Since relinquishing my US citizenship in 2011 and shedding the most toxic aspect of my life here in Canada, I now worry about another kind of toxicity. Let me explain: For about ten years I’ve dealt with two nagging and debilitating conditions: peripheral neuropathy and tendinopathy. It came to a head in November 2012 when Cathy asked me to put some carriage lights up on our garage and I twice fell off the ladder, missing the last rung and falling on my butt, and I also missed a step on the way to the garage and fell on my face. This was the result of the growing issue of peripheral neuropathy–not able to tell where my feet were causes loss of proprioception. So I went on a low carb high fat diet (LCHF) and lost 40 lbs, and most of the neuropathy went away. But then in the Fall of 2013, I started having the relapses of tendinopathy which were worse than anything I’d had before–quadriceps, achilles, IT bands, rotator cuffs, neck, toe, elbow tendons–even today, I’ve had to use crutches since last Wednesday and medicate myself (ibuprofen) for throbbing pain in my right foot. This has caused me to cancel an academic trip to Switzerland planned for next week.

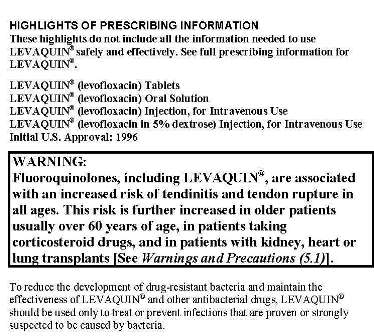

I n October 2013 I was searching for a dietary solution to my tendon problems and I learned that Cipro, an antibiotic in a class called fluoroquinolones (FQs) is the likely culprit of both my tendinopathy and my neuropathy, as well as several other problems (dysbiosis, weight gain, etc.). In 2008, the year after I stopped my last dosage, the FDA issued a black box warning for tendinitis and tendon rupture for Cipro. I now belong to a group of people called “Floxies” because FQs (Levaquin, Cipro, Avelox, etc.) all have the stem “flox” in their scientific name. On Facebook there is Fluoroquinolone Toxicity Group with over 3000 members, many of whom are suffering much worse than me. Despite these problems, Cipro and other FQs remain a very well-prescribed drugs as doctors hand them out as though they were candy for sinus infections, traveler’s diarrhea, and other common ailments, when FQs should only be used for life-threatening bacterial infections when other antibiotics have failed.

n October 2013 I was searching for a dietary solution to my tendon problems and I learned that Cipro, an antibiotic in a class called fluoroquinolones (FQs) is the likely culprit of both my tendinopathy and my neuropathy, as well as several other problems (dysbiosis, weight gain, etc.). In 2008, the year after I stopped my last dosage, the FDA issued a black box warning for tendinitis and tendon rupture for Cipro. I now belong to a group of people called “Floxies” because FQs (Levaquin, Cipro, Avelox, etc.) all have the stem “flox” in their scientific name. On Facebook there is Fluoroquinolone Toxicity Group with over 3000 members, many of whom are suffering much worse than me. Despite these problems, Cipro and other FQs remain a very well-prescribed drugs as doctors hand them out as though they were candy for sinus infections, traveler’s diarrhea, and other common ailments, when FQs should only be used for life-threatening bacterial infections when other antibiotics have failed.

Agency Capture

Today, having nothing better to do as the pain had me pretty much laid up on my back (as the ibuprofen kicks in), I decided I would watch the film Bought which can be viewed live-streaming for free until the 15 March. It describes what I think is the most important component in American style corruption, agency capture. Bureaucrats and political appointees that control powerful agencies like the FDA are too often former executives of the industries that they are supposed to regulate–and then after their tenure in Washington is over, they go back to the industry, usually to a six if not seven figure salary. With insiders in the agency, their products pass into usage without any real scrutiny. If an agency catches a drug company in malfeasance, the company agrees to pay a fine which is a small fraction of the profits that they gained through lying about their products. The government thus allows the public to be exposed to dangerous chemicals and GMO foods that damage the health both children and adults. This is how Washington DC has become the most corrupt capital in the world and instead of schooling the world in human rights as the US did after WWII, Washington is now showing the world how corruption is done on a large scale. Allow the industry to capture the government through the promise of lucrative future employment.

Mordor’s Heart, the Department of Treasury and the IRS

So now, have I tweaked your interest? Are you wondering if agency capture affects the IRS and the Treasury Department? Judging by the people hired and where they go after their stay in Washington, i.e., back into the financial industry, I would claim that agency capture works perfectly in the case of bankstering and the Treasury

So now, have I tweaked your interest? Are you wondering if agency capture affects the IRS and the Treasury Department? Judging by the people hired and where they go after their stay in Washington, i.e., back into the financial industry, I would claim that agency capture works perfectly in the case of bankstering and the Treasury

Department. Jack Lew for example used to work as an executive a Citigroup, and apparently his lack of success as a trader was no black mark against him. Democrat Jon Corzine went from governor of New Jersey to MF Global and stole a couple billion from customers accounts and has managed to avoid going to jail. While he didn’t work for US Treasury, he does illustrate how important it is to have friends in high places. What about our good friend Douglas Schulmann? Apparently he now works at BNY Mellon.

And what about 30-year IRS Vet–who used to comment frequently at the Isaac Brock Society in the early days. Some thought he was trolling for business at Isaac Brock, though I never accused him of that. Apparently, the going rate for a cross-border compliance condor lawyer is now $1000 per hour. So work as a litigator for the IRS for 30 years, retire to a nice compliance industry private practice, and rake in a few million a year. So it is clear that the creation of complex laws and regulations helps the the former insiders to rake it in, all while collecting a government pension.

I saw a recent survey that showed that the top job for US persons working abroad was in financial industry. It would appear that US banking regulations, thanks to FATCA, has become the USA’s chief export. FATCA has made some clear winners, but ordinary expats with retirement savings are not among them. We are just scratching the surface here, but I think the few examples I have given illustrates the true problem in the heart of Mordor.

@EmBee

No worries…when it comes to something like “Bought”, the more people posting the link the better. Maybe more will watch it and see what we saw. It’s a video that I will not forget.