UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

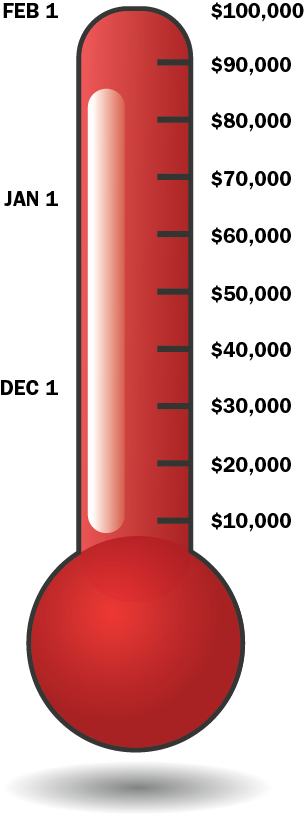

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

@LM,

There may be areas where the FATCA IGA and legislation is in direct conflict with areas of provincial jurisdiction. Perhaps where the federal government cannot force the provinces to comply, yet the federal actions have provincial repercussions which the provinces may or may not be aware of. Maybe there are unexplored areas where the ‘sovereignty’ of a province is important vis a vis FATCA, just as the sovereignty of Canada as an autonomous nation is significant.

Regarding the practice of sending Canadian mothers across the border to give birth in US facilities, and thus causing the ‘new’ Canadian babies to incur a lifelong US taxable person liability. I would be surprised if this was no longer happening in border communities as healthcare facilities continue to be overtaxed. (here are some figures for previous decades http://www.cbc.ca/news2/background/lostcanadians/border-babies.html but I haven’t found any more contemporary ). A border baby as a plaintiff would be very interesting as they were born with the UStaxable burden involuntarily – and solely as a direct result of a Canadian provincial institution’s actions – to send a Canadian citizen mother over the border due to inadequate Canadian health facilities in their border community.

I am not proposing an actual suit, merely pointing out that this provincial practice has significant lifelong legal and financial repercussions for the Canadian baby and their Canadian family – which otherwise would not have arisen if the person was able to be served in a Canadian hospital – and thus born solely a Canadian citizen on Canadian soil. This is one example in which the federal government has created a potential FATCA/USextraterritorialCBT related liability for the provinces in an area of otherwise sole provincial jurisdiction. That is in addition to the fact that credit unions are also provincially regulated – yet are affected by FATCA (and soon GATCA?) , and that there will be many provincial bodies who employ Canadians with the UStaxableperson taint in civil service positions where they would have an FBAR burden to report their Provincial employer’s accounts if they have co/signatory powers on them. In some cases, those provincial employees are overseeing the accounts of other accountholders (whose status as a USP is unknown or undetermined) as well. Those provincial civil servants would have a fiduciary duty and a duty of care to the province, and to the actual owners of the accounts – which would be in conflict with any FBAR/FATCA related role they might also have.

We have not seen anything that indicates that the provinces are aware or concerned that the federal government’s adoption of FATCA (which was meant in part to support FBAR) created a new problem for the provinces. If they are, there is no indication that they have opposed it.

It struck me as an interesting angle to be able to raise this with our provincial MPs and bodies and broaden awareness of what the wide scope of FATCA means to many more Canadians – both individuals as well as Canadian institutions than one might think. The example of the extraterritorial tax burden which is now to be incurred even on the DNA level – of the UScitizen origin of the sperm or ova in IVF and donated embryos may never be an insurmountable problem (because it is unlikely to come officially to US attention for tracking people down for US tax purposes) but it does underscore the ultimate absurdity of the position that the Conservative party has decided to adopt that it ‘respects’ the ‘right’ of the US to make its own tax laws.

I post these ideas here because though I am not a lawyer, some of these angles which seem absurd might possibly be of interest.

@Badger,

This statement/angle of yours is especially interesting and I have passed it with your comment on to the Arvay team:

“A border baby as a plaintiff would be very interesting as they were born… as a direct result of a Canadian provincial institution’s actions – to send a Canadian citizen mother over the border due to inadequate Canadian health facilities in their border community.”

NorthernShrike: (RE poster with pull tabs)

There is an 8.5″ x 11″ FATCA/IBS poster with pull-off tabs you can copy/use on the Anti-FATCA Publicity and Protest Materials page (http://isaacbrocksociety.ca/what-is-fatca-draft/). I’ve posted them all around the local University where possible.

Perhaps an ADCS poster could also be created and offered to others via that page (send to Pacifica and she will put it up on the site). Keep the creative promotional ideas coming!!!

@ MuzzledNoMore: RE Green-card holders – – please share with us the article name/link please — sounds ++++ interesting.

@ Badger – – these issues are DEFINITELY of interest!!!! Makes everyone think!!!

@LM,

MuzzledNoMore’s reference to the green-card holder is in today’s edition of the original post at the top. It’s text of a e-mail that ADCS received from a donor who wrote about their situation.

Craigslist.ca might not be too restrictive in terms of duplicative advertising. In any event it would be a new venue.

It appears that a Government representative has been in contact with Kijiji. They will not allow any of my Fatca ads at all anymore. Seems the government is powerfull. I cannot see any other fatca ads on Kijiji either from anyone else. The government is at it again.

@Stephen, here is one example of a source that describes where Canadian citizen border babies continue to be born:

http://www.pressherald.com/2012/07/01/challenges-for-campobello-island-a-crossing-to-bear/

That article is also especially interesting as it cites David Alward – a Conservative MP and up until recently the Premier of New Brunswick (http://en.wikipedia.org/wiki/David_Alward) who can attest to the travails of being a Canadian border baby born with UStaxableperson status and the difficulties in satisfying the US ( http://hodgen.com/new-brunswick-premier-is-in-the-ovdi/ ). His Conservative collegues who made light of the effects of US extraterritorial CBT on Canadians (ex. Bill C-31 FATCA discussions) this year must have almost certainly been aware of his example, and probably of other Conservatives who were not outed as UStaxablepersonCanadians in the press.

“….For generations, people in these parts had paid little thought to the border, traversing it to shop, date, marry and deliver their babies. Thousands of people in easternmost Maine and southwestern New Brunswick are dual citizens on account of birth or marriage, including New Brunswick Premier David Alward (born in Massachusetts) and a quarter of Campobello’s residents (born at the hospital in Machias or with the midwife in Lubec)…..”

See also excerpt from book by James Laxer:

http://books.google.ca/books?id=MjVlI8V0i9AC&pg=PT42&lpg=PT42&dq=campobello+island+canada+birth+us+hospitals&source=bl&ots=1C6YgX6tbw&sig=OSV77pgEU8y-O-chDWYP2uve0DY&hl=en&sa=X&ei=SstfVJHhNdiBygTw14CICw&ved=0CEUQ6AEwBg#v=onepage&q=campobello%20island%20canada%20birth%20us%20hospitals&f=false

News articles from as recently as 2007 make clear that this continues to be a phenomena in several provinces – from BC to the Maritimes “”… We always regret when we have to transfer a baby or mother to another jurisdiction for care,” said Canada’s Health Minister George Abbott….” http://www.komonews.com/news/local/10216201.html

It appears we have two new groups of people who need to work on a lawsuit. The families that were sent to the US to have their babies, and the spouses who were never told about their “IRS requirements” (before getting married to a Canadian who was born in the USA) by the Canadian government. I personally want answers, however, I know from past experiences, that sending questions to my local MP Joe Preston in St Thomas and the minister of finance will go unanswered like the ones I have in my file here.

@Badger,

I have spoken to “border babies” but did not fully consider your point that some (all?) mothers were “directed” by a provincial government institution to give birth in a foreign country.

Are the provincial governments legally responsible for the (unintentional) harm this has caused?

@Badger I remember an article from 2011 about Campobello and FATCA.

Franklin Delano Roosevelt would be outraged at what the US is doing to Canadians and in particular to Campobello Islanders. His family owned a summer home there from the 1800s and his own son was born on Campobello. The Canadian mothers who must travel to Maine to give birth when the ferry to the New Brunswick mainland is not running travel across the Franklin Delano Roosevelt Bridge.

At Finance Committee, New Brunswick MP Mike Allen said a large number of his constituents are affected by FATCA because they were born in Maine. He doesn’t care. In fact, his FATCA claim to fame is “Congress has spoken.”

Con MP John Williamson is quoted in the article you posted. He voted for the IGA and the enabling act. Yet, below is what he said in 2012. He didn’t show much “common sense” for “ordinary, hard working Canadians.” Instead, he swung the “sledgehammer” for the Americans.

I have posted a note on Kijiji Ottawa under the category “financial and legal services”. See:

http://www.kijiji.ca/v-financial-legal/ottawa/class-action-suit-against-the-government-of-canada/1031549685?enableSearchNavigationFlag=true

I posted it with the email address “huck.finn443@yahoo.com”. This was not easy. Kijiji tried to revert it to another email address I used previously. I would appreciate someone checking the ad to see that it has the email address indicated. If it has any other email address, don’t post it here. Just indicate that it is not as I intended. Many thanks!

@Native Canadian, how do you the government has done this? Does Kjijij let you know? This is very disturbing.

NorthernShrike,

Ad doesn’t show an email address that I can see. Doesn’t show any other ads posted by “this person” so if you have previous ads to another email address, they did not come up. It does pinpoint a location on map though. I sent an email and asked a copy be sent to me. A copy came — from kijiji, not you.

@ Northern Shrike

I checked the ad. It’s there alright but I don’t see an e-mail address anywhere. Where does one look for that? One thing that happened with my husband is that when he tried a g-mail account it didn’t work but when he tried a yahoo account it did. He doesn’t know why (maybe g-mail had problems that day) and I don’t know why he has so many accounts but I guess it comes in handy sometimes. I did notice that it listed adcs-adsc.ca as a website though.

@ Native Canadian

Our 2 ads are still there. If the government is up to dirty tricks as you suggest then might I just say to Brock’s government assigned minder — Hope you’re learning something. I wonder how they sleep at night?

@Calgary411 and @EmBee

Thank you for this. It is fine with me that there is no email address showing. I don’t particularly want to hear from cranks. People can go to the website and take it from there.

Kijiji requires address or postal code. I put in the latter. I don’t care if it is displayed.

My kijiji ad (in French) is still there. 13 views!

Time to try craigslist.ca?

Also, try using an emailid from mail.com.

If kijiji is problematic maybe it’s time to try craigslist.ca. It might have a different audience. Fresh fishing grounds.

Also, try using an emailid from mail.com.

Gotta move fast before govt catches on again.

Ever since FATCA the americans no longer deserve the stars and stripes flag anymore.

@ Cheryl. I do not know for sure, but there is no reasonable explanation for Kijiji to not allow “certain” types of ads. This seems odd.

I just listed an ad in London Kijiji. Lets see if it gets posted today.