This is a 15-part series which is designed to provide you with some basic education on:

How the U.S. S. 877A Exit Tax rules work; and

How they particularly affect Canadians with a U.S. birthplace, who lived most of their lives in Canada.

The 15 parts are:

Part 1 – April 1, 2015 – “Facts are stubborn things” – The results of the “Exit Tax”

Part 2 – April 2, 2015 –“How could this possibly happen? “Exit Taxes” in a system of residence based taxation vs. Exit Taxes in a system of “citizenship (place of birth) taxation”

Part 3 – April 3, 2015 – “The “Exit Tax” affects “covered expatriates” – what is a “covered expatriate”?”

Part 4 – April 4, 2015 – “You are a “covered expatriate” How the “Exit Tax” is actually calculated”

Part 5 – April 5, 2015 – “The “Exit Tax” in action – Five actual scenarios with 5 actual completed U.S. tax returns.”Part 6 – April 6, 2015 – “Surely, expatriation is NOT worse than death! The two million asset test should be raised to the Estate Tax limitation – approximately five million dollars – It’s Time”

Part 7 – April 7, 2015 – Why 2015 is a good year for many #Americansabroad to relinquish US citizenship – It’s the “Exchange Rate”Part 8 – April 8, 2015 – “The U.S. “Exit Tax vs. Canada’s Departure Tax – Understanding the difference between citizenship taxation and residence taxation”

Part 9 – April 9, 2015 – “Why understanding the U.S. “Exit Tax” teaches us all we need to know about “citizenship taxation”

Part 10 – April 10, 2015 – “The s-877a exit tax and possible treaty relief under the canada us tax treaty”

Part 11 – April 11, 2015 – “S. 2801 of the Internal Revenue Code is NOT a S. 877A “Exit Tax”, but a punishment for the “sins of the father (relinquishment)”

Part 12 – April 12, 2015 – “The two kinds of U.S. citizenship: Citizenship for “immigration and nationality” and citizenship for “taxation” – Are we taxed because we are citizens or are we citizens because we are taxed?”

Part 13 – April 13, 2015 – “I relinquished U.S. citizenship many years ago. Could I still have U.S. tax citizenship?”

Part 14 – April 14, 2015 – “Leaving the U.S. tax system – renounce or relinquish U.S. citizenship, What’s the difference?”

Part 15 – May 22, 2015 – “Interview with GordonTLong.com – “Citizenship taxation”, the S. 877A Exit Tax, PFICs and Americans abroad”

reposted from: Citizenshipsolutions blog

Leave a reply

Renouncing US citizenship? How the S. 877A “Exit Tax” applies to your non-US assets – “Exit Tax” Explained – 9 Parts http://t.co/Zbi6aSffoU

— Citizenship Lawyer (@ExpatriationLaw) April 1, 2015

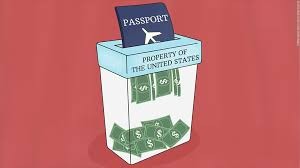

There is much discussion of the U.S. rules which operate to impose taxation on the residents of other countries and income earned in those other countries. You will hear references to “citizenship taxation”, “FATCA Canada“, PFIC, etc. It is becoming more common for people to wish to relinquish their U.S. citizenship. The most common form of “relinquishment is renunciation”. The U.S. tax rules, found in the Internal Revenue Code, impose taxes on everything. There is even a tax on “renouncing U.S. citizenship”. I don’t mean the $2350 USD administrative fee which everybody has to pay. (Isn’t that really a tax?). I mean a tax on your assets. To be clear:

You must pay a price to NOT be a U.S. citizen.

This tax is found in S. 877A of the U.S. Internal Revenue Code.

It’s defined as the:

“Tax responsibilities of expatriation”

Few people are aware of this tax. Fewer still understand how it works. As FATCA operates to enforce U.S. taxation on many Canadian citizens, and increasing numbers wish to NOT be U.S. citizens, the importance of understanding the U.S. “Exit Tax” increases.

It is particularly important to understand what triggers the “Exit Tax”. You will be subject to the “Exit Tax” if you are a “covered expatriate”. You must know what that means and why, sooner or later, everybody will become a “covered expatriate”.

The “Exit Tax” is not a simple “token tax”. For Canadians, the tax can be a significant percentage of their net worth. Furthermore, the tax is payable NOT on actual gains, but on “pretend gains”. (Where would the money come from to pay the tax?)

Hang on to your seats. You will shocked, amazed and horrified by this.

Since the advent of FATCA in Canada, this issue is increasingly important.*

To be forewarned is to be forearmed!

This is a 15-part series which is designed to provide you with some basic education on:

How the U.S. S. 877A Exit Tax rules work; and

How they particularly affect Canadians with a U.S. birthplace, who lived most of their lives in Canada.

This will be covered over a 15 day period in a “15-part” series.

Although this series is beginning on “April Fools Day”, I assure that this is NOT a joke.

“The unfairness of the exit tax under 877A and its dependence on accidents of birth, over which a person has..”http://t.co/saSFv17C9Y 1/2

— U.S. Expat Canada (@USExpatCanada) April 7, 2015

“…no control is breathtaking.The article makes a convincing case 4 calling the exit tax “evil.” http://t.co/saSFv17C9Y 2/2

— U.S. Expat Canada (@USExpatCanada) April 7, 2015

____________________________________________________________________________

* Why this is of increased importance: The role of FATCA and U.S. taxation in Canada

A picture/video tells a thousand words. Have a look at the “Rick Mercer FATCA video” in the following tweet:

Are you or have you ever been a U.S. citizen? It’s time to check! https://t.co/smEH5PAZI4 – The Canadian banks are looking for you.

— Citizenship Lawyer (@ExpatriationLaw) April 1, 2015

FATCA is U.S. law which is designed to identify financial assets and people, outside the United States, that the U.S. believes are subject to its tax laws. (It makes no difference whether the person is a Canadian citizen”.) This includes people who were:

– born in the U.S.

– Green card holders

– people born to U.S. parents in Canada

– “snow birds” who spend too much time in the United States

The Government of Canada is assisting the United State to implement FATCA in Canada. To be specific:

– on February 5, 2014 the Government of Canada formally agreed to change Canadian to identify “U.S. connected” Canadians in Canada

– in May of 2014, the Government of Canada passed Bill C 31 which contained the implementing legislation

– on July 1, 2014 FATCA became the law in Canada

– since July 1, 2014 many Canadians have received a “FATCA Letter” (can the U.S. claim you as a taxpayer?)

The Alliance For The Defence Of Canadian Sovereignty has sued the Government of Canada in Federal Court on the basis that the participation of the Canadian Government in FATCA, is in violation of the Charter Rights of Canadians. You can keep up with their progress on the Alliance blog” which is here.

FATCA is a tool to enforce “U.S. taxation in Canada”. The result is that more and more Canadian citizen/residents will be forced to pay U.S. taxes. But, U.S. tax rules include much more than tax. They are source of comprehensive information gathering and “information returns”. Typical returns required by U.S. taxpayers in Canada include: FBAR, FATCA Form 8938, Form 5471, Form 3520, Form 3520A and many more.

In addition, U.S. tax rules are different from Canadian tax rules. The most painful example is that when:

– Canada allows a “tax free” capital gain on your principal residence

– the

U.S. imposes a 23.8% tax on the sale of your principal residence (you get a $250,000 deduction)

Sound horrible?

It is, but:

It’s only Canadian citizens with a past “U.S. connection” who will be subject to these taxes. It is estimated that approximately one million Canadians may be subject (as “U.S. Subjects”) to these rules. But, Canadians with a “U.S. connection” are members of families. Therefore, U.S. taxation in Canada will impact all members of a Canadian family which has at least one “U.S. connected” member.

John Richardson

by chance I just came across this comment from “Repeal Fatca” that pertains to this discussion:

http://business.financialpost.com/2014/08/20/cra-will-not-assist-irs-in-collecting-penalties-against-dual-citizens-subject-to-fatca/#comment-1551724879

Tdott can you protect newbies from all the ridiculous paranoia at this website. Can you please become the new KalC? I do not like coming here and other than talking to Dash who appears to be living in USA. I am pretty much done here.

You are bang on I have listed the court cases below. The last thread I sent to KalC was a new source to confirming how correct he was in his statement about minnows.

tdott says

April 2, 2015 at 1:13 pm

@GeorgeIII

I believe that up to now, Canadian courts have not been very receptive of IRS attempts to extract money from Canadians. Additionally, the IRS is in such a weakened condition at the moment that I would not think it likely that it would expend precious resources on going to foreign court to make a case that it probably wouldn’t win.

Of course, all of the above could change in the future, but for now non-compliant USCs are probably OK, IMO.

The court cases are

http://scc-csc.lexum.com/scc-csc/scc-csc/en/item/7322/index.do

http://uniset.ca/other/cs6/68OR2d379.html

On the last point, it appeared to Cartwright J. that all the necessary facts were before the judge of first instance and that nothing would have been gained by proceeding to a trial. With respect to the first argument, Cartwright J., at p. 725, pronounced the law as follows:

“In my opinion, a foreign state cannot escape the application of this rule, which is one of public policy, by taking a judgment in its own Courts and bringing suit here on that judgment. The claim asserted remains a claim for taxes. It has not, in our Courts, merged in the judgment; enforcement of the judgment would be enforcement of the tax claim.”

Thanks for your comment, LM. On the subject of *gifting*, I saw this yesterday and copy it here:

From IRS Tax Tips Newsletter, April 1, 2015:

Seven Tips to Help You Determine if Your Gift is Taxable

If you gave money or property to someone as a gift, you may wonder about the federal gift tax. Many gifts are not subject to the gift tax. Here are seven tax tips about gifts and the gift tax.

1. Nontaxable Gifts. The general rule is that any gift is a taxable gift. However, there are exceptions to this rule. The following are not taxable gifts:

-Gifts that do not exceed the annual exclusion for the calendar year,

-Tuition or medical expenses you paid directly to a medical or educational institution for someone,

–

Gifts to your spouse (for federal tax purposes, the term “spouse” includes individuals of the same sex who are lawfully married),NOTE (I have crossed this one out!) as USCitizenAbroad points out that this is NOT TRUE FOR us outside the bounds of the USA:

-Gifts to a political organization for its use, and

-Gifts to charities.

2. Annual Exclusion. Most gifts are not subject to the gift tax. For example, there is usually no tax if you make a gift to your spouse or to a charity. If you give a gift to someone else, the gift tax usually does not apply until the value of the gift exceeds the annual exclusion for the year. For 2014 and 2015, the annual exclusion is $14,000.

3. No Tax on Recipient. Generally, the person who receives your gift will not have to pay a federal gift tax. That person also does not pay income tax on the value of the gift received.

4. Gifts Not Deductible. Making a gift does not ordinarily affect your federal income tax. You cannot deduct the value of gifts you make (other than deductible charitable contributions).

5. Forgiven and Certain Loans. The gift tax may also apply when you forgive a debt or make a loan that is interest-free or below the market interest rate.

6. Gift-Splitting. You and your spouse can give a gift up to $28,000 to a third party without making it a taxable gift. You can consider that one-half of the gift be given by you and one-half by your spouse.

7. Filing Requirement. You must file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, if any of the following apply:

-You gave gifts to at least one person (other than your spouse) that amount to more than the annual exclusion for the year.

-You and your spouse are splitting a gift. This is true even if half of the split gift is less than the annual exclusion.

-You gave someone (other than your spouse) a gift of a future interest that they can’t actually possess, enjoy, or from which they’ll receive income later.

-You gave your spouse an interest in property that will terminate due to a future event.

@US_Foreign_Person and others:

I do not want to give up this fight. I put a lot of effort getting into America, I spent wonderful time in America and I would like to keep to door open. Why should I lose all of this just because one stupid unconstitutional bureau like IRS?

Why don’t we become US citizens, US_Foreign_Person and fight?

I am hoping the things will change and justice will win. If they do not change and if it gets worse, then none of us here should worry about renouncing and other things. At that time America becomes enemy and I will not give a damn s**t what label they put on me as I will pronounce myself “non-US person”. And I will just never travel to America. Full stop.

P.S. – I am just worried that if we do rush decision by giving up our GC and passports and things change later AND we want to ever come back to America in future, we will not be able to.

@Calgary411

Please note this statement:

“-Gifts to your spouse (for federal tax purposes, the term “spouse” includes individuals of the same sex who are lawfully married), (suggesting not taxable).”

This is NOT so. A gift to a non-U.S. citizen spouse is NOT excluded from the Gift Tax rules.

See the following posts on this problem:

https://renounceuscitizenship.wordpress.com/?s=FBAR+marriage

A U.S. citizen can gift up to about $150,000 per year (check the numbers) to an “Alien/foreign spouse” without having to file a gift tax return.

This is perfectly sensible, given the presumptive U.S. hatred of anything foreign.

Good that you have clarified from what the IRS newsletter says, USCitizenAbroad!!!!

Further illustrates and highlights the absurdity that because we are in different countries and may have “alien/foreign spouses” — to say nothing of the US same sex qualification — we are further discriminated against. The blatant discrepancy should be so noted in any US IRS newsletter sent out — THIS DOES NOT APPLY FOR YOU — ONLY TO THE PURE *HOMELANDER*!

Thank you!!!

@GCHolder1970

Majority of my family have no interest in being Americans… the ones that are American by birth are either giving it up or trying to decide… Point I was trying to make was that as a GC holder who held the stupid thing too long… its a lose-lose situation…. I still have family in the US that I want to see… many elderly…

Whatever I have… its made outside the US… why should they get a piece of it… I didn’t make a dime of that in the US… I have to report things that has been in our family for yrs prior to the GC in another country… no money was used from the US… Explain that to me.. I am more then willing to pay on what I made in the US… that is fair.. I pay taxes if owed to many countries… US is the only one who is trying to rob me then to top it off… they want a map of it all so then I could be a victim of ID theft… I trust no gov’t… so the rah-rah… lets be americans fell to the ground like a rock… sorry

GCHolder1970,

What you’ve just pointed out is that we must all weigh our individual situations and make our decisions based on what is best for us and our families.

[I spent wonderful growing up years in America and will always have those memories — but my decision is I will never again trust anything the US says (and not just on this issue). The US warned me in 1975 when became a Canadian citizen that I would be thereby losing my US citizenship. Things changed; my family’s lives were turned upside down; and I made a different decision than the decision that may be right for you and your family.]

Think of the citizenship as a “label”. Citizenship is intangible, it is only a definition. I can label myself as communist or right-winger, but what does it mean?

If you say out loud “I am not American” and then you do not file a tax return or you identify yourself as non-American is it wrong? Is it wrong even if you just do not go through embassy route and pay fees? I don’t think so.

Just stop worrying about it. If they (IRS) come knocking at your door in London say politely : “F**k you I am not American. Have a nice day”

I am personally denying any existence of foreign assets, non that I have many but still. And should the situation get worse I will just run away …

@GCHolder1970

Good way to put it… label… even if u give up or not your US citizenship or GC… Like @calgary411… they can’t take away your wonderful memories… I also have wonderful memories in the US… but the problem is that the black cloud the US has put on the US person… that is what everyone thinks of… not the great memories… What I really hate is the hiding… real or not… we all have to prove we aren’t US persons.. now I know what my family felt like during the war…

@US_Foreign_Person :

and I believe “label” is the only one correct definition. You can “peel it off” at any time for no cost and in no time at all.

Now the renunciation fee is over $2000. If they wake up tomorrow and say it is going to be 1 million dollars to renounce, will I be suffering for the rest of my life being “USC”, whatever they call me, and continue being their property? … of course not.

The country where I am from was labeled by Russia as fascist. So according to Russia I am “fascist” too. Do I give a damn thing about that? 🙂

@GeorgeIII

To be honest, I’m usually one of the more paranoid people here (although I like to think of it as being overly careful), so I don’t think I’d make a good “KalC” 🙂

@maz57

Found what I thinking of. It’s the Mutual Collection Assistance Request (MCAR) clause that the US has with a limited number of countries – Canada, France, Denmark, Sweden, and the Netherlands.

I know that Canada’s clause explicitly exempts Canadian residents who were Canadian citizens at the time the tax liability was incurred, so I’ll go out on a limb and assume that’s true of the other countries as well.

So, I now (mostly) agree with you – the Canada-US tax treaty will not change to allow assistance in the collection of tax liabilities from citizens of the targeted country as long as real reciprocity is required. That still leaves the (hopefully remote) possibility of the US strong-arming Canada to change the treaty in non-reciprocal way.

I hate that I now have to add ‘real’ (or ‘true’, or ‘symmetrical’) when talking about any aspect of reciprocity with the US. Thanks for that, Mr FATCA.

@GC Holder: it all comes down to your own individual situation. I personally, approaching 50, am beginning to realize that I will not return to live in the US, and will not need to. It may become necessary, according to how things evolve, to consider giving up my citizenship in order to have a more simple financial life, and death… It is also highly probable that after renunciation I would still be allowed in the US as an EU citizen. Frankly, if I can spend some time in the US when I’m retired, that’s great, I don’t need to be a citizen anymore. I would not feel safe, however, with a St Kitts passport or similar. What happens if no other country lets you in anymore??

The situation for my young boys is different: they have a whole life ahead, and the US remains an exciting place, full of opportunities. Therefore I do not regret giving them US citizenship, in addition to their EU passport. They can do what they want with it later, it’s easier than not having it and wanting desperately to go live in California.

It also, clearly, depends on one’s financial liabilities and on banking. If you can continue banking normally, either by being under the radar (without a US birthplace for instance) or by complying, that’s great. If you cannot, you may feel forced to renounce (see discussion on banking in Japan as an American somewhere else here, comments by Japan T).

Also, someone with no significant assets is in an easy situation, even if earnings are high. The significantly rich should have been advised well enough to be either out or compliant by now, and may even be better served residing in the US. Trouble is for people with significant assets, from a few $100K to a couple $1m. Not rich, but stuff that the IRS likes to tax/penalize/confiscate.

The U.S. Founding Fathers spicifically prohibited an income tax, but a group of Marxists lied thru their teeth and got the American People to change the founding document after Marx was dead.

We still have a large contingent of Marxist’s in both houses of our legislature. They are living off the labor of the workers who send way too much of their paycheck to Them to use as they see fit.

I want every worker to have all he or she earns. I want the Marxist Amendment to our founding document repealed. If the 16nth amendment was repealed all Americans living abroad would immediately not be required to file any papers about their assets or income—-why not ask a congressman to help you get the 6nth amendment repealed and the FairTax passed. Those living outside the country would only be taxed when they visited and only then if the purchased something.

@ Wilton:

truly splendid idea! Now, how likely is to get that change to happen?

Great series, thank-you.

My MP, John “thrilled about the FATCA IGA” Weston is appalled that I paid capital gains tax to the US on the sale of my principal residence in Canada, and on more than one occasion said that there should be some way for that to not have happened. His is the party that positioned the CRA to report on Canadian bank accounts to the IRS. That should not have happened either, but both did. Now the Canadian government will help in facilitating the US taxation of our homes in Canada, if only to report the cash assets after the fact. Funny how Mr Weston can’t make the connection between the two.

Reminder to check out new entries at Renouncing US citizenship? How the S. 877A “Exit Tax” may apply to your Canadian assets – 9 Parts.

The 9 parts are:

Part 1 – April 1, 2015 – “Facts are stubborn things” – The results of the “Exit Tax”

Part 2 – April 2, 2015 – “How could this possibly happen? “Exit Taxes” in a system of residence based taxation vs. Exit Taxes in a system of “citizenship (place of birth) taxation”

Part 3 – April 3, 2015 – “The “Exit Tax” affects “covered expatriates” – what is a “covered expatriate“?”

Part 4 – April 4, 2015 – “You are a “covered expatriate” How is the “Exit Tax” actually calculated”

Part 5 – April 5, 2015 – “The “Exit Tax” in action – Five actual scenarios with 5 actual completed U.S. tax returns”

Part 6 – April 6, 2015 – “Surely, expatriation is NOT worse than death! The two million asset test should be raised to the Estate Tax limitation – approximately five million dollars – It’s Time”

Part 7 – April 7, 2015 – “The two kinds of U.S. citizenship: Citizenship for “immigration and nationality” and citizenship for “taxation” – Are we taxed because we are citizens or are we citizens because we are taxed?

Part 8 – April 8, 2015 – “I relinquished U.S. citizenship many years ago. Could I still have U.S. tax citizenship?”

Part 9 – April 9, 2015 – “Leaving the U.S. tax system – renounce or relinquish U.S. citizenship, What’s the difference?”

The information received from this site is very helpful and comforting for those of us that feel we are shouting against an isolated wall

Does Exit tax change for cost of living each year ?

Quite an eye-opener. Thank you for having those 1040 and 8854 scenarios run so we can actually see the differences in black and white. Quite enlightening and horrifying. I see even more clearly how very *lucky* I am to have renounced when I did, where I did.

It should not have to depend on the luck of the draw regarding our different life circumstances. It should be just and fair taxation law — which for us should ONLY be US residence-based taxation.

Today’s Part 6 – April 6, 2015 – “Surely, expatriation is NOT worse than death! The two million asset test should be raised to the Estate Tax limitation – approximately five million dollars – It’s Time”

Take the weekend to catch up on this most informative series, with bonus segments to come:

Part 10 – April 10, 2015 – “The two kinds of U.S. citizenship: Citizenship for “immigration and nationality” and citizenship for “taxation” – Are we taxed because we are citizens or are we citizens because we are taxed?

Part 11 – April 11, 2015 – “I relinquished U.S. citizenship many years ago. Could I still have U.S. tax citizenship?”

Part 12 – April 12, 2015 – “Leaving the U.S. tax system – renounce or relinquish U.S. citizenship, What’s the difference?”

Thank you for the reminder, Calgary411.