UPDATE January 24, 2015: THIRD OF FIVE LEGAL BILLS PAID

[We now have a NEW POST taking us up to May 1, 2015. This post will be retired from service.]

On August 11, 2014, Constitutional Litigator Joseph Arvay filed a FATCA IGA lawsuit in Canada Federal Court on behalf of Plaintiffs Ginny and Gwen, the Alliance for the Defence of Canadian Sovereignty (en français), and all peoples worldwide. Read Alliance’s Claims and comment on our Alliance blog.

Chers amis et donateurs,

Ensemble, nous avons atteint notre but : ramasser les fonds nécessaires pour payer la troisième des cinq factures légales de notre poursuite judiciaire.

Ramasser 300 000 $ provenant de petits dons est un exploit tout à fait extraordinaire et nous invitons notre gouvernement canadien, ainsi que tous les autres gouvernements qui ont piétiné les droits de leurs citoyens, à en prendre bonne note.

Chaque jour, nous nous rapprochons de notre but. Déjà, nous avons ramassé plus de la moitié des fonds nécessaires pour payer les frais légaux de notre poursuite contre le gouvernement canadien et l’entente FATCA.

Si nous avons parcouru un si grand bout de chemin, c’est grâce à nos deux courageuses plaignantes, Ginny et Gwen, à nos donateurs provenant du Canada et de partout dans le monde, ainsi qu’aux administrateurs des sites Internet Isaac Brock Society et Maple Sandbox. Ils permettent tous à nos voix d’être entendues.

Merci !

L’équipe de l’ADSC

———————————————————————————————–

Dear Friends and Supporters,

Together we have reached our goal of paying off the third of five retainer fees for our Canadian FATCA IGA lawsuit.

Raising $300,000 from small donations is a pretty amazing achievement and we ask the Government of Canada, and those other governments who have also tossed away rights of their citizens, to take notice.

It’s still a marathon, but we are more than half way to pay off the Federal Court legal costs.

We have come so far because of our brave Plaintiffs, Ginny and Gwen, our Canadian and International donor-supporters, and the administrators of the Isaac Brock and Maple Sandbox websites who make it possible for our voices to be heard.

Thank you all,

—The ADCS-ADSC team

@ FuriousAC

You just had the 1000th thought on this thread and it was a good one. I would only add that Rajotte, Adler, Allen, Keddy, Saxton and Van Kesteren voted Yes/Oui in lockstep with Harper’s agenda (succumb and sell out to all US idiotology) but here we are saying No/Non to them in the only way we can, the ADCS lawsuit. It’s $10,000 per week now to get to the third tranche finish line so as Sir Isaac Brock once said, “Surgite!”

For Schubert1975 (thanks for your comment regarding another, the latest, Canadian Supreme Court ruling) and Everyone else needing and longing to see the Canadian Challenge succeed:

We CAN do it and we SHALL!

FuriousAC,

There was a substitute that day — as Blaze pointed out. I have corrected in my comment.

@FuriousAC: It is not in the video, but on May 29, Gerald Keddy said it is only “rare possibilities” for joint account holders like spouses to be affected. Keddyy also claims to be protecting us when we cross the border. Then, of course, is Keddy’s inaccurate declaration that people born in Canada to American parents are not automatically Americans:

And, following that…

“Canadians know that only if you’re a dual citizen will you be caught in this. And only in the rare possibilities of those individuals who may have a joint account are you caught in this.”

Keddy is treading on dangerous ground making a statement like that.

To understand what the above is suggesting to those who are not affected, replace “dual citizen” with negro, woman, Muslim, atheist, etc.

That statement is encouraging a larger group of people to marginalize and cause harm to another smaller group for they own selfish benefit. That’s a very dangerous statement to be making while in public service.

I just posted this on RNC Chairman Reince Priebus’ FB page:

“Americans Overseas are renouncing US citizenship in record numbers in rejection of FATCA, FBAR and Citizenship Based Taxation. The State Department is trying to slow down the rate of renunciations by raising the fee to $2,350 and it is believed that Treasury is sandbagging the numbers. Nobody is renouncing because they want to, but because they have to. The Democrats are trying to downplay the situation, but its not working. America is losing its Diaspora.”

@MiddleFinger,

Come on, admit it. You are really the FATCAFINGER!

I met with my Conservative MP, John Weston yesterday and he was pretty convinced that the US would start withholding anyway even if Canada said no. Our government really believed that they had no choice in the matter and as far as an exemption clause for Canadian citizens and PR’s go, he said that the US would have never agreed. I said they had a duty to at least try! Maybe if Canada had kicked up enough fuss the rest of the world would have found the impetus to join in. Imagine the US withholding against their closest ally and trading partner, I said. He said that no one likes it, but in the end we know they placed the interests of banks over that of its citizens. For that they’ll have to take their lumps, which they seem prepared to do – at taxpayer’s expense!

Bubblebustin….I’m impressed that at least you got an audience with a Conservative MP…..maybe you are the crack in the tent that the camel can get it’s neck through. My MP Scott Reid (ON) is totally useless on the subject and stopped responding to any questions a long time ago. I’ll work towards getting him defeated for sure.

Do you think that maybe they’re starting to listen, and at least pretend they’re sympathetic?

Thank you.

@ Bubblebustin

Good for you for meeting with John Weston. Honestly, once those talking points have been drilled into their heads I swear they seal the holes with concrete. The simple truth is that the Cons showed no due diligence when they skimmed over and glossed over the FATCA IGA the USA shoved in their faces. They failed to do what they were elected to do — protect Canadians and safeguard Canada’s sovereignty. I don’t think I’m the only one who will never forgive them for that.

Everyone check out this movement by Leadnow. Its a concerted effort to defeat the cons by strategic candidate endorsement in swing ridings.

http://we.leadnow.ca/votetogether

Thanks PierreD, EmBee

I had my first meeting with my MP when all of this began back in 2011. It’s well document here is you just search “John Weston”. My next physical encounter wasn’t until December of last year when I was invited to his open house at his constituency office. I really bended his ear so he insisted I meet with him again, which I did yesterday.

The meeting was basically a rehash of what the Conservatives should or shouldn’t have done and him telling me that the US left them with no option but to comply, until I touched on the issue of reciprocity under the IGA. I had written to him prior to the meeting with a series of questions I wanted him to address, a couple of which were: “The US also appears to be slow to provide reciprocity to Canada. How long will Canada wait for the US to live up to its agreement with Canada? What will Canada do when it becomes clear that the US has not intention of reciprocating?” I also told him about the newly launched legal effort by the Republicans to have FATCA repealed. He was very intrigued by both. He told me that he was going to look into the reciprocal element of the IGA and talk to a minister, I believe, about it today. Among other things, I insisted that no Canadian should have their private banking information given to the IRS without a system in place for Canada to receive the same, as per the IGA agreement. I followed up today by asking him if Canada was going to continue supporting the US in this charade.

I feel it would benefit all of us if we not only supported ADCS but contacted our MP’s to look more closely at whether Canada should hand over private financial information on their citizens on the mere promise of something. Now that the FATCA IGA is a reality, it may be worth our while to try to persuade our representatives to view the lack of reciprocity as a potential impasse to this agreement. Just a thought.

@Blaze. Thank you for the list. I will let the public see how they voted and what they voted to protect(not Canadians). These scoundrels who committed treason will become a part of Canadian history. Their actions need to be pointed out to all Canadians. It irks me to think we will pay their pensions. It seems that this is the new “normal” for our elected officials, do what your leader tells you to do without conscience and never mind the public, they will pay you for it…

Blaze: Thank you for the video of the Finance Committee. Do you, by any chance, have the clip where one of the committee members, I think it was Keddy, says that the agreement would not affect Canadians? By that statement, he was showing us that he doesn’t think that “dual citizens” are Canadians at all!

Everyone,

I helped us get off track in what we’re discussing here. Although we are talking about the very real reasons for the Canadian litigation aimed at the Conservative government that sold us out, we need to keep the focus of this thread that we keep on top of all others here at Isaac Brock on the very important deadline we must meet — FOURTEEN DAYS to make the next retainer payment for the Canadian lawsuit.

Please consider what you can do to make this happen. (I made a promise to myself that when my very first Registered Retirement Income Fund (RRIF) payment was put into my account this month as I am at the age that I had to convert my RRSP or face penalties, it would be forwarded on to http://www.adcs-adsc.ca/. I have now kept that promise.)

I know how hard it is to scrape money together again and again. The need and time is upon us to make that next pledged payment for the cost of justice. We must not fail ourselves and our children. I hope you can help, however big or small. Thank you so much.

@MuzzledNoMore

I don’t know where he said it, but here is the transcript where he denies saying it. Of course, what he neglects to say is that every Canadian deserves the rights and protections of ALL Canadians.

http://openparliament.ca/committees/finance/41-2/39/gerald-keddy-8/

@The Mom

“Wanna’ see pitchforks and torches? That may be the way the Americans WANT it to work, but I could never see that happening.”

I hope that time will prove you right, but I’d be concerned. It seems that the US government is ALREADY trying to insert themselves into purely domestic Canadian transactions. I forget (or never heard) what the final resolution was, but there was someone posting here awhile back who was a “US person” but had signing authority for the accounts for their Canadian employer (I think it was a law firm). She was potentially going to have to turn over all the firm’s financial data to the IRS. If she’d done so, this would have resulted in transactions involving Canadian-only clients of a Canadian-only law firm going to the IRS. I don’t believe she did so but was looking into removing herself from having signing authority.

Interesting article. Not sure where to share it so please delete if this is inappropriate thread.

https://www.dollarvigilante.com/blog/2014/12/30/the-latest-fatca-propaganda-atrocities.html

@ forever canadian

Can’t remember if you’ve commented before. Welcome! One spot for listing good articles is:

http://isaacbrocksociety.ca/media-and-blog-articles-open-for-comments/

The Dollar Vigilante has put out quite a few excellent FATCA articles.

Thirteen days

http://www.adcs-adsc.ca/DonateADCS.html

was at some friends for dinner last nite. there was another couple there that i had never met.

the subject of america came up and then so did FATCA.

this chap moved to canada in the late 90’s became a canadian citizen in 2004 and renewed his american passport in 2009. as well just got within the last 30 or so days his nexus card. he was a us military vet as well. he tavels often also to see family in the states.

when i described to him the whole CBT and since him being an american having to file us tax forms. he said he “just stopped filing them” when he came to canada because he was never told about CBT or anything else about his legal requirements.

he was to put it mildly shocked that given all that he has done (military, nexus, passport) never once was anything said to him about having to file taxes for the rest of his life. he had never heard of CBT and was amazed that it was going to cost him $2350 and 6 years compliance to shed his american ness.

i of course directed him to this website and urged him to donate to the lawsuit and to spread the word.

Thanks for sending him here after educating him, mettleman. Now he knows the sad truth of that tattoo on his rear end and the value placed on all he has given to the US through his military service. Shocked, but didn’t think you had 10 heads? Hope he spreads what he has learned to others.

And, I hope this person will be reading here as he checks out IsaacBrockSociety.ca and a new donor to help us reach our February 1st payment for the Canadian litigation — it is for him as for the rest of us.

If you’re reading here, new friend of mettleman, welcome.

As much as we all need to be the messengers of bad news, as mettleman was, these stories make me so sad to think of the panic of the OMG moment for these poor people.

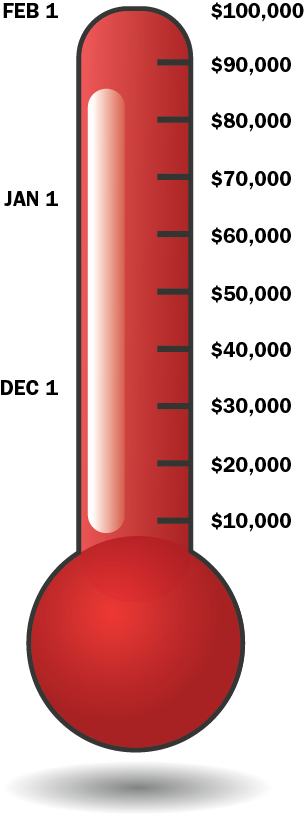

Weekends are sometimes the pits, with only PayPal and other electronic transfers available to raise the Sovereignty Thermometer. May the heat be with you @ Stephen Kish when you go to the mailbox on Monday.