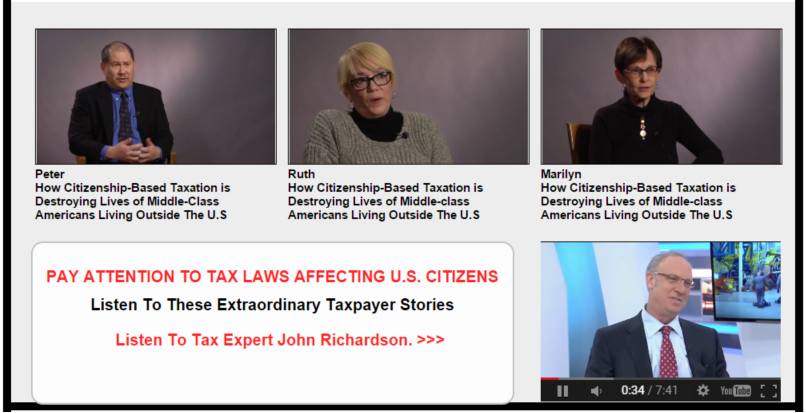

Kat Jennings, CEO of Tax Connections deserves a very special ‘thanks” for highlighting issues facing US Persons including FATCA, FBAR and CBT. And for publishing the videos that we made in February in Toronto.

This is an event not to be missed! Register for your free ticket HERE

8:00AM PDT/11:00 am EDT/15:00 GMT

What Is FATCA, FBAR, CBT, FCC, OVDP? What Does It All Mean?

Introducing Tax Expert: Michael DeBlis, DeBlis Law, Bloomfield, New Jersey9:00 PDT/ 12 noon EDT/ 16:00 GMT

What Are Your Tax Filing Obligations As A U.S. Citizen Living Abroad?

Ephraim Moss and Joshua Ashman, ExpatTaxProfessionals, U.S. And U.K.10:00AM PDT/1:00 pm EDT/17:00 GMT

You Have An Offshore U.S. Account – Criminal, Quiet Disclosure Or Amnesty! What Do You Do?

Frank ”Chip” Hider, Hider & Associates, Dallas, Texas11:00 am PDT/ 2:00 pm EDT/ 18:00 GMT

What Do You Do If You Have Trusts Or Investment Accounts Set Up Offshore?

TBA12:00 pm PDT/ 3:00 pm EDT/ 19:00 GMT

Exit Tax Operates To Confiscate Assets Of Those Who Moved From The U.S. Years Ago; And On Assets Acquired After Leaving The U.S. (Including Non-U.S. Pensions)

John Richardson, Citizenship Solutions, Toronto, Canada

The first day of the online Internet Tax Summit is focused on a topic that everyone should watch! You see, even though you think it may not involve you or your life I believe these stories will touch your lives. Taxes can have unintended consequences and that is why you should all listen to these stories. Starting August 1, 2015 we will be bringing you real stories of citizens whose lives have been greatly affected by FATCA. It is time for everyone to listen and you can decide for yourself if something like this could happen to you.

The first day of the online Internet Tax Summit is focused on a topic that everyone should watch! You see, even though you think it may not involve you or your life I believe these stories will touch your lives. Taxes can have unintended consequences and that is why you should all listen to these stories. Starting August 1, 2015 we will be bringing you real stories of citizens whose lives have been greatly affected by FATCA. It is time for everyone to listen and you can decide for yourself if something like this could happen to you.

Kat Jennings CEO

For the Online Tax Summit register today

For the Online Tax Summit register today

Great initiative

I joined and shared this on Twitter & Facebook.

It will make the anti-FATCA snowball bigger