This is a 15-part series which is designed to provide you with some basic education on:

How the U.S. S. 877A Exit Tax rules work; and

How they particularly affect Canadians with a U.S. birthplace, who lived most of their lives in Canada.

The 15 parts are:

Part 1 – April 1, 2015 – “Facts are stubborn things” – The results of the “Exit Tax”

Part 2 – April 2, 2015 –“How could this possibly happen? “Exit Taxes” in a system of residence based taxation vs. Exit Taxes in a system of “citizenship (place of birth) taxation”

Part 3 – April 3, 2015 – “The “Exit Tax” affects “covered expatriates” – what is a “covered expatriate”?”

Part 4 – April 4, 2015 – “You are a “covered expatriate” How the “Exit Tax” is actually calculated”

Part 5 – April 5, 2015 – “The “Exit Tax” in action – Five actual scenarios with 5 actual completed U.S. tax returns.”Part 6 – April 6, 2015 – “Surely, expatriation is NOT worse than death! The two million asset test should be raised to the Estate Tax limitation – approximately five million dollars – It’s Time”

Part 7 – April 7, 2015 – Why 2015 is a good year for many #Americansabroad to relinquish US citizenship – It’s the “Exchange Rate”Part 8 – April 8, 2015 – “The U.S. “Exit Tax vs. Canada’s Departure Tax – Understanding the difference between citizenship taxation and residence taxation”

Part 9 – April 9, 2015 – “Why understanding the U.S. “Exit Tax” teaches us all we need to know about “citizenship taxation”

Part 10 – April 10, 2015 – “The s-877a exit tax and possible treaty relief under the canada us tax treaty”

Part 11 – April 11, 2015 – “S. 2801 of the Internal Revenue Code is NOT a S. 877A “Exit Tax”, but a punishment for the “sins of the father (relinquishment)”

Part 12 – April 12, 2015 – “The two kinds of U.S. citizenship: Citizenship for “immigration and nationality” and citizenship for “taxation” – Are we taxed because we are citizens or are we citizens because we are taxed?”

Part 13 – April 13, 2015 – “I relinquished U.S. citizenship many years ago. Could I still have U.S. tax citizenship?”

Part 14 – April 14, 2015 – “Leaving the U.S. tax system – renounce or relinquish U.S. citizenship, What’s the difference?”

Part 15 – May 22, 2015 – “Interview with GordonTLong.com – “Citizenship taxation”, the S. 877A Exit Tax, PFICs and Americans abroad”

reposted from: Citizenshipsolutions blog

Leave a reply

Renouncing US citizenship? How the S. 877A “Exit Tax” applies to your non-US assets – “Exit Tax” Explained – 9 Parts http://t.co/Zbi6aSffoU

— Citizenship Lawyer (@ExpatriationLaw) April 1, 2015

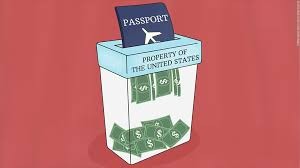

There is much discussion of the U.S. rules which operate to impose taxation on the residents of other countries and income earned in those other countries. You will hear references to “citizenship taxation”, “FATCA Canada“, PFIC, etc. It is becoming more common for people to wish to relinquish their U.S. citizenship. The most common form of “relinquishment is renunciation”. The U.S. tax rules, found in the Internal Revenue Code, impose taxes on everything. There is even a tax on “renouncing U.S. citizenship”. I don’t mean the $2350 USD administrative fee which everybody has to pay. (Isn’t that really a tax?). I mean a tax on your assets. To be clear:

You must pay a price to NOT be a U.S. citizen.

This tax is found in S. 877A of the U.S. Internal Revenue Code.

It’s defined as the:

“Tax responsibilities of expatriation”

Few people are aware of this tax. Fewer still understand how it works. As FATCA operates to enforce U.S. taxation on many Canadian citizens, and increasing numbers wish to NOT be U.S. citizens, the importance of understanding the U.S. “Exit Tax” increases.

It is particularly important to understand what triggers the “Exit Tax”. You will be subject to the “Exit Tax” if you are a “covered expatriate”. You must know what that means and why, sooner or later, everybody will become a “covered expatriate”.

The “Exit Tax” is not a simple “token tax”. For Canadians, the tax can be a significant percentage of their net worth. Furthermore, the tax is payable NOT on actual gains, but on “pretend gains”. (Where would the money come from to pay the tax?)

Hang on to your seats. You will shocked, amazed and horrified by this.

Since the advent of FATCA in Canada, this issue is increasingly important.*

To be forewarned is to be forearmed!

This is a 15-part series which is designed to provide you with some basic education on:

How the U.S. S. 877A Exit Tax rules work; and

How they particularly affect Canadians with a U.S. birthplace, who lived most of their lives in Canada.

This will be covered over a 15 day period in a “15-part” series.

Although this series is beginning on “April Fools Day”, I assure that this is NOT a joke.

“The unfairness of the exit tax under 877A and its dependence on accidents of birth, over which a person has..”http://t.co/saSFv17C9Y 1/2

— U.S. Expat Canada (@USExpatCanada) April 7, 2015

“…no control is breathtaking.The article makes a convincing case 4 calling the exit tax “evil.” http://t.co/saSFv17C9Y 2/2

— U.S. Expat Canada (@USExpatCanada) April 7, 2015

____________________________________________________________________________

* Why this is of increased importance: The role of FATCA and U.S. taxation in Canada

A picture/video tells a thousand words. Have a look at the “Rick Mercer FATCA video” in the following tweet:

Are you or have you ever been a U.S. citizen? It’s time to check! https://t.co/smEH5PAZI4 – The Canadian banks are looking for you.

— Citizenship Lawyer (@ExpatriationLaw) April 1, 2015

FATCA is U.S. law which is designed to identify financial assets and people, outside the United States, that the U.S. believes are subject to its tax laws. (It makes no difference whether the person is a Canadian citizen”.) This includes people who were:

– born in the U.S.

– Green card holders

– people born to U.S. parents in Canada

– “snow birds” who spend too much time in the United States

The Government of Canada is assisting the United State to implement FATCA in Canada. To be specific:

– on February 5, 2014 the Government of Canada formally agreed to change Canadian to identify “U.S. connected” Canadians in Canada

– in May of 2014, the Government of Canada passed Bill C 31 which contained the implementing legislation

– on July 1, 2014 FATCA became the law in Canada

– since July 1, 2014 many Canadians have received a “FATCA Letter” (can the U.S. claim you as a taxpayer?)

The Alliance For The Defence Of Canadian Sovereignty has sued the Government of Canada in Federal Court on the basis that the participation of the Canadian Government in FATCA, is in violation of the Charter Rights of Canadians. You can keep up with their progress on the Alliance blog” which is here.

FATCA is a tool to enforce “U.S. taxation in Canada”. The result is that more and more Canadian citizen/residents will be forced to pay U.S. taxes. But, U.S. tax rules include much more than tax. They are source of comprehensive information gathering and “information returns”. Typical returns required by U.S. taxpayers in Canada include: FBAR, FATCA Form 8938, Form 5471, Form 3520, Form 3520A and many more.

In addition, U.S. tax rules are different from Canadian tax rules. The most painful example is that when:

– Canada allows a “tax free” capital gain on your principal residence

– the

U.S. imposes a 23.8% tax on the sale of your principal residence (you get a $250,000 deduction)

Sound horrible?

It is, but:

It’s only Canadian citizens with a past “U.S. connection” who will be subject to these taxes. It is estimated that approximately one million Canadians may be subject (as “U.S. Subjects”) to these rules. But, Canadians with a “U.S. connection” are members of families. Therefore, U.S. taxation in Canada will impact all members of a Canadian family which has at least one “U.S. connected” member.

John Richardson

Thank you, John Richardson. What you present brings to memory the disregard the of this issue in testimony on May 13 and 14, 2014 at the House of Commons Standing Committee on Finance. So little regard for Canadians, such as https://openparliament.ca/committees/finance/41-2/35/?singlepage=1 …

Scott Brison, Liberal MP, asked Darren Hannah, Acting Vice-President, Policy and Operations, Canadian Bankers Association:

Mr. Hannah answered:

Too little time spent; too little research and too little regard for submissions made to the Finance Committee, all buried in omnibus Bill C-31 and voted into law by the majority Conservative government (the party vote, all in lockstep). Disregard for Canadians — both US-defined *US Persons* and, in cost, ALL Canadians, mere collateral damage in the interest of Canadian (and their US branches) *foreign financial institutions*, in implementing US FATCA law in Canada to override Canadian laws, including the Charter of Rights of Freedoms.

A refresher of those two days in compilation video at ADCS-ADSC *In Parliament*: http://www.adcs-adsc.ca/Parliament.html.

I look forward to your additional 8 parts. In my naïveté, you have been my teacher.

I’d really like to know why the US thinks they have the right to “tax” people on the sales of their primary homes owned OUTSIDE of the US and on their corporations which they hold OUTSIDE the US? This arrogance just BURNS me no end!!!

@GwEvil

How about… what right does the US get to tax crap that is not made in the US? I understand that taxes need to be paid on things made in the US… I am fine with that… I pay taxes to every single country that I made in that country… but the US wants every frigging thing that is in your name no matter if it was made in the US or not… GC holders are in a bad situation… alot of us had a life prior to the US… have a life after the US… why should we be taxed on that??? We are what I call… fake citizens… tax us like crazy & we have no rights at all to protest or say boo…

What’s really disgusting is the entitlement comments from the homelanders thinking that they have a right to the money earned by those who live outside the United States. “Pay your taxes…Pay Your Fair Share”. What part of “I don’t use their infrastructure” don’t they understand? It’s greed talking and the US government is utilizing their greed to make life hell for those of us who live abroad (talking about spouse of course; not me. I was born in Canada to two Canadian parents).

I am looking forward (kind of sick actually) to parts 4 & 5. I have not really been able to digest parts of 8854 to this day. Particularly about pensions. I find that seems to be one thing that people never seem to consider when mentioning what assets they have and whether the U.S. thinks they have the right to any part of it. Having to claim the entire amount as being paid out is truly over-the-top especially when none of it was earned in the U.S. Why Canadian politicians have no issue with the amount of Canadian capital that will get sucked into the giant deficit hole south of us is truly incomprehensible.

If one owns a house in a major Canadian city and a decent pension, that alone is enough to reach the $2,000,000. Then add on the other normal investments etc. I expect people who are covered have no idea…..the question is, how far is the U.S. willing to go to take it? How much are people going to put up with? I would expect this is where lines will be drawn; if more are exposed via FATCA, more will begin to refuse, there’s always strength in numbers.

@calgary,

I have watched those videos so many times I can hear each and every irritating inflection from Hannah and all the rest of them. The bankers and witnesses are bad enough. But I still react the strongest to those MPs who seem to have family members who are USC’s and they are stuck 20 years in the past when there was no enforcement etc. They seem to think nothing will change and it is so clear that most of them did not read the legislation; their comments are simply too idiotic. I can still hear Blaze repeating that phrase “Americans abiding in Canada.” How they can put that first, when we LIVE here, we pay taxes HERE is so incredibly insulting, dismissive, disrespectful and repugnant. I certainly hope they get what they deserve in the next election.

Imagine if out of 1,000,000 Canadians with the “U.S. taint,” that only 300,000 renounced/relinquished and that 250,000 had to pay an exit tax of $100k. That would be $25,000,000,000. Perhaps politicians consider that peanuts? I do not recall the figure Hannah indicated to be Canada’s “worth” to the US other than “are we significant players, Yes…are we significant enough….NO.” When all the bank compliance costs are added as well as the amounts of fees incurred by those coming into compliance; money going into suits etc., it seems an incredibly wasteful exercise that will do nothing to solve the problem of tax evasion. It certainly does virtually nothing to benefit Canadian society….All that money that could be used for Canadian healthcare, education, infrastructure…….

For those that are making submittals to Senate Finance, it is important to note that all all exit taxes must be removed. In the previous round of submissions, an exit tax was proposed in the ACA submission, and Senate Finance liked it.

The existing tax treaties are fully capable of taxing any capitol of US citizens when the assets are sold and the gain is realized. Gains and income are allowed to be taxed in US tax law. Not wealth, not assets, and not phantom gains.

The RBT proposals should also be clarified to not be restricted. No bs about long term non residents and tests. If you are resident, you are not resident.

I wonder what the consequences of filling out the form incorrectly.

“Willfully” it states that the penalty is according to perjury. I wonder if there could be anything more such as negation of the renouncing act or some other such.

“Nonwfillful” incorrectness penalty is not stated. I guess it might be a modest penalty related to the amount of tax owed but not paid. I wonder if it is limited to that.

Mark Twain: I totally agree with you about the absolute necessity for the provision of an exit tax to be completely removed from any RBT proposal. That is one of the main reasons I cannot whole-heartedly support ACA’s package. Our situation demands a complete “forgiveness” of perceived “past debts”. Frankly, those who have already paid an exit tax under the current rules should get their money back. I was always taught that you paid for things you received, not for things you got rid of!

For newbies

If you do not plan to go to USA you can ignore the exit tax. The USA may still consider you still a USA person for tax purposes but Canada does not.

from Canadian government

http://www.cra-arc.gc.ca/tx/nnrsdnts/nhncdrprtng/fq-eng.html#q2-5

” 19. Does the agreement require Canadian financial institutions to report to the CRA on any individuals who relinquished their U.S. citizenship?

No. Canadian financial institutions do not have to report on any individuals who have relinquished their U.S. citizenship and are not residents of the U.S.

Financial institutions may ask individuals who have relinquished their U.S. citizenship for documentation to this effect.

22. If I am assessed tax or a related penalty by the U.S., will the CRA assist the U.S. to collect it?

While the Canada–U.S. tax treaty says that Canada may assist the U.S. to collect certain taxes, it also says that the CRA will not assist the IRS to collect your U.S. tax liability if you were a Canadian citizen when the liability arose. This is true whether or not you were also a U.S. citizen at the time.”

I once saw a post stating that Conservative at FATCA hearing state they will not collect USA taxes for Canadian income for people who were not Canadian citizen at the time liability occurred.

@US_Foreign_Person:

But GC holders have had the advantage of not having US place of birth, so for now at least, they are flying under the radar with FATCA. Plus they can pretty easily get rid of their status by just surrendering their card at a consulate.

I am deliberating whether I should apply for US citizenship or not. I realize all the obstacles the government and IRS have put into place. But at the same time, I make living in the States and when I go back to my home country I would still like to have access to the US.

I know you are here used to talk about getting rid of citizenship, but almost nobody knows how hard is to get only the freaking GC.

It should be noted that the Liberal was the party that first approved collecting taxes for USA citizen who were not Canadian citizen in the 1995 tax treaty. They and the NDP are receiving support from Democrat campaign strategist so the Liberals may collect taxes from non Canadian citizens for Canadian based income.

” 22. If I am assessed tax or a related penalty by the U.S., will the CRA assist the U.S. to collect it?

While the Canada–U.S. tax treaty says that Canada may assist the U.S. to collect certain taxes, it also says that the CRA will not assist the IRS to collect your U.S. tax liability if you were a Canadian citizen when the liability arose. This is true whether or not you were also a U.S. citizen at the time.”

I once saw a post stating that Conservative at FATCA hearing state they will not collect USA taxes for Canadian income for people who were not Canadian citizen at the time liability occurred.”

It shoud be noted that the Liberal was the party that first approved collecting taxes for USA citizen who were not Canadian citizen in the 1995 tax treaty. They ans the NDP are recieving support from Democrat campaign strategist so the Liberals may collect taxes from non Canadian citizens for Canadian based income.

Former Obama aides advising NDP, Liberals on campaign strategy

http://www.theglobeandmail.com/news/politics/ndp-liberals-using-grassroots-mobilization-tactics-from-obama-campaigns/article22216447/

GeorgeIII,

A U.S. tax attorney informed me that even though the CRA will not ASSIST in collecting taxes or penalties for the IRS, the IRS can still single any one individual out, take them to court, and win a judgement. None of us is completely safe if they decide to start making examples of people. They have the power to do so under the tax treaty.

I’ll be the downer (again) and say that I suspect the likelihood of no exit tax is slim to none. Even Canada has an exit tax (called a “departure tax”). And when you consider that a *rational* exit tax (which the US’s is not, due to CBT) is merely a settling up of deferred taxes, then it actually makes sense.

So, the problem is not the exit tax, per se. The problem is that it’s applied to expats who haven’t lived in the US for eons. I.e., the root problem is, as in all cases, CBT.

IMO the best that one could hope for is that USCs who lived outside of the US for more than X years (where X is a largish number) would be spared the exit tax or subject to a trimmed down version. And this would be a one-time thing for “grandfathered” expats only. However, even that seems really unlikely given how Congress currently views USCs abroad.

@GeorgeIII

I believe that up to now, Canadian courts have not been very receptive of IRS attempts to extract money from Canadians. Additionally, the IRS is in such a weakened condition at the moment that I would not think it likely that it would expend precious resources on going to foreign court to make a case that it probably wouldn’t win.

Of course, all of the above could change in the future, but for now non-compliant USCs are probably OK, IMO.

I have seen repeated references stating that the Revenue Rule is on its way out. In addition to FATCA, CSR is on its way in. It is not a stretch to imagine cooperation between govts in developing programs where there will be collection of non-local taxes to remit to the US. They will come up with some formula or remitting based upon what balances out between the exchanging governments. It will become just another way for governments to grab more and make it seem all reasonable, as a way to cut tax evasion. Which is in the best interests of all, right?

I can still imagine the US slapping liens on accounts via US subsidiaries. There is nothing about the behaviour of the U.S. that suggests they will not stoop to more aggressive actions to achieve its goals.I have NO faith in the Canadian government to fight them on this; they basically said in the IGA that they agree to whatever changes in future that Treasury deems necessary. Treaties ALWAYS override domestic law.

Remember the way we reacted with our OMG moments 3 years ago. If we had been told a year prior to the end of say, OVDI 2011, that all this was coming in the future, I would expect the reaction would be the same. Of course, no reasonable country would ever do such a thing; it would be too hard to administer, too many people will still slip through, etc. This is not to suggest people should not rush to decisions to comply etc but merely to remind that what we think is acceptable has not been demonstrated by any government with regard to this matter.

@GCHolder1970

I do not know what past requirements were but one cannot simply surrender a green card to a consulate. There is a process of formally giving up this status and until then, a cg holder is still liable for taxes, etc. See http://www.uscis.gov/i-407

The US would never sign up to CSR because it would require real reciprocity. So there is nothing to fear on that front, at least. Unfortunately, I suppose the US could arm-twist changes to the Canada-US Tax Treaty to require mutual collection, though.

@GCHolder1970

Made stupid mistakes by having mail sent to family in the US because we needed the statements to make sure things were paid… it was innocent enough… no one thought twice about it… We move around so no fixed addy.

I want to give up the GC but the problem is… it could wipe us out since we had the GC for more then 8 yrs… We were piss poor when we went to the US… We left the US to other countries… We have no real residence since we move around alot. My elders in the family split their time between more then 3 countries yearly… but have mail sent to their children in the US… I am joint on many accounts… family is not rich… this is their version of a will… they have stashes all over… family survived a war… they trust no one nor do they believe in putting everything in 1 country… They also own things from previous generations they were able to get back after the war… how the heck do u put a price on that to figure out capital gains when they sell… what’s the going price for a home that has no indoor plumbing & big holes in it…. built more then 60 yrs ago… Not that easy to clean this up by just giving up the GC since I also have family in the US I want to see.. We thought it was like in Canada & every other country we were in… pay on what is made there… My entire family is mixed up in this… This is like a ton of bricks on my chest that I can’t get rid of. This US bs has to be stopped… this is one reason they are hated… they think they are the centre of the world & what they say is law… We even had a Canadian Gov’t person state… Congress has spoken… Hey idiot… we don’t have a congress…

This is why this Canadian lawsuit has to win… if we don’t stop this… our next generation who are tainted will be shackled to the US by our stupid mistakes… So please… donate… we got to take out the big stick out to slap the crap out of them…

@ GCHolder1970

Welcome to Brock! Getting a GC (or kryptonite card as I came to call it) was not terribly difficult for me because I married an American (he’s not an American now though). I was not employed in the USA so I never needed to show it to anyone down there, except a couple of times at the border crossing. What I can’t forgive them for is that they did not provide any instructions on how to get rid of the damn thing. I learned it was null and void a year or so after I returned home to Canada in the 90s but I never heard of the I-407 until 2012 when I discovered Brock. Anyway I followed the e-mail instructions given to me by the Calgary consulate. Mailed off my I-407 to USCIS with my GC attached but it just disappeared into a black hole. (The mail tracker said they received it though.) So my advice is that if you ever want to rid yourself of your GC card — take it in person to a consulate and don’t leave without a stamp of approval on your I-407.

To John Richardson,

Thank you thank you thank you for bringing to us this detailed series on the “EXIT TAX”. For many of us, this is the most complicated piece of information in the puzzle prior to renunciation, but it absolutely MUST be figured out/calculated prior to the oath-taking at the consulate since the “EXIT TAX’ is totally based on one’s total assets the day BEFORE that meeting at the consulate.

Hopefully you will cover gifting opportunities to potentially bring one’s final tally down below the “YOU WILL NOW DIE OF EXIT TAXES” level. I totally agree that this 2 million point should be increased over time, just like many other stated tax-demarcations (and how long has it been at that level??? What would be the 2015 US dollar equivalent be of the 2 million dollar amount in the year this Exit Tax was introduced? ).

Your expertise, advise and thinking in this (and many other technical/legal realms) is so helpful to us all.

@tdott. I understand your points and I agree. A fair and sensible exit tax is one that “settles up” previously deferred taxes as a condition to exit the system. This amounts to a simple moving up of the taxation date of gains which will eventually be taxed anyway upon death or withdrawal in the case of accounts such as IRAs. This type of exit tax is not a new or additional tax over and above what will be payed down the line anyway.

One problem I have with the US style exit tax is that it taxes assets that aren’t leaving the US because they were never in the US in the first place. If the US ever straightens out this Godawful mess it would logically include an exit tax which covers the deferred gains of US situated assets but leaves assets which were accumulated elsewhere out of the calculation. That I could live with.

The other problem I have with US style exit tax is that it isn’t really income tax. For those who exceed the exclusion it more more closely resembles confiscation. This, of course, is not terribly surprising; it is in line with the Obama administration’s attack the rich mentality.

But we’re dreaming here; they won’t straighten it out in our lifetimes.

@tdott (again).

Re: Changing the Canada/US treaty to require mutual collection. I don’t see that happening because that would require the US to collect within their borders for Canadian tax liabilities. Unlike our stupid Canadian government, the US government jealously guards its tax base and sole right to collect tax within its borders.

They love money coming in but they don’t like to allow money to leave.

Martin Armstrong dubs Fatca “the worst act in history,” responsible for setting in motion a global depression:

http://armstrongeconomics.com/2015/04/01/28838/

@max57

Re mutual collection: I agree it’s difficult to imagine the US collecting tax from US citizens on US soil on behalf of a foreign government, but aren’t there already a number of such agreements in place between the US and another country? I’m almost sure there are.