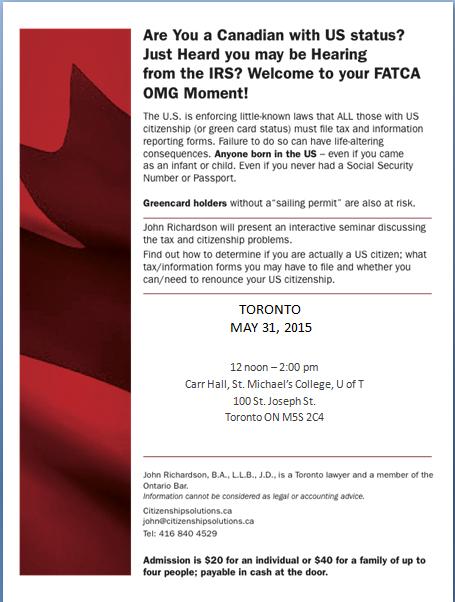

TORONTO

Sunday

May 31,2015

12 noon – 2 p.m.

$20.00

Carr Hall

100 St. Joseph St.

Toronto ON M5S 2C4

MAP

The “FATCA Hunt” – the hunt for U.S. persons (whatever that is) began on July 1, 2014 which was “Canada Day”. Although both the definition of “U.S. person” and whether one meets the definition is not always clear, the search has begun. The level of FATCA awareness has begun. Some organizations are actively warning people that “U.S. Personness” matters. The purpose of the warning is presumably to encourage people to ”come clean” and deal with their U.S. tax situations. In some cases, there is no particular warning – just a letter indicating that they are suspected to be a “U.S. person”. Often one must prove to the institution sending the letter that one is not a U.S. person.

We have recently learned that no Canadians have yet been reported by the CRA to the IRS. This will not occur prior to September 15 and is required by September 30, 2015. You may wish to keep track of a suit trying to prevent this information from leaving Canada

www.adcs-adsc.ca

WHO: John Richardson, B.A., L.L.B., J.D., is a Toronto lawyer and a member of the Ontario Bar.

Citizenshipsolutions.ca

ADMISSION: $20 per individual or $40 for a family up to four. Payable in cash at the door.

Hope to see you, your families and friends! Spread the word!

Information presented is NOT intended or offered as legal or accounting advice specific to your situation.

I am an American National born in one of the 50 states, not a US stautary citizen of D.C.

I have never filed an income tax return, therefore I have never made a voluntary election to pay income tax to the federal gouvernment.

The IRS cannot tax me, FATCA has no effect on me because I’m an american national.

All americans born in one of the 50 states can terminate voluntary election to pay taxes because that’s the law.

Take the time to read this and check it out. Know your bill of rights (16th amendment was only aimed at US statutary citizens of D.C.)

Read on : http://grandcaystrategies.com/nonresident.html

The distinction between an american nationel and a US citizen is even written on the first page of the US passeport “to permit the citizen/national of the United States herein” meaning citizen OR national.

In french it does say citoyen OU ressortissant des Etats Unis (same in spanish).

The US gov and the IRS have been lying to us all this time

We had this discussion about the legalities, but read what’s happening in the UK and criminal gangs producing convincing enough passports to open UK bank accounts.

“The Met said organised criminals use printers costing around £1,000 to create convincing passports, driver’s licences and bank cards.

The genuine versions are produced on higher quality printers, under strict controls.”

http://www.bbc.com/news/uk-32890979

If making a clone of your Canadian or EU passport and just change the place of birth, that at least for today would be an effective method to bypass FATCA.

The danger is in future the US Government could start asking banks to cross check names against their whole database. However, that’s probably not going to happen anytime soon, but it would certainly make the IRS’s job a lot harder.

Safe FATCA data? The IRS can’t get it right.

With the IRS’s service ‘Get Transcript,’ criminals have accessed the tax details of around 100,000 taxpayers direct from the IRS.

http://www.irs.gov/Individuals/Get-Transcript

How on earth is FATCA data going to be ever secure given the long distribution line going through the hands of many bank employees, IT workers, contractors or consultants?

Steven,

http://www.immihelp.com/immigration/us-national.html says that ALL US citizens (you and Gwen and Ginny born in the USA) are US nationals…

BUT NOT ALL US nationals are US citizens – those who are *US nationals only* are those born in an outlying possession of the US (American Samoa and Swains Island).

Wikipedia says the same.

And, the IRS says: http://www.irs.gov/Individuals/International-Taxpayers/Immigration-Terms-and-Definitions-Involving-Aliens

Alien

An individual who is not a U.S. citizen or U.S. national.

U.S. National

An individual who owes his sole allegiance to the United States, including all U.S. citizens, and including some individuals who are not U.S. citizens. For tax purposes the term “U.S. national” refers to individuals who were born in American Samoa or were born in the Commonwealth of the Northern Mariana Islands who have made the election to be treated as U.S. nationals and not as U.S. citizens.

U.S. Citizen

An individual born in the United States.

An individual whose parent is a U.S. citizen.*

A former alien who has been naturalized as a U.S. citizen

An individual born in Puerto Rico.

An individual born in Guam.

An individual born in the U.S. Virgin Islands.

*The Child Citizenship Act, which applies to both adopted and biological children of U.S. citizens, amends Section 320 of the Immigration and Nationality Act (INA) to provide for the automatic acquisition of U.S. citizenship when certain conditions have been met. Specifically, these conditions are:

One parent is a U.S. citizen by birth or through naturalization;

The child is under the age of 18;

The child is residing in the United States as a lawful permanent resident alien and is in the legal and physical custody of the U.S. citizen parent; and

If the child is adopted, the adoption must be final.

**********

Why you or Gwen or Ginny or any accidental American owe their sole allegiance to the United States without choice (a CLAIM, an OPT-IN, not an OPT-OUT of US citizenship if the facts allow AND with full knowledge of consequences of US citizenship based taxation) is entrapment. Or, at least that’s what my common sense tells me.

@Tricia Moon

“Greencard holders without a ‘sailing permit’ are also at risk.”

Green card holders are at risk whether they have a sailing permit or not. All the sailing permit (Form 2063 or 1040C) does is certify that the green card holder appeared to be compliant (tax-wise, not necessarily FBAR-wise) at the time of departure. It doesn’t change anything regarding their “US personhood” at the end of the year for IRS or FBAR purposes.

Basically the sailing permit–at least as I understand it–is only the first step that a green card holder would need to take to sever their ties with Uncle Sam. It might be useful documentation to show an intent to leave but it is only a first step. The sailing permit–which at present isn’t enforced but like CBT is the kind of thing the US could start to enforce at any time–is obtained prior to leaving the US and only covers tax up to the date of departure.

However after filing the sailing permit the former resident, to cut their ties with Uncle Sam, would still need to file an I-407 surrendering their green card, applicable FBAR’s, and a final tax return including any “exit tax” payable. The sailing permit is only the first step.

We are told that we should be in compliance with the IRS by many voices. My question is what happens if I never enter the U.S again and simply thumb my nose at the IRS. What could they do?

@ henry We are told that we should be in compliance with the IRS by many voices. My question is what happens if I never enter the U.S again and simply thumb my nose at the IRS. What could they do?

they will much like monte python’s “stop or I shall say stop again”

I am a self relinquisher and have zero intention to cross the border into America ever again…..what can they do??? are they going to send brown shirted thugs to my door and drag me back to America??? don’t think so….

are they at some point assuming they can figure out who I am….I bank at a “local client base” credit union, have zero monitary transactions involving America….what will they do send me a letter that I can use on the bottom of my bird cage????

screw compiling with an unjust and unfair law…..just ignore America and get on with your life and let them come find you. don’t make it easy by standing up and waving your hand and say here I am come get me. if they want us make them work their damn a$$es off to begin to find us and then figure out what to do with us

@Henry @mettleman

I’ve long believed that simply “flying under the radar” is the best policy in many cases as you suggest. However there are probably a variety of factors that combine to determine how well this will work so it is likely a personal decision to make after taking a lot of factors into account:

–Were you born in the US? In practice they seem to be on more of a witch hunt (at least for the moment) for a US place of birth as opposed to those who are ‘US persons’ for other reasons (naturalized, born abroad to US parent, green card, snowbird, temporary visa, etc).

–Do you expect to live only in Canada or will you want to live in other non-US countries? In general it seems easier domestically in Canada to use documents not showing a place of birth. Not necessarily true in other countries.

–Do you ever need to travel to the USA even briefly? Are you in a line of work (and/or sufficiently retired) where an unwillingness to travel to the US would affect your career prospects? Certain fields seem to allow one to “stay put” whereas in other fields business travel is expected and if you are travelling for business from Canada, it is likely at least some of it will be to the US.

–Are you willing to sign forms stating you are not a ‘US person’ but Canadian only? Some people consider that to be lying; others consider it to be your right as a Canadian in Canada. You need to decide how you feel about it ethically. You need to think about how you would answer questions like “are you now or have you ever been a US person”, “do you have a US social security number”, and/or “where were you born”.

–Do you expect to have children in the future? Unfortunately there is not much you can do to change the status of children already born, but if you don’t want your future children to have an unwanted citizenship, renouncing openly rather than flying under the radar may be the wiser approach.

–If married–or you expect to get married–how does your present or future spouse feel about these issues? Any risks involved with either approach will extend to your spouse as well so you need to have them on board with your decision.

–Are you expecting to have to open new bank accounts in the near future or can you make do with what you have for the foreseeable future?

Like I say flying under the radar is IMHO the best strategy if it works for you but it may not (sadly) work for everyone.

@Henry @mettleman

Another factor to consider is what will happen at the time of your death. I’ve sometimes had the impression that it can be possible to stay under the radar during one’s lifetime but the compliance people seem to unavoidably swoop in at the time of one’s death–so that is another factor to be considered.