and more general sense …

First – the Judge

My subject impressions …

I have always felt that both “listening to” and “deciding” this case would be a nightmare for a single judge. That said, I am very pleased with the Justice Martineau. I say this for the following reasons:

1. He is working hard (and I thing gets it) to understand that FATCA affects Canadians who happen to also be U.S. citizens. He understands (I think) that the primary impact of FATCA is Canadian citizens and residents.

2. He is working hard (and I think he gets it) that the effect of U.S. “Extra-Territorial Taxation” is to subject Canadians to U.S. taxation which could result in double taxation (a point that is flatly denied by the Government lawyers).

3. He is (I think) a Judge who is experienced in a number of areas of law and understands that this is NOT JUST an issue of taxation (the Government lawyers are trying to paint a picture of FATCA being just one more treaty in the sea of “information exchange”).

4. My impression of him (rightly or wrongly) is that he is an intelligent man who attempts to be fair.

5. He clearly has spend considerable time learning about the broad issue AND he is seeking to learn more!

Some objective facts …

The lesson from John L. LeCarre’s “Russia House” – You can learn a lot by the questions that are asked …

For me, the most interesting part of the day was actually at the beginning. Justice Martineau began by asking the lawyers to explain where, in the Constitution of Canada, the Government of Canada received the authority to enter into the IGA. In others words what precise section of S. 91 of Canada’s Constitution allowed the Government to do this at all.

This was interesting to me for two reasons:

A. It demonstrated that he recognizes that there are constitutional limits on what the Government of Canada can do; and

B. It recognized the issue of whether the FATCA IGA could bind provincial credit unions (at least this is what I think he was getting at).

In any case, it’s very encouraging that Justice Martineau addressed the question of:

What allows the Government of Canada to enter into the IGA at all?

Second, Team Arvay …

Joe Arvay and David Gruber did a superb job. The issue in this “Summary Trial” is whether the FATCA IGA can be authorized/justified under the existing Canada U.S. Tax Treaty. To this end, Team Arvy had to explain:

A. That the FATCA IGA was subject to and limited by the terms of the Canada U.S. Tax Treaty (the Government is arguing that the FATCA IGA should be used to interpret the tax treaty); and

B. That the terms of the Canada U.S. Tax Treaty do NOT extend to authorizing the kind of information exchange required by the FATCA IGA.

I believe that they made the argument about as well as it could be made (this does NOT mean that the Judge will agree). But, the argument was well made. What impressed me most about Mr. Arvay’s discussion of the FATCA IGA, was that his description “hit the sweet spot” of:

• explaining just enough so that the issue could be understood; but

• NOT explaining so much that the issue could NOT be understood.

Lessons from Warren Buffett – You may recall Warren Buffett’s saying that:

Joe Arvay and Warren Buffett both understand the “just enough, but not too much principle”.

Third, The Government lawyers …

Although our cause is just, the case is legally complex and the legal arguments are difficult. We all know that we begin with a presumption that the FATCA IGA will be upheld. Sorry, but that’s just reality. Anybody with a U.S. place of birth who lives outside the United States is now subject to oppression and persecution. It is incumbent on those who are oppressed and persecuted to reclaim their dignity, reclaim their rights and reclaim their freedom. That’s just the way it is.

The Government could have selected a better legal team. My impression is that the Government lawyers do NOT understand the broader implications of FATCA, that FATCA is an issue that affects ALL Canadians, that FATCA burden’s Canada’s sovereignty and most importantly that:

FATCA is simply wrong!

Remember:

“It’s not a sprint. It’s a marathon.”

This will be appealed. It will continue for a long time. That said, this group of “government lawyers” has the capacity to “snatch defeat out the jaws of victory.”

We will see.

Fourth, the observers …

It’s significant that there are people there. There are people watching. It’s shows that people care. It makes it clear to Justice Martineau that his decision will affect the real lives, of real people in real ways.

This can never be a bad thing!

Conclusion, so far so good …

Today is August 5, 2015. Four years ago – on August 5, 2011 – the compliance industry was “herding people” into the IRS OVDI program. The “push back” is beginning. Today is day two of the hearing. I will keep you “posted” (okay, bad pun intended).

P.S. Speaking of bumper stickers, how about these:

or if you don’t agree then:

Thank you for this!

Thank you, John Richardson. With your thoughts on Day 1 and those anticipated on Day 2, plus the comments at Brock and the coaching of Ginny Hillis, I’m beginning to understand this litigation process much better. Yes, it is a long road ahead but we’ve taken the first steps and that’s what counts. Sir Isaac Brock used his last breath to say, “Surgite!” and now I can’t seem to stop repeating it but after this summary trial we really are motivated to “Push on!”. I think it’s just the fact that someone is actually listening (Judge Martineau), even though I know he could rule for the defendants, that lifts one’s spirits.

@EmBee — “I think it’s just the fact that someone is actually listening (Judge Martineau), even though I know he could rule for the defendants, that lifts one’s spirits.”

My thoughts exactly. I think this in itself is a big deal. And thank you again, John, for your thoughts and perspective in another excellent commentary.

Your bumper sticker, “American by birth…” reminds me of a famous quote attributed to organist and composer Healey Willan: “English by birth; Canadian by adoption; Irish by extraction; Scotch by absorption.”

This is just for fun…

Sounds promising. Thanks for the update!

Anyone else waiting like a kid on Christmas Eve for John’s Day 2 report?

Hoping I will still be awake for Santa 🙂

UPDATE AFTER DAY 2 (through cross-post of link from @ADCSovereignty, John Richardson): @ADCSovereignty reaches “milestone” – End of #FATCA summary trial means the “End of the beginning”

Deckard,

I’ve now posted through a link to the Day 2 at yesterday’s post — see comment above.

And, I now have read it — a MUST READ FOR EVERYONE and MORE!!!

Thank you for the Day 2 Report, John Richardson. It is brilliant and, in my view, telling for all of us. It needs the understanding of many others, starting with the candidates who seek our vote for leadership of our country, Canada, on October 19th.

“Justice, I feel sorry for you having to resolve this issue.”

It seems the government lawyers know their client is guilty and cannot be defended. On what grounds could they appeal if Justice Martineau comes down in our favour?

@John

Thank you so much for your vivid, moving and inspiring summary. This was indeed just the opening salvo of what will be a long and difficult campaign.

I’d like to expand on your exploration of how the release of FATCA-disclosed information might be used to enforce FBAR penalties. We’ve previously discussed the potential for even greater dissemination and application of this information by other US agencies and how that might be in direct contravention of the Article XXVII Exchange of Information provisions in the Canada-US Tax Treaty. Here is part of that section:

Let’s contrast these treaty constraints with Section 6103 of the actual IRS FATCA regulations, as explored in the following article:

http://www.acfcs.org/by-taking-certain-steps-the-irs-may-share-bank-data-it-gets-from-foreign-banks-under-fatca-with-other-us-agencies/

John, I’d love to know your thoughts on this and its possible relevance and application to the ADCS lawsuit.

Having read John’s summary and commentary on Day 2 yesterday, in Vancouver, my first feeling was “Wow”. He conveys well the significance of the day and all that was said in the courtroom.

One question I had is answered, i.e., in a Summary Trial, does the judge write a detailed decision. John wrote:

“Regardless of his decision, Justice Martineau is likely to write a comprehensive decision that explores the facts and the issues. His decision will be reviewed on appeal and the contents of his decision will be a major part of the review.

I am confident that even if the Government wins round 1 (and I am not suggesting I believe this will happen), Justice Martineau’s decision is likely to include certain “findings”, “observations” and “arguments” that will be very helpful to ALL anti-FATCA and anti-CBT litigants going forward.”

@John: I do not understand why the judge’s “what else” question was a new OMG moment for lawyers or anyone else following this, As many people know, I have believed since I read Levin’s demands that the intent is to share FATCA information–despite insipid comments by Finance Canada officials that they trust their treaty partners.

Also, did the government lawyer actually say U.S. persons in Canada are either compliant or they are tax cheats?

Oh how the tides turn. A few years ago the Canadian govt considered us innocent, law abiding minnows caught in a tax web. Now we are either “tax compliant” or “tax cheats”. The US person is evolving as a species.

The also said Fatca was just an information sharing agreement and that there would be no new taxes imposed on US persons living in Canada.

Oh man. If an injunction is evoked- it will be like throwing a wrench in the machine. What would happen THEN? Canada is such a big deal. it is a huge country and important. If Canada overthrows the IGA with America- then it will put into question all the others.

Fingers crossed.

First, my profound thanks for all the reporting from the Courthouse yesterday on day 2 of the trial, and John’s excellent Day2 analysis.

It seems to me that when we go back to the first issue of FATCA :

That it was UNenforcable in foreign countries BECAUSE it required violation of privacy and banking laws in those foreign countries.

To get around both ( because they knew the countries around the world did not have the resources to fight financial warfare nor did many have the sophistication to know the legalities and were sorely afraid of any kind of assault from the US) they came up with the IGAs

Identified as a ‘treaty’ it is and was really , as many have identified it here, a Trojan Horse prepared to be installed in a foreign country to get information that a country otherwise would be unwilling and unable to give. Information that could and would be used by the recipient for any and all purposes they choose to use it without the knowledge or consent of the individual OR the inconvenience of getting a warrant to prove probable cause.

Of course it is not a treaty as the IGAs have not been taken to Congress for ratification. NOR is Treasury authorized to be a treaty partner with another country , especially a treaty partner of the US.

(A fact that is at the core of the litigation in the US along with 8 Constitutional violations AND legislation in Congress right now. )

Specifically for Canada the government had to be willing to OVERRIDE existing privacy and banking laws , ignoring or overriding provincial jurisdiction and allowing the blanket information to be sent again, WITHOUT probable cause.

And they were TOLD that in the Senate Finance Hearings. By Prof. Christians, Arthur Cockfield, Lynne Swanson and SIX opposition MPs who proposed amendments that would have been a viable workaround while the US fought out the legality fight of FATCA itself.

Protecting Canadian Citizens and Permanent Residents from the leviathan reach of illegal inquiry into private citizen private personal and financial information was and is their obligation as a government.

Knowing that the scope of the snooping would include Canadian citizens who were in no way connected to the US regarding taxes of any kind except they happened to be married to or otherwise associated in business with a ‘US Taxable person’ ( Definition left entirely to IRS determination, that determination as flexible and fluid as they wish it to be for their own interests) Knowing that the information as comprehensive as what is demanded would be used not for tax assessment but PENALTY assessment wherever they could find an excuse to levy it, even on Canadian taxpayers who are in no way subject to US taxes whatsoever.

They could have adopted any one of those six recommendations as an amendment that would have given that protection.

In my view, the reason they did not is because the banks did not want it. The banks are also protected by privacy laws against foreign countries intrusion and the gov. has tools at it’s disposal to thwart any attempt by the US to override that.

Yet they chose to throw open the border, throw citizens and residents to the wolves and work diligently to ignore one basic fact:

The US wanted ALL this information ‘WITHOUT PROBABLE CAUSE’

THAT was the firewall the government of Canada deliberately tore down.

When Mr. Taylor suspended his cross-examination of Prof. Christians and refused Mr. Arvay’s suggestion that they continue with it rather that end it at that point as both Prof. Christians and the Arvay team were there for that very issue both that day and the next yet Mr. Taylor refused and ended his cross-examination.

THEN going to the judge to ask for an adjournment because they did not have the time to cross-examine Prof. Christians. As the Judge said, ‘all you had to do was pick up the phone and ask a few questions’ on denying the adjournment.

It is my view that Mr. Taylor realized in that moment during Prof. Christian’s cross that her affidavit and it’s supplemental held the key.

@FuriousAC

Great analysis! Man, this entire story is going to make one hell of a non-fiction page-turner in a few years. We are literally making history!

“Both of these regulations lead to the crucial provision of the US tax code, Title 26, Section 6103, which covers “confidentiality and disclosure of returns and return information.” This lengthy section opens several doors through which US government agencies, and even the US Congress, could traverse to obtain tax and bank account information the IRS will receive from foreign financial institutions (FFI) under FATCA. Section 6103(i) permits disclosure of tax “return information” to “any federal agency” for use in virtually any matter over which the agency has jurisdiction.”

Does this need repeating again…

The US Department of Justice and courts have held that Section 6103 permits disclosure of tax “return information” including social security numbers PUBLICLY, to everyone who wants to download it through PACER. There is no confidentiality. No one needs convoluted routes.

I’m just curious about something. Someone mentioned that Berg had a conference room at the courthouse. It was also mentioned that the Crown lawyers were conferring with Berg, and possibly associates. I’m assuming MG, Berg et al would not do this out of the goodness of their hearts, and we taxpayers paid for it.

Would a Freedom of Info. request reveal the payment to him/them by the Crown in this case?

There was a report of lawyers from I believe Moody’s ? Who is paying them and what were they doing? It would be interesting to identify others there.

JC,

Wouldn’t the only answer, one way or another, be that the Canadian taxpayers are paying for Moodys to advise the Government of Canada lawyers — and those Canadians the US deems US Persons are also paying for the Arvay team’s brilliant work, which we need to make sure continues!

The Mom brought up this very thing a little earlier: http://isaacbrocksociety.ca/2015/08/05/from-adcssovereignty-fatca-lawsuit-is-underway-thoughts-on-day-1-and-more/comment-page-1/#comment-6360501.

If the lawsuit in won because of the possibility of the US using the info for FBAR penalties, how could this possibly be appealed? This is a fact, and we have proof that this has been done in the past with Canadians who have joined OVDI.

Also, if the lawsuit is won, what prevents the Canadian government to modify the IGA to correct the findings of the judge soon after they are published and transfer the data anyway (say for example exclude the data from joint accounts which is also the elephant in the room)?

“If the lawsuit in won because of the possibility of the US using the info for FBAR penalties, how could this possibly be appealed? This is a fact, and we have proof that this has been done in the past with Canadians who have joined OVDI.”

Facts can be ignored by courts at all levels. Different “facts” can be invented by courts. Court rulings can rely on “facts” that they invented, and courts can prevent entry of rebuttal evidence.

In Canada I had this happen in an unemployment insurance hearing (not exactly a court but the umpire was a federal judge) and in Ontario Small Claims Court. Harry Kopyto likely had it more often.

In the US I’ve had this in several federal courts. Mostly the courts just block submissions of evidence. But in one case a US court denied that they had even received a piece of evidence — I wonder if the appeals court will allow testimony from the person (not a party) who served it by certified mail and received the return receipt signed by a court employee, as they do not have to allow such testimony. Whatever a court has to do to make its favoured party win, the court will do.

Cross Posted @ADCSovereignty reaches “milestone” – End of #FATCA summary trial means the “End of the beginning”

There are FATCA 8938 penalties as well as FBAR penalties. Perhaps theoretically one can get both fines on the same account.

And what was the reply to the Crown’s assertion of the “benefits” for Canada of the IGA being avoidance of 30% witholdings? Hopefully the judge was not left with this impression. In the comment to the metro article I suggested some alternatives for the Canadian government instead of just agreeing to it all.

Was the Bopp suit mentioned?

@NormanDiamond

What you are describing is a corrupt system. If the system is corrupt in Canada, then God help us. The only thing we can hope for is that the judge takes his profession seriously, has integrity, and handles the case with honour and according to the laws of Canada.